- Smart technology would bring real value to WMs leading to huge growth for the entire WM market

- China’s wealth management sector acquiring capabilities WMs need to win

- Lufax customer profiling system enables real-time identification of customer intentions a possibility

In the new era of smart transformation, financial technology (fintech) companies are evolving from market disrupters to enablers and partners of traditional wealth mangers, helping to realise the growth potential of the entire wealth management (WM) market, according to a new report commissioned by Lufax, an internet-based wealth management and consumer finance platform.

The report, titled “Global Digital Wealth Management Report 2019-2020” and authored by Boston Consulting Group (BCG), recommends that incumbent asset management companies, which mainly rely on offline business, can cooperate with fintech companies to revitalise old brands to meet clients’ demand for smarter services. The ongoing Covid-19 pandemic will accelerate momentum for wealth firms to enhance digital touchpoints as foot traffic plummets.

Smart transformation to propel digital wealth management into the new era

The affluent market, as defined by households with investable financial assets under $1 million, represents a fresh and scalable source of growth for WM over the coming decade, with a customer base representing 27% of all revenue while only accounting for 17% of the total assets under management (AUM).

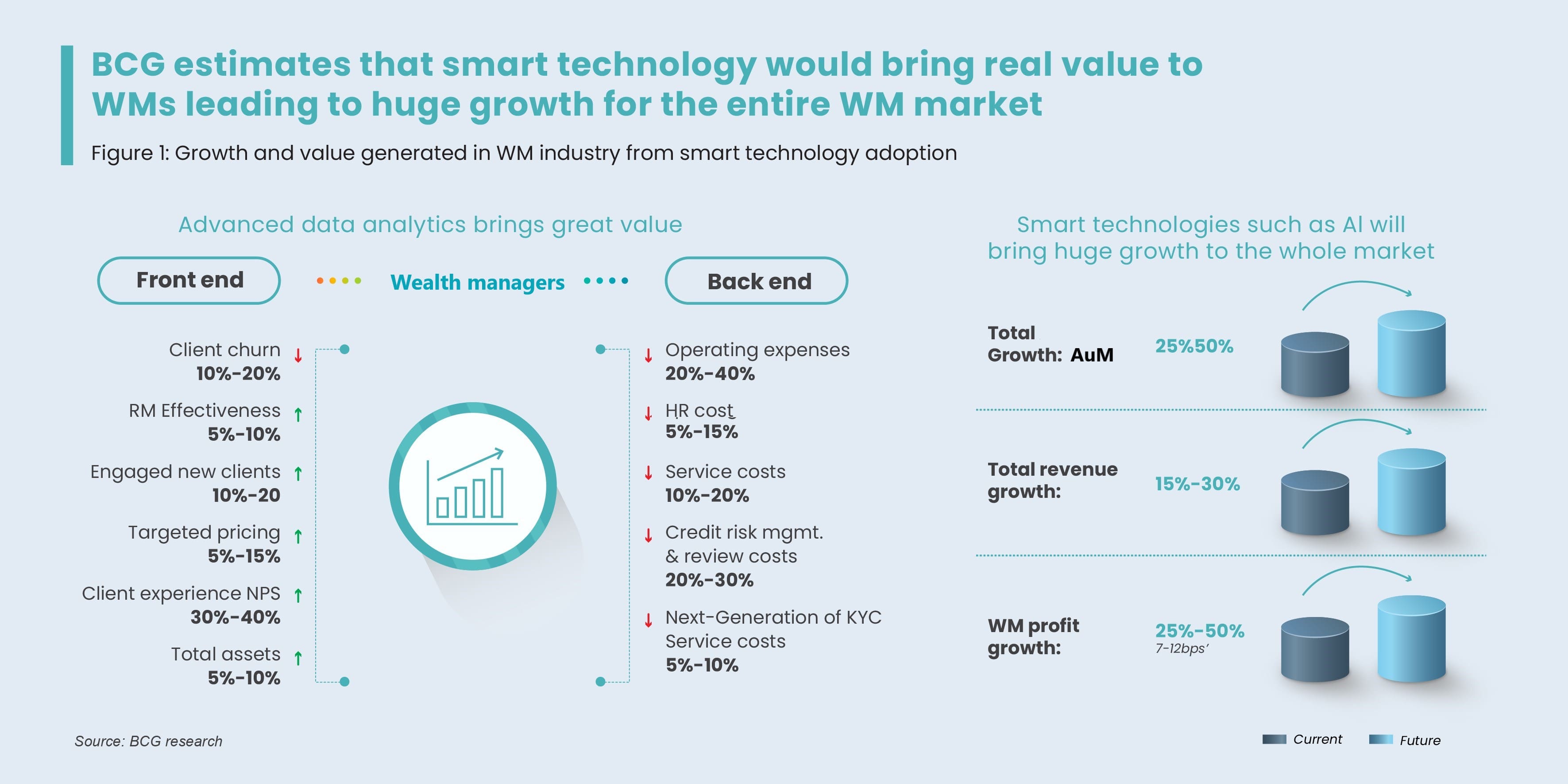

Most people in this segment have half of their assets stored in cash or savings accounts. With the contribution of the rising customer subsegment, the report forecasts a 25-50% increase in AUM, a 15-30% growth in revenue, and a 25-50% expansion in profit margin over the coming decade.

