- UOB built on its strong franchise across 500 offices in 11 markets in Asia Pacific

- A strong digital customer servicing capabilities in the medium business segment

- UOB’s financials in SME banking outperformed its closest peers in Hong Kong and Singapore

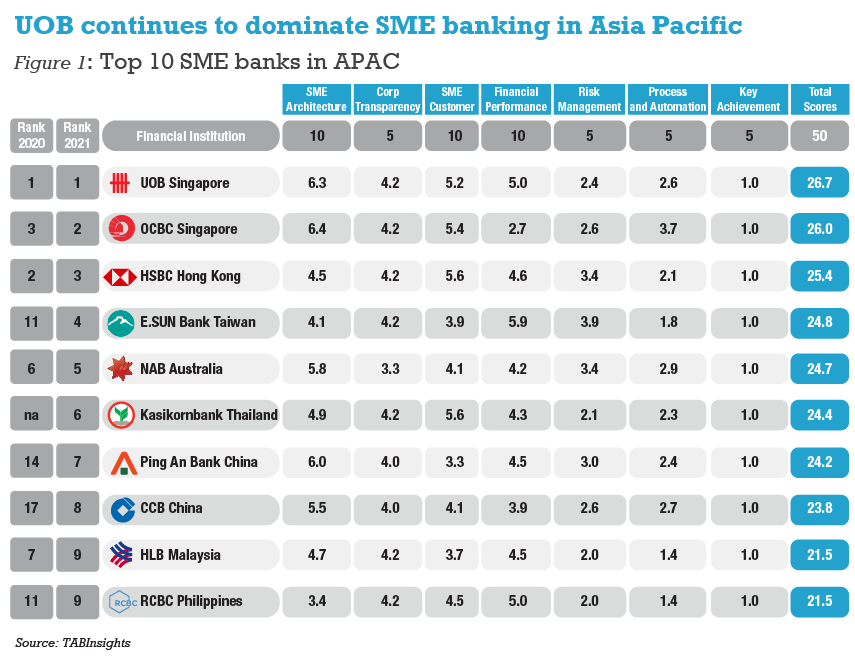

UOB Singapore’s regional small and medium enterprise (SME) franchise dominated again in 2021 and awarded The Best SME Bank in the Asia Pacific Region (APAC) with a strong score in financial performance, rolling out a coherent strategy and offering across markets and providing leading customer value through their experiences of offline and online services. To access the full scorecard and key performance indicators (KPIs) we apply in our evaluation to determine the best SME banks click here.

UOB Singapore is among the leading banks that responded swiftly to provide timely and effective relief measures to help SMEs to survive. The banks stepped up their financial and non-financial support to help SMEs rebuild and grow in the new normal, and redesign the customer journeys to allow more flexible ways to bank.

UOB Singapore was the first bank to extend assistance to SMEs in February 2020 with a $3 billion (SGD 4.1 billion) relief assistance fund ahead of any government support measured, making it the largest share in government relief loans in Singapore.

It digitalised and streamlined application processes which take as fast as two days for clients to receive funding and helped more than 10,000 retail and food and beverage SMEs set up their online presence since 2020. Overall, UOB offered a total of $27 billion (SGD 37.3 billion) internal and government-assisted relief schemes across the region helping more than 10,000 businesses to survive the crisis, with micro and small enterprises representing x%.

Similar initiatives across the industry have brought tangible customer, business and brand outcomes to the banking sector. In this context, banks have accelerated the digitisation and automation of their SME operations and processes. While more nascent than in retail financial services, digitisation of the SME product and service journeys is helping banks to create capacities and economies of scale that did not exist before. With the pandemic becoming endemic and possibly ending, banks see the survival phase among businesses coming to an end, and growth gradually recovering.

UOB is not only the largest SME lender in Singapore among the three local banks with a market share of over 20%, it also runs one of the largest regional footprint next to DBS of any bank in APAC in servicing SMEs. Its regional loan book contributes X% to its portfolio.

UOB built on its strong franchise across 500 offices in 11 markets in APAC

UOB’s strong franchise of 500 SME offices across 11 markets connecting businesses to opportunities across the region is unrivalled even among its top peers in the region. Its network leadership enables the bank to offer foreign direct investment (FDI) advisory which provides integrated market entry solutions. It serves as a one-stop service for foreign companies looking to enter new markets. To date, UOB’s FDI advisory unit has supported over 3,500 companies in their cross-border expansion in Asia, most are mid-sized companies. This is complemented by its global business development services that structure cross-border financing solutions by offering cost-effective and/or alternative funding combining both onshore and offshore lending and facilitate credit approval for cross-border transactions. For the middle market segment, it launched the China-Thailand renminbi cash pool solution and multi-currency cross-border cash pool solution to support its clients’ cross-border liquidity needs. UOB was also the first Singapore bank to receive the appointed cross-currency dealers (ACCD) licence for renminbi/rupiah in China and Indonesia to deepen capabilities in ASEAN currencies. UOB is the only offshore bank nominated by People's Bank of China (PBOC) to provide FX and cash trade services. This facility alleviates medium-sized enterprises’ pain points of funding shortage during overseas expansion, especially when scaling into Southeast Asia, and a reduction in financial and tax costs, as well as in administrative workload for the client.

