- FIs need to become more efficient and lower cost providers

- China’s consumption demand in longer term expected to sustain and lead recovery

- Early end of fiscal stimulus may delay recovery till 2022 and beyond

The dramatic drop in employment globally as a result of COVID-19 mitigation measures has caused a drag on consumer spending and production that is impacting business flows and working capital cycles. Corporates are preserving cash flow and identifying additional avenues to access liquidity in order to sustain business and stay afloat.

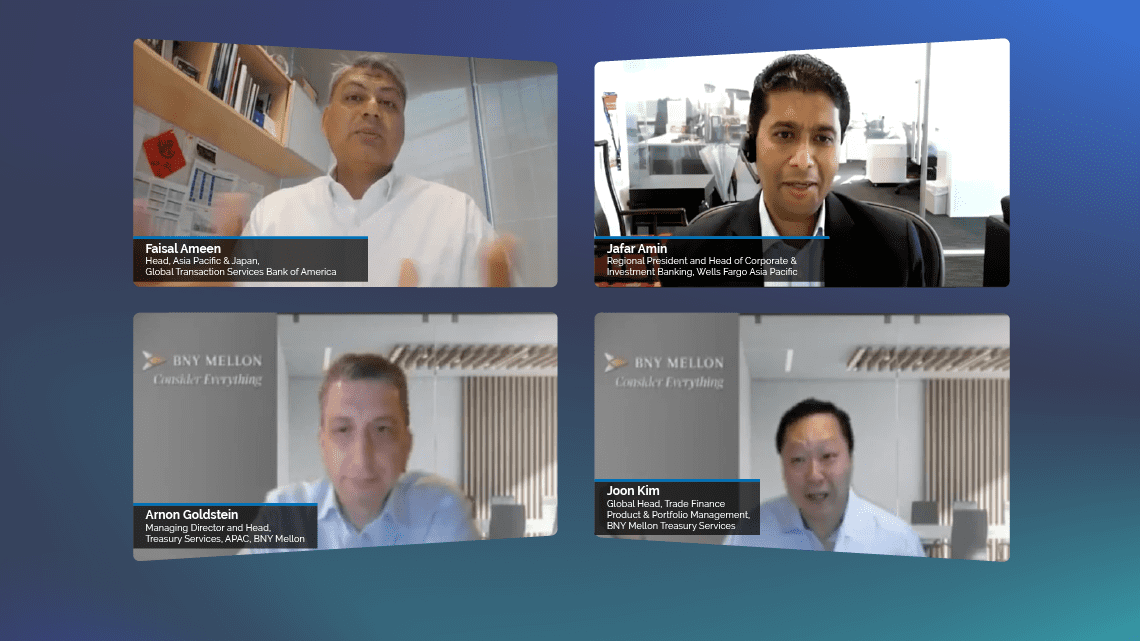

Faisal Ameen, head of global transaction services for Asia Pacific and Japan at Bank of America (BoA), proffered, “we will see a huge amount of impairment to demand until unemployment rates start to recover. Not all countries are going to recover at the same rate”.

“Many more companies are preserving cash. They're trying to have better quality forecasting. In quarter one, we saw more hedges. Now, we're seeing a little more normalisation towards centralised treasury functions around liquidity management, payments and receipts because they need a tighter hold on the working capital cycle”.

“They are also repatriating cash back to head office and are reviewing the types of credit facilities that they have, depending on who they are and what industry they are in. Companies are also reassessing the credit ratings of suppliers, banks and clients, even they're making the assessment,” he added.

The challenge for transaction banks is compounded by historical low interest rates which started before the pandemic but has since been exacerbated by quantitative easing and accommodative monetary stance to stimulate economic recovery.

FIs need to become more efficient and lower cost providers

Jafar Amin, Well Fargo’s regional president and head of corporate and investment banking for Asia Pacific, cautioned the industry to be prepared for a longer period of low interest rates and to pivot to other sources of revenue and profit growth, “we need to be more focused on opportunities to take greater advantage of fee driven businesses, and businesses that are going to generate the right returns without necessarily just relying on the yield from the balance sheet, whether that's deposit or loans”.

He added, “I actually think that's a good thing. Because it forces banks to be much more focused on value added services and driving solutions”. He believes that the key is to focus on improving efficiency and lowering unit costs by increasing digitalisation and automation as well as to add value through innovative solutions, especially around risk management and customer service.

