- The evolution challenge facing banks

- The Impact of SME digitalisation and fintech innovation

- Achieving ‘bank as a financial OS’

The evolution challenge facing banks

Fintechs, unlike traditional banks, have gone after underserved customers like small and medium enterprises (SMEs). Think neobanks targeting local merchant stores, trade finance solutions for e-commerce sellers or lending products for software-as-a-service (SaaS) businesses. Improvement in public digital infrastructure and supportive regulations have further spurred innovation in SME-focused solutions. As a result, the landscape for SME banking has become a lot more favourable today:

a) Digital technology has significantly reduced the cost to acquire and serve smaller customer segments, unlocking important markets for banks

b) Digital technology and financial automation are transforming the way businesses are profiled for risk and revenue, pushing real innovation in banking products and services

However, the challenge for banks is not just one of adopting emerging technology stacks; they face disruptive competition from the unbundling of banking products. Fintechs are building value-added products on top of vanilla bank accounts, payments or cards. This is not only eating into banks’ revenue, but challenging the ‘ownership’ of customer relationships that banks have traditionally enjoyed.

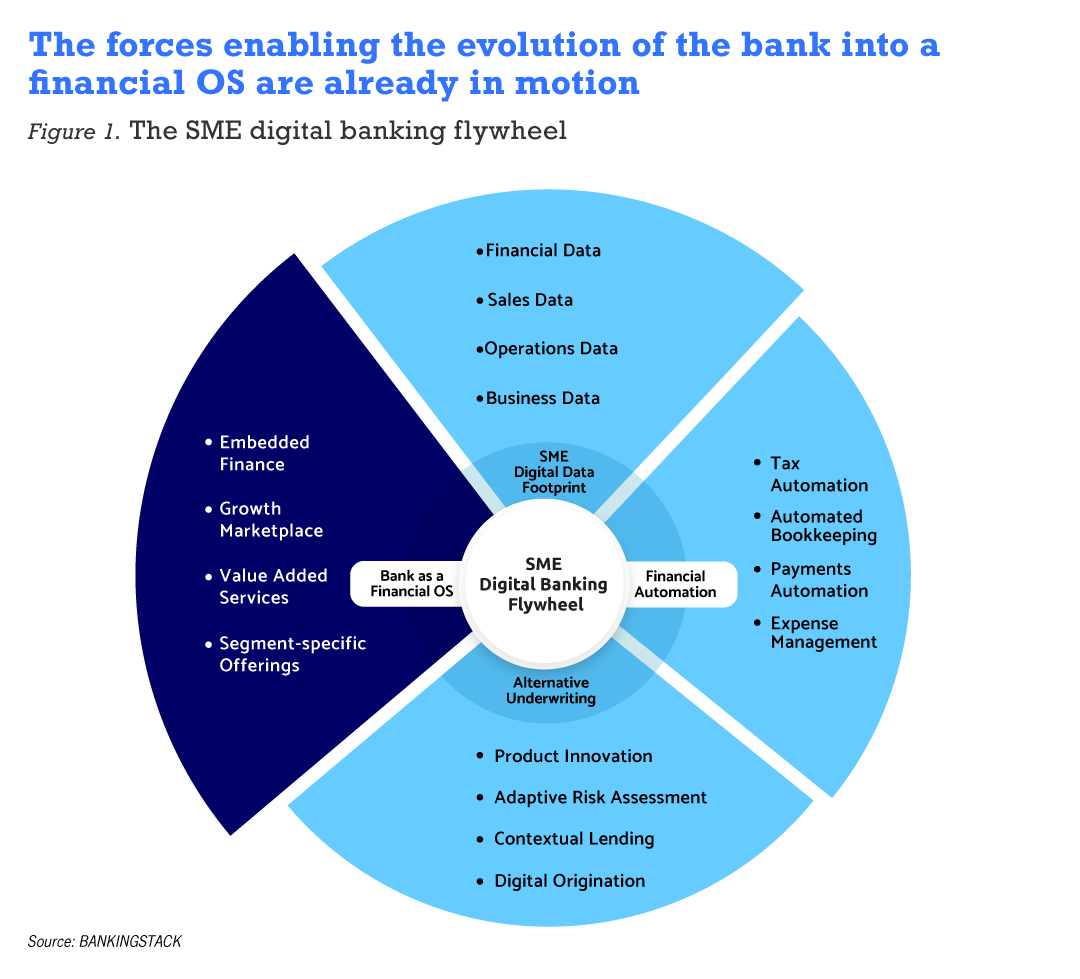

The next evolution of digital banking will see banks adapt their business models to create a ‘financial operating system’ (OS) comprising core banking services, financial automation capabilities, alternative underwriting capabilities, value-added services, and collaborative marketplaces. Building such a financial OS will put banks back in control of the innovation and unbundling of their products, as well as how their traditional strengths (license, trust, infrastructure) are monetised.

The impact of SME digitalisation and fintech innovation

The rapid development in digital public infrastructure and digital adoption by SMEs have created extensive data footprints. This has removed friction from origination and onboarding of SME businesses, making it possible for banks to plug into public and private databases and access the most important data points for a business in a matter of minutes.

Financial automation capabilities help businesses automate their most critical finance and accounting processes and keep track of their cash flows in almost real-time.

For banks, financial automation transforms their understanding of a business’ credit worthiness. It enables a forward-looking understanding of revenue patterns, vulnerabilities, and risk, instead of the traditional static evaluation.

With SME digital adoption and financial automation, banks can now take a data-led approach to underwriting, enabling:

- Digital originations, with online eligibility checks

- Contextual underwriting models for different product types

- Ongoing monitoring of SME business performance, risk, and fraud indicators

- Flow-based underwriting models to drive innovation in unsecured loans

This transformation in underwriting has led to innovations in products like merchant cash advance and business-to-business (B2B), while buy now pay later (BNPL) is one of the most closely watched spaces in digital banking today.

Achieving ‘bank as a financial OS’

The framework of the bank as a financial OS will vary for each bank, depending on customer segment and product priorities. However, the broad components of an OS remain similar:

- Segment-specific digital banking offerings: From targeted origination and onboarding experiences, to solutions best suited for the nature and life stage of business, banks need to work towards better product fit for their customers.

- Bundled value-added services: Bundled value-added services pertaining to bookkeeping, expense management, taxation, vendor management, and so on, are becoming critical differentiators for digital banking offerings.

- Growth marketplace: Offering SMEs growth marketplaces to connect with other service providers, vendors or business partners, can be a strong incentive to remain within the bank’s ecosystem. This also allows banks to control how their core offerings are bundled by third-party providers.

- Embedded finance: Exposing application programming interfaces (API) and allowing partners to build their own offerings as an experiment rather than a strategy. Banks need to offer ‘productised’ embedded finance solutions to SMEs, with no-code, low-code options to make adoption cheaper and faster.

Digital banking is a bigger opportunity for banks than fintechs With traditional strengths in core banking, lending, cards and payments, banks have the necessary capital and infrastructure to deliver digital banking use cases profitably. What’s needed is a holistic vision for their digital banking business model, and the necessary building blocks to create a financial OS that continues to innovate and scale.

Anish Achuthan is the Co-Founder and CEO of Open Financial Technologies, a digital banking enterprise powering 2.7 million SME businesses.

All Comments