The first half of 2022 has passed, and the future of digital assets is becoming more vague, despite an increase in use and popularity. Since January 2022, more than a third of the 31,000 cryptocurrencies have disappeared from marketplaces, and investors in the remaining 20,000 cryptocurrencies have recorded substantial losses.

Investors saw the market capitalisation of the cryptocurrency market reach $2.9 trillion at the beginning of November 2021. Partly, it was due to the appreciation of currencies like bitcoin (market domination of about 40%) by the wider investment community; and partly due to the increasing interest in decentralised finance (DeFi) applications in various industries. It was also driven by the introduction of non-fungible assets (NFTs) that found many use cases in gaming and sports.

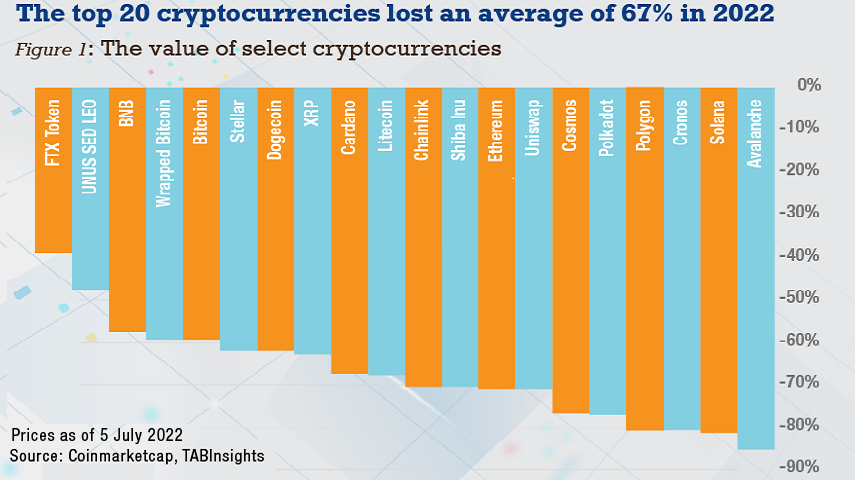

The devaluation of the market, which as of 5 July is at $880 billion, has been accelerating, due to several reasons. The crash of Terra (Luna) which lost 99.9% of its value on 11 to12 May 2022 has been linked to the loss of trust in currencies, which promise minimal volatility via complicated financial structures. The top 20 cryptocurrencies lost an average of 60% in valuation in that period.

Elsewhere in the financial markets, there are negative returns on investments, the Dow Jones Index for example has recorded not-so-immaterial losses (-11.8%) as of 5 July.

The market trend has been explained by a combination of developments including the geopolitical tensions with Russia, the record-breaking inflation waves, and the soaring energy prices.

To counter the effects of these developments, central banks around the world have sought relief via policy changes. The Federal Reserve of the United States for example has put its benchmark interest rate at a range of 1.5% to 1.7% through a series of percentage liftings.

Investors could consider potential interlinkages between traditional financial markets, e.g., the stock markets, and the new marketplaces offering trades with digital assets. Simply, the general negative outlooks for financial markets may hamper investments in digital assets.

For pessimist investors, the liquidation of funds such as Three Arrows Capital should be a clear warning sign of unhedged investment decisions in digital assets. For optimistic investors, the current market trend is perceived as yet another crypto winter. According to their reasoning, cryptocurrencies should remain strong as a technological phenomenon that can advance financial markets and facilitate better services.

Despite the optimism of such investors and given the current turmoil, there are few indications that cryptocurrencies would onboard another cycle of record-breaking valuations, at least in the near term perspective.

The valuations of the cryptocurrency market in 2021 did somehow implicate a potential drop at a later point in time. Six months into 2022, this promise has materialised.

All Comments