- WeBank of China, Ally Bank from the United States and ING’s global digital bank offering top the inaugural global ranking of leading digital banks.

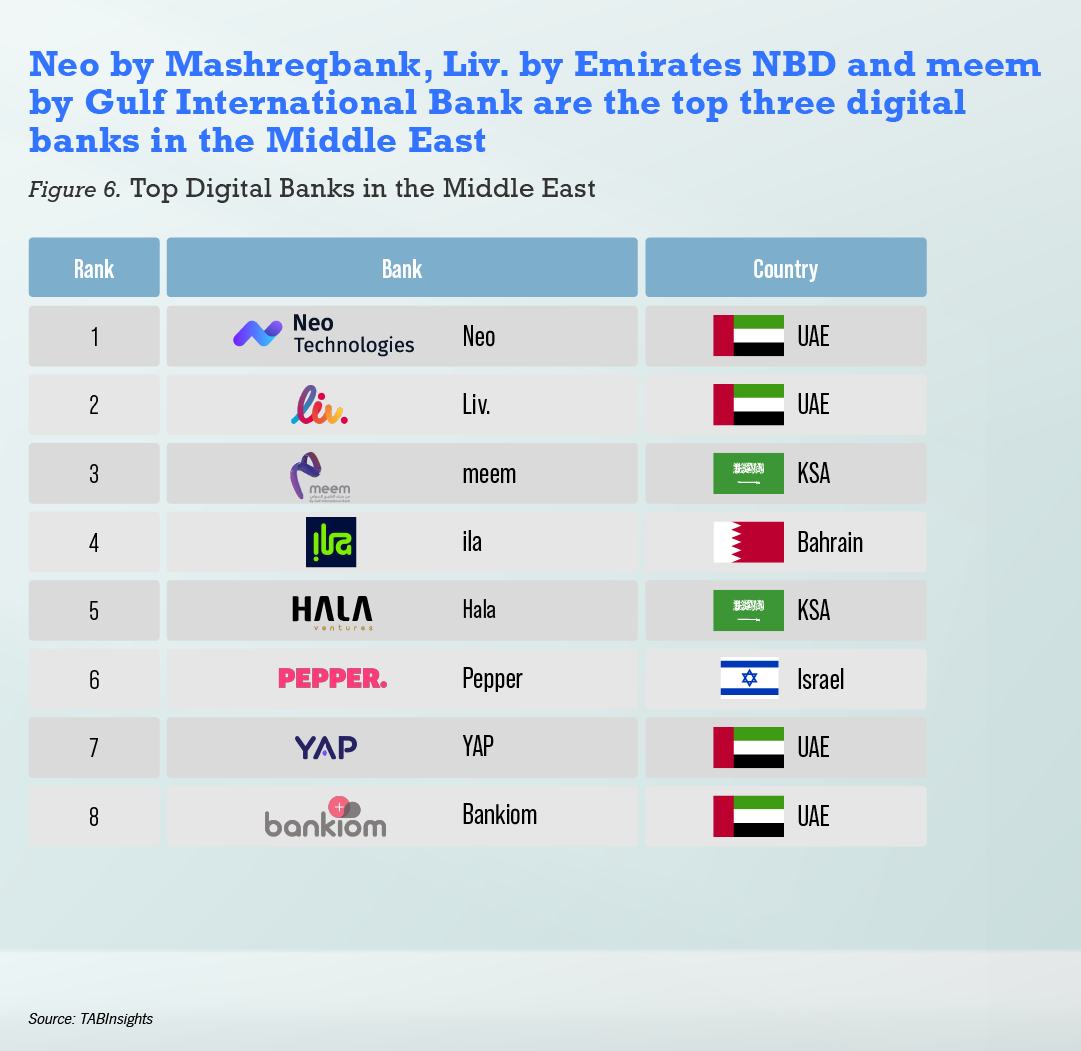

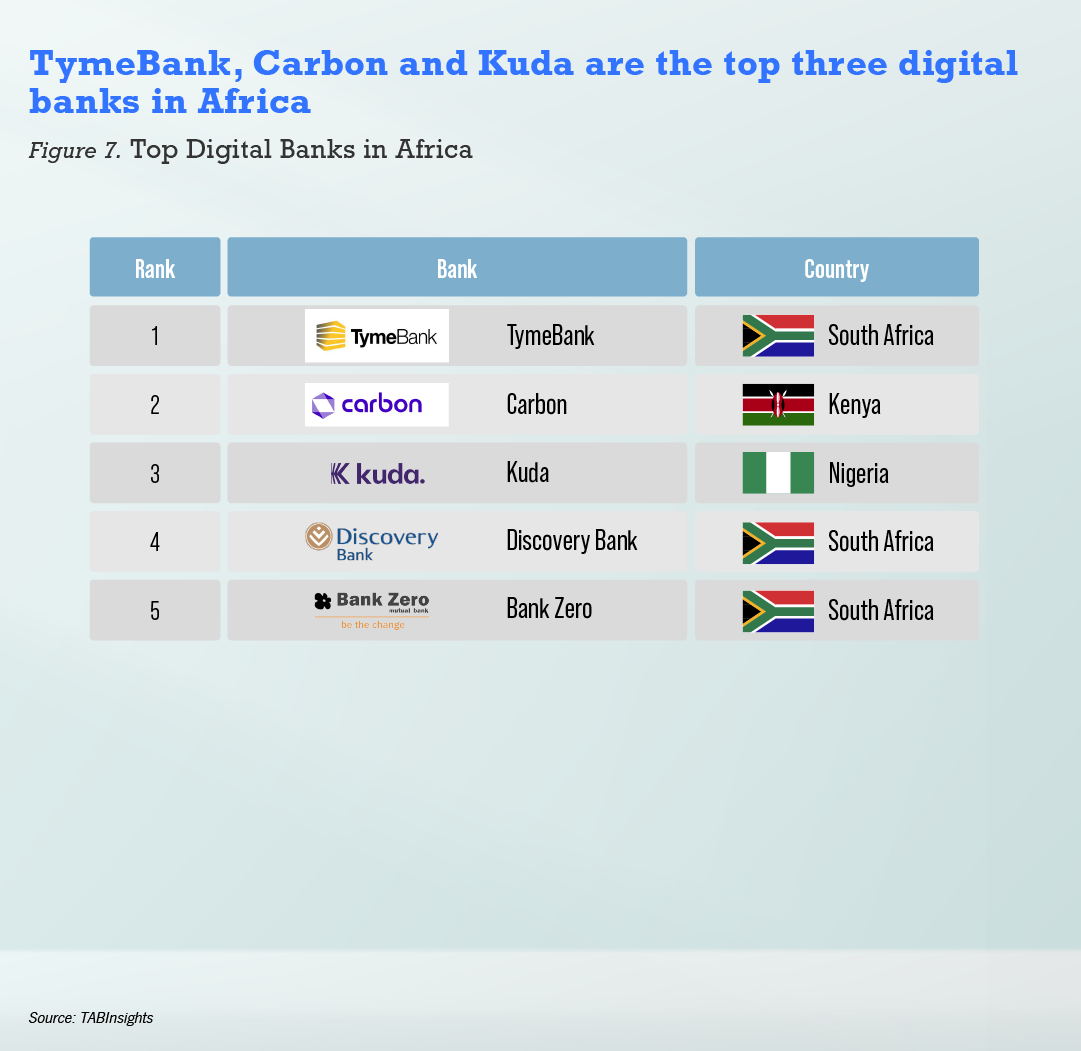

- Top ranked banks by country and region include Nubank of Brazil for South America, TymeBank of South Africa for Africa, Wise for the UK, NEO by Mashreq Bank for the Middle East and LINE BK of Thailand for Southeast Asia.

- Just 29 of top 100 digital banks globally are profitable. Aggregated assets of world’s top 100 digital banks stood at $2 trillion in 2021. Together, they generated annual gross revenues of more than $51 billion.

To track the increasing array of standalone virtual, neo or challenger banks, TABInsights, the research arm of The Asian Banker, has launched the world’s first comprehensive assessment of global digital-only banks, to rank them according to a transparent set of evaluation criteria across five key dimensions: customer experience, market/product coverage, profitability, asset and deposit growth and funding. There is no shortage of coverage of digital banks today. However, most lack a clear and specific definition of a digital bank as well as a set of objective and transparent criteria to assess and rank them. This inaugural ranking aims to address this gap by assessing them on a more consolidated and consistent global perspective. The Global Top 100 Digital-only Banks Ranking focuses on the most successful first and second generation digital-only banks that operate independently of traditional commercial banks and offer a unique virtual customer experience.

We include digital banks that have very limited physical outlets or hubs. The differentiation to traditional banks is that the physical location is integral to the experience of its digital users, are non-transactional and do not serve non-digital customers. We also include digital banking services of commercial banks only if they are standalone operations or subsidiaries. While majority owned by commercial banks, this type of digital banks has separate brands, onboarding processes, products, and services that are designed only for their unique users/customers and are not available to other customers of their parent banks. This is different from mobile digital banking apps which can be used by all customers of the parent banks.

The Global Top 100 Digital-only Banks Ranking covers digital banks from 36 countries. Scale does matter, but so do profitability, operational efficiencies, the ability to raise funds and the way these digital banks grow a healthy loan book. For a comprehensive view of the Global Top 100 Digital-only Banks Ranking visit TABInsights Global Top 100 Digital Bank Ranking 2022

WeBank of China, Ally Bank in the US, and the retail arm of ING Group, top the 2022 global ranking of leading digital banks. Two of those, Ally Bank and ING, are first generation digital-only banks -and it shouldn’t come as a surprise. With the rise of digital tech driven banks since 2014, it is easy to miss the strong performance and transformation that leading first-generation digital banks underwent since the global financial crisis in 2008.

