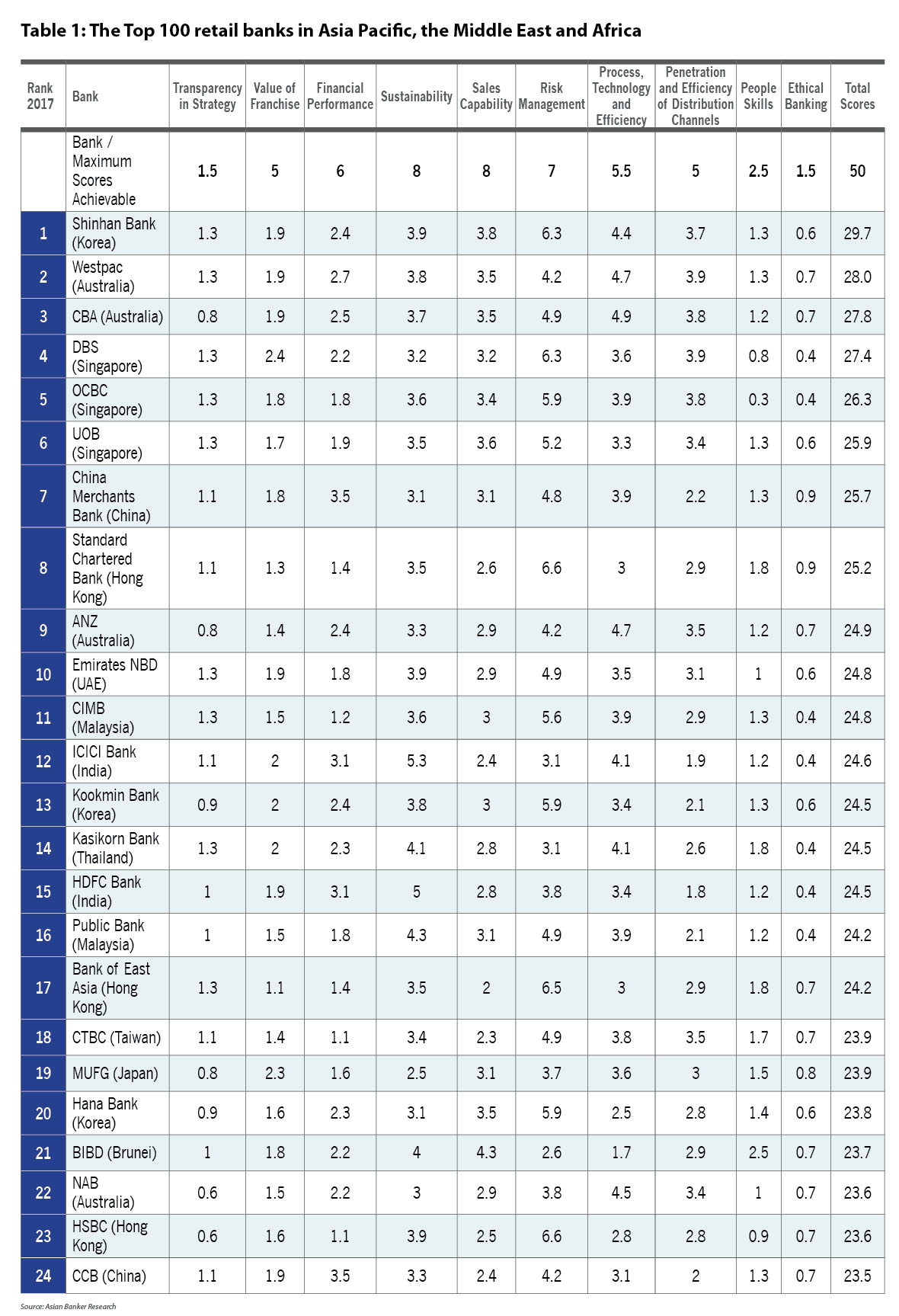

- The ranking is based on The Asian Banker’s market leading balanced scorecard methodology, which assesses financial institutions across ten dimensions

