- A cautious approach to recruitment was adopted in several markets amid uncertainties

- The rise of digital banking licences is changing the recruitment landscape

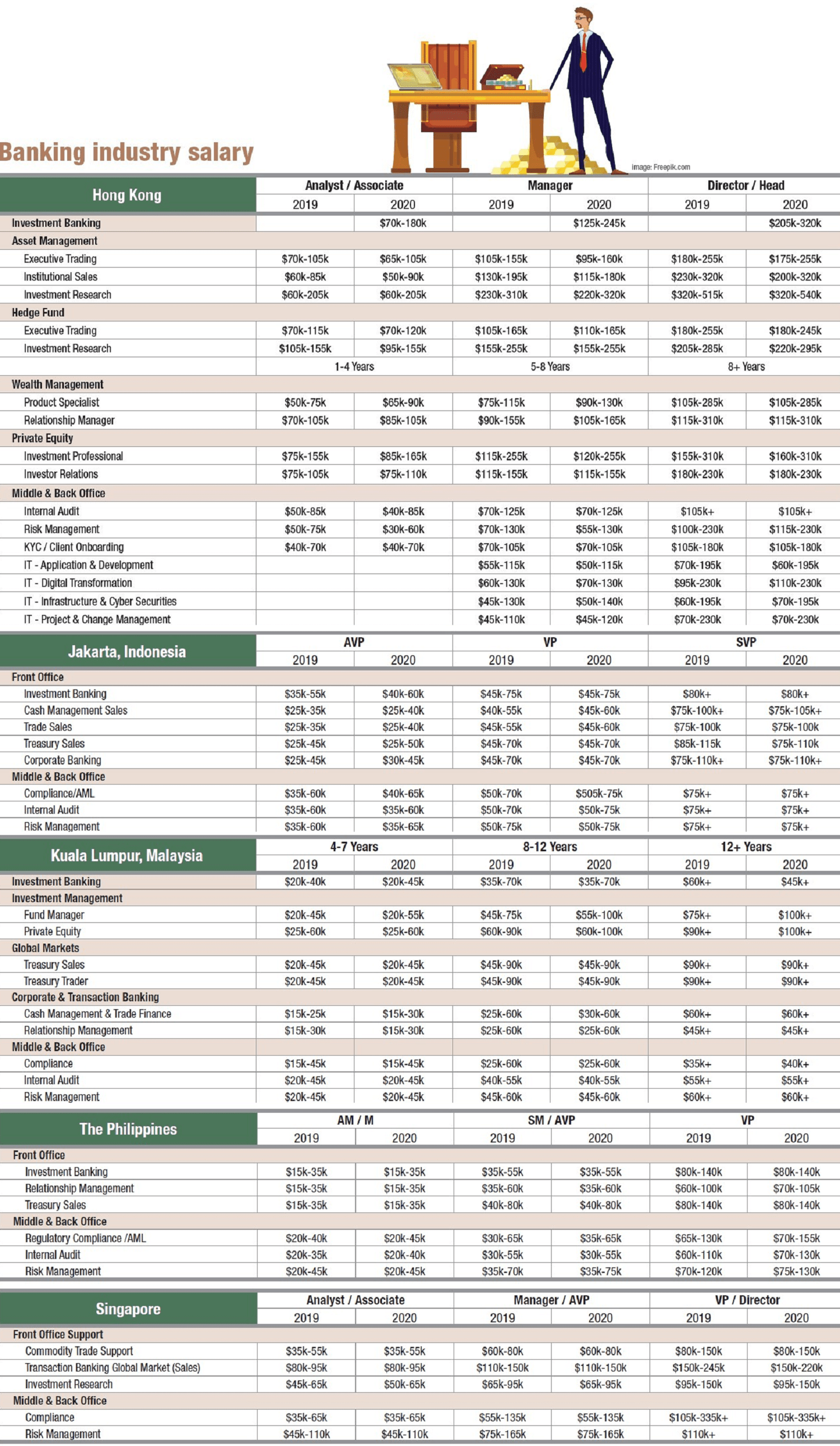

- The latest figures on average salary for key banking positions in Hong Kong, Jakarta, Kuala Lumpur, Philippines, and Singapore

In Asia Pacific, the need for technology and digital talent intensifies further as institutions continue to accelerate their digital transformation efforts. Meanwhile, the growth in risk and compliance market continues, due to new regulations and guidelines set by central banks and financial regulators. Aside from these roles, recruitment was largely focused on replacement hires. In addition, the demand for talent with international experience has been growing in countries like the Philippines, due to the increased globalisation of domestic businesses and the expansion of multinational companies in these countries.

A cautious approach to recruitment was adopted in several markets amid uncertainties. In Hong Kong, hiring levels were more subdued in 2019, owning to political instability and the US-China trade war. Although the hiring activity among professionals in the fields of private banking and wealth management remained steady, the recruitment of talent in trading and equity-related financial services positions declined. In 2020, it’s expected that the political uncertainty will continue to influence the hiring rate in Hong Kong. The hiring activity in Indonesia and Malaysia was adversely affected by general elections and domestic policy changes, but hiring is expected to be more active in 2020.

The rise of digital banking licences is changing the recruitment landscape. Officials have begun offering digital-only (also known as neo, virtual, and challenger) banking licences across the region, which will drive hiring activity and stiffen the competition for skilled digital and technology talent. Virtual banks have experienced high levels of interest from jobseekers, and some technology professionals are expected to leave traditional banks and join the new players. According to the salary survey released by Robert Walters in 2020, 88% of fintech professionals in Hong Kong are optimistic about job opportunities in 2020. Additionally, they will also need to recruit talent in areas such as finance, risk, compliance and strategy.

Source: Robert Walters, Asian Banker Research

Notes: “Salary” refers to base salary figures in USD on an annual basis, excluding benefits or bonuses

All Comments