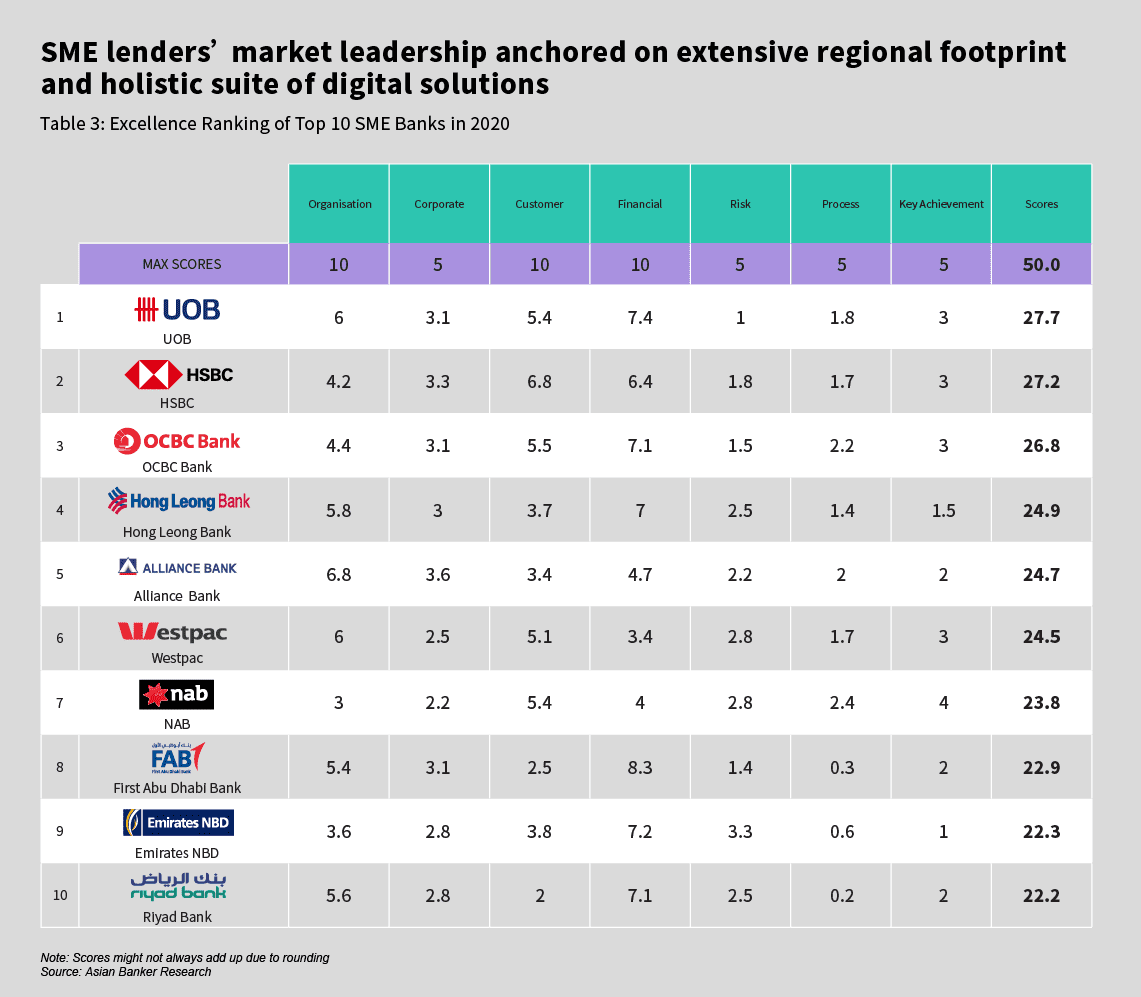

The small and medium-sized enterprise (SME) banking segment continues to undergo a process of transformation in terms of how it is connecting and servicing its customer base. Similar to its retail banking counterparts, there is continued and sustained disruption from various fintech players as SME financing remains an underserved segment and funding gaps persist limiting opportunities for enterprises to scale and grow. The top 10 SME banks evaluated from this year’s programme of more than 35 institutions for the Best SME Bank in 2020 completely reflect this paradigm shift.

A key standout is UOB’s BizSmart, a platform of digital business management solutions that gained traction last year with 40% increase in sign-ups and the bank’s suite of solutions for SMEs in Southeast Asia connecting with UOB accounts and facilities. HSBC is also commendable given its decent top line growth in 2019 and having one of the highest NPS scores while also responding emphatically to the COVID-19 pandemic.