Despite the impact on the trade and cash businesses, the capital markets and asset distribution business of many American banks, such as Wells Fargo, have benefitted from the record trading year. Global financial markets have so far had a bumper year, seemingly disconnected from the malaise in the real economy.

Amin elaborated, “core to Wells Fargo's franchise in Asia is a strong markets distribution platform that we have supporting our US origination activities, but also the distribution into the very important institutional client base here in Asia. And no surprise, if you've spoken to other banks, it's been a record year for both markets divisions and across the mortgage backed securities, rates business, and credit trading”.

He continued, “companies have obviously taken advantage of those conditions. And this has been particularly true for us in the US, and on a more selective basis here in Asia in terms of the client base that we support, particularly in US dollars. There's just tremendous liquidity in Asia and everybody is looking for ways to make their money work. And I think the stimulus that we've seen from central banks has certainly helped”.

As global capital markets continue to outperform the real economy, they will create growth opportunities for financial institutions (FIs) but the balance sheet business will continue to suffer from low rates and depressed margins.

Arnon Goldstein, head of treasury services for Asia Pacific at BNY Mellon (BNY), observed an overall decline in payment volumes, underlining weakness in clients’ demand, but an increase in liquidity, especially in local currency and dollar liquidity as lending demand has been depressed. However, any rebound in volume will be uneven as some economies continue to grapple with the COVID-19 pandemic.

BoA’s Ameen reflected the same position, “there's been a flight towards quality and institutions like us are awash with cash, more so than we actually need and can optimally place out”.

Need to strengthen business continuity and operational resilience

The disruption to traditional supply chains and logistics has precipitated the need to strengthen business continuity planning to increase institutions’ operational resiliency and ability to operate remotely. Processes have to be streamlined and enhanced to incorporate alternative digital solutions, such as e-signature and biometric-enabled authentication and authorisation, to replace traditional manual ones.

The pandemic has also caused FIs to reassess correspondent banking relationships, and partners’ operational resilience, risk controls, and ability to support and facilitate transactions remotely and ensure business continuity.

“You want to make sure that your partner, whether it's a correspondent bank, or a trade services providing bank, that it has good redundancy, resiliency, as well as risk and controls, and most importantly, can handle your business remotely,” said BNY’s Goldstein.

FIs have had to pivot to technology and the digitisation of their internal as well as clients’ processes to become more efficient and ensure business continuity.

“Given the fact that we are facing a situation where the logistics of original trade documents being communicated between counterparties have become really difficult. We have had to act and digitalisation has become extremely important,” remarked Joon Kim, the global head of trade finance product and portfolio management at BNY.

China’s consumption demand in longer term expected to sustain and lead recovery

While global trade volumes have been down significantly in 2020, BNY’s Kim sees “a cautious sense of optimism and recovery” by the latter part of the fourth quarter of this year and the beginning of next, at the macro-level.

Well Fargo’s Amin is sanguine about a rebound in inter regional trade and payments with a resumption of domestic consumption in China and the reopening of key markets across the region as COVID-19 is brought under control. The bank has seen a strong increase in volumes since the third quarter and he expects the trend to hold should the pandemic continue to be kept under control and there are no further deterioration or shocks on the geopolitical front.

Amid the escalating trade friction between the US and China, companies are shifting production bases and supply chains closer to their home and designation markets. BoA’s Ameen however opined that the impact on China may not be as drastic in the longer term as perceived. He predicts that Chinese consumption demand in the future will continue to drive significant onshore production and supply chain capability that will be difficult to be entirely displaced.

Early end of fiscal stimulus may delay recovery till 2022 and beyond

Meanwhile, there is a risk that as fiscal stimulus starts to unwind and taper prematurely at the early signs of recovery in 2021, that full global economic recovery may be delayed and extended beyond 2022.

“The reality is that the 2020 (stimulus) measures are not sustainable, they will either be taken out early or partly extended, but they can’t go on forever. And you will start to see the ramification of that play out in 2021,” BoA’s Ameen warned.

Banks in the meantime are focused on helping FI and corporate customers integrate, automate, digitalise their cash, trade, payments and treasury capabilities.

All Comments