The digital asset universe has caught the interest of many and proven that it‘s here to stay. For most, the first thing that springs to mind when you talk about digital assets is cryptocurrencies; while this is an important element of digital assets, it‘s not the part that has the attention of banks. To understand this, we have to understand the different categories of digital assets, relevant from a banking perspective.

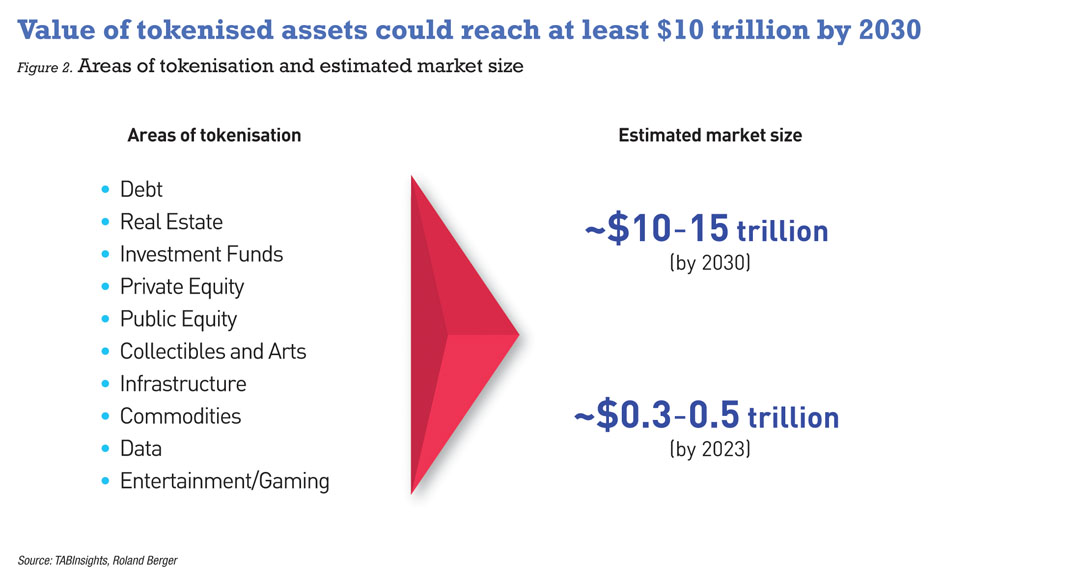

The challenges around the legal and regulatory aspects of cryptocurrencies have meant banks have a limited risk appetite for them. The part of digital assets that has excited banks is the tokenisation of traditional finance and real-world assets. According to a Citi report, tokenisation of financial and real-world assets could be the use case driving blockchain’s breakthrough, with tokenisation expected to reach up to almost $4 trillion in value by 2030.

In addition to the market opportunity, banks are excited as tokenisation solves many prevailing problems in the industry, addresses fundamental issues like liquidity, transparency, and operational efficiency, while fostering innovation in financial markets.

Tokenisation fast-tracking digital assets into mainstream banking

Given the buzz around tokenisation, it is important to understand what exactly it is. Tokenisation refers to the creation of tokens—pieces of code on a blockchain that records information about underlying assets and liabilities, and their attributes, status, ownership and transaction history. Tokens enable the transfer of ownership and titles of value directly via a digital ledger.

Tokenisation offers possibilities for blockchain technology to solve traditional problems such as lack of transparency, and offers the ability to fractionalise assets and democratise access to the public. Anyone could own a fraction of a high-value asset that they could never touch otherwise. It also unlocks a new way to monetise illiquid assets and improves accessibility. Tokenisation also makes transfer and settlement of assets more efficient.

Hari Janakiraman, head of industry and innovation for transaction banking at ANZ explained: “In today’s financial markets, information and payment are exchanged on different platforms. For example, when you buy securities, transfer of ownership and payment for the sale happens on different platforms at different times.

“Tokenisation is the game-changer that brings them together, allowing both to happen at the same time. Tokenisation merges data and payment on a single platform, creating a future of efficiency, security, and convenience like never before.”

Presented with the potential benefits, it‘s no surprise that banks are investing heavily in digital assets and tokenisation solutions. Janakiraman elaborated: “Digital assets and tokenisation represent the next generation of how financial markets will operate. With the move to real-time economies and shortened turnaround times, the financial industry would need to keep pace and continue to evolve. Tokenisation and the underlying technology will play a big part in facilitating the banks to play their role in supporting the real economy in a more meaningful way.”

Ronit Ghose, global head for future of finance at Citi Global Insights, echoed the sentiment: “In the future, digital assets and tokenisation will not be considered innovation but seen as business as usual. Accordingly, the need to invest in these solutions is now, or else banks run the risk of being seen by their clients as not having a complete product offering and hence losing market share.”