Financial performance: UOB leads on key indicators

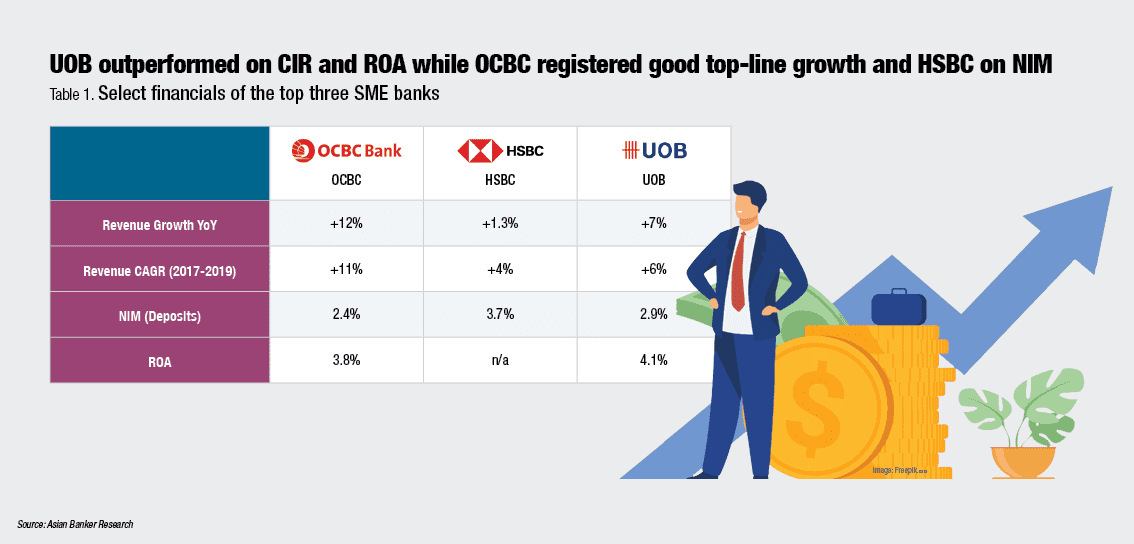

In 2019 UOB delivered solutions to SMEs that resulted in solid revenue growth for the business and expanded the available market opportunity for the bank across the region. Almost half of total revenue now comes from outside its primary Singapore market. While OCBC showed the better top line growth at +12% for 2019 and CAGR growth at +11% from 2017 to 2019, both HSBC and UOB outperformed OCBC in terms of NIM, CIR and ROA. HSBC outranks both UOB and OCBC in terms of average net income per SME.

Interestingly, HSBC and UOB’s revenue size is almost twice as large as OCBC and both banks had generated almost the same amount of operating revenue in 2019. The second half of 2019 was a particularly challenging year for HSBC in view of trade war and the social unrest as demonstrated by the negative GDP growth in Hong Kong (YoY 3Q: -2.8%, 4Q: -2.9%). The revenue growth of 1.3% for HSBC Business Banking will need to be considered in the context of Hong Kong’s economic and operating environment. Notwithstanding the challenging conditions, HSBC achieved a 5% growth in its asset book. New products and propositions launched such as Sprint Account and PayMe for Business have also been engines for revenue growth in 2019.

