- Gross income from retail financial services for banks in Asia Pacific is expected to grow at a stable compound annual growth rate of 10% between 2016 and 2020.

- Most markets in the region will see flat or slightly declining retail banking income growth.

- New technologies, non-traditional competitors, heightened regulatory requirements, shifting customer expectations, and unfavourable economic conditions are the main factors that put banks’ retail profitability under pressure.

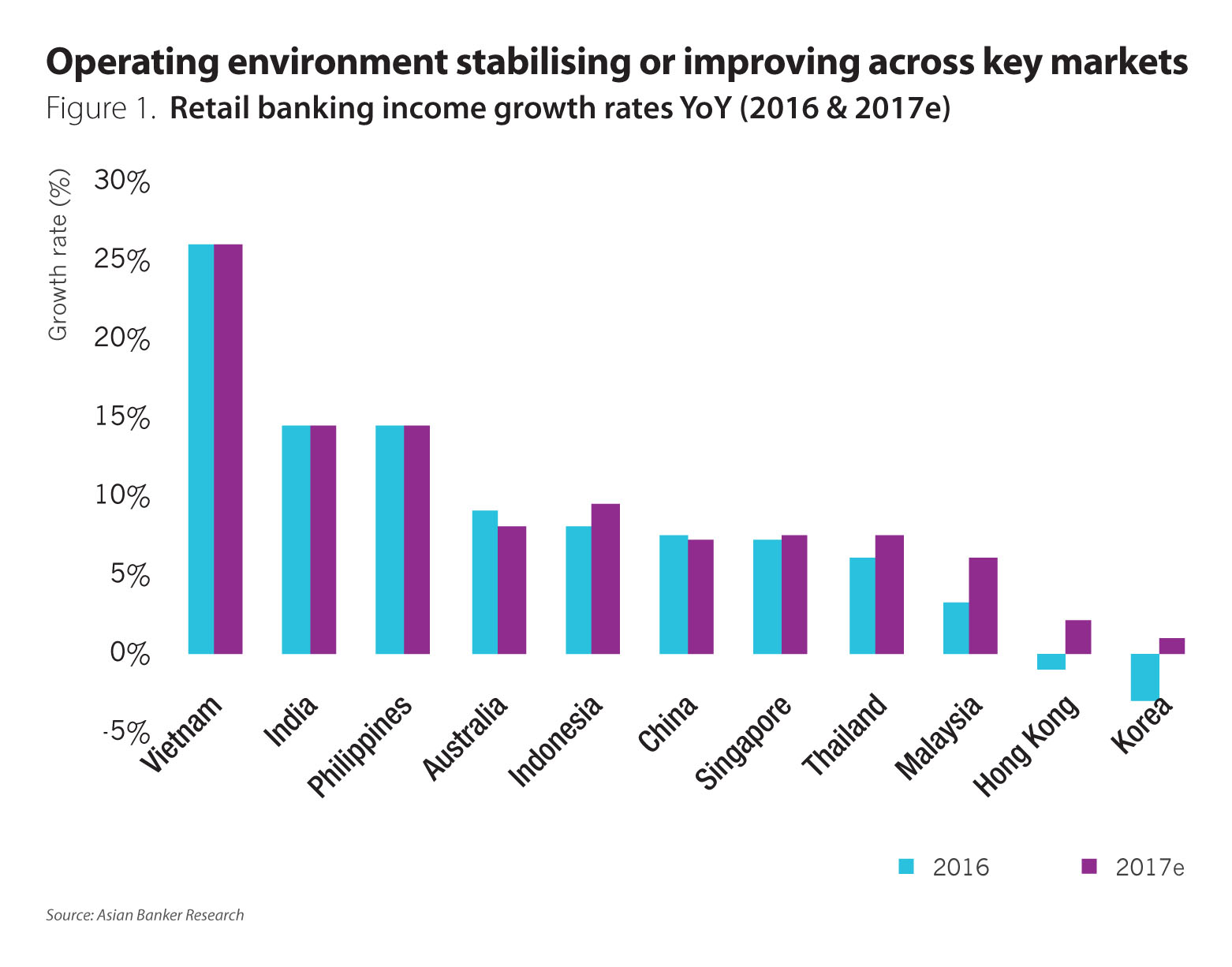

In Asia Pacific, the retail banking industry continues to grow. The gross income from retail financial services for banks is expected to expand at a slightly faster pace in 2017 compared to the previous year, as we expect slightly improved outlooks in markets such as Indonesia, and Thailand, Korea and Hong Kong.

