- The project focused on developing design to address critical challenges

- Possibilities of using multiple CBDCs issued on a shared platform for international settlement

- CBDC could come up to 20% of the world in three years

The Bank for International Settlements (BIS) Innovation Hub and central bank partners in Australia, Malaysia, Singapore and South Africa announced last March 2022 a shared platform to facilitate international settlements with multiple central bank digital currencies (multi-CBDCs). This study, dubbed as Project Dunbar, is a multi-currency common settlement platform that would allow transacting parties to pay each other directly in different currencies without the use of intermediaries like correspondent banks.

The project focused on developing design to address critical challenges

Project Dunbar is one of the first technical experiments in the emerging multi-CBDCs space. The project's goal is to develop design solutions to three major issues in the construction of a shared multi-CBDC platform.

According to Andrew McCormack, head of the BIS Innovation Hub, the project identified three critical questions: which entities should be allowed to hold and transact with CBDCs issued on the platform? How could the flow of cross-border payments be simplified while respecting regulatory differences across jurisdictions? What governance arrangements could give countries sufficient comfort to share critical national infrastructure such as a payments system? The project proposed practical solutions for addressing these issues, which were validated through the development of prototypes that demonstrated the technical viability of multi-CBDC shared platforms for international settlements. “A common platform is the most efficient model for payments connectivity but is also the most challenging to achieve. Project Dunbar demonstrated that key concerns of trust and shared control can be addressed through governance mechanisms enforced by robust technological means, laying the foundation for the development of future global and regional platforms,” he added.

While prototypes were constructed and tested successfully during the project, they were based on a preliminary design and the best set of assumptions known to the team at the time. New knowledge and a greater understanding of the project led to ongoing modification of the assumptions. Unknowns were discovered, allowing for a better grasp of the problems that must be overcome. The project has a lot of challenges but these were better understood and subsequently solved. However, even at the completion of this first phase, there are still more questions in the future. Assumptions will continue to be challenged as new information arises, and designs and prototypes will continue to improve.

Possibilities of using multi-CBDCs for international settlement

The ultimate goal of Project Dunbar is to create a global network of connected CBDC platforms and interoperable CBDCs. The central banks involved are the Reserve Bank of Australia (RBA), Bank Negara Malaysia, the Monetary Authority of Singapore (MAS) and the South African Reserve Bank (SARB), led by the BIS Innovation Hub’s Singapore centre.

Separately, the central banks of China and the United Arab Emirates (UAE) collaborated with their counterparts in Hong Kong and Thailand to look at the usage of CBDC in cross-border foreign currency payments. The four governments are also working together on a project called 'm-CBDC Bridge' with the BIS Innovation Hub Centre in Hong Kong. The UAE Central Bank had already completed a wholesale CBDC proof-of-concept with the Saudi Central Bank, called Project Aber, allowing domestic and cross-border transactions to be settled using central bank money via distributed ledger technology (DLT).

Also, in the wholesale CBDC space, ‘Project Jura’ – which presented its conclusions in December 2021 – saw the Banque de France (BdF) and Swiss National Bank (SNB), examining if CBDCs can be utilised effectively for cross-border settlement between financial institutions in partnership with BIS and six commercial enterprises. The core of this was a dual-notary signing solution created by R3 on the Corda platform.

According to the BIS report: “In the roadmap to achieving the vision of Project Dunbar, the next major step is developing and testing a regional multi-CBDC platform to a high level of production fidelity.”

A single global settlement network that unites all central banks and commercial banks would be perfect and the epitome of efficient cross-border payments. However, given the difficulty of central banks sharing vital financial infrastructure and the specific needs of each jurisdiction, it is predicted that a shared multi-CBDC platform will be implemented as a succession of regional platforms rather than a single worldwide platform.

