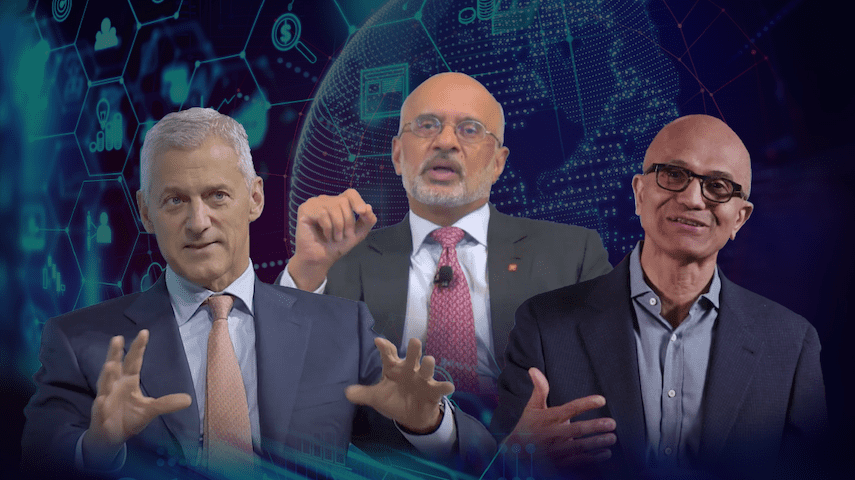

DBS Bank CEO, Piyush Gupta, and his counterparts at Standard Chartered Bank (StanChart), Bill Winters, and Microsoft, Satya Nadella, discussed how banks’ offices will in the future become places for ideation and collaboration rather than workspaces. New tech stacks leveraging big data and artificial intelligence (AI) will give leading banks a four- to-five-year head start on full digitisation. Speaking at a conference in Singapore, the three leaders see an evolving and important role for workers of the future. While technology enables transactions, customers will still want people to help them.

Over the last decade, Gupta said that the technology industry has fundamentally lifted the bar in what customers expect. “The service at your fingertips, any time, in context. That bar is now being applied to financial services.” Moreover, companies have used data and AI to provide insights and opportunities that human beings have not been able to do.

“This year, the willingness of companies and individuals to take to digital solutions in every industry has been profound,” he commented. The fastest growing population this year (for digitisation) has been people over 60 years of age, followed by migrant labourers and small and medium sized enterprises (SMEs). There has also been a game-changing shift in digital payments, with cash usage in Singapore down 40% and volume on PayNow, the domestic real-time transfer network, up 60% to 70%. “None of this is because technology got developed,” Gupta opined. Instead, “the psyche changed.”

Piyush Gupta, CEO, DBS Bank

Satya Nadella, CEO, Microsoft

“What we have seen,” added Winters, “is an acceleration of discrete trends. The integration of finance into day-to-day consumer transactions that had been underway accelerated, and basic financial systems grew into broader ecosystems.”

Outside any organisation, said Nadella, the real change has been in consumer expectations. Companies are working on interfaces for customers that personalise the experience. “That’s revolutionary.” While banking has always been a leading technology adopter, Nadella believes there will be even greater acceleration and disruption.

Offices and the way people work will change

Looking ahead to the “future of work”, Gupta said it is hard for the office to go away. “What makes us human beings, social creatures, is not easy to change so rapidly. Human interaction is not going to disappear any time soon.” What will change, though, is that technology will make a fundamental difference to the way things get done.

Winters said that surveys conducted by the bank turned up some surprises. Since staff have a less robust work environment at home, he was certain that they would want to get to the office. However, 85% of staff in Chennai and Bangalore value flexibility and would rather save the hour-and-a-half commute each way. They prefer to work at home for three or four days per week and use the office only as a “convening centre.” The bank has pivoted, Winters said. “We want to have spaces where people come together to ideate.” The future of the office will be around collaboration spaces, not workspaces. Additionally, the bank is trying to take commercial space closer to where groups of employees live and create “spokes” outside of the office.

A key longer-term trend, Nadella said, is the impact of data on productivity. “We’ve never seen an experiment like this where we have constraints on where we can be, how we can be. We’re able to sustain a level of productivity that is stunning. How people collaborate is fundamentally changing. It’s about the firstline worker being able to reach out to the expert who is remote. Collaboration environments are going to shape how we come together. Well-being, learning, collaboration are going to be three ways in how we approach our careers.”

Nadella said that two things have grounded his approach as he navigated these changes. “One of the things when things get more complicated is going back to the basic principles of why you exist, that sense of purpose. We focused on when Bill (Gates) and Paul (Allen) started Microsoft. They created technology for other developers. That basic concept is more powerful today.”

The other part, Nadella said, is culture. “Even if you have the sense of purpose, there’s only one thing that’s gotten in the way of success. That’s humans. The reality is you have to stay hungry, nimble, start learning, each day. We adopted this cultural mean, a growth mindset. It pushes you from being this know-it-all to being this learn- it-all.”

