- UAE launched the first in the region KYC Blockchain Platform in February 2020, allowing sharing of data between licensing authorities and FIs

- Banks in the UAE have launched self-service channels so customers can update KYC remotely

- Banks in the country are collaborating with the Ministry of Interior to digitise their KYC journey

Know your customer (KYC) is a procedure followed by financial institutions (FIs) to identify and verify the details of new customers. This is aimed at preventing fraud and other financial crimes such as money laundering and terrorist financing. In placing KYC on top of their digital transformation journey, FIs are also able to onboard customers seamlessly and obtain information that helps them provide the best experience possible while adhering to regulatory requirements.

The current KYC process, however, entails a lot of manual documentation and verification. Information is collected from scanned physical documents or captured by devices. Validation is done manually through various sources, causing delay.

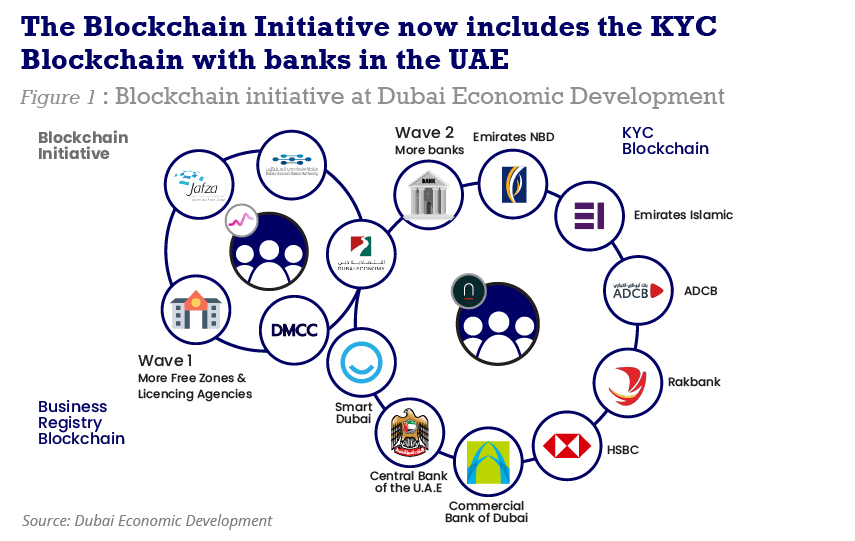

The UAE KYC Blockchain Platform was launched in February 2020 by Dubai Economy (Dubai’s Department of Economic Development) together with its founding partner banks. The main motivation is to create a national ecosystem that simplifies the sharing of verified KYC data between licensing authorities and FIs.

In 2020, Dubai Economy Department (DED) and Dubai International Financial Center (DIFC) Authority formed a collaboration to strengthen the UAE KYC Blockchain Consortium. This made the consortium the first national corporate digital KYC (eKYC) platform in the region to speed up the customer onboarding process. The consortium included UAE banks that were part of the KYC blockchain project. These were: Abu Dhabi Islamic Bank (ADCB), Commercial Bank of Dubai (CBD), Emirates Islamic, Emirates NBD, HSBC Middle East, and RAKBANK. Mashreq Bank joined in 2022, making it seven banks in total. At present, the KYC blockchain platform maintains around 50% of corporate eKYC data in the country.

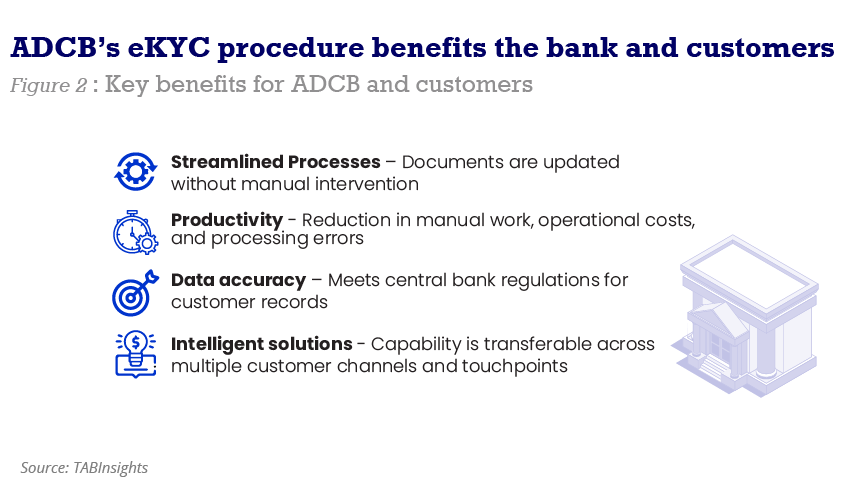

Banks in the UAE have been launching eKYC solutions in line with the government efforts to establish ecosystems. ADCB, a leading FI in the UAE developed a self-service channel to assist customers in updating their KYC documents remotely. Customers can access ADCB Personal Internet Banking (IB) on its website and the ADCB Mobile Internet Banking app (MIB) and update their Emirates ID and passport from their mobile or desktop.

Using optical character recognition (OCR) technology, information entered by the customer is validated against backend systems. If the details are accurate, a service request (SR) is created, and systems will be updated with the new details. This entire process is automated and can be completed in under five minutes with minimal risk compared with a previous manual process which took two days to complete. As of August 2022, 111,000 customers have updated their KYC details digitally, with 92% of customer records updated in a straight-through processing (STP).

On 15 October 2022 Dubai Islamic Bank (DIB) announced partnership with the Ministry of Interior (MOI) to implement a digital KYC journey for its new customers. This will allow new customers to open an account without visiting a branch, through face recognition technology. In 2021, MOI launched its digital verification face gateway service which provides secure artificial intelligence-based (AI) solutions to verify customer identity remotely. Alternative financial services players such as Al Ansari Exchange was the first money transfer company in the country to implement a complete eKYC journey for onboarding in collaboration with MOI, using facial recognition.

The UAE is leading by example globally by implementing a blockchain ecosystem for KYC data sharing. Following in the footsteps of the Dubai Government’s strategy of building a paperless and digital ecosystem, DED is investing heavily in the country’s digital economy.

Exchange of data and information between FIs and banks allows for the creation of a safe and efficient ecosystem that reduces risks associated with fraud, money laundering, and financial crimes. By linking all KYC-related data and information, the UAE became a pioneer in the banking system and has encouraged banks and other FIs in the country to create their own KYC initiatives either in-house or by collaboration to offer a seamless experience for their customers.

All Comments