- Hong Kong and Singapore saw bank loans contract in 2022

- Bank loan growth in India, Indonesia and the Philippines accelerated the most

- Overall loan growth momentum is expected to be steady

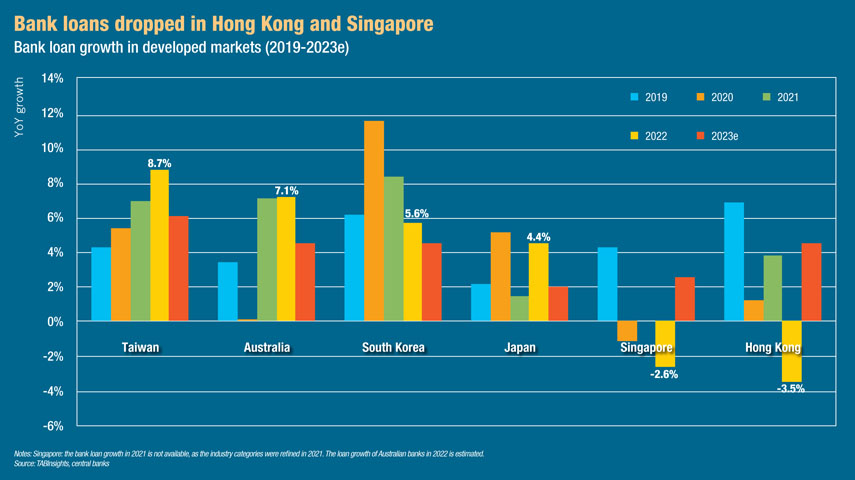

Total bank lending in the Asia Pacific expanded by 9% in 2022, down from 9.4% in 2021. Excluding China, growth was 5.9% in 2022, edging up from 4.9% in the previous year. Among the 13 markets in the region, Hong Kong and Singapore are the only two markets that posted a decline in bank loans in 2022, while India registered the strongest growth. Total loans in China, Indonesia, the Philippines and Vietnam also grew at double-digit rates. Most central banks across the region raised interest rates to fight inflation, resulting in higher borrowing costs. The inflationary pressures and the lagged effect of interest rate hikes will affect demand for bank loans in 2023. Countries such as Australia, India, Malaysia, Indonesia and the Philippines will face slower loan growth. In China, banks will sustain double-digit loan growth. Meanwhile, some improvement in loan growth is expected in markets such as Hong Kong, Singapore and Thailand.

Hong Kong and Singapore saw bank loans contract in 2022

Total loans of licensed banks in Hong Kong fell by 3.5% in 2022. The growth of total loans for use in Hong Kong decelerated from 4.3% in 2021 to 0.9% in 2022, cooled by the tepid demand for housing and corporate loans. The total of other loans for use outside Hong Kong that accounted for 27% of total bank loans, dropped by 10.3% in 2022, following a mild increase of 1.3% in the previous year.

In 2022, Hong Kong Monetary Authority raised its base rate from 0.5% to 4.75% due to its linked exchange rate system. Sluggish loan growth was partially due to lower borrowing costs in mainland China.

In Singapore, total bank loans dropped by 2.6% in 2022, dragged down by decreases for both loans to residents and non-residents. Total loans and advances to non-residents fell by 6.4%, while business loans and consumer loans dropped by 4.8% and 16.3%, respectively. Total loans and advances to residents, that accounted for 63% of total loans, declined by 0.3%.

In the last quarter of 2022, total bank loans fell by 4.4% to $962 billion (SGD 1.29 trillion) as customers adjusted to higher borrowing costs. In addition, the government unveiled several property cooling measures on 30 September 2022 to ensure prudent borrowing.

Bank loan growth in India, Indonesia and the Philippines accelerated the most

The loan growth of Indian banks improved to 18% year-on-year (YoY) in September 2022 from 5.8% YoY in September 2021. Total loans of private sector banks grew at 21% YoY in September 2022, compared to 6% YoY for public sector banks.

Countries such as Indonesia, Malaysia and the Philippines also experienced improvements in bank loan growth in both 2021 and 2022. The universal and commercial banks in the Philippines achieved loan growth of 13.4% in 2022. In Indonesia, total bank loans grew by 5.2% in 2021 and 11.3% YoY in November 2022, after contracting by 2.4% in 2020.

Vietnam and China registered the strongest growth in total loans during the period from 2019 to 2022, with a compound annual growth rate of 12.7% and 12.1%, respectively. Loan growth in Vietnam has remained relatively stable over the past few years, while China’s bank loan growth has decelerated gradually.

Thai banks recorded the slowest loan growth among the emerging markets in the region in 2022, decelerating from 6.5% in 2021 to 2.1% in 2022, which can be partially attributed to corporate loan repayment.

Overall loan growth momentum is expected to be steady

It’s expected that bank loan growth will decelerate in countries such as Australia, India, Malaysia, Indonesia and the Philippines amid high interest rates. However, the overall bank loan growth in the region is expected to sustain momentum in 2023.

In China, business and consumer confidence is gradually improving as China exited from the Zero-COVID policy and reopened. Loan demand in China will increase and banks will step up lending to support its recovering economy. The reserve requirement ratio for eligible financial institutions was lowered by 0.25% at the end of 2022 to boost liquidity in the financial system.

In Hong Kong and Thailand, the demand for bank loans is expected to improve, in line with the momentum of economic recovery. Companies in Hong Kong will borrow more to capture the development in the Greater Bay Area.

In Singapore, the property cooling measures will tame demand for housing loans as it will take some time for the impact of measures to be fully felt. However, a modest improvement in overall loan growth is still expected.

All Comments