- WeBank is the largest all-digital bank in China and in the world

- It posted strong growth and return on equity (ROE) in 2021

- Provides a wide range of products based on advanced blockchain infrastructure

WeBank was recognised as Best Digital Bank in China, the Asia Pacific, and the World at The Asian Banker’s China Awards Programme 2022.

WeBank has continuously expanded its scale of development with cutting-edge digital technology since its launch in 2014, predominantly driven by its digital retail lending business and micro, small and medium enterprise (MSME) loan business. The bank launched the first distributed core banking system in China, supporting high-concurrency transactions between millions of customers. The highest single-day financial transactions reached 790 million, and product availability rate reached 99.99975%. The bank lowered the cost of yearly information technology (IT) operation and maintenance for a single account to less than 10% of its peers.

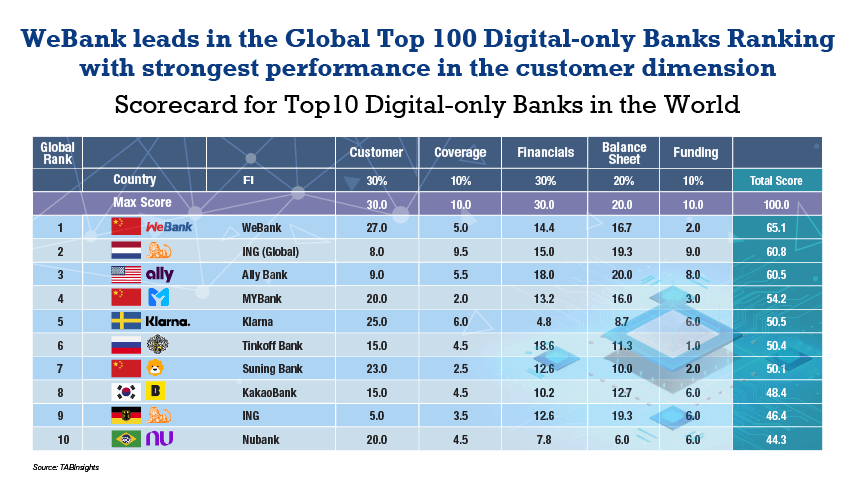

Customer: WeBank is the largest all-digital bank in China and in the world

Tightly integrated with social media and payment platforms like WeChat and WeChat Pay, WeBank built a strong financial balance sheet since its launch in 2014. To date, WeBank has 323.4 million customers, the largest customer base among all digital-only banks around the world. The number of customers grew by 4.3 million per month, still ahead of its peers.

In 2021, WeBank has announced its plan called "The 100 billion for 100 Industries through Digital Supply Chain Finance", focusing on five directions: consumption, new infrastructure, green energy, modern agriculture, and specialised new technology. The plan aims to continue supporting industrial growth with digital technology. As of 31 December 2021, the bank provided digital financial support to 30 national key industrial chains, cooperated with nearly 500 brand partners, and served nearly 130,000 dealers and suppliers.

Financials: WeBank leads with gross revenue of $4.18 billion (RMB 29.1 billion) in 2021.

WeBank had gross revenue of $4.18 billion (RMB 29.1 billion) in 2021, a rapid year-on-year (YoY) growth of 36%. It also achieved an ROE of 32% in 2021, demonstrating a top-tier profitability level given that 71 banks out of the Top 100 Digital-only Banks Ranking were unable to profit.

The bank had a slightly higher cost-income ratio (CIR) in 2021 at 35%, average level for digital banks, but higher than strong traditional commercial banks, which is usually under 30%. WeBank also saw lower average revenue per user at $13/user (RMB90.21/user), than its international competitors Ally Bank $830/user (RMB 5,759.62/user) and ING Global $832/user(RMB 2,650.81/user). Having a lower average revenue per user is acceptable considering Webank only operates in China, but it will have to better manage cost efficiency if competing with traditional commercial banks is in the strategic picture.

Coverage: A wide range of products based on advanced blockchain infrastructure

WeBank logged record-setting results in 2021 that demonstrated growth momentum across all indicators. With its blockchain-enabled open banking platform, the bank has become a connector to most financial institutions in China. It was also the first bank in the world to build a large-scale, commercially viable blockchain infrastructure ecosystem that lowers the annual IT operation and maintenance cost of a single account to less than a tenth of its peers’, both domestic and abroad. The peak value that can be handled through the ecosystem in a single-day transaction reached more than 790 million times. Moreover, the product availability rate has reached 99.99975%.

It recently launched the WeBank blockchain brand to drive the deployment and application of blockchain technology for environmental, social, and governance (ESG), and sustainability-related programmes. Since 2017, the bank has led the development of the open-source Financial Services Blockchain Services - Be Credible, Open and Secure (FISCO BCOS) financial-grade consortium chain platform. It attracted more than 3,000 institutions and over 70,000 individual members that deployed several hundred blockchain applications in various industries including finance, healthcare, law and justice, agriculture, and manufacturing.

About The Asian Banker

The Asian Banker is the region’s most authoritative provider of strategic business intelligence to the financial services community. The global research company has offices in Singapore, Malaysia, Manila, Hong Kong, Beijing, and Dubai, as well as representatives in London, New York, and San Francisco. It has a business model that revolves around three core business lines: publications, research services and forums. The company’s website is www.theasianbanker.com

You may visit the Excellence in Retail Financial Services page at http://awards.asianbankerforums.com/retailfinancial/

To view the respective evaluation criteria, click here: https://awards.asianbankerforums.com/Hong Kong-awards/criteria

For further information, you may get in touch with:

Chris Kapfer

Head of Research

Tel: 6393 36196747

All Comments