Smart transformation will more conveniently and accurately find the right products for the right customers, enabling a smarter wealth management model that is personalised and adds value through reaching new client segments and providing full customer lifecycle service.

BCG estimates that smart technology would bring real value to WMs leading to huge growth for the entire WM market

Figure 1: Growth and value generated in WM industry from smart technology adoption

Traditional financial institutions are breaking institutional restraints through open cooperation and accelerating the implementation of smart technologies, allowing for a smoother consultation process, ease of purchase, and after-sales interactions. Fintech firms are switching their mindset and strategies from 2C to 2B.

“Fintech still only accounts for 5-6% of the entire financial market, and is poised for sizable growth from unmet needs,” said Greg Gibb, Lufax chief executive officer. “Financial institutions as well as fintech companies will benefit from striving to become less siloed and seeking closer cooperation.”

With fintechs facing higher customer acquisition costs, new WM fintechs need a rich supply of data to regularly update their algorithms and an estimated $2 billion in AUM to break even. Lack of clients will lead to insufficient data and practical application scenarios, hindering small- and medium-sized financial institutions from creating great value.

China’s wealth management sector acquiring capabilities WMs need to win

China’s WM market is approaching a turning point where the unique value of smart transformation requires better investor education. From the perspective of capital, smart and personalised wealth planning will help relieve Chinese-style middle class anxiety.

The report explains that smart technologies, rather than relying on the salesforce, can help with the following areas: democratise WM through data-driven investor education based on the investor’s interest and attention, clarify incomprehensible financial jargon, and better address the difficulty in understanding risks and benefits.

Data and use cases are more important than algorithms, as these are the keys to developing artificial intelligence (AI) capabilities and advancing the knowledge curve. The analysis of customers’ browsing histories on finance and economics content will be the best reference to capture relevant data. For instance, Lufax has established a content community that recommends customised information and dispenses advice based on investment experience, transaction habits, and the risk preferences of users.

For rule-based operations, replacement of humans by AI does yield better results. This would entail goal-based solutions at lower costs for wealth management and financial planning for the affluent segment through an algorithm-powered robo-advisory service. For more complex demands such as tax and succession planning for high net-worth individuals, smart tools can empower human advisors with better capabilities and efficiency.

With Asia set to leapfrog from human-based advisory to AI-driven solutions, Chinese WMs are primed to overtake their counterparts in developed countries. For example, the first credit payment tool used by a majority of the youth is no longer a credit card, but the credit service Huabei, which is tied to their Alipay and Taobao accounts.

Specifically, the report suggests that AI and other smart technologies will resolve the current pain points in the Chinese WM market by allowing WMs to help improve investor education, customize robo-advisory services for the affluent segment and enhance risk control. It will also help steer the development of the wealth management market to “return to the fundamental purpose” as promoted by the Guiding Opinions on Regulating the Asset Management Business of Financial Institutions in China.

Balancing growth with compliance

Increasingly stringent regulatory requirements are raising the cost of compliance for WMs, especially multinational firms operating across jurisdictions. According to a survey by Duff & Phelps — a US-based global advisor —10% of overall WM revenue is forecast to be spent on regulatory compliance by 2022.

Regulatory technology (regtech) solutions have emerged to allow for regulation tracking and risk monitoring, giving more transparency to compliance and know your customer (KYC) and more safeguards for anti-money laundering. Regtech helps shore up the resilience against operational issues with fully digitised processes to keep better records and leave less room for errors, thus demonstrating its value in cost reduction, efficiency, and smart compliance.

Lufax has launched a customer profiling system centred on KYC and Know Your Intention (KYI), which includes a KYC labelling system and a predictive KYI model. Periodically updating tags covering customer transaction history, consumption characteristics, and psychological traits is the hallmark of the KYC labelling system.

The KYI model, on the other hand, utilises a 100,000-neuron network at the base of the platform to accumulate and analyse five categories of customer data to make real-time identification of customer intentions a possibility: short-term behaviour, long-term behaviour, product preference, service preference, and habits when using the platform.

Regulators should shift away from a rule-based regulatory approach to one that is data-driven, play a current and active role empowering WM to seek innovation, and help steer development toward healthy and sustainable growth. One such method, suggests the report, is to create a regulatory sandbox to foster, curate, and test out innovation.

To accelerate technological applications, the UK Money Advice Service has set up a regulatory sandbox in which applicants are unable to pass if they fail to prove that the correct procedures and due diligence have been followed. They will also have to prove that they have conducted a detailed review in the experimental environment in addition to confirming the legitimacy of the product based on current rules and laws.

Other regulatory headaches for wealth management fintechs are related to the accountability of AI. Developing algorithms with built-in interpretability and introducing transparent external solutions that can extract the key process and data from AI to explain the logic of its operation can be adopted to improve AI interpretability.

All Comments