UOB was among the first in Asia to build its environmental, social, and governance (ESG) financing framework and serves multiple SME segments across different industry types, company sizes, and markets across the region. In 2021, it enhanced its green building developer sustainable finance framework to incorporate more property asset types. It was one of the first banks to launch the green trade finance and working capital framework. Among its key initiatives is the U-Drive and electronic waste ecosystem financing, an integrated green financing solution for the electric vehicle (EV) ecosystem in Singapore, a solution that connects the EV value chain – from automotive brand owners, automotive dealers and charging point operators to end-users seamlessly. The electronic waste ecosystem financing supports and addresses the funding needs of the value-chain by increasing flexibility in working capital. In addition, UOB is one of the first banks to partner CO2X, a sustainability platform connecting corporates with accessible carbon tracking solutions and green financial services.

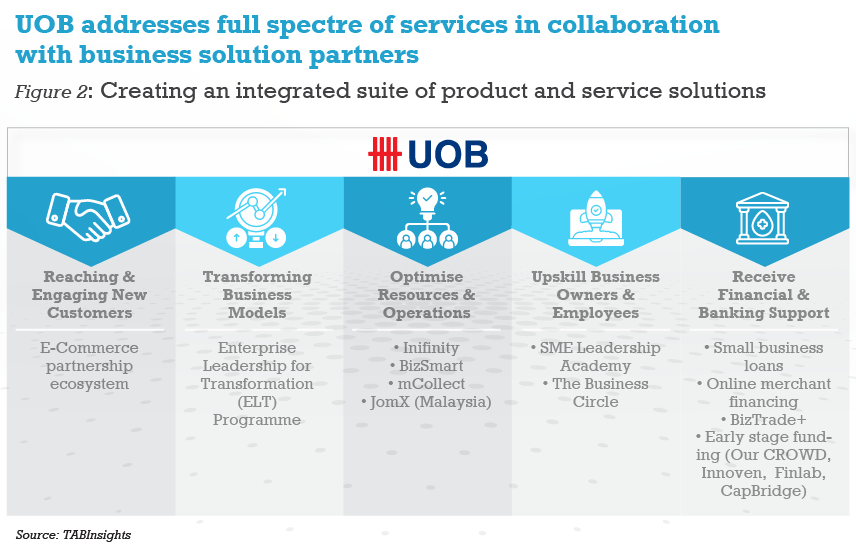

Delivering key value propositions across an ecosystem of solutions

Enterprises, regardless of its size, expect increasingly from banks a fully integrated product and service suite covering core financial as well as stakeholder needs such as the owner’s personal finance, employees’ financial needs, the requirements of suppliers and dealers, and the lifecycle demands from start-up to international expansion. UOB is leading its peers in building and curating such an integrated platform where all is in one place.

BizSmart is a suite of business management solutions for smaller businesses that UOB is building with more than a dozen business partners in accounting, e-commerce, marketing, payments, small business financing and automated wealth management to help SMEs manage clients end-to end business activities through web and mobile apps. Businesses are drawn to the bank’s ecosystem because they can market and showcase their products and solutions to gain new customers. UOB increased the solution classifications to seven different categories spanning 20 industry partners, including online food ordering capabilities and fulfilment systems. As of 2021, businesses that have taken up BizSmart have shown an average growth of about 20%, with younger companies showing more than 50% rise.

The bank has also built a comprehensive financing toolbox for start-ups and closed the largest amount of business venture loans in 2021 in the programme.

Strong digital customer servicing capabilities in medium business segment

UOB Singapore remains in the Top10 ranking for business banking based on its net promoter score (NPS) in the SME segment. It offers an improved customer experience through automation and process simplification in the micro and small segment such as instant online account opening, straight- through services for unsecured loan applications, while its core strength in the relationship managed SME account is increasingly spilling over into multi-product relationships.

In a large scale, Greenwich survey, that benchmarks banks relatively across the board from August to November 2021, UOB maintained its leadership position in customer relationship quality, among key banks such as DBS, HSBC Hong Kong and Kasikornbank Thailand. The survey covers six key markets, Singapore, Indonesia, Malaysia, Thailand, China and Hong Kong.

The bank also demonstrated that its digital solutions are becoming well entrenched with its SME customer base with digital business payments a core component of their businesses, connecting them to further growth opportunities. Ninety five percent of SME customers are digitally active. The bank observed a 10% pivot towards the use of digital payments in 2021 such as PayNow Corporate as opposed to cash and cheque payment channels.

Customers using UOB Infinity, its digital business banking platform, and BIBPlus solutions across the region increased significantly.

The bank has also been expanding its financing support to micro, small, medium enterprises (MSMEs) by providing them short tenor cash advance loan or a longer-erm working capital loan, or new to bank (NTB) clients with less than three years in operation. Businesses can be onboarded digitally through the entire process with a straight-through application process. Parallel to this initiative, the bank has entered small-ticket financing to online businesses operating on e-commerce platforms in Vietnam, Thailand and Malaysia since 2019.

UOBs financials in SME banking outperformed its closest peers in Hong Kong and Singapore

In 2021, UOB was again among the best financially managed banks in SME banking compared to its closest rivals. The bank’s SME business contributes more than 20% to overall bank revenue, compared to 28% at DBS and 37% at Kasikornbank Thailand. The bank has consistently delivered strong financial results in particular since 2019 giving UOB a critical edge in maintaining its best SME bank status in APAC. It outperformed its closest competitors in profitability based on return on assets in SME banking.

Group SME saw a double-digit growth in outstanding loan balances in 2021. The bank outperformed HSBC and OCBC in annual profit generation per SME customer. UOB also managed to increase its fee income to cushion the compression on the deposit net interest margin in 2021 and stood among the best cost-managed portfolios in this year’s programme.

In risk management, impaired business loans have been declining among the top 10 banks and so has the portion of loans that needed to be restructured. Compared to its competitors, UOB has among the lowest average delinquencies levels for small businesses.

This is a sponsored article and does not necessarily reflect the opinion of the publisher.

All Comments