The prospect of a global coordinated stimulus and vaccination-led rebound in 2021 was short-lived, scuppered by the emergence of new and more virulent variants of the virus, and a full-blown pandemic resurgence.

A more sustained resumption in economic and social activities did not materialise in 2021 and has clouded the economic outlook for Asia Pacific (APAC) in 2022. In many instances, conditions at the end of 2021 were worse than at the start of the year. Hospitalisation and deaths from Delta exceeded 2020’s tally, social distancing measures became more restrictive, trade and supply chain bottlenecks persisted and domestic social and political order deteriorated as inequality in income and economic opportunities widened.

Aggressive fiscal and monetary stimulus measures funded by government deficits have increased public debts, and fuelled asset prices and inflationary pressures. More significantly, it has limited government policy room to do more to drive growth in 2022 and beyond, especially for less developed economies.

Externally, geopolitical tensions between the United States (US) and China, as well as Russia and the West escalated noticeably into 2022, weighing on global business confidence and investment sentiment. Growth in developed and advanced economies, in particular, the US and European Union (EU), reversed in the second half of 2021, lowering demand for products from emerging and developing economies in APAC and the rest of the world.

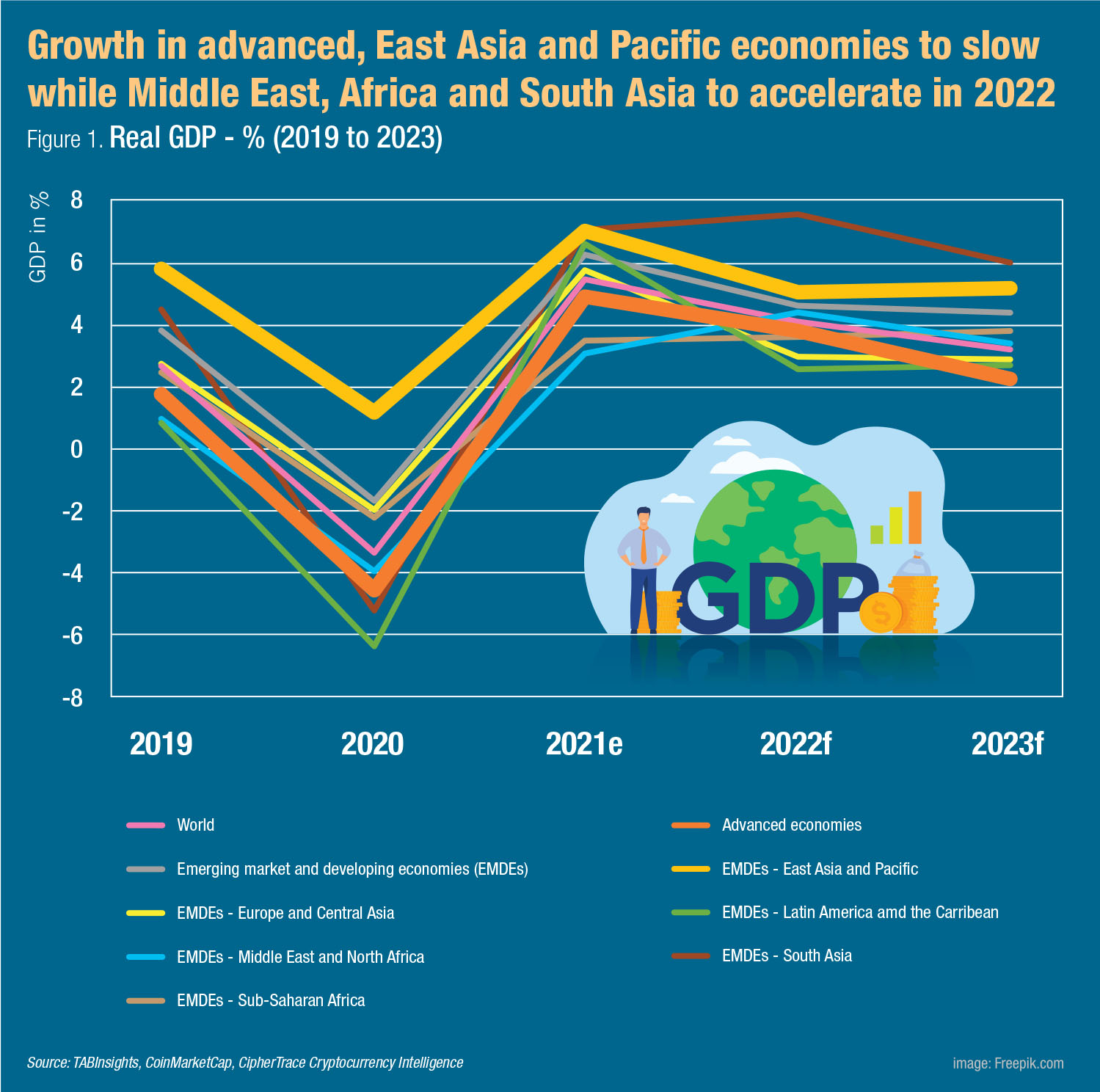

The World Bank expects global growth to slow markedly from 5.5% in 2021 to 4.1% in 2022 and 3.2% in 2023 as the build-up of demand evaporates and fiscal and monetary support starts to unwind around the world.

APAC economic growth to slow and diverge in line with global trend

The slowdown is accompanied by an increasing divergence in growth rates between advanced economies and emerging and developing economies. Growth in advanced economies is expected to slow from 5% in 2021 to 3.8 % in 2022 and 2.3% in 2023—that it says will sustain output and investment to pre-pandemic levels. However, in emerging and developing economies, growth is expected to fall more precipitously from 6.3% in 2021 to 4.6% in 2022 and 4.4% in 2023.

Ayhan Kose, director of the World Bank’s Prospects Group, said, “In light of the projected slowdown in output and investment growth, limited policy space, and substantial risks clouding the outlook, emerging and developing economies will need to carefully calibrate fiscal and monetary policies”.

