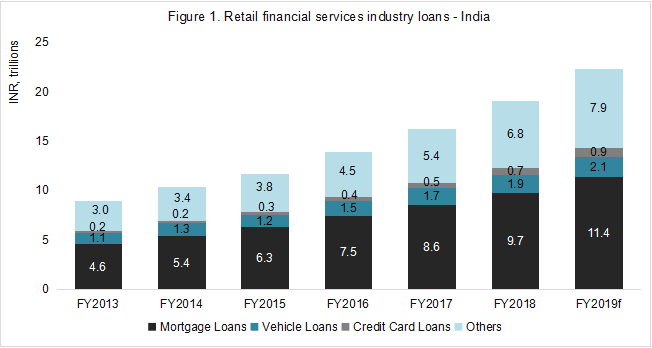

Retail Financial Services Industry Loans

Retail lending drives loan growth in India banking sector

FY ends in March

Source: Asian Banker Research

l Retail banking sector has been the main growth driver for Indian banking sector during the past few years, as banks’ exposure to corporate banking sector has been reduced due to bad loans problems. Their retail lending has grown at a compound annual growth rate (CAGR) of 16.2% over the FY2013 to FY2018 period, making India's retail banking one of the biggest among emerging markets.

l At the end of March 2018, mortgages accounted for 51% of total retail loans, down from 54% three year ago. Credit card loans have recorded the fastest pace of expansion, growing at a CAGR of 22.5% during FY2013-FY2018.

l Going forward, retail banking still has immense opportunities and strong growth in Indian banks’ retail lending is expected to continue, given their relatively young populations, low penetration and improving consumer purchasing power. The indebtedness of India households is still at relatively low levels of GDP. The growing network of banks and increasing use of digital technology will also contribute to the growth.

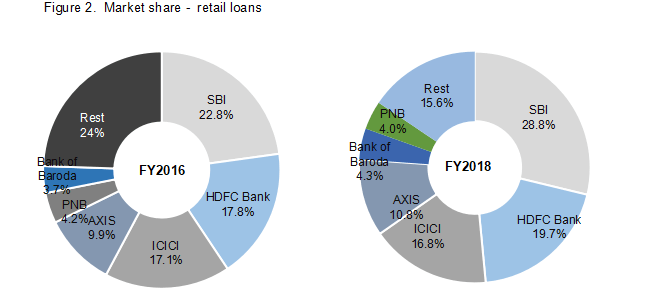

The four largest banks in India accounted for 76% of total retail loans

FY ends in March

Source: Asian Banker Research

l Largest Indian banks have seen an increase in their retail loans market share in the past two years. State Bank of India made up 28.8% of total retail loans in India banking sector at the end of March 2018, up significantly from 22.8% at the end of March 2016, which is mainly attributed to the merged with its associated banks, as well as Bharatiya Mahila Bank.

l State Bank of India remains as the largest home loan provider in India, with the market share increasing from 25.5% at the end of March 2016 to 32.1% at the end of March 2018. when it comes to vehicle loans, HDFC Bank is the market leader. Meanwhile, HDFC bank is also the largest credit card issuer in India.

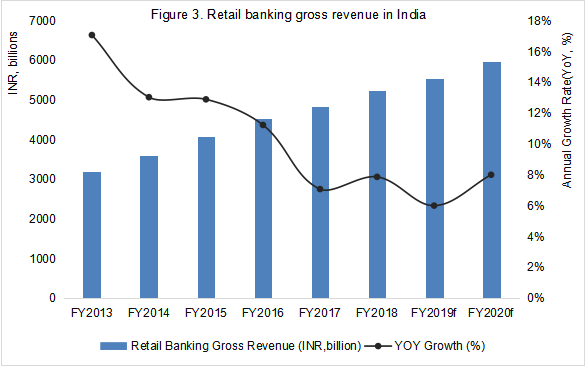

Retail Financial Services Revenue

Indian banking sector saw slower retail banking revenue growth

FY ends in March

Source: Asian Banker Research

l Despite the strong retail loan growth, most Indian banks have witnessed deceleration in their retail banking revenue growth in the past two years. Total retail banking revenue of Indian banks grew by 7.5% during FY2016 and FY2018, compared to a growth rate of 17.1% for total retail banking loans. Some banks even saw their retail banking revenue shrink, such as Syndicate Bank and Central Bank of India.

l YES BANK, however, has posted strong retail revenue growth during the past few years, as the bank has been growing their retail banking aggressively to diversify its advances. The bank’s retail banking will continue to grow, as it aims to expand its retail loan book by 75% to around $ 7.55 billion (INR 560 billion) by 2019-20.