CBDCs could be issued by 20% of world’s central banks in three years

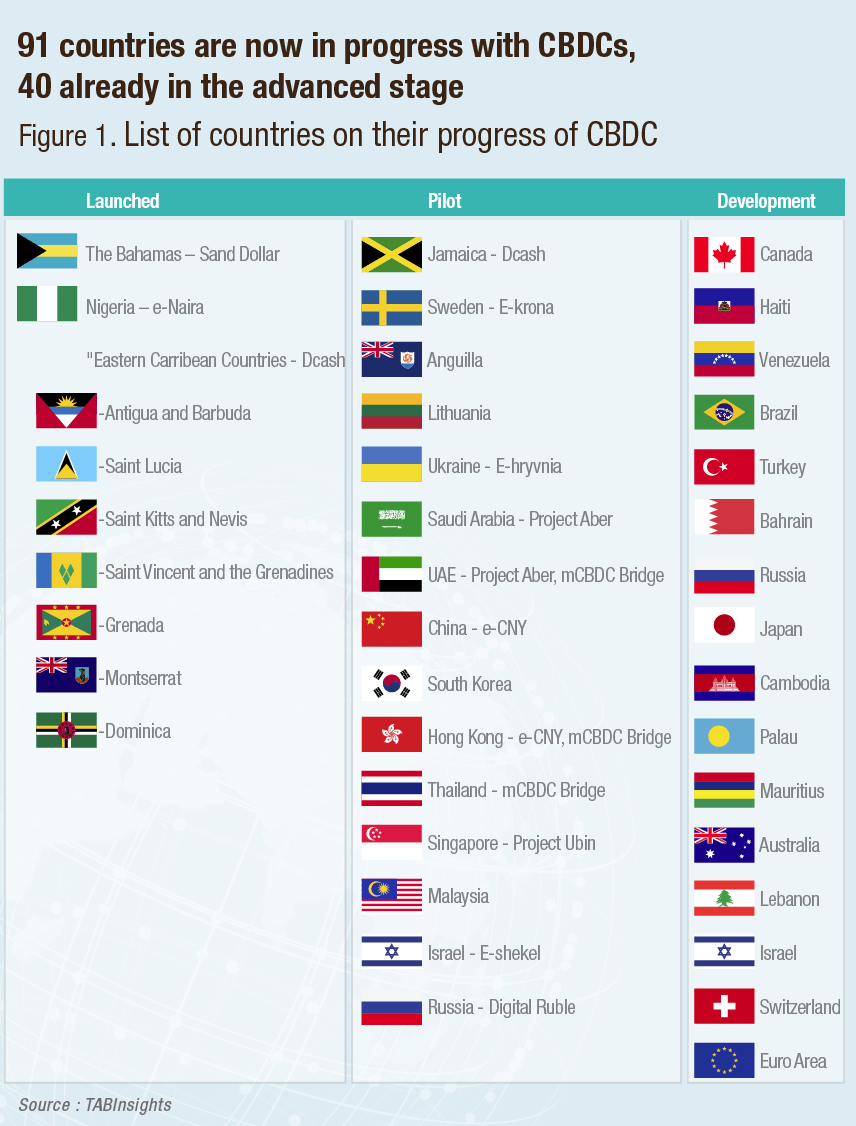

Over the last few years, the use of CBDC-related technologies to facilitate international payments has grown in popularity, with many central banks partnering in a similar fashion to those participating with Project Dunbar. According to a survey by BIS, CBDCs will be the future of payment, with up to 20% of the world's central banks likely to issue their own digital currencies in the next three years. The poll found that central banks in emerging and developing economies are more likely to issue CBDCs than those in developed economies. In October 2020, the Bahamas became the first country to issue the Sand Dollar, a general-purpose CBDC. A number of bigger countries have also been testing the waters, with China the most advanced.

Nine countries have now fully launched a digital currency. Nigeria is the latest country to launch a CBDC, the e-Naira, the first outside the Caribbean. Of the countries with the four largest central banks (the US, the Euro Area, Japan, and the UK), the United States is furthest behind. 14 countries, including China and South Korea, are now in the pilot stage with their CBDCs and preparing a possible full launch.

Project Dunbar finished with more questions than solutions since it began as an exploratory project with a limited timescale. This is to be expected, as its primary focus was on discovering probing and resolving problems. The G20 roadmap includes CBDCs as a focal area for new payment infrastructures. CBDCs show great promise in improving payments, and have been the subject of exploration by multiple central banks.

All Comments