The United Arab Emirates (UAE) is one of the main data centre locations in the Middle East, with more than 10 data centre investments. In 2021, Amazon Web Services (AWS) announced the development of a new data centre region in Abu Dhabi for customers to utilise advanced cloud technologies to store data locally while serving end-users with lower latency requirements. The AWS data centre is anticipated to be launched in the first half of 2022. This will be its second data centre in the region after Bahrain, which was launched in July 2019. Moreover, in October 2021, the Emirati telco, du, opened two data centres, in Abu Dhabi and Dubai respectively.

In 2021, the Saudi Ministry of Communications and Information Technology (MCIT) launched an $18 billion plan to collaborate with local players to build a network of hyperscale data centres across Saudi Arabia. It aims to t attract and grow digital investments in the kingdom, in areas such as cloud service providers, gaming and e-sports, video streaming service operators and content delivery network (CDN) operators. In 2021, a local IT provider, MIS, partnered with Saudi Fransi Capital to establish a private investment fund, worth $320 million, to develop six data centres.

In Egypt, data centre providers are taking steps towards expanding the market size. Cairo has three providers running its four data centres and in 2021 telco, Orange announced it will build a $135 million data centre in Cairo’s administrative capital. Orange is also planning to open the first phase of its data centre in Alexandria, Egypt.

Turkey has 13 providers running 15 data centres in the country. In September 2021, Turkcell opened a $295 million data centre in Tekirdag to store data locally. Enterprises in Turkey are growing their technology infrastructures to become more competitive and are creating strong demand for data centre resources within the country.

In Israel, Microsoft is planning to launch its cloud computing service Azure in early 2022 to enable cloud developments and provide infrastructure for IoT/AI computing, network, and data analysis. In addition, Server farm a collocation provider based in California announced a partnership with Israel Infrastructure Fund to open a data centre in the second half of 2022 to support businesses to grow in the digital era which would cost around $188 million. Israel’s data centre market size is expected to grow at a CAGR of over 17% during the period 2020-2026. The government has launched The Nimbus Project, to address the creation of a channel for the provision of cloud services for the government. In August 2021, EdgeConnex acquired Global Data Center to expand its presence in Israel. The adoption of advanced technologies such as cloud, IoT, big data, and AI will lead to adopting high-performance computing infrastructure in the future. The massive investments in data centres and the introduction of global cloud service providers in Israel are probably going to drive the IT infrastructure market.

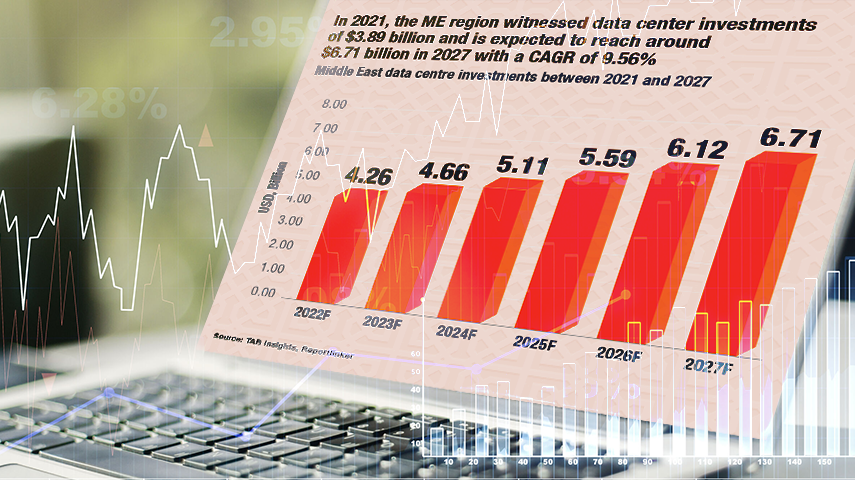

It is imminent for countries in the Middle East to accelerate towards digital transformation as they adopt advanced technologies such as 5G, IoT, AI, and big data. and create investment opportunities in the data centres industry. Data centres in the financial services industry are crucial, as they offer capabilities to access the storage and use of the colossal amount of data at scale, anywhere and in real-time. As these new data centres are built, FIs must adopt a holistic approach to leverage them to meet customers’ evolving needs to remain competitive. At the same time, the industry has to grapple with a heightened cyber threat environment and the challenges of more stringent third party outsourcing and IT risk management regulation to ensure the safety and security of customers’ data, transactions and assets.

All Comments