Traditional banks in the Middle East are riding the waves of disruption from new emerging technologies to enable greater financial inclusion. Incumbents in the region are also leveraging open banking frameworks to enhance customer experience and tap new business models and revenue opportunities There are many open banking initiatives looking to re-shape the financial sector across the region. For instance, Bahrain was the first country in the region to introduce open banking in 2017, when the Central Bank of Bahrain (CBB) initiated its project. In 2018, it released rules that are guided by the European Union’s Payment Services Directive 2 (PSD2). In the fourth quarter of 2020, CBB officially launched the country’s open banking framework and during 2021 it witnessed a progressive increase in competition and innovation in retail banking services.

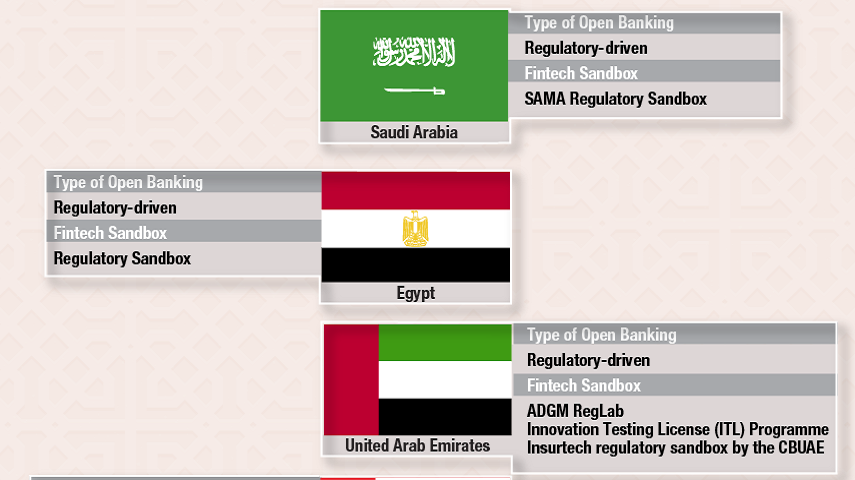

Likewise, the Saudi Central Bank (SAMA) established its regulatory sandbox in 2018 to drive the strategy and development of fintech ecosystem by allowing financial institutions (FIs) and fintechs to offer their products in an innovative and safe environment. In 2019, SAMA published its draft payment services regulations. In the same year, the number of fintechs licensed to operate increased from seven to 14, particularly in the payments space. In 2020, SAMA announced the issuance of payment services provider (PSP) regulations and the launch of new licences for non-bank FIs bringing the total number licensed to 15 companies. Regulators have taken several approaches to encourage adoption of open banking, like enabling market-driven initiatives or imposing a higher degree of standardisation and enforcing compliance. For example, Tarabut Gateway, a fintech company is building a universal API platform to link banks with third-party providers in Saudi Arabia, UAE and Bahrain. In January 2021, SAMA announced that it will launch its own open banking policy, with guidelines to come into effect in mid-2022.

The United Arab Emirates (UAE) has made a number of open banking announcements through its central bank and state regulators such as Dubai International Finance Centre (DIFC) and the Abu Dhabi Global Market (ADGM) who are collaborating to boost the financial services sector and the economy. In 2019, ADGM created its API regulatory guidance to promote interoperability, resilience, innovation and collaboration. Meanwhile, DIFC Fintech Hive has been working with local banks on introducing an API sandbox programme. While Dubai Financial Services Authority (DFSA) is granting specific licences for account information service providers (AISPs) and payment initiation service providers (PISPs). In 2021, Mashreq Bank became the first regional bank to launch an API developer portal to encourage the development of new and innovative digital journeys and experiences for consumers.

In Egypt, open banking has been evolving with updates to the regulatory agenda. In 2019, the government announced a data protection law. There are collaborations between The Egyptian Banks Company, a venture co-owned by the Central Bank of Egypt (CBE), the Ministry of Finance, and several national banks, to create regulations for open banking. In the meantime, Banque Misr plans to launch a digital-only bank in 2022 making it the first in Egypt in line with the country’s vision towards open banking.

Oman is also drafting an open banking API strategy as part of its fintech framework and roadmap. It comprises several initiatives aimed at establishing and nurturing a comprehensive fintech ecosystem to stimulate innovation in the financial sector. Some of these initiatives include the introduction of fintech regulation, the establishment of a regulatory sandbox, the release of a cloud computing framework, as well as initiatives related to electronic know-your-customer (eKYC), fintech education and virtual assets. In line with these steps to boost the fintech ecosystem, Bank Muscat launched a $100 million fintech investment vehicle called BM Innovate in September 2020. Through the fund, the bank aims to create a network of fintech ecosystems by investing in local and international fintechs. Moreover, in December 2020, the Central Bank of Oman (CBO) launched the Financial Regulatory sandbox, permitting participants to live-test their innovative fintech solutions in a safe environment under the supervision of the CBO. In November 2021, Oman and Saudi Arabia signed a memorandum of understanding and launched the Saudi-Omani Digital Skills Initiative which includes training programmes in fields such as fintech, data and artificial intelligence.

Open banking presents a potentially massive growth opportunity to drive new revenue streams. Middle East countries are moving forward to develop open banking infrastructures, facilitate FIs’ collaboration with third-party service providers (TPPs) and encourage data sharing between them. A case in point, Kuwait Finance House in Kuwait and Jordan’s Jordan Payment and Clearing Company and other players in the region are working together across borders to pave the way for open banking opportunities to reshape the future of the financial services in the region. In Jordan, Al Ahli Bank has created a sandbox using Temenos APIs as part of its open banking project. The main attributes behind open banking are openness (between banks and non-banking institutions), a platform-based approach that connects institutions with customers to create value, systematic regulation of these services, and the use of APIs connecting parties in the system.

All Comments