- RHB Bank’s retail business saw double-digit compound annual growth rate

- The bank’s personal financing provides real-time approval

- RHB mobile banking app integrates customer lifestyle

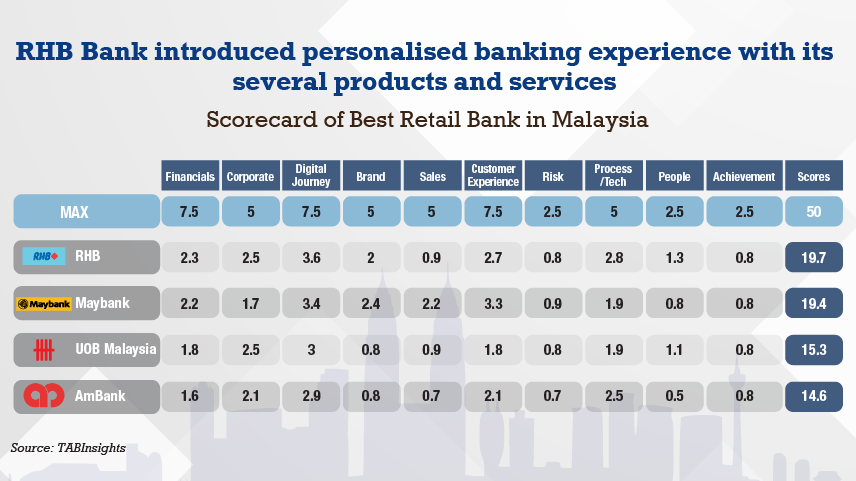

RHB Bank was recognised as Best Retail Bank in Malaysia at the TAB Global’s Excellence in Retail Financial Services Programme 2022 based on its digital transformation journey in retail and its expanded ecosystem and new digital products. Along with its fintech partner, the bank introduced straight through processing on personal financing that reduced the turn-around-time of approval from 24 hours to real-time decisioning.

Among the finalists for best retail bank were Maybank, UOB Malaysia and AmBank. RHB Bank was recognised for its digital transformation journey which helps improve its retail operations. It has delivered more innovative products and services, greater operational efficiencies and better customer experience.

Financial performance: RHB Bank’s retail business saw double-digit CAGR

RHB Bank showed a strong financial performance, with retail business posting a double-digit compound annual growth rate (CAGR) and improved return on equity (ROE). It grew by 8% year on year (YoY), higher compared with the industry’s 5% growth. Gross retail revenue has 2% CAGR while the bank’s ROE is at 10%, up from 8% in the previous year. Its retail deposits grew by 8% YoY, with a CAGR of 12% and retail loans grew by 5% YoY.

The number of mortgages originating from the RHB MyHome app increased to 56% from 40% in 2020, with contributions from the services of RHB Partners app, which stood at 83% compared to 69% in the previous year. It accelerated the growth of mortgage loans by continuing to build on the homeowner’s ecosystem. The growth in retail segment was driven by deposits, and innovative products and services through improved digital onboarding. Diversification of deposit and funding sources has been the bank’s ongoing long-term strategy. Deposit acquisition from retail and wholesale businesses is managed through strong relationships with customers and increased focus on digital channels.

Meanwhile, AmBank’s retail income increased by 9% to $358 billion (RM1.6 billion). Gross retail revenue has 4% CAGR and its retail deposits growth stood at an estimate of -0.15% CAGR compared to RHB bank’s 8% growth. The Group’s small and medium enterprise (SME) loans portfolio achieved a CAGR growth of 20.8% in fiscal year (FY) 2021. Net interest income rose 9% in line with loan expansion.

Digital journey: The bank’s personal financing provides real-time approval

RHB Bank leveraged its digital transformation journey through expanded ecosystem and new digital products. Along with a fintech partner, it introduced straight-through processing (STP) on personal financing with real-time decisioning.

The group continues to ensure the successful execution of “fund our journey, invest to win and transform the organization” (FIT22) strategy, which is now on its final phase of implementation. The FIT22 has transformed the group into a customer-centric banking group, which delivers excellent service to customers by adopting a digital-first strategy through online ecosystems.