WeBank, the largest all-digital bank in China with total assets of $69 billion, takes this year’s crown as best digital bank in the world. Tightly integrated with the social media and payment platforms WeChat and WeChat Pay, it has built a strong financial balance sheet since its launch in 2015, driven by its retail and SME micro loan business. WeBank logged record setting results in 2021 that demonstrated growth momentum across all indicators. The bank with its blockchain enabled open banking platform has become a super connector to most financial institutions in China. It is the first bank in the world that built a large scale and commercially viable blockchain infrastructure ecosystem supporting more than 360 million transactions per day.

It recently launched the WeBank blockchain brand to drive the deployment and application of blockchain technology for environmental, social and governance (ESG), and sustainability-related programmes. Since 2017, the bank has led the development of the open-source FISCO BCOS financial-grade consortium chain platform. It has attracted more than 3,000 institutions and over 70,000 individual members that have deployed several hundred blockchain applications in various industries such as finance, healthcare, law and justice, agriculture, and manufacturing.

Ally Bank, the largest all-digital direct bank in the US with total assets of $173 billion is placed second in the global digital bank ranking. It does not only count a strong balance sheet and robust financials, but has adapted to the changing consumer trends and competitive landscape. Since its re-branding from General Motors Acceptance in 2009, the bank has been successfully pivoting to a diverse product set which increasingly attracts millennial and gen-z consumers. Sixty-nine percent of new deposit customers in 2021 came from the millennial and gen-z segment. Ally Bank reported record-setting results in 2021 that demonstrated growth across home loans, lending, investment, and insurances. This achievement has been on the back of a 96% leading customer retention rate, which is increasingly spilling over into multi-product relationships.

ING Direct, ING’s branchless retail business, was launched in 1997 in Canada, and expanded into Australia, France, Germany, Italy, Spain, the United Kingdom (UK), and the United States (US). Although the operations in Canada, the UK and the US were subsequently sold off in the 2010s, ING Direct became the precursor of the bank’s successful direct banking businesses in the other markets, which were rebranded to ING between 2017 and 2019. A number of these are highly placed in the global ranking. While it may not be the first direct bank in the world, ING’s direct banks have nevertheless outlived many of its peers, including its earlier internet banking contemporaries such as First Direct/Midland Bank and Prudential/Egg in the UK and Security First Network Bank in the US, as well as those that emerged later from the fintech boom with much fanfare such as Atom Bank in the UK and Simple and Moven in the US. It has evolved into a profitable modern digital bank.

Top ranked banks by country and region include Nubank of Brazil for South America, TymeBank of South Africa for Africa, Wise for the UK, NEO by Mashreq Bank for the Middle East, and LINE BK of Thailand for Southeast Asia.

Just 29 of top 100 digital banks globally are profitable. Aggregated assets of world’s top 100 digital banks stood at $2 trillion in 2021. Together, they generated annual gross revenues of more than $51 billion.

Out of the Global Top 100 Digital-only Banks, only 29 digital banks are profit making enterprises as of full year 2021. Average ROE for this segment stood at 16% with Tinkoff Bank of Russia leading the field with 53%. Digital banks with a focus on personal finance, wealth management and SME banking are among the most profitable ones. Asia Pacific as a region takes the lion share hosting 55% of profitable banks.

Fifty-two percent of profitable banks are represented by first generation digital banks, those that can be traced to the internet or dot.com boom of the late 1990s and early 2000s.

Average time to profitability, the time from launch to break even, considerably decreased from about five years for first-generation digital banks to two to three years for the best second-generation banks launched after 2014. WeBank is leading the record with time to profit of 24 months. Profitable digital banks have been commercially operating on average for 11 years.

The average cost to income ratio (CIR) of profitable digital banks in 2021 was relatively high at 62% for first generation digital banks. While second generation digital banks are more efficient with an average CIR of 46%.

Looking at the profit and loss trajectory of digital-only banks over the last three years, we expect that more will tip into profitability for full year 2022 and an increasing number among the global top 100 aim boldly to turn into the black by 2024.

Aggregated assets that make up the world’s top 100 digital banks exceeded $2 trillion in 2021. To put this in context, the world’s 100 biggest traditional commercial banks have combined assets of $114 trillion.

While the top 100 digital-only banks generated a combined annual gross revenue of more than $51 billion, and offer on average of 5.4 top line products, the five largest revenue generating banks in the ranking contributed 65% of total revenue, indicating the small revenue of most digital banks.

All Comments