With 45 leading banks around the world backing it, blockchain or the distributed ledger, has moved firmly into the technology spotlight. Although still in development, it is touted as the next big revolution in financial technology.

According to R3 CEV’s managing director of business development and marketing, Charley Cooper, “blockchain will transform how financial transactions are recorded, reconciled and reported – all with additional security, lower error rates and significant cost reductions.” R3 CEV is the consortium that is bringing together a growing list of the world’s top banks like JP Morgan Chase to collectively define standards and develop applications for blockchain.

Initial experiments quickly demonstrated the potential to increase efficiency and reduce costs of banking operations.

Banks are racing to commercialise this technology as a means to capture the first mover advantage. To be sure, according to CoinDesk, one of the earliest online blogs to track the development of blockchain, investments into blockchain technology in 2015 totalled $600 million and it is expected to rise more than 50% to over $1 billion in 2016.

(Read: Blockchain Initiatives)

What are the key benefits?

The key benefit of blockchain is that it reduces the role played by intermediaries leading to reduced costs and improved efficiencies. Ripple is one of the leading technology companies to use blockchain to develop a decentralised payment solution. According to its managing director of Asia-Pacific, Dilip Rao, the key attribute of blockchain is its ability to “remove the need of central operator to manage, confirm and track transactions within a system.”

The other key attributes of blockchain – encryption, proof-of-work procedure and automated smart contracts – protect transactions against manipulation and fraud. Last but not least, as it is essentially a synchronised database, it provides an audit trail that allows transactions to be checked and validated in real time.

Each of these attributes comes together to enable applications such as cryptocurrencies, automated administration of assets, fraud-proof election system and a truly global payment network that were previously only made possible with a trusted central authority.

Key commercial use cases of blockchain

While there may be a multitude of possible applications of blockchain, Cooper believes that the technology is best used for “distribution, verification and record keeping of transaction information more effectively and quickly in a decentralised manner, leading to both cost-saving and time-saving efficiencies.”