Leading banks making moves in digital assets

Citi has been active in digital assets and has already piloted Citi Token Services for cash management and trade finance. The service uses blockchain and smart contract technologies to deliver digital asset solutions for institutional clients, and integrates tokenised deposits and smart contracts into Citi’s network.

Citi worked with Maersk and a canal authority to digitalise a solution that serves the same purpose as bank guarantees and letters of credit in the trade finance ecosystem. The pilot demonstrated programmable transfer of tokenised deposits that provided instant payments to service providers via smart contracts.

Citi Token Services has also been applied to a global cash management pilot, enabling clients to transfer liquidity between Citi branches on a 24/7 basis and reducing friction related to cut-off times and gaps in the service window. Citi, in partnership with a key investment and wealth management client, has also conducted a proof-of-concept to test use cases that demonstrated how traditional assets, in this case a private equity fund, could be tokenised and brought onto digital networks.

One bank setting the standards in the world of digital assets is JPMorgan (JPM). Nikhil Sharma, head of growth at Onyx Digital Assets said: “We’ve been pioneers in building traditional financial products on blockchain rails. Our blockchain-focused business unit, Onyx by JPMorgan, has three private permissioned blockchain offerings that streamline information, money, and asset movement for our clients. Onyx digital assets is our multi-asset tokenisation platform designed to help clients get more mileage out of their assets and transact in newer, faster, cheaper, and in more secure ways.”

JPM launched programmable payments for Siemens through its blockchain-based digital currency, JPM Coin. This solution allows users to programme their transactions, allowing clients to place customised rules on their payments. Even Asia-domiciled clients are live on JPM’s Onyx digital assets platform, with DBS becoming the first bank in Asia to complete an intraday repurchase transaction on JPM’s intraday repurchase application on Onyx digital assets, thereby compressing timeframes and boosting operational efficiencies.

When it comes to digital assets, cocreating solutions along with customers is a consistent theme across banks to solve for real-world problems and ensure early adopters. Sharma from JPM said: “For JPM, the starting point of any tokenisation solution is establishing a clear business case with like-minded counterparts. A prime example is our Tokenised Collateral Network (TCN) application that focuses on creating greater mobility for collateral. This offering, that has been tested and used by BlackRock and other financial institutions, showcases the power of tokenised assets, especially in the context of collateral. Through TCN, money market funds can now be mobilised and utilised more efficiently, unlocking fresh pools of liquidity for margining purposes.”

Janakiraman from ANZ concurred on the importance of co-creation, saying: “Innovation needs to focus on step-changes that will completely shift the way financial services are delivered to customers in the future. We work hand-in-hand with customers and regulators to rise above the hype. Co-creating solutions is how we bring real, tangible value propositions back to our customers who are the heart of our business.”

ANZ has executed many innovative solutions including the first Australian-bank issued Australian dollar stablecoin (A$DC) payment through a public permissionless blockchain transaction. ANZ subsequently supported one of its customers to purchase tokenised Australian carbon credits using A$DC. ANZ also traded tokenised Australian Carbon Credit Units with a partner.

ANZ had a key role in the Reserve Bank of Australia’s central bank digital currency (CBDC) pilot project and was selected for three of the 14 use cases, and acted as nominated distributor for selected participants. The use cases ANZ worked on included using eAUD [electronic Australian dollar] for instant payments in an offline environment, testing how eAUD can speed up contributions for superannuation payments and using decentralised networks to test tokenised carbon-credit provenance and atomic settlement.

ANZ is scaling the solution built for the superannuation payments pilot with institutional customers from the super funds industry and exploring how this solution can be supported towards commercialisation.

Another bank that is investing aggressively in digital assets for institutional as well as retail clients is HSBC with a leading digital assets platform (Orion) and a range of innovative solutions. Benjamin Chodroff, head of HSBC Lab, Innovation and Ventures, HSBC, offered: “HSBC has been a pioneer in the digital assets space by creating Orion and launching tokenised bonds and tokenised gold on private ledgers.

“We are also among the first foreign banks to participate in China’s CBDC pilot on e-CNY [electronic Chinese yuan]. We have been pioneering research and development in Hong Kong’s e-HKD [electronic Hong Kong dollar] CBDC pilot and launched an open-source Android and iOS wallet. We are participating in Hong Kong’s Project Ensemble for tokenised deposits. HSBC has also announced its HSBC Orion Digital Vault and has many conversations happening in multiple regions on the future of digital assets.”

HSBC helped the Hong Kong Monetary Authority (HKMA) complete a digitally native green bond issuance for the Hong Kong government with the bonds directly issued onto Orion’s private permissioned blockchain. HSBC has also launched tokenised gold for retail customers here, and had earlier launched tokenised gold for institutional clients in London. The bank has successfully tested the use of tokenised deposits in intragroup payment transactions together with Ant Group. HSBC also plans to launch a digital assets custody service for institutional clients who invest in tokenised securities.