Growth in East Asia and Pacific is expected to slow to 5.1% in 2022, in tandem with the deceleration in China’s growth. However, South Asian economies, Bangladesh, India and Pakistan in particular, are expected to see a pick-up in growth to 7.6% this year.

Taimur Baig, chief economist at Singapore’s DBS Bank sees 2022 characterised by strong consumer demand in developed markets and a substantial reopening dynamic in emerging markets, clouded by US monetary policy moves. However, the Omicron variant threatens to spoil the narrative. He wrote in a commentary, “Even if it turns out to have more bark than bite, i.e. very infectious but not particularly lethal, the world’s vulnerability to variants is well underscored, shedding harsh light on the danger posed by global vaccine inequity. Markets will remain on the edge with inevitable news-flow of this nature”.

Banks can expect stable outlook but risks persist

Moody’s forecasted a stable outlook for APAC banks in 2022, based on what it believes to be improving economic conditions in the region and banks’ steady capital and liquidity buffers. It expects banks to maintain strong balance sheets with stable solvency and liquidity positions.

While problem loans will increase modestly as governments end their support measures, banks’ strong credit provisions will mitigate asset quality risk. With stable and healthy core capital ratios and improving profitability, banks’ will also continue to grow their loan books, make dividend payments and manage capital through share buybacks, it concluded.

Still, Alicia Garcia Herrero, chief economist for APAC at French investment bank, Natixis, warned banks in the region to enter 2022 with great caution. “On the one hand, the pandemic is not over as clearly exemplified by the spread of Omicron. This is already leading to reduce domestic and international mobility, which will worsen economic growth. At the same time, the Fed’s tapering will put upward pressure on interest rates, worsening credit risk further,” she elaborated

Eugene Tarzimanov, vice president and senior credit officer of Moody’s, expects an uneven economic recovery across the region, “Problem loans will increase moderately as most remaining government support and forbearance measures end. Banks’ profitability will improve as loanloss provisions decline to pre-pandemic levels in most systems, while liquidity conditions will remain favourable”.