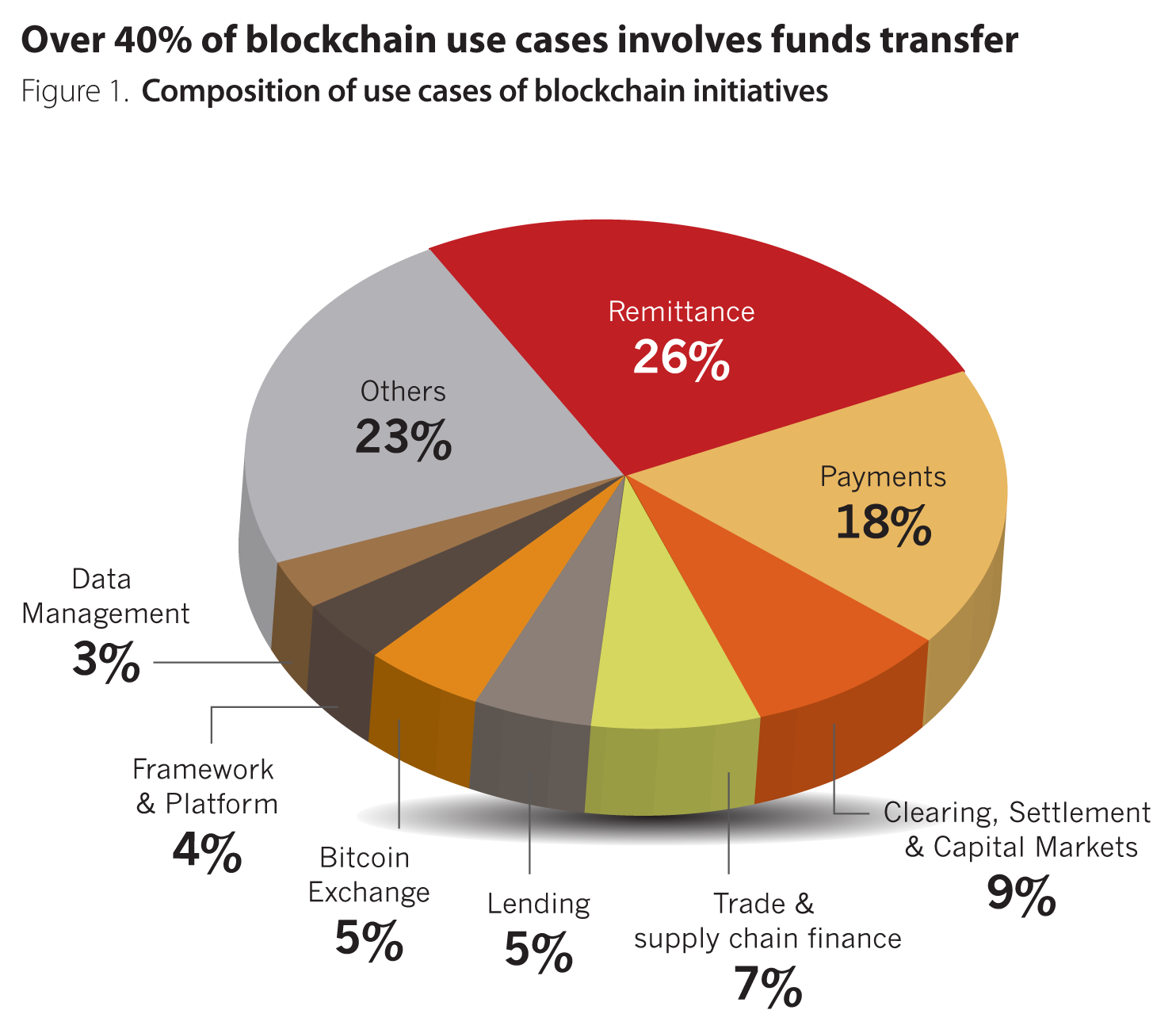

Nevertheless, according to the Asian Banker’s research of over 100 fintechs, banks and technology firms, there are currently more than 30 use cases in areas such as remittance, trade finance, data management and KYC, with more being trialled each day.

Fintechs

The most common use cases of blockchain among fintechs are in remittance, payments followed by clearing, settlement and other capital markets applications.

Among these fintechs, some are competing directly with banks, such as P2P lender, BTCJam while others are forming collaborative relationships with banks. Most of these are involved in services around cryptocurrencies while the collaborators are trying to use blockchain to enhance current business processes. It is not too surprising that the collaborators are usually more well-funded and larger, namely: R3 CEV, Ripple and Digital Assets Holdings. R3’s Cooper echoed this view that, “the key to developing these technologies in a way that would be meaningful and efficient was to work in collaboration with the industry to develop a single solution, pooling resources rather than spending time focusing on individual projects that would then effectively require to be duplicated across institutions.”

R3 CEV leads a consortium to develop solutions and standards around issuance, trade finance and smart derivatives contracts. Headed by David Rutter, former ICAP BrokerTec CEO, it recently completed a trial where member banks tested five different blockchains to issue, trade and redeem a fixed-income product.

Ripple offers distributed ledger solutions for cross-currency settlement. It is based on “blockchain-like” technology, but offers distinct advantages of real time settlement and the ability to accommodate any type of fiat currency within a transaction. Banks have applied the technology in other areas such as trade finance and currency exchange. To date, more than 30 banks have piloted Ripple with 90 more in the pipeline.

Helmed by ex-JP Morgan executive, Blythe Masters, Digital Assets Holdings is exploring blockchain for a range of post trade processes. At the same time, it is pushing standardisation through the Hyperledger group that brings together banks, consultants, exchanges and IT firms.

Banks

Beyond partnerships, banks have also invested heavily into internal R&D. JP Morgan recently announced that it has earmarked $9 billion to explore technologies like blockchain. Bank of America is looking to gain a first mover advantage by having filed close to 15 blockchain patents, with another 20 in its pipeline.

Capital market applications is another area of interest for the global banks. Deutsche Bank has tested a corporate bond platform that uses smart contracts to issue and redeem bonds while Mitsubishi UFJ is working on a proof of concept for promissory notes.

In general, global banks have the majority of their efforts centred on moving funds and securities quickly and cheaply around their global networks.

Closer to home, DBS, Standard Chartered and the Infocomm Development Authority of Singapore initiated a trade finance collaboration with Ripple to better track invoices and to solve the problem of invoice duplication. A group of Korean banks have also come together to kick off a blockchain remittance project.

One other key application that goes beyond finance is data management. Contrary to the belief that a shared ledger will have inherent privacy issues, R3’s Cooper holds the view that a distributed ledger can serve as a shared platform where client data can be exchanged securely, bound by a specific data privacy legal contract and its use can be made transparent to the respective data provider, for example a regulatory authority.

He added: “Whereas today the exchange of data between regulators may be through physical media or files and the use of the data is not immediately transparent, a distributed ledger creates immutable transactions and audit trails which can be analysed by the regulator.” As an added benefit, the usage of data within smart contracts is automatically self-enforcing and self-executing against a jurisdiction’s specific data privacy or banking secrecy laws.