Retail banking income growth is anticipated, however, to grow slower between 2016 and 2020 compared to the period from 2012 to 2016.This is the updated 2017 results of the large-scale study of The Asian Banker Research on income generation in retail financial services the Asia Pacific region.

The evolving operating environment continues to challenge Asia Pacific’s retail financial services industry. New technologies, non-traditional competitors, heightened regulatory requirements and compliance costs, shifting customer expectations, and unfavorable economic conditions are the main factors that place downward pressure on banks’ top line retail banking revenue.

There are however stark variances in growth rates between mature and emerging markets. Korea, Hong Kong, Australia, Japan, Taiwan and Singapore are expected to grow on average by 4.5% in 2017 while the rest of the emerging markets will grow at a rate of 12% in 2017 (Figure 1).

Going forward, we expect the region as a whole to grow at the CAGR of 8% from 2016 to 2020, as compared to 10% between 2012 and 2016.

Asian Banker Research also forecasts that gross retail banking income for the entire region will grow by 8% by the end of 2017 after showing a yoy growth of 7.5% in 2016 and 10% in 2015.

Aggregated retail banking income for the region reached about $500 billion by 2016. This includes income from retail deposits, mortgages, credit cards and/or unsecured lending, wealth management, and, wherever possible, small and medium enterprise (SME) banking. The ability to generate gross income in any market is a key indicator of wallet share and a determinant of a bank’s bench strength in retail financial services.

China’s retail financial services industry contributes 43% to total regional income in 2016, followed by India (14%) and Australia (13%) (Figure 2). The income from Southeast Asia’s retail financial services made up around 10% of the region’s gross income in 2016. Going forward, China is expected to see a slight decrease in its share of retail banking income in gross income for the region, while India and Southeast Asian countries are expected to take up a bigger proportion.

China

The operating environment for Chinese banks will remain challenging in 2017, driven by a slowing economy, more regulatory tightening and a deteriorating retail asset quality. The narrowing net interest margins (NIMs) and increasing retail impairment charges will continue to weigh on the retail profitability of Chinese banks.

Chinese banks have aggressively extended residential mortgage lending in 2016 but growth of residential mortgage will slow in 2017. Property curbs have been imposed to cool the overheated property markets.There is a growing concerns over soaring housing prices and the surge in loans to property developers and home buyers.

Chinese banks are expected to face higher funding costs. Liquidity conditions will continue to tighten, as the Fed is expected to raise interest rates further in 2017. Banks may raise deposit rates to compete for low cost core deposits due to the interest rate liberalisation, which in turn will lead to higher funding cost and narrower interest rate spread. This has impacted profitability.

In 2017, Chinese banks will see a decreasing demand for wealth management products. Exposure to the shadow banking segment has increased as banks have tried to diversify their income structure. However, the People’s Bank of China and the China Banking Regulatory Commission have been stepping up efforts to control the rapid growth – and we expect new regulations coming in place in 2017 which will further impact income generation from this segment.

India

While India is the second best growth play in Asia Pacific for 2016 and 2017, the retail financial services industry struggles to find its growth engines. Consumer finance via credit cards or direct loans has been the only business gaining momentum and banks have built up a sizeable unsecured loan business. All other important retail banking lines such as cards, mortgages, automobile lending are continuing to trend downwards/sideways in growth.

For the period April 2016- March 2017, India’s retail financial services industry saw a retail banking income growth of 14.5% on average. We expect that on average the industry’s retail banking income will grow between 14 to 15% again for the period April17 to March 2018 with the top private banks ranging between 18-22%.

For the period between 2016 and 2020, we expect a CAGR of 13% compared to 15% during the period from 2012 to 2016. Recent initiatives to lower lending rates, subsidized housing themes and a rise in non-cash payments may well support retail banking income growth in the double digits.

We believe that a focused business model, a strong low cost core deposit franchise, risk management capabilities and needs based customer service will be key determinants of success in this market.

As for the best income players- the strongest banks for the period up to March 2017 were HDFC Bank and Axis Bank for the first tier and IndusInd, Yes Bank, Kotak Mahindra and Syndicate Bank for the 2nd and 3rd tier banks.

