As we enter 2024, the global banking industry stands at a critical crossroads, marked by transformative challenges and borderless opportunities. The landscape is rapidly shifting, underpinned by complex economic dynamics, technological disruptions, and an ever-increasing emphasis on sustainability and ethical practices.

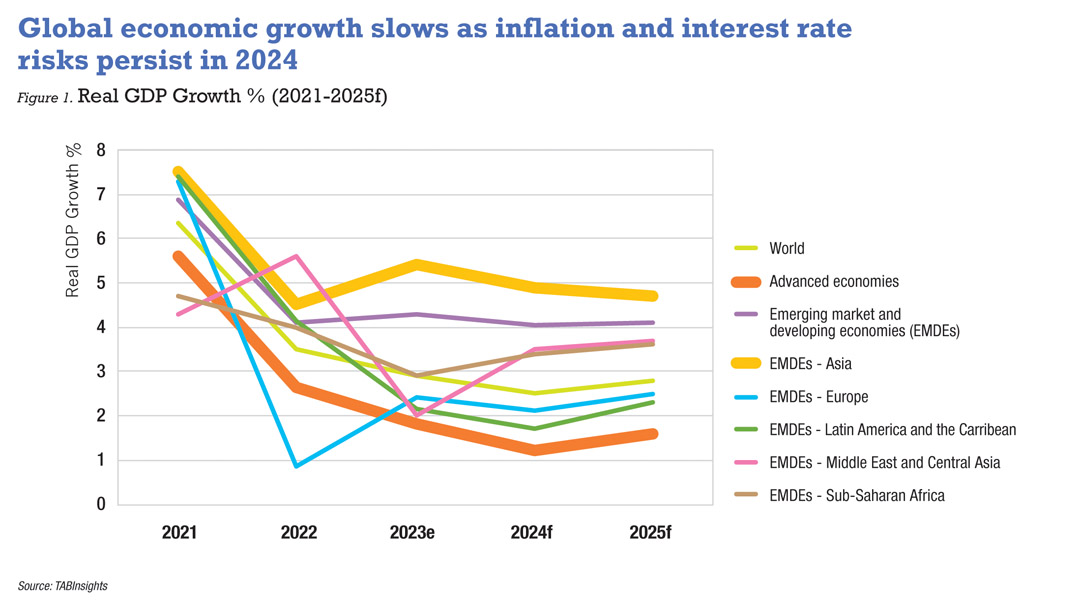

The International Monetary Fund (IMF) projected global economic growth to slow to 2.9% in 2024, the third consecutive year of slowdown, primarily due to the drag from higher interest rates to combat inflation. For advanced economies, the IMF anticipates a slowdown from 2.6% growth in 2022 to 1.5% in 2023, and further to 1.4% in 2024, as the effects of policy tightening become more pronounced.

Meanwhile, emerging market and developing economies are expected to experience a modest decrease in their growth rates from 4.1% in 2022 to an even 4.0% in both 2023 and 2024.

While developing economies in Asia continue to slow their growth in 2024 to 5.0%, those in the Middle East and Africa are expected to grow faster by 3.2% and 3.3%, respectively, in the year ahead.

One of the most significant challenges facing the banking sector is the intersection of global and regional economic uncertainties. Banks are not just contending with the traditional cycles of boom and bust but also grappling with geopolitical tensions and the repercussions of a changing global order. Adding to this complexity is global economic divergence, with disparities in recovery trajectories and inflation across advanced and emerging economies, creating uneven pressures and opportunities in the banking landscape. This environment demands a strategic recalibration, where agility and foresight become indispensable tools in a banker’s arsenal.

Technological advancement, especially the rapid growth of the artificial intelligence (AI) realm, offers a panacea and a Pandora’s box for the banking sector. While AI presents unprecedented opportunities for efficiency and customer engagement, it also brings forth ethical and regulatory dilemmas that require careful navigation. The industry must tread this path with a balance of enthusiasm for innovation and a deep sense of responsibility.

The drumbeat of climate change and sustainable finance is growing louder, echoing across boardrooms and banking halls. The sector is increasingly recognising its pivotal role in championing sustainable finance. This goes beyond mere compliance or branding exercises; it’s about fundamentally rethinking how banking can contribute to a sustainable future. The transition to a low-carbon economy is not just a moral imperative but also a business one, as it opens up new avenues for growth and innovation.

Looking ahead, the global banking industry is poised to embark on a journey marked by profound transformation. The challenges are manifold, but so are the opportunities. It’s a time for the industry to not only adapt and survive but also to thrive and lead. The banks that will emerge stronger are those that can skilfully navigate the economic uncertainties, harness the power of technology wisely, and commit unwaveringly to sustainable practices.

The future of banking in 2024 and beyond will be shaped by those who can adeptly manoeuvre through these complex times while keeping an eye on the horizon for emerging trends and opportunities. The journey may be fraught with challenges, but for the prepared and the prudent, it could be a journey of potential and promise.

All Comments