Wilson Chen, ZA Bank’s director of business in the Greater Bay Area (GBA), recently sat down with Christian Kapfer, director of TABInsights, at the bank’s Hong Kong headquarters to discuss its regional expansion plans.

ZA Bank, an offspring of ZA Insurance, China’s pioneering internet-based insurer, was co-founded by industry titans Ant Finance, Ping An Group, and Tencent. It is currently expanding its services to encompass Hong Kong, Greater China, and Chinese customers worldwide.

Chen attributes the bank’s impressive market share growth to its competitive rates, adaptability, and unwavering customer-centric approach. He also believes that ZA Bank should cater further to specific underserved segments.

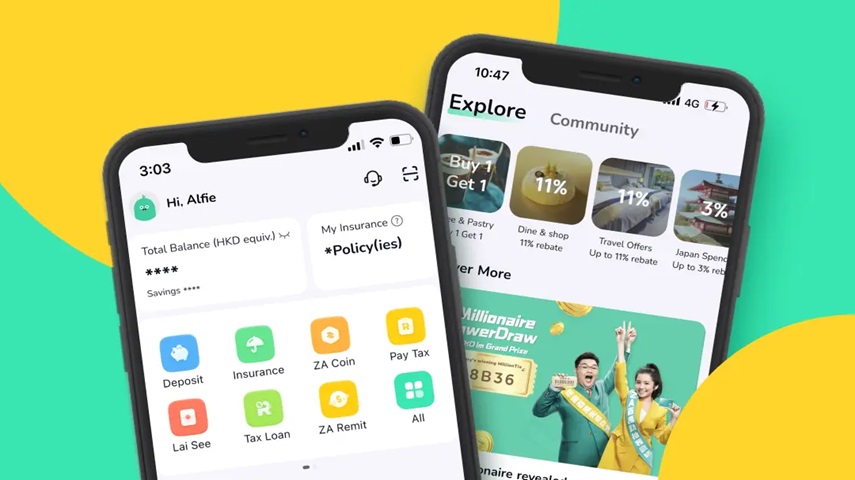

ZA Bank has significantly expanded its range of financial products, particularly in insurance and investments. It now offers nine key services, including current and savings accounts, fixed deposits, personal loans, fund investments, and an extensive array of bancassurance products in partnership with global insurance and asset management firm Generali and ZA Insurance.

What sets ZA Bank apart from its Hong Kong peers is its dedication to serving both local and international Chinese customers. In 2022, it further enhanced its global cross-border payment services through a strategic partnership with WISE.

All Comments