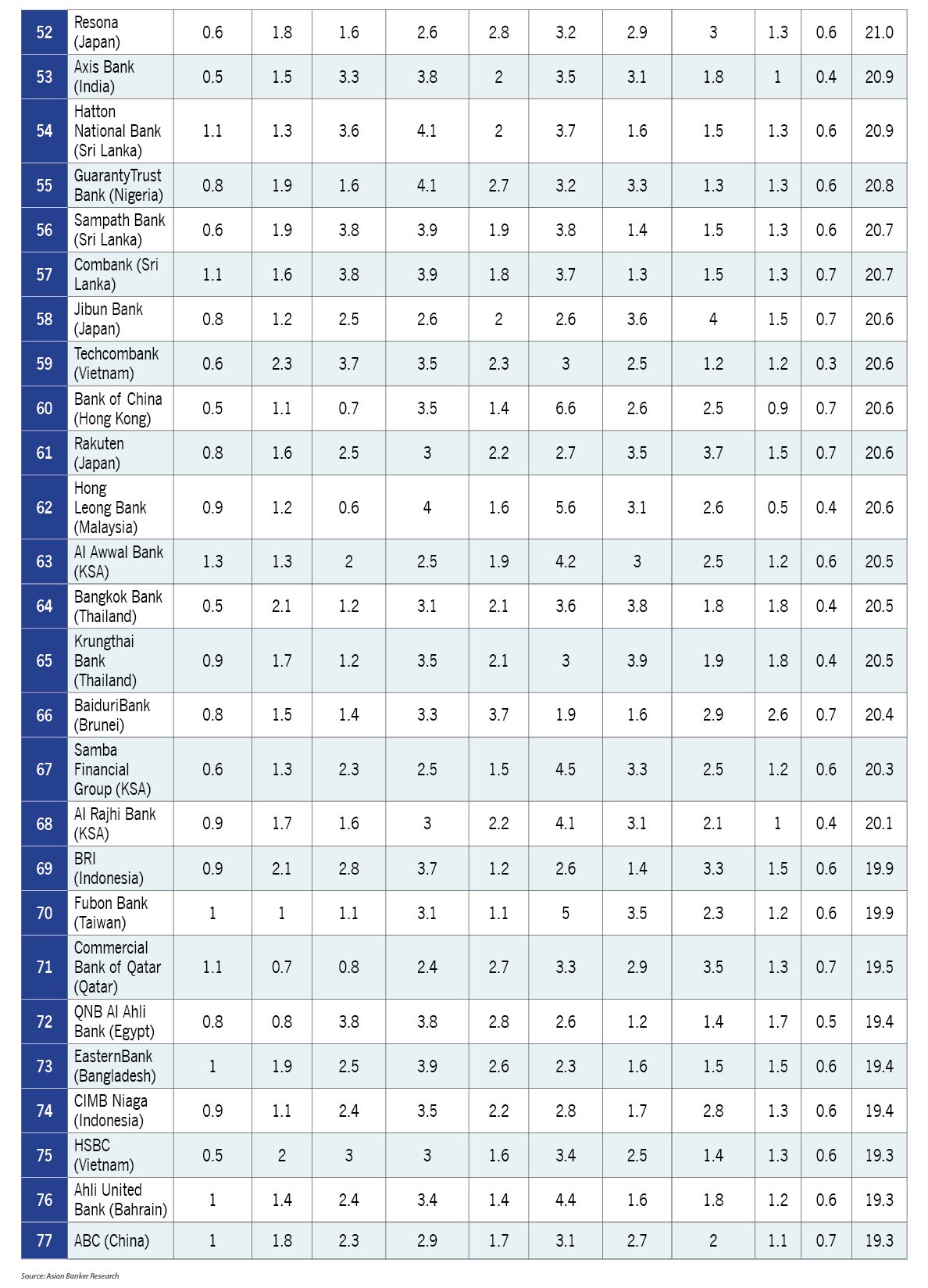

- Higher delinquencies and non-performing loans as well as incidences of fraud in emerging markets were impacting the risk score in the overall Top 100 ranking

- Technology showed the second highest gap, impacted by high turnaround times for credit cards and mortgages

The ranking is based on The Asian Banker’s market leading balanced scorecard methodology, which assesses financial institutions across ten dimensions. The scorecard consists of ten dimensions with 37 indicators. Only in some areas do size matter. Smaller banks may be handicapped in some areas - less than 10%of all indicators favour larger banks. The assessment is centred in the core belief that a well-run retail bank is one that demonstrates a long term, sustainable and profitable franchise with the customer as its core proposition.

Overall, higher delinquencies and NPLs together with incidences of fraud in emerging markets were impacting the risk score in the overall TOP100 ranking, showing the highest gap to total scores in the risk management dimension. Technology showed the second highest gap, impacted by high turnaround times for credit cards and mortgages and in some countries incidences of major network downtime.

For the TOP10 in the ranking, the biggest gaps to total score were observed in the value of franchise and financial performance. Both dimensions saw reduced scores due to the low growth environment banks operate in affecting top and bottom line growth. The value of franchise score tracks the brand value a bank enjoys in market place, which is reflected in the growth of low cost retail deposit and net customer growth.

Shinhan Bank Korea bagged Asia Pacific’s Best Retail Bank. In a tight race, Shinhan Bank Korea was outmanoeuvring DBS Singapore and Westpac Australia with better digital infrastructure, resilience gained in a difficult market and starting to bridge successfully the gap between client digital needs and services offered. Shinhan Bank has built a leading market share of above 20% in each of the key retail asset segments. The bank aims to digitise 80% of its retail loan portfolio by 2020.

Emirates NBD edged out convincingly its Middle Eastern rivals propelled by its consistent financial performance, sales and successfully digitising its services since 2012. It has risen to one of the most innovative retail banks in the TOP100 in a span of less than five years.

Below is the list of the top 100 retail banks in Asia Pacific, the Middle East, and Africa this year:

Read the Top 100 Retail Banks in Asia Pacific, the Middle East and Africa

All Comments