- Financial institutions in China are working with financial technology companies to improve their operations and provide better services

- China Construction Bank has focused on digital transformation, continuously restructuring process and innovating its products and services.

- China CITIC Bank has launched a new system to settle credit that uses a blockchain technology-based electronic transmissions system

Together with the prosperity of e-commerce, the pace of fintech companies is greatly accelerated. The total amount of e-commerce in China has reached $3.8 trillion (RMB26.1 trillion), representing approximately 40% of the global market. And the mobile banking consumers are expected to reach 1600 million by 2020 (Figure 1). With the soaring demands, fintech in China has been developing rapidly and is world-leading by several measures. Although risks like no stable cash flow, lower credit rating, and lack of collateral for might occur, the Chinese government’s attitude towards fintech is still supportive, despite some recent tightening measures.

At the same time, faced with the challenges from non-bank players, banks are especially motivated to take advantage of new technologies to transform their business and expand customer base. Except for big four banks and joint commercial banks, even city commercial banks have already expressed their willingness to work with fintech companies. Relying on economies of scale, traditional banks still obtained the majority of the market in China, and they believe that these partnerships will help them to exploit the benefit of financial technologies to consolidate their positions. Cloud computing, data analytics, artificial intelligence (AI) are all among their targets.

According to the Chinese government, China is aiming to increase the scale of its cloud computing industry by more than 2.5 times by 2019 from 2015 levels. China Banking Regulatory Commission (CBRC) also plans to implement 60% of the banking systems for the cloud by 2020.

In their effort to join or even lead the trend of fintech, the financial institutions in China have been purchasing the services of fintech companies to improve operations and services in different forms. Apart from engaging in partnerships,which represents over 50% of the collaboration between banks and technology companies, financial institutions can also provide services to fintech companies, set up venture capital funds or start-up programs.

Until now, a great number of Chinese banks have built their various partnerships with fintech companies or developed their own fintech development strategies. For example, China Construction Bank announced a strategic partnership with Ant Financial in March. Agricultural Bank of China Ltd also worked with Baidu, one of the major internet search engines, to build intelligent bank. Bank of China and Tencent have established a joint financial technology laboratory which will work on cloud computing, big data, blockchain and artificial intelligence etc. Though at the same time, there are also challenges standing in the way of their cooperation, such as IT security, compliance and regulatory uncertainty. To reach a sustainable growth, it’s necessary for the banks to explore the most suitable approach for financial technology strategy, and find a balance point between digitisation of services and traditional manual banking service.

China Construction Bank

As one of the largest banks in China, China Construction Bank (CCB) has always been a pioneer in taking advantage of new technologies to promote the development of the banking industry. As early as 2015, the bank has grabbed the market opportunity to launch the financial technology strategy with the benefit from government policy, and contributed its efforts to build a multi-dimensional financial technology system. Moreover, the bank also has always been focusing on digital transformation, continuously restructuring process and innovating its products and services.

In the collaboration with outside fintech companies, the bank has committed to striving a win-win effect between the bank itself and the technology companies. Along its road to collaborate with technology companies, it’s clear that the bank form the alignment with fintech companies step by step. The whole process starts from a very early period, and the cooperative relationship matures as the whole environment for emerging financial institutions turning to stable and supportive.

In 2015, to deepen the relationship between the bank and high-tech companies as well as to better serve the financial needs of the customers, the bank launched the first financial technology union in China. The financial technology union is based in Guangdong province, which attracted more than 150 technology enterprises in the first year. It provides financial services to over 4,500 technology companies in Guangdong, andhelps them to tackle the collateral problems due the light asset capital structure of high-tech companies.The forming of the financial technology union strengthened the long-term relationship between the bank and technology companies, getting the bank well prepared for the following collaborations and developments.

In 2016, the bank launched a fintech innovation centre in Guangzhou, which is the first fintech innovation centre in the bank level for a mega commercial bank. The innovation centre is expected to serve more than 12 thousand technology enterprise and provide more than $43.5 billion (RMB300 billion) to support the development of real economy. As one of the five main commercial banks in China, the bank’s efforts in the fintech innovation centre signified its marching in exploiting financial technology, which was supposed to become one of its core competencies in future development.