Significant downside risks persist

He however warned of some downside risks to the outlook, “Coronavirus resurgences followed by strict lockdowns and economic disruption are a downside risk to our stable outlook. In such a negative scenario, bank earnings will be pressured as economic recovery is derailed by new coronavirus waves or sharp declines in the prices of properties and financial assets”. Rising asset prices across APAC is expected to have mixed credit implications for banks. Property price inflation will strengthen the value of collateral held by banks. However, any sudden correction in the real estate market given the uncertain economic or financial conditions will increase risks. Meanwhile, high commodity prices are a positive for banks in commodity-exporting economies like Indonesia and Malaysia as well as trade finance hubs such as Singapore and Hong Kong.

Baig warned of bubbles forming in the asset markets, which have been marked by historically high valuation across the spectrum. “While rates, liquidity, and investor appetite are conducive for the froth to persist, the space between profit-taking and a downward spiral narrow at such lofty levels. Unlike the Chinese authorities who appear impervious to asset price corrections, the Fed in particular faces tremendous pressure to support the markets; 2022 may bring several tests of such nature”.

He noted that the global economy and markets took notice of China’s market selloff and economic slowdown in 2021, but there was little spill-over. “Further correction in China, be it from pandemic resurgence, regulatory crackdown, or power shortage, could put a major dent in global demand and investor sentiment”.

Baig also called for countries to start dealing with the fiscal cost of the pandemic. “Many countries have seen their debt to GDP ratio go up by 15% to 30% over the past couple of years. Regardless of the level of interest rates, the time to stop adding to debt has arrived, which would require both healthy GDP growth and reduction in fiscal support. This would be a challenging act, to say the least, with a high chance of a few sovereign stumbles. These risks are likely to manifest outside of Asia, but the stress could spill over to these shores”.

“Monetary policy will remain largely accommodative or neutral in APAC. However, some central banks may raise interest rates amid higher inflation and lower economic disruptions from the coronavirus. Expectations of stronger inflation may lead to a steepening of yield curves, a positive for banks’ net interest margins (NIMs),” commented Tarzimanov.

Herrero expects inflationary pressures stemming from supply chain disruptions to continue as renewed border controls will increase shipping and airfreight costs and production might also be affected negatively. “However, demand should also be weakened by Omicron, lifting some of the inflationary pressures,” she noted.

However, Tarzimanov foresees supply chain bottlenecks easing in 2022 from very strained levels as the supply of goods improves, consumer demand shifts and labour markets evolve. “This will positively affect economic growth and support bank earnings,” he remarked.

Herrero sees supply chains disruptions not just from the resurgent pandemic but new climate change requirements, “Indeed, at least during 2022, supply chains will be affected by renewed COVID waves as well as the energy transition as the shipping industry moves towards reducing emissions”.

She explained, “Climate change and the energy transition are going to be a major driver of banking activities as environment, social and governance (ESG) lending will increase much faster than any other and clients will be increasingly sensitive to banks’ actions on the ESG space. In other words, banks which are perceived greener will face a lower cost of funding but will also be able to capture clients more easily”.

Confronting the digital competition

In addition to the risk of a resurgent pandemic pressuring bank earnings, banks may also face substantial tightening of liquidity and funding conditions due to unexpected changes in monetary. There is also significant competitive pressure on incumbent banks from financial technology (fintech) firms and digital banks

“The pandemic has clearly accelerated the need for digital banking services. Banks which are not ready for this challenge will not be able to compete,” Herrero remarked.

Tarzimanov explained, “Digital disruption will continue, lowering transaction costs and benefiting the unbanked in APAC. Competitive pressure is rising for incumbent banks, but how rapidly established and new fintechs can take market share will depend on the different regulatory and policy environments in APAC. Cybersecurity challenges will remain acute, with banks investing heavily to strengthen operational resilience and customer data protection”.

All Comments