While rising inflation and the interest rate hike required to curb it usually widen banks’ interest margins, they also tend to increase borrowers’ repayment burden and limit their access to further credit. This may result in greater asset quality risk for banks, reduces their overall lending while at the same time increases the costs of borrowing for higher risk segments, such as the consumers and small and medium sized enterprises (SMEs).

In a recent report, Moody’s Investors Service stated that central banks in ASEAN will further tighten monetary policy as weakening local currencies increase import prices and worsen capital outflows. It expected that while higher interest rates will largely widen banks' net interest margins, asset risks will also increase, but interest rates will rise gradually and inflationary pressure to abate in 2023, keeping growth in problem loans modest.

Nevertheless, in times of heightened economic and financial stress like now, non-bank and non-traditional lenders are expected to step in to fill the void. The relatively recent emergence of fintech and techfin lending platform companies has transformed the banking landscape in Southeast Asia. By increasing digitalisation of financial services, they have brought innovation in product and service personalisation as well as risk management and fraud prevention at a scale and speed never seen before, onboarding millions of financial services users, many for the first time.

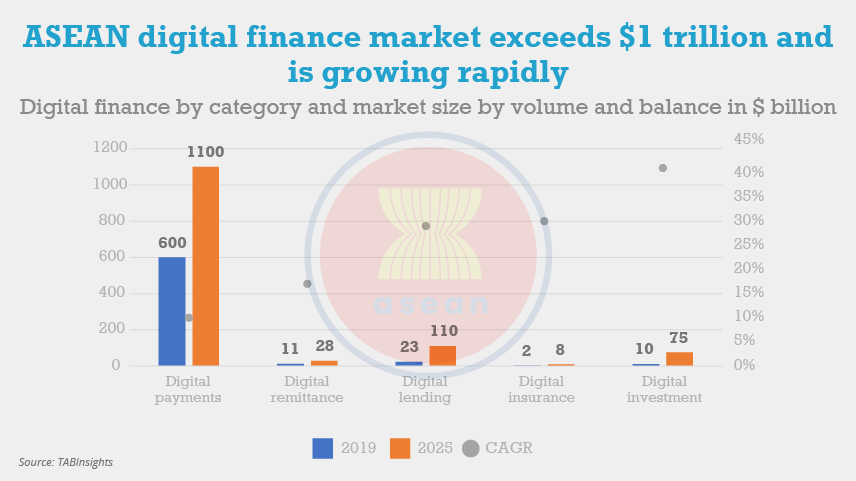

Regulators and central banks in ASEAN are also increasingly licensing many of such fintech collaborations to operate as regulated digital banks, recognising their superior data analytics and digital distribution capabilities to meet the needs of the higher risk and underserved segments. Digital banks and fintech platforms could tap into the $1 trillion plus digital payments and $110 billion digital lending markets that the ASEAN region is estimated by global big tech firm Google and Singapore’s national investment company Temasek to generate by 2025. They will play an important and timely role to help these customers, especially the SMEs, to access credit and grow.

In order to succeed, their own ability to access lower cost funding, scale their financing volumes with a lower unit cost, and diversify income streams, such as through payment and wealth management and bancassurance services, will be critical. The larger players would have already lined up financing agreements with the regional and global banks. In addition, they are also diversifying their funding sources in the financial markets through asset securitisation or private debt deals. For example, two Singapore-based digital lending platforms, Funding Societies/Modalku and Validus recently partnered with HSBC and Citibank in respective $50 million and $100 million facilities to secure their long-term funding.

The success of such players is never guaranteed, but in the Southeast Asia region where the financial gap is clear, they do stand a better chance. In a recent ranking of the global top 100 digital-only banks, The Asian Banker found that only 29 are profit making in 2021. Average time to profitability is between two and three years with an average return on equity (ROE) of about 16%. Those focused on personal finance and wealth management, or SME banking are among the most profitable, and slightly more than half, 55%, are in Asia. SMEs have been an underserved market due to the perception that they are high-risk with low growth potential, mainly due to the lack of visibility of their actual financial conditions. The launch of licensed digital-only banks and collaboration with fintechs will plug the gap with their innovative supply chain financing and technology-enabled solutions.

All Comments