Satya Nadella, CEO, Microsoft

Digitisation has given better solutions to customers

While digital transformation has been rapid, Gupta said there still are gaps. “We focus and prioritise the big things that matter,” he said, such as payments, trade finance and loans. To make sure employees can work effectively at home, Gupta said, “we had to put in a lot of last-mile fixes.” To ensure that customers are adequately equipped, the bank’s application programming interface (API) platform provides a better financial infrastructure, is easier for plug-and-play, and helps them to adapt.

There has also been an exponential increase in demand from customers for realtime information about their interactions with the bank and about the market as a whole. Winters said, “An overnight batch doesn’t work anymore. To take it to realtime is a substantial investment. Finding ways to get information to customers, information to colleagues, which is as fast as what customers can get themselves, present challenges.”

To maintain clients at the heart of everything Microsoft does amid this digitisation, Nadella said, the focus is customer obsession. There are three key practices: diversity; one company; and customer obsession. “No customer cares about internal divisions or technology or strategy,” he said. To be relevant, “we have been trying to train ourselves on having a deep sense of empathy for your customer. It starts with deep listening skills. To meet unmet unarticulated needs of customers, you need that in place. It assumes you have technology. Organisations that have good listening systems are working through this crisis much better.”

Digital infrastructure gives banks advantages

Both Winters and Gupta said that having the right infrastructure for digital banking is essential.

DBS Bank has been on the journey for six or seven years, Gupta said, and success comes from rearchitecting the tech stack. “Moving from legacy to cloud is not easy. We are 99% done.” Going forward, he said, a big difference will be the use of AI. “You need to have the core, which is data. To clean up the data has taken us four years. That is not an easy shift for a lot of companies. It’s not going to be easy to play catch-up.”

StanChart has similarly made significant changes, Winters said. The digital bank it launched in Hong Kong is rated 4.8 in the app store and uses a brand-new tech stack. What differentiates StanChart, he said, is its partnerships with Hong Kong Telecom and Trip.com. “We have a full reach to the Hong Kong population

Being able to process and get the data to provide a better product and service is the key differentiator. We’re building digital banks in Korea, Taiwan. Banking as a service in Indonesia will launch in the first quarter. We feel a ton of opportunity,” Winters said.

Even though new players bring different perspectives and have good technology as well as large customer bases, Gupta noted that nobody has a monopoly on technology. “We’ve been on the journey for a period of time. We have 7,500 engineers in the company, more than bankers. We have a full suite of applications - payments, remittance, wealth management, financial planning, investment. There’s nothing that DBS Bank doesn’t provide. We have what it takes to be an effective competitor.”

Asked about trust, Nadella said that it is earned, not claimed. “The fact that my financial services relationship and data are important, you (banks) have that trust surplus.” Core principles that led to the creation of that surplus, he said, include privacy, cybersecurity, AI ethics, and internet safety. “These four areas are design principles in how we work, and the products and services we build. We can’t say ‘AI did it.’ We need to adhere to principles.”

Despite concerns, new opportunities abound

Looking ahead, Winters expects markets to open up dramatically. “We expect some economic recovery. 5% global growth would be great. From a technology perspective, (consumers will) take this fundamental shift in mindset in 2020 out of necessity and introduce us into their mainstream life. That allows us to do many things to benefit the customer.” His concerns, he said, are a long drag due to COVID-19 and economic dislocations.

Despite digitisation, Winters said there will be a substantial role for human being in services where trust is necessary. “Well after the point where roboadvisors give better advice than human beings, customers will still want to talk to a human being to validate their view. We need to use AI to enrich the quality of our advisors. Advisors will give the reassurance that customers need. Humans have a real role to play. On the one hand, we have to play in technical spaces. That will be the way transactions will be executed. Important life decisions – retirement, education - will require human input.”

Gupta said his key concerns are the interest rate environment and the cost of credit that will create real issues in the economy after government moratoriums end. On the other hand, 2020 was game changing in terms of people’s opening to think about technology differently. “The rebound will give businesses that are nimble the capacity to build out new businesses, not least in sustainability and payments.”

From a technology provider perspective, Nadella said financial services is going to ride the wave of changes in the core paradigm of technology. At the foundation level, computation and the computing fabric is getting embedded in organisations. Once they have computational resources, they have the next resource, which is data. They have the ability to take that data and turn it into analytics or predictive power. “The organisation is only as good as it analyses the past or predicts the future,” he said. Then, the experience is changing. Mobile is ubiquitous. Video is first class. People expect telebanking that is ubiquitous. Virtual reality (VR) and augmented reality (AR) are going to become mainstream. The experience will be multi-sense, multi-device, driven by AI, powered by this computational engine.

All Comments