The Monetary Authority of Singapore is currently exploring such a solution with OpenTradeDocs, a startup which participated in its accelerator programme.

[[!detect.appcontent?&id=`[[*id]]` &content=` `]]

`]]

How are banks getting involved?

1. Start an innovation lab

According to Deutsche Bank’s Chan Boon Hiong, head of market advocacy for APAC & MENA, starting an innovation lab goes beyond development of new technology but more importantly, it promotes awareness and a culture of innovation. He added: “At Deutsche, the existence of a lab has resulted in more rigorous discussion about applications and issues around blockchain.” This is key to the preparation of the talent pool that is required to manage these technologies when it is time to transit.

The importance of such labs is highlighted when some Korean banks such as KEB Hana Bank and the Industrial Bank of Korea (IBK) recently failed to join R3CEV due to “shortage of fintech standards”, probably as a result of not having worked extensively with them before.

2. Form partnership with other banks and regulators

Banks enter into partnership with other banks and even the regulators to explore possible applications. Technically, a private blockchain between banks with high volumes is easier to deploy and benefits will be more immediate. The partnership between DBS, SCB and IDA Singapore also demonstrated that regulators can play a supportive role in terms of setting boundaries.

3. Join a consortium

This is a scaled up variant of a partnership. Although membership is not a given, participation allows members to work under a strategic and coordinated vision. The key benefits of such consortium are standardisation, cost efficiencies and time to market, all of which are meant to address the key concerns of executives we spoke to.

4. Tapping on the fintechs

Barclays recently signed two blockchain start-ups from its own accelerator programme, Wave and Chainanlysis, to work on trade finance and compliance screening respectively.

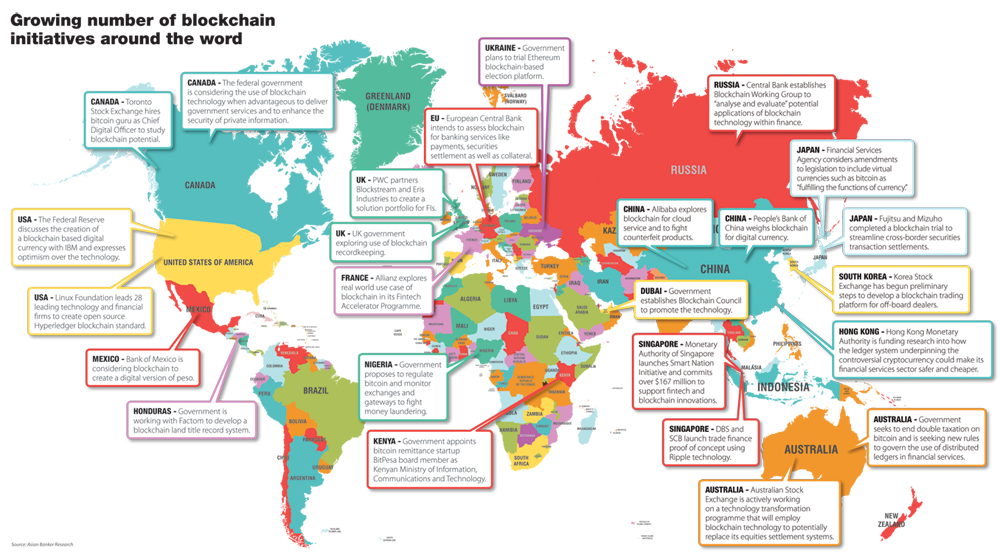

Introducing the directory of blockchain initiatives

Digitisation and the rise of fintechs such as those developing blockchain use cases are expected to have profound impact on the banking industry.

Blockchain according to DBS chief innovation officer, Neal Cross, is “not a technology but a business design plan.” A business plan requires not only an overhauling of its business processes and IT architecture, but there must also be sufficient talent to manage them and this takes time to develop.

The good news is, there is still time for banks to start acting as impact of blockchain while potentially significant, will only happen in the long run.

Appraising distributed ledger technology for banks today often rests with a special group of people who run their nascent fintech or innovation programmes. Indeed, it is not exactly an insignificant task to pick the winner or winners in the technology that may create the most fundamental transformation in the financial services industry since the introduction of the electronic ledgers and computer networks. It is about time that the technology gets beyond the realm of innovation labs. To help banks navigate the various developments in this emerging technology, the AsianBanker has compiled the first ever directory of 100 of the leading blockchain initiatives from around the world.

All Comments