Improved operating environment across a few markets

In 2017, retail banking income growth outlook will be improving in a few markets compared to the year before. Markets such as Hong Kong, Indonesia, Malaysia, South Korea and Thailand will be showing better growth rates. In Indonesia, banks have been struggling with the slowdown in retail loans since 2010 and the sector has never really recovered. Retail banking income is expected to expand at faster pace in 2017, mainly because retail loans have been picking up. In Thailand, due to lower loan loss provisions, retail banking income growth will recover in 2017, but only slightly. Thai banks are expected to return to full retail financial services growth in 2018, which will benefit however mostly larger banks with strong exposure to SME banking.

Hong Kong and South Korea

Hong Kong and South Korea will likely swing back to positive growth in 2017. The downturn in Mainland China and weakening Renminbi have negative effects on Hong Kong’s retail financial services market, particularly wealth management business which contributes a large part to retail banking income. In addition, income from retail banking was also weighted down by a series of prudential measures introduced by HKMA during the last few years. In 2017, Hong Kong will record positive growth from retail banking on the back of an improved economy.

Korea was the worst affected market in regards to income generation in the past few years with most banks recording stagnating or negative income growth. The anaemic housing market and associated regulatory changes have materially impacted the mortgage business. Regulations require Korean banks to take over registration fees for mortgages, lowering switching costs for customers, and to meet a quota on fixed rate mortgage origination. Korean banks have been crawling slowly out of their situation by downsizing and restructuring their operations and moving to lower cost digital channels. We see a tepid turnaround in the retail financial services market, despite a continuous challenging economic and operating environment.