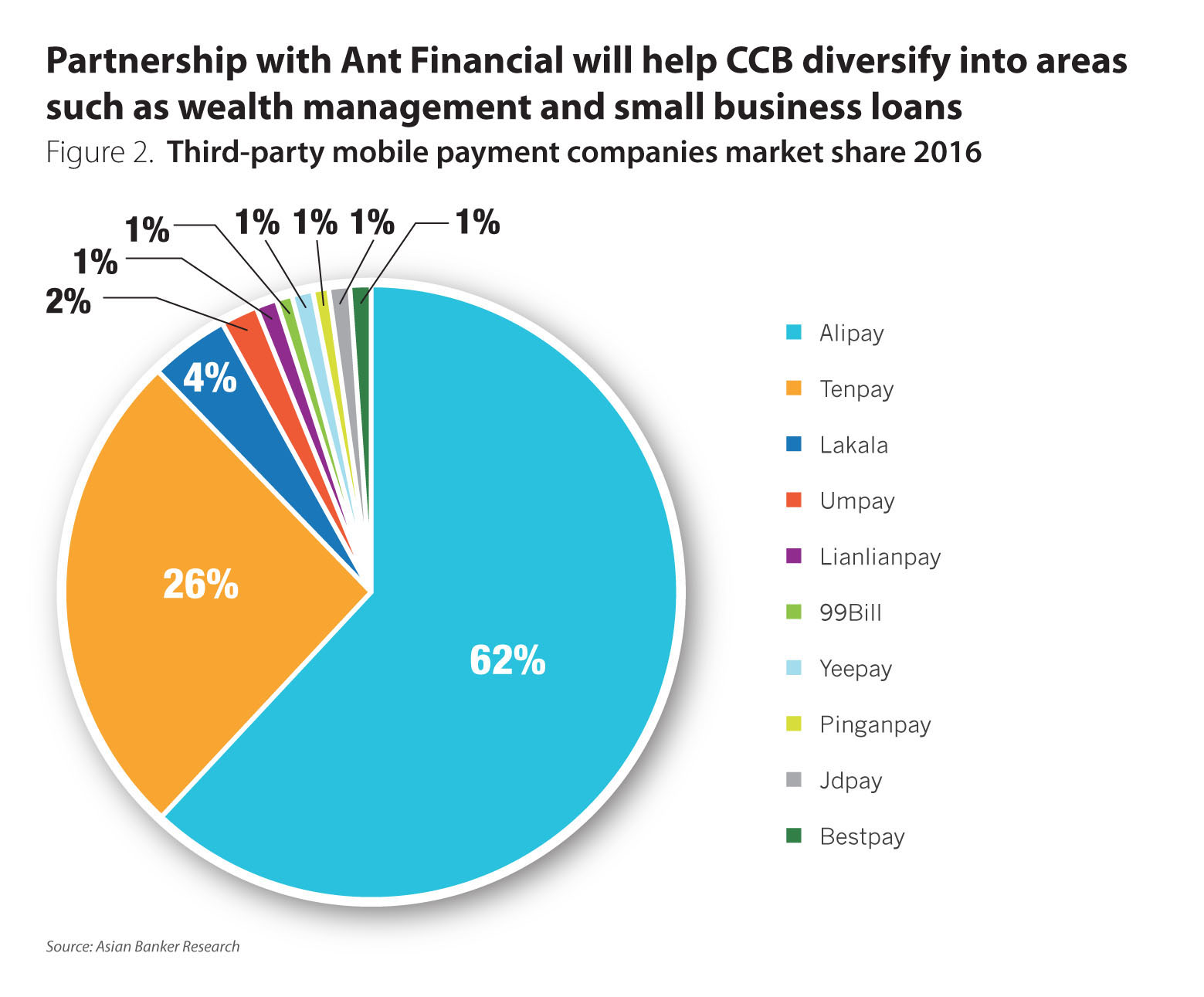

In 29th March 2017, CCB announced to enter a strategic partnership with Alibaba and its subsidiary Ant Financial. The partnership will allow Ant Financial to provide the bank’s wealth management products through its Alipay and Ant Fortune platforms. Alipay is an undoubtedly leader among third party mobile payments, which made up of 62% market share (Figure 2). The two sides will promote offline and online channel business cooperation and electronic payment business cooperation as well as open the credit system. In the future, the two sides will also achieve mutual recognition and scanning of two-dimensional codes and Alipay will support the bank’s mobile APP payment. The formal partnership between the bank and Alibaba indicates not only the bank’s recognition of financial technology companies, but also its willingness to taking advantage of the emerging market power to reinforce its market position. And the technological strength of the outsider will accelerate its own ability to apply the latest technologies and innovate products and services.

