This year, Saudi Arabia-based Al Rajhi Bank is the largest Islamic bank and also the strongest Islamic bank in the evaluation of the top 100 largest Islamic banks for the financial year 2018. The bank saw its total assets expand by 6.4% to $97.3 billion, larger than that of Dubai Islamic Bank, the second-largest Islamic bank, and Maybank Islamic, the largest Islamic bank in Asia Pacific by 60% and 79%, respectively.

This year’s evaluation covers 100 largest Islamic banks from 22 countries with $903.9 billion in combined assets, $583.4 billion in net loans, $662.4 billion in deposits and $12.9 billion in net profit. Only Islamic banks whose financial data was available in financial year 2018 were included in the ranking.

Islamic or Sharia-based banking is guided by Islamic economics. Because it eschews the charging and paying of interest and trading of assets that are non-Shariah compliant or haram, it is considered a more equitable and sustainable form of finance and has also gained popularity outside the Muslim world.

It has been playing an increasingly important role in the financial services industry, and generally demonstrates robust growth and resilient fundamentals. Some governments have been encouraging the expansion of Islamic banking services in their countries.

The Asian Banker has launched the inaugural evaluation of what will be an annual ranking of the largest and strongest Islamic banks, mainly in Asia Pacific, the Middle East and Africa.

Largest Islamic banks

From the list of the 100 largest Islamic banks, the top ten largest include eight banks from the Middle East and two banks from Asia Pacific. On aggregate, the top ten accounted for 51.3% and 67.7% of combined assets and net profits respectively.

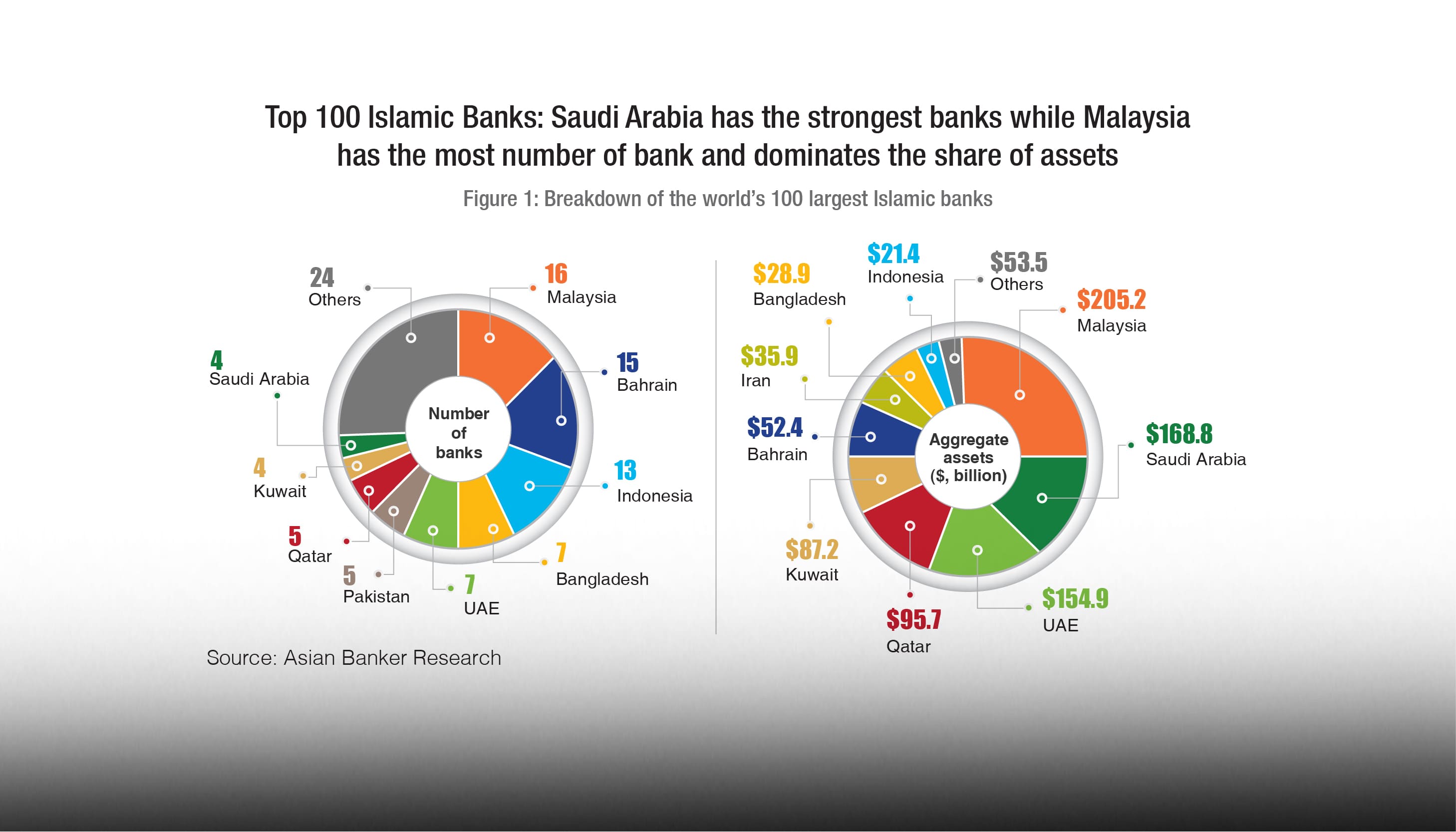

Malaysia, Saudi Arabia, UAE, Qatar and Kuwait are the largest markets in terms of the Islamic bank assets, with their aggregate assets representing 79% of the combined assets of the 100 largest Islamic banks. The Islamic banks in Malaysia, including both domestic and foreign Islamic banks, held six out of the top 20 ranks and 16 of the total 100. Notably, the combined assets of all Malaysian Islamic banks accounted for 23% of the 100 largest Islamic banks’ assets.

Although there are only four Saudi banks on the list, they are among the top 20 largest banks by assets. Besides, two banks from Iran made up 4% of combined assets. After Malaysia, Bahrain and Indonesia have the next largest number of Islamic banks at 15 and 13, respectively. However, the aggregate bank assets in Bahrain and Indonesia accounted for only 6% and 2%, respectively.

Saudi Islamic banks the strongest

Al Rajhi Bank tops the list, while Dubai Islamic Bank and Kuwait Finance House came in second and third. The top ten strongest Islamic banks include three Saudi banks, two Malaysian banks, two Qatari banks, and one bank each from Kuwait, Pakistan and the UAE.

On average, Saudi Arabia achieved the highest strength score at 3.9 out of 5, followed by Kuwait (3.7), Qatar (3.5) and UAE (3.3). The profitability and asset quality of Saudi Islamic banks are strong, and they maintained a robust capital position and ample liquidity. Their average return on assets (ROA) reached 2.5%, compared to 1.5% recorded by all the 100 banks. The average strength score of Malaysian Islamic banks on the list is 3.1 out of five, lower than the average recorded by all the 100 banks, at 3.2. Their average ROA was only 0.9%.

The 100 largest Islamic banks posted an average asset growth of 8% after removing the anomaly of MBSB Bank in Malaysia, which completed the acquisition of Asian Finance Bank in 2018. It is higher than the average asset growth rates recorded by the 100 largest banks in the Middle East and the 500 largest banks in Asia Pacific, at 5.3% and 5.6%, respectively.

Looking ahead, Al Rajhi Bank is expected to remain the largest Islamic banks in the near future, as the bank continues its efforts to sustain financial strength. Islamic banking remains less developed in Africa.Overall, Islamic banking industry will continue to expand steadily.

All Comments