Most profitable players in retail financial services

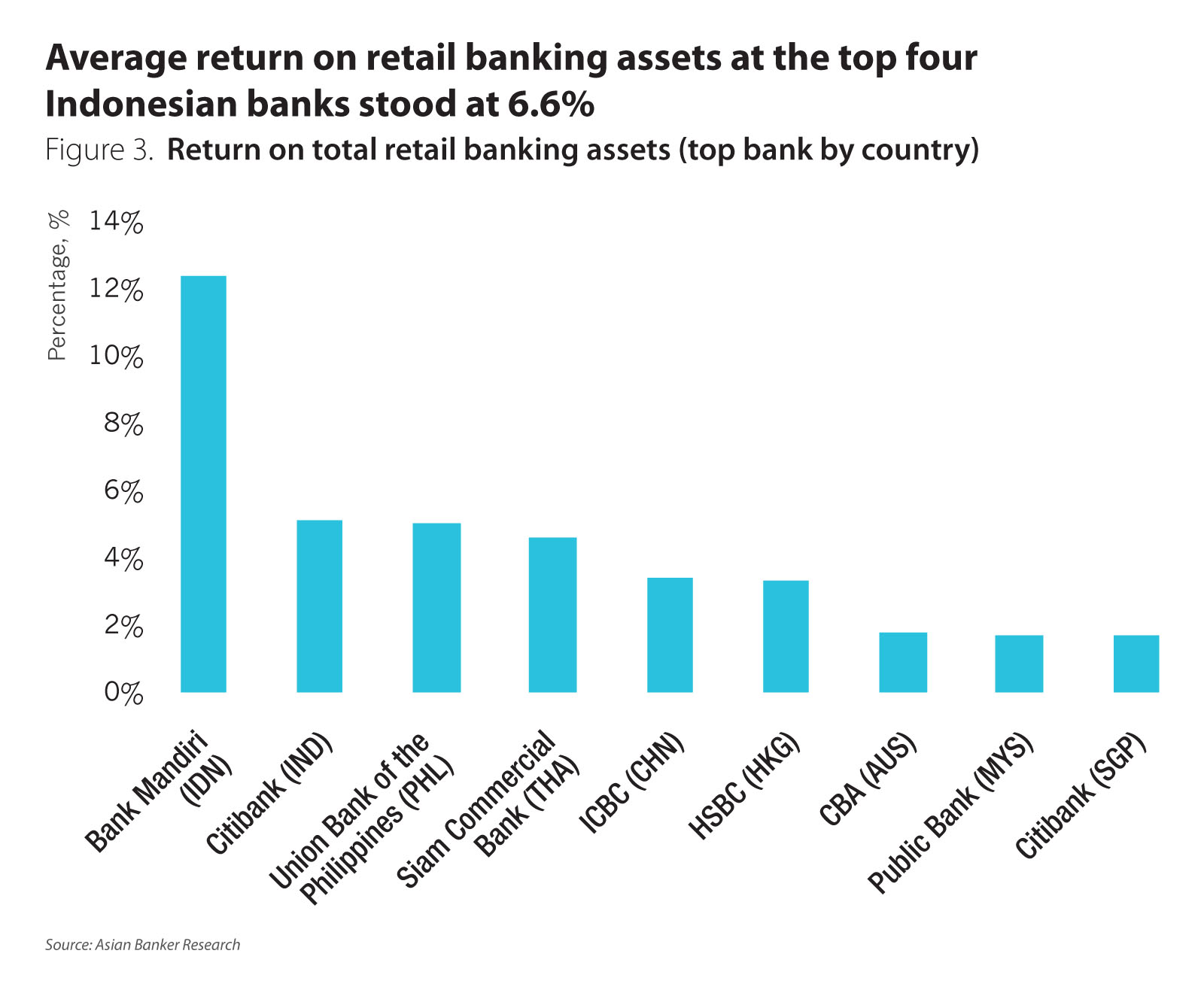

Indonesia’s retail financial services industry remains the most profitable in the region. Although Indonesian banks are under NIM pressure, their NIMs are still higher than their regional peers. Meanwhile, they aim to boost fee-based income, which will also help maintain their retail profitability. Bank Mandiri in Indonesia continued its strong retail banking financial performance in 2015, with the highest retail profitability measured by the return on retail banking assets (Figure 3). In addition, Bank Negara Indonesia, Citibank in India and Union Bank of the Philippines also produced high return on retail banking assets at above 5%.

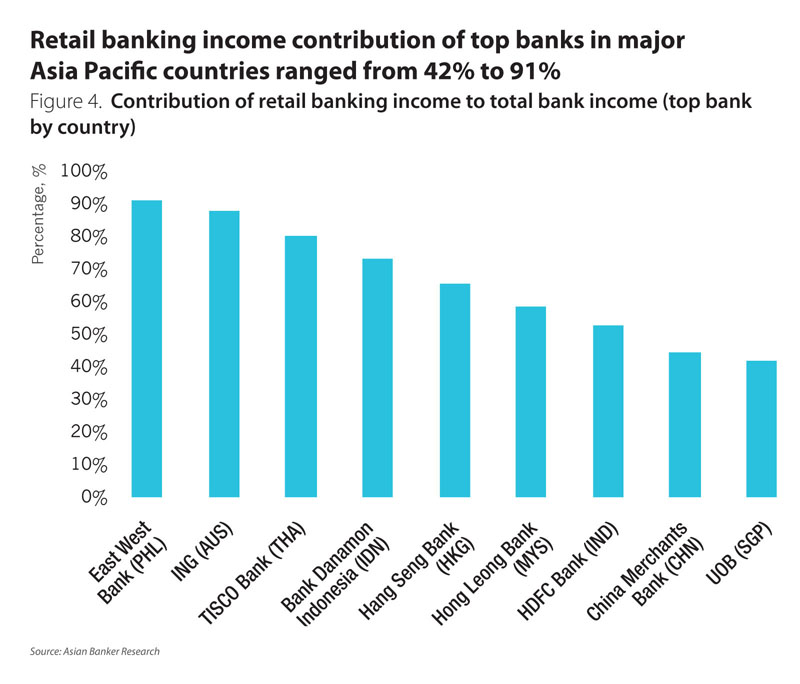

Overall, Asia Pacific banks have increasingly relied on the contribution of their retail banking business. In 2015, East West Bank Corporation in the Philippines, ING Australia and TISCO Bank in Thailand were the top banks in retail banking income contribution. Their retail banking income contributed more than 80% to total bank income (Figure 4).

To conclude, the overall retail banking income growth outlook for Asia Pacific is expected to improve slightly in 2017, despite continued challenges. Although banks in some countries will see moderation in the growth of retail banking income, we expect markets such as Hong Kong, Indonesia, Malaysia, South Korea and Thailand will be showing better growth rates compared to the previous year.

All Comments