In its process of digitisation, the bank is also representing the future of banking revolution with the most advanced technologies and offering reference for the transformation of banking industry.

With its branches filled with AR interaction window, mobile financial expert and other technological devices, the bank is trying to combine the strength of digitisation and traditional manual service to create a best customer experience. Based on its sharp vision to the future, the bank continues to restructure the process and transform the business function. The bank has successfully constructed a comprehensive digital banking system made up by traditional branch service, intelligent teller machine and mobile terminal for customer and banking staff.

As a result of all these culminations, the average time to open an account has been reduced from nine minutes to less than four minutes, with the average waiting time declined for one fifth. With the implementation of intelligent teller machine, the previous 20 minutes for foreign settlement can be reduced to one minute. Furthermore, with the application of cloud technology, the transactions in different branch can be processed together in the head office, which improves the overall efficiency of operations. The overall business efficiency was promoted for more than five times. The bank realised digitisation from a traditional bank based on big data and other advanced technologies, pioneering the transformation of the whole industry.

Consistent with its development in multiple channels, the bank has built the e-commerce financial service platform with the strategy to promote financial business with the development of e-commerce. In the end of 2016, the bank promoted three new financial technology innovation products to help the financing problems of high-tech small and medium-sized enterprises (SMEs). These three products are targeted at high-tech SMEs with light asset but rich intellectual properties. With accurate collateral rate, the financial products allowed the collateral of intellectual properties and help the development of these enterprises.

China CITIC Bank

As one of the earliest commercial banks to participate in the financing activities in the international financial market,China CITIC bankhas the genes for innovation and creation. In its course to embrace internet development and develop new growth points, the bank has always grasped each opportunity to jump out of its comfort zone to open up new market space.Starting as the supervisory bank for Alipay, the bank has been cooperated with Alibaba, JD Finance, Tencent and Baidu, and now it’s developing its own strength to implement blockchain for electronic transmissions platform.