Organisation: servicing SMEs across the growth spectrum

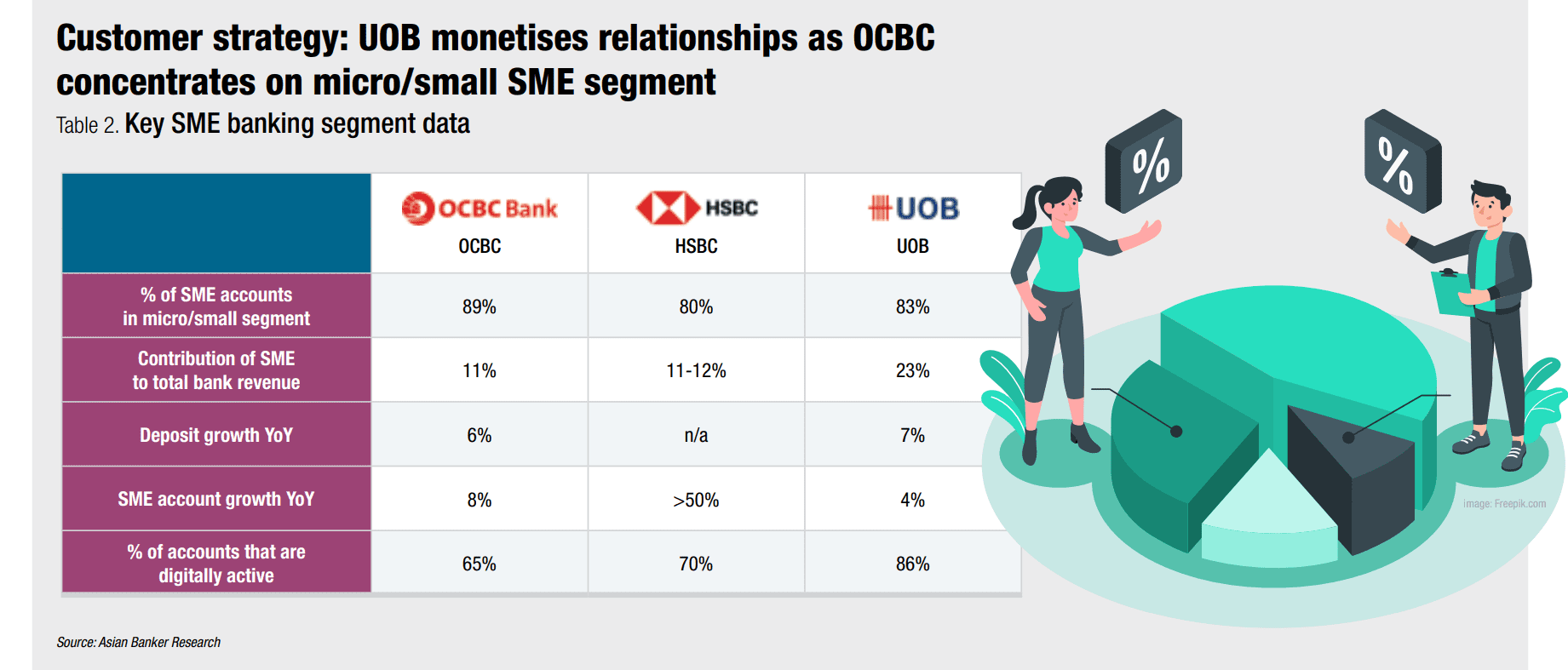

UOB offers different digital solutions for various SME segments (start-up, growth, mature stage) while deploying 40 dedicated full-time tech implementation specialists across the region. Its Finlab SME Leadership Academy helps both start-ups and SMEs grow their businesses by matching SMEs with technology solution providers to suit their needs (pre-funding/debt stage etc.). HSBC’s SME business architecture leans towards the corporate side organisationally within the bank and the financial profile of its clients is also larger compared to the other banks under consideration. HSBC’s Sprint account for start-ups has been well received in 2019 and the bank grew its SME accounts by more than 25,000 new accounts (or 50% YoY growth).

Interestingly, OCBC Bank lets start-ups open business account immediately after incorporation. OCBC also offers a fast track account opening for sole proprietor status SMEs and there is no need to visit a branch to complete the application or receive a cheque book. With instant decisioning of a business loan application at OCBC, SMEs can now get loan approval status within five minutes, and online loan disbursements more than doubled, achieving 24% of loan applications via the digital platform.

HSBC has a market share in SME loans of above 20% while OCBC is among the top 2 banks in regard to the size of the loan book. OCBC launched an online loan application to enable SMEs have access to financing in a more convenient and frictionless manner. By leveraging the national depository MyInfo (MyInfo Business), loan application forms are pre-filled with the necessary information removing the need to submit documents separately.

UOB scored well in the high number of SME customers although OCBC nominally has more and grew more accounts in 2019. A plus point for UOB is that 92% of all SME accounts are revenue-generating and active despite maintaining comparable deposit growth with OCBC in 2019. OCBC grew its digital customers to 64%, contributing to 84% of total SME revenues and is thrice the revenues of non-digital customers. Digital transactions account for 72% of total SME transactions by value and OCBC now has more than 40% market share of total corporate PayNow registrations in Singapore.

Clearly, having an effective digital strategy has become imperative to both drive new SME account acquisition as well develop another sustainable revenue stream for SME banks who want to compete in this market.

All Comments