Increasing interest in retail CBDCs

Another area of digital assets that is seeing increasing engagement across the banking industry are CBDCs. These can be likened to a digital version of a national currency that would be issued as a direct liability of the central bank. While currently only a handful of countries have launched a CBDC, many central banks globally are either researching CBDCs or are live with pilots.

The focus initially has been on wholesale CBDCs (wCBDCs) as the use cases there are more compelling. However, increasingly, central banks have also started to evaluate the potential of retail CBDCs (rCBDCs) by exploring different use cases. While progress is being made on CBDCs, implementation will take time as there are still some legal, regulatory and policy matters to be resolved.

Stablecoins vs tokenised deposits

While banks are actively supporting CBDC pilots across the world, their response to stablecoins has been far more measured given the lack of regulatory clarity around them. Recently, some central banks have become receptive to fiat-backed stablecoins and this may revive banks’ interest in stablecoins. On the other hand, banks have embraced tokenised deposits. Given that this is commercial bank money embodied in a new technical form, it sits comfortably as part of the banking ecosystem.

Says HSBC’s Chodroff: “CBDCs are just one of multiple types of digital money that will co-exist in the banking landscape. For wholesale institutions, a CBDC can demonstrate expedient and cost-effective capabilities with new forms of institutional programmability not currently offered in existing payment rails.

“However, for retail and even institutions, we may find new forms of digital money that could offer superior capabilities while addressing many of the valid concerns on end-user ownership, privacy, and end-user programmability in crossborder settings. Some central banks may consider supporting ‘tokenised cash’ and ‘tokenised deposits’ on both private and public blockchains.”

Arbitrage impacts investor protection

While digital assets are increasing in popularity, challenges remain. There is lack of clarity around legal classification of some digital assets. Different regulatory treatment across jurisdictions creates possibilities for regulatory arbitrage and this impacts investor protection. Also, banks are implementing solutions with proprietary tokens that are not interoperable. There is also increased cybersecurity risk and the cost to integrate these solutions into existing tech stacks. In addition, digital assets are not easily understood, which slows adoption.

Says Citi’s Ghose: “Question is whether you see it as a glass half full or half empty. In digital assets adoption, there are numerous steps from inception followed by pilot and then production. Banks need to keep regulators in the loop throughout the process while they work on these solutions as the legal and regulatory environment on digital assets is still evolving. Getting all stakeholders, internal and external, on board can be challenging and timeconsuming in such a fast-evolving and not easily understood environment.”

Banks are working hard to remove barriers to adopting these technologies through a strong emphasis on training. Regulators are also showing a growing inclination to work across jurisdictions to improve interoperability of digital assets.

HKMA announced a project with an intention to provide support to the development of the tokenisation market in Hong Kong. In another interesting development, the Bank for International Settlements together with seven central banks and the private sector will investigate how tokenised commercial bank deposits can be seamlessly integrated with tokenised wholesale central bank money in a publicprivate programmable platform.

Bankers optimistic: Old and new money will coexist

Given the increased cooperation and a more facilitative ecosystem, bankers are optimistic about the future of digital assets. Citi’s Ghose said: “Adoption of tokenisation solutions and other select digital assets use cases by banks will happen at a much faster pace in future. This will be driven by an impetus from both the buy and sell side and supported by more open regulatory regimes. All forms of money, old and new, will have their use cases and will coexist in the future. Old rails will keep improving and will be supplemented by new rails, bringing value for all stakeholders.”

Chodroff from HSBC concurred, saying: “Banks are trusted institutions and can help bring together various parties. Banks have an incredible opportunity to be a trusted adviser to clients on all types of digital assets and create new types of products that meet client needs.

“While the technology and regulations in this space are changing quickly, custody, payments and real-world asset tokenisation are fundamental capabilities that every bank must solve in the digital assets space. This will be an iterative research and development process. We are constantly exploring new proof of concepts on technology that advance our understanding and create new capabilities and better customer experiences.”

JPM’s Sharma agreed: “At its core, tokenisation is about standardising information, mutualising workflows, and automating processes. These are fundamental principles that are hard to argue with. There is growing demand from clients, who have seen tangible value-unlocks from tokenisation on our platforms.

“Other market participants, including traditional banks, financial market infrastructures like CSDs [central securities depositories] and CCPs [central counterparty clearing houses], and fintechs, are also exploring the benefits of tokenisation. As more proof points continue to accumulate, I believe the digital assets market will grow over time, benefiting the ecosystem as a whole.”

At the end of the day, adoption will be driven by the right use cases and ease of use. Banks are on the right track by offering solutions that don’t require clients to host a blockchain node to access these services. The regulators are more open to adopting the power of digital assets, and there is also increased willingness from market participants to try out pilot use cases and move towards commercialisation.

Whilst challenges will always exist, the stars seem to be finally aligning favourably for digital assets.

All Comments