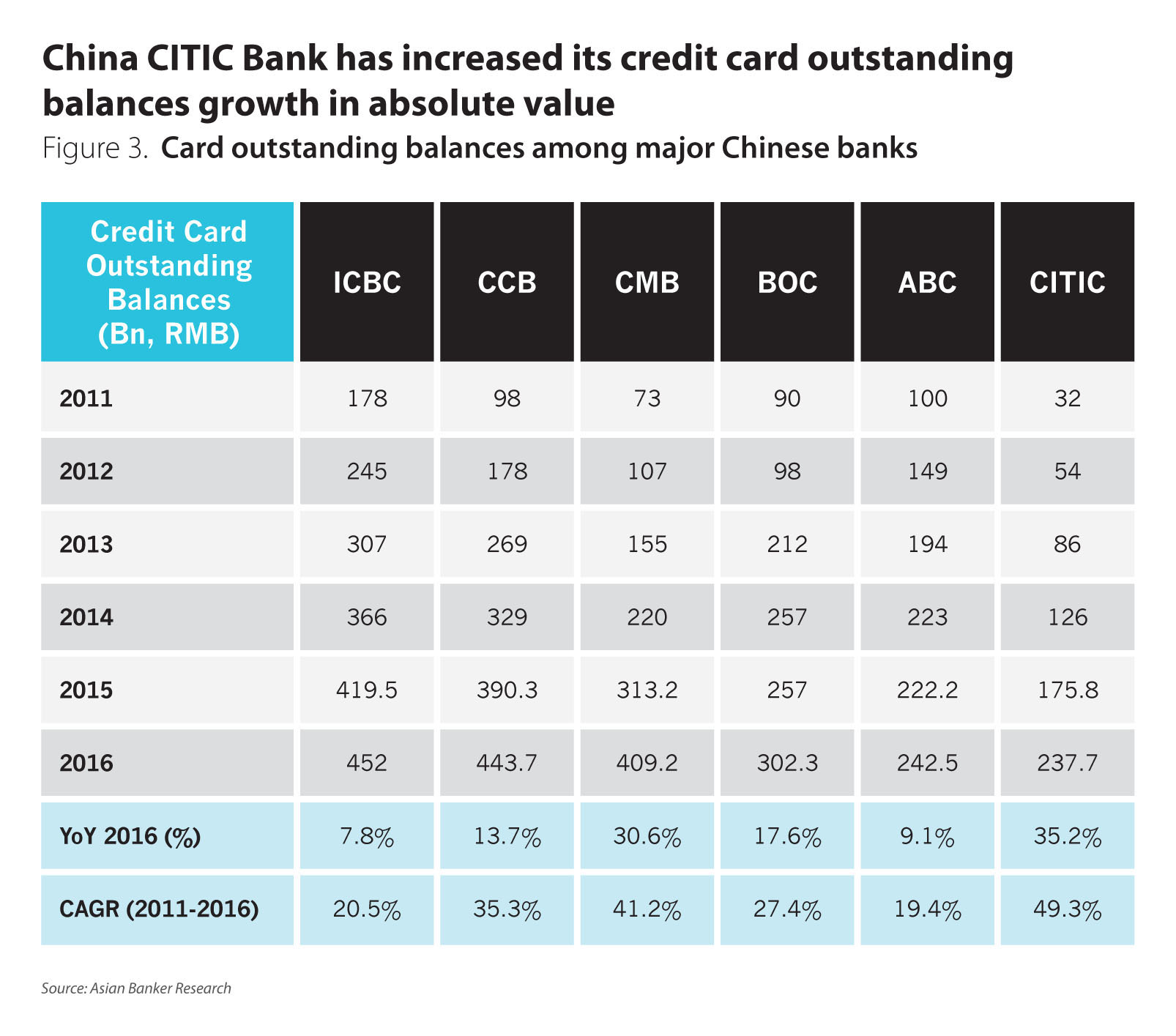

As early as 2010, China CITIC bank cooperated with Alipay to be its supervisory bank in fund payment business. And the bank managed to increase its custodian asset by $0.34 trillion (RMB2.35 trillion) in one year, which ranked first in the whole industry. In 2013, the bank formed a strategic partnership with Tencent, laying down its foundation in e-commerce financial service. In August 2015, the bank collaborated with JD Finance and launched a joint credit card, which integrates the benefits of bank and internet finance. The total application amount of the credit card has reached one million in 100 days, making it a sample for the collaboration between bank and Internet finance platforms. The compound annual growth rate of the bank’s credit card balances outstanding reached around 35.2% (Figure 3), showing the bank has launched deeply customised service based on the different characteristics of its partners, which improves the customer experience and guarantees the market share.

In 2017, the bank implemented distinguished initiatives in equipping itself with the technology advantage, creative thinking and multiple channels in fintech field. On January, the bank received regulatory approval to establish a direct bank with Chinese searching engine giant Baidu in Beijing.As the first direct bank operating as an independent legal entity in China, Baixin Bank will become a port for the bank to apply cloud computing, AI and mobile connectivity technologies for its users. On May 2017, the bank put forward the concept of finance ecology, making it the new tag for the bank. Centric with the bank, the finance ecology platform consists of city commercial banks, rural commercial banks, loan companies and peer-to-peer platforms to provider innovated financial services in different scenarios.

On 27th July 2017, the bank announced that it has established a system for the settlement of credit that uses an electronic transmission network backed by blockchain technology. Known as BCLC, this is the first ever letter of credit system in the banking industry built with blockchain technology.On the first day, the total transaction amount for letter of credit has reached $14.5 million (RMB100 million), marking the successful attempt of the bank to entirely break the constraints of a traditional banking system.With the mission to become the leader of internet finance, the bank is utilising internet finance to develop the new business model for banking industry, which is a necessary quality for the banks to survive in this era.

New players still need to follow the basics of financial services

Faced withcontinuous technology disruption, traditional financial institutions will be forced to transform to tackle the challenges brought by it. However, regardless of the advanced technologies of financial start-ups and technology enterprises, the new players still need to follow the basics of financial services. And this is where they need to work closely with real economy and very probably, with the help of traditional banks to maintain continuous growth. With the Chinese economy developing, business models and consumption behaviours are gradually shifting to digital and personalised trends. Under this new model, banks are gradually mastering technologies such as cloud computing, big data, AI, shifting the function of branch networks to product and service development in smart channels. With their digital transformation, the traditional banks will finally find the balance between new technologies and traditional process.

All Comments