Digital transactions increased from 86% in 2020 to 93% the following year. Over one million customers onboarded the new RHB mobile banking app with over 13,000 SME eSolutions customers, a 41.3% increase from 2020. In many areas, the results achieved with the implementation of the FIT22 strategy have exceeded expectations. This includes the reduction of approval turn-around-time from 24 hours to real-time decisioning and resulted a 143% YoY growth in total loan disbursement. In addition, RHB launched several digital-channel products such as RHB online banking (IBK) and Refreshed RHB mobile banking app.

Maybank’s digital capabilties has changed and evolved rapidly as RHB. The bank has almost 16 billion digital transactions across the region, with more than $200 billion (RM896.0 billion) in value. The bank initiated its digital journey in 2013 with projects like Maybank2u Biz app that enabled Maybank to achieve its digital bank status today. The mobile app provides simplified and secured mobile banking services while consumer and SME segments can access fast and hassle-free digital loans from application to approval. It also introduced lifestyle apps such as Maybank E-wallet (MAE) app. The bank’s approach is for its digital solutions to not just focus on financial services, banking transactions or payment needs, but to include other lifestyle or complementary features to support customers’ day-to-day lives.

The bank launched the Maybank-Bakong cross-border fund transfer, a real-time fund transfer service with low fees, via MAE app and the National Bank of Cambodia (NBC)’s Bakong e-wallet, making it one of the first banks in the world to partner with NBC.

Customer Experience: RHB mobile banking app integrates customer lifestyle

RHB Bank’s new mobile app gives lifestyle privileges and enables customers to make online purchases. The bank recorded 2.25 million registered digital users, up by 7.14% YoY. RHB MyHome web provides seamless digital experience for homebuyers that eliminates the hassle of visiting the branch or meeting up with a mortgage consultant during the pandemic. MyHome app has decreased the sales time spent per application from eight hours to just three hours. The MyHome product has contributed to 56% of mortgage sales acceptance, equivalent to $1.37 billion (RM5.8 billion).

The bank also revamped its internet banking platform to empower customers through digitalisation including the use of electronic signature facility for affluent customers. It also facilitated digital transactions such as term deposit placement and multi-currency accounts.

The bank has been actively engaged with customers and staff to encourage their migration to digital-only banking via the RHB internet and mobile banking platforms. With a growth of 56% YoY, it increased its sign-ups, reflecting the adoption of digital platform by more than half of its retail customers. As a result, the bank saw a notable increase in consumer loan applications and disbursements via digital channels.

In 2021, UOB Malaysia launched a digital account opening service using the all-in-one mobile banking app, UOB Mighty that offers straight through account opening. Registered users grew to 614,000, up by 10%. Active users at 466,000, up 7% growth, but still lower than RHB’s 2.25 million customers. Total transactions grew 39% YoY while app downloads also increased by 45% YoY. With this latest enhancement, customers can embark on their financial journey within 10 minutes, which is up to 60% less than the average time typically taken to open an account in person. As part of UOB’s commitment to provide customers with progressive and convenient solutions, the bank also launched an official store on Shopee, an e-commerce platform. The customers can select UOB banking products and sign up.

About TAB Global

TAB Global is the region’s most authoritative provider of strategic business intelligence to the financial services community. The global research company has offices in Singapore, Malaysia, Manila, Hong Kong, Beijing, and Dubai, as well as representatives in London, New York, and San Francisco. It has a business model that revolves around three core business lines: publications, research services and forums. Visit the company website at www.theasianbanker.com

You may also visit the Excellence in Retail Financial Services page at http://awards.asianbankerforums.com/retailfinancial/

To view the respective evaluation criteria, click here:

https://awards.asianbankerforums.com/retailfinancial/criteria-country

For further information, you may get in touch with:

Mr. Chris Kapfer

Research Director

M: (+63) 94 3283 6015

ckapfer@theasianbanker.com

All Comments