Smart regulation as an idea argues for the importance of choosing the relevant instruments to meet the imperatives of large-scale changes and sizing the regulatory toolbox accordingly, in this process it is also important to consider the presence of a narrow window of opportunity.

Potentially, smart regulation is a fitting policy design alternative for supervising innovations in decentralised finance and crypto or digital assets that promise to reshape financial markets.

Smart regulation advances ‘efficient regulation’, which is a different policy design alternative, in the sense that it targets one real industry problem at a time instead of several outcomes of a large-scale change.

Binance´s call for smart regulation is found in the manifesto released in mid-November, 2021 that listed ten fundamental user rights. Specifically, the second states, “Smart regulation encourages innovation and helps keep users safe.” The purpose of the manifesto is to stimulate stability in the market place and ensure continuous growth.

Similar moves have been made by other industry giants such as the US-based Coinbase, which runs a set of business lines including a digital assets exchange like Binance.

In light of these guidelines, it’s obvious that Binance and Coinbase are attempting to demonstrate their capacity to self-regulate. Self-developed guidelines are a recurring exercise in any industry, typically performed by separate and independent entities that represent it. It is also in line with contemporary policy design norms which encourage principle-based regulations. Meanwhile, the manifesto can also be seen as an invitation to cooperate.

For Binance, it has become important to be on the right side of regulations, as pushbacks from regulators has hindered its growth.

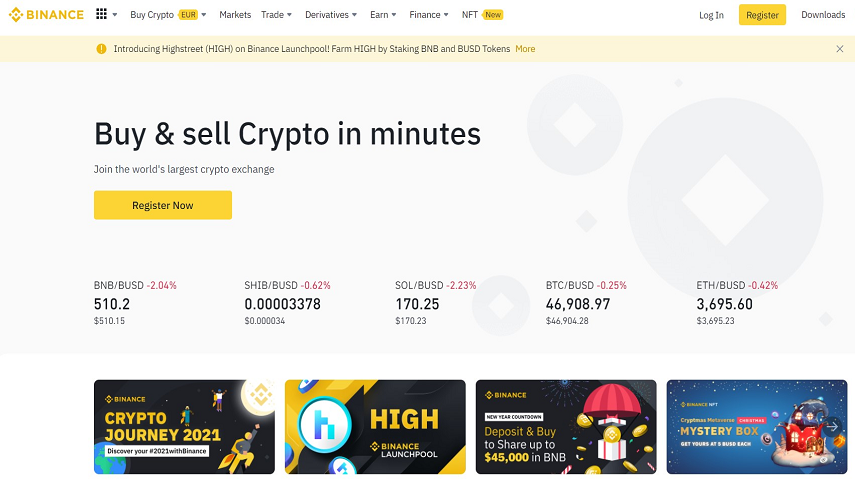

Binance was founded in China in 2017 by now CEO, Zhao Changpeng, and has since embarked on an aggressive international expansion path. It is estimated to have the largest number of visitors, 190 million, and users, about 29 million, to its website and apps, from various countries.

Binance’s market presence in countries such as the US, Bahrain, and Singapore has made several headlines recently.

According to Bloomberg, Binance has faced regulatory investigation and actions in the US on matters related to tax evasion and illicit trades. In an attempt to comply with regulators, it has blocked US users from accessing its global services. Instead, it has established Binance US that is a separate entity and regulated.

In contrast, Binance has had fewer problems reaching agreements with the regulators in Bahrain, where it recently received an in-principal approval to provide digital assets services.

Its attempt to enter Singapore has been a mixed bag of successes and failures. It has taken a 18% stake in Hg Exchange, a private securities exchange launched with the support of the Monetary Authority of Singapore (MAS). Binance announced in September 2021 that effective from October 2021 it had created an alternative platform for Singapore based users similar to the one for its US users.

Binance announced in July 2021 that its application for a digital exchange licence was under review. However, Bloomberg reported in December that the application was rejected over concerns about money-laundering risk. Apparently among the hundred plus crypto service applications the MAS has rejected so far, according to Nikkei Asia.

It will face both pushbacks, as it did in China, and invitations to shape new standards, as in the UAE and Indonesia. Regardless, it will be through a combination of self-developed guidelines, product and service adjustments as well as formal licensing and dialogues with regulators and policymakers that further growth can be ensured and stronger trust is built in the market place. Next stop for Binance, a digital exchange licence in the United Kingdom.

All Comments