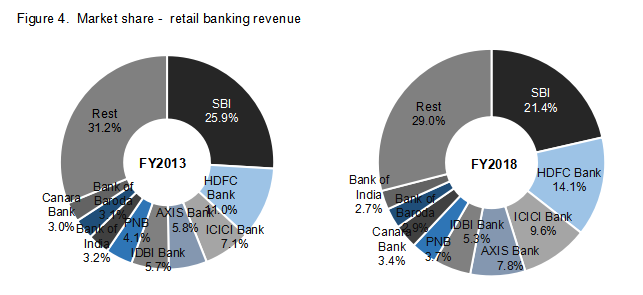

Indian private sector banks registered faster growth

FY ends in March

Source: Asian Banker Research

l During the period FY2013-FY2018, the combined retail banking revenue of the 22 Indian public sector banks grew from $38.7 billion (INR 2.11 trillion) to $45.8 billion (INR 2.98 trillion), representing a CAGR of 7%. Over the same period, HDFC Bank, ICICI Bank and AXIS Bank, the three largest private sector banks in India, have seen their retail banking revenue expand at the CAGR of 16%, 17% and 17%, respectively.

l Indian private sector banks grew their retail banking revenue much faster, partially because they grew from a lower initial revenue base. Meanwhile, public sector banks account for a major share of total bad loans in India, and private sector banks benefits from the struggles of their state-run counterparts. Overall, private sector banks have invested more heavily on digital technology and focus more on customer experience.

Payment

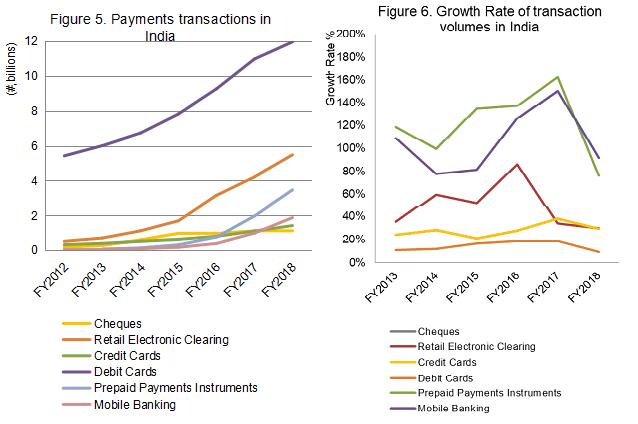

| India witnessed one of the fastest growth in mobile banking payment over the years | Mobile banking has the highest growth rate among other payments methods |

FY ends in March

Source: Asian Banker Research

l The digital banking penetration in India is relatively low. However, in the last few years, Indian government and banks have emphasised on pushing the digital economy with the country’s demonetisation efforts and encouraged people to use their mobile phones for banking purposes.

l The volume of mobile banking transactions increased from 977 million in 2016-17 to 1872 million in 2017-18, almost double the transaction volumes. The increase is huge and shows that mobile banking becomes the mainstream and reduces dependency on physical bank visits. Also, 2017-18 marked a historical moment that the volume of mobile banking transactions surpassed credit card usages for the first time.

l The declining growth rate for both Prepaid Payments Instruments (PPIs) and mobile banking volumes in 2017-18 could be explained by tougher Know Your Customer (KYC) norms for digital wallets and prepaid payments instruments introduced by Reserve Bank of India (RBI) in October 2017. According to the latest data from RBI, mobile wallet companies now have managed to claim back their customers.

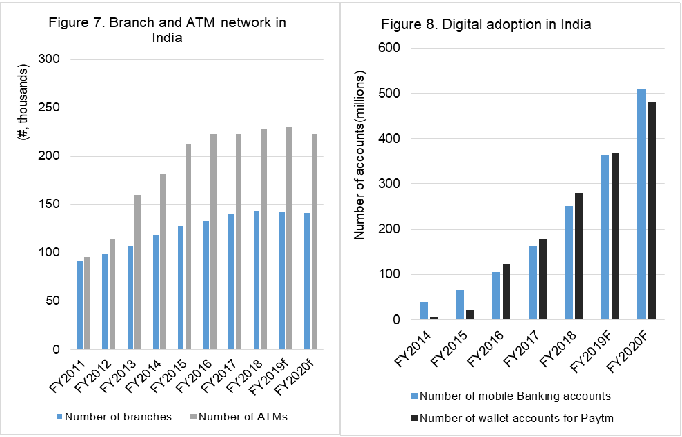

Increased uptake of mobile wallets and rapid growth in ATM numbers in the Indian banking sector

l In 2016, the Indian government started introducing ATMs in post offices, in a bid to promote financial inclusion. This widened the gap between the number of branches and ATMs, which has grown rapidly over the past few years.

l Also, the government has been actively promoting digital transactions, with the introduction of the United Payments Interface (UPI), a mobile-based fund transfer platform, as well as the Bharat Interface for Money (BHIM) by National Payments Corporation of India (NPCI). As such, there has been rapid growth in the number of Paytm wallet accounts, with Paytm Payments Bank’s total registered user base coming in at over 220 million users, as of April 2018. Digital user growth in the past months has stalled as India’s central bank prohibited Paytm Payments Bank to open any more accounts likely due to issues with e-KYC onboarding. Only a fraction of the 220 million users are full eKYC registered accounts. In the course of it, Renu Satti stepped down as CEO from Paytm Payments bank in July this year.

l In major banks, the increase in mobile users outgrows that of internet banking users. SBI India grew its internet banking users from 22 million to 50.9 million between March 2015 and June 2018, an increase of 2.3 times. Likewise, mobile banking user grew by 226% from 13.5 million to 30.5 million from March 2015 to March 2018.

All Comments