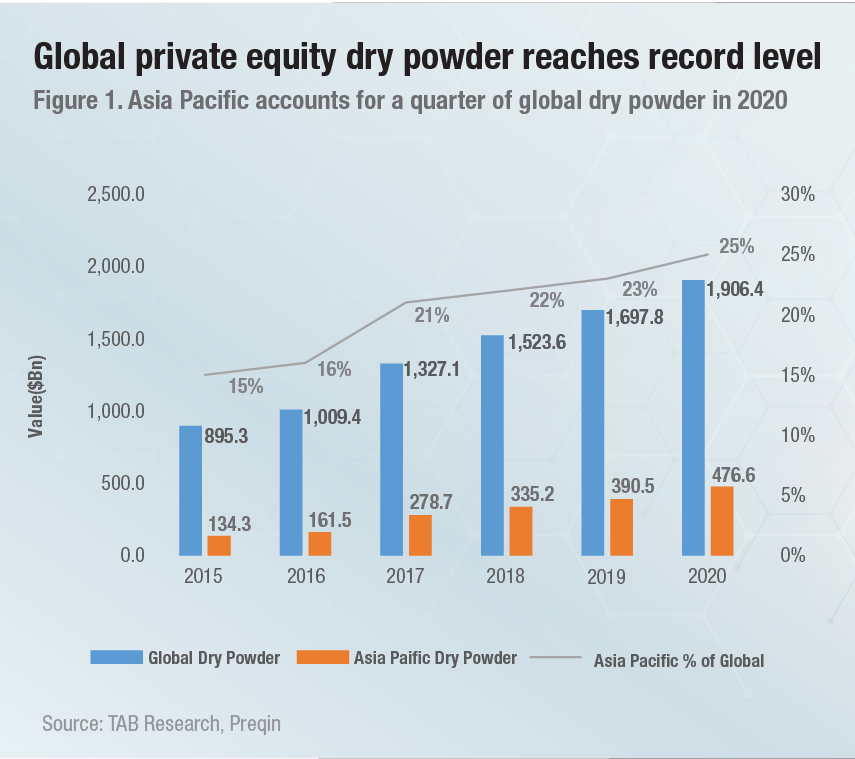

- Global private equity dry powder is at a record level of nearly $2 trillion with 25% in Asia-Pacific and another 19% in Europe.

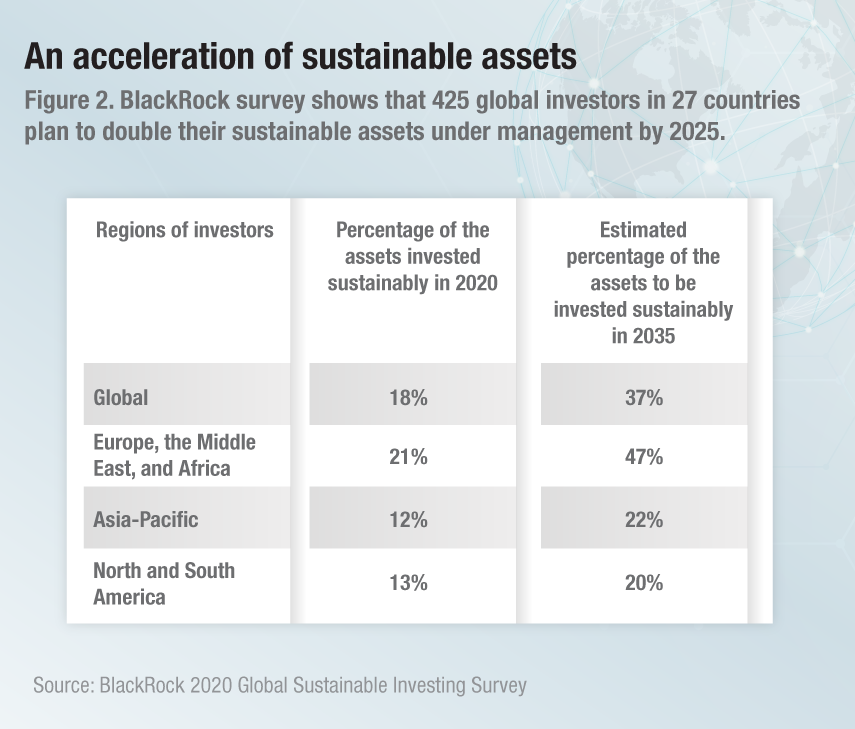

- ESG trend going mainstream is unstoppable for private equity as investors plan to double their sustainable assets under management (AUM) in next 5 years, according to a BlackRock survey.

- PE can truly “do well by doing good” with its unique contribution to ESG and impact investing.

Dry powder, a PE slang for the capital committed but not yet invested, reaches record high in 2020.

Global private equity ‘dry powder’ reaches record high level

Asia Pacific region, with more than $476 billion as of November 2020, represents 25% of the global ‘dry powder’, above Europe (19%). Dry powder allocated to Asia Pacific continues to outgrow US, Europe, Middle East and Africa popularly known as the EMEA region) in 2021 as institutional investors continue to increase allocations toward Asian PE/VC firms, according to KPMG

The trend of ESG going mainstream is unstoppable for private equity

As in the old days of musketeers, the dry power would and must ultimately be used to load a gun to shoot the targets. For reviving from the global pandemic, the record level PE dry powder is also bound to be deployed and ESG is one of the attractive avenues for investments.

The Covid 19 pandemic has reinforced investors’ awareness for long-term business sustainability, as well as financial performance. So, ESG indicators and ESG investment analysis is now a part of the due diligence process. This trend is set to increase in 2021 as it is estimated that $3 trillion has been raised across more than 5,400 funds managed by firms that subscribe to ESG principles, according to Preqin,

BlackRock’s,survey of 425 investors form 27 countries on sustainability investing showed that respondents plan to double their AUM under sustainability assets under in the next five years – number rising from 18% of AUM on an average today to 37% by 2025.

PE takes the form of a limited partnership, with the fund manager serving as general partners (GPs) by contributing around 1% to 3% of the total fund investment size. The remaining investment is made by limited partners (LPs), including pension funds, university endowments, insurance companies, and high-net-worth individuals.

LPs are essentially the deep-pocket investors of PEs. Though LPs have no influence over investment decisions when the capital is raised, they can decide to offer no additional investment if they are not satisfied with the fund or the GPs. For GPs, this means that ESG is fast becoming a key indicator for raising money and formulating their investment decisions.

On the unstoppable trend of ESG going mainstream, Bonn Liu, partner at ASPAC and head of asset management, KPMG China, says, “ESG investing is poised to have a breakout year as investors drive adoption and the asset class is increasingly viewed as a value driver. As ESG reporting becomes more of a priority for regulators, and investors flock to these funds, it has the opportunity to offer differentiation for PE investors.”

Private equity is better positioned to do well by doing good

PE firms today are active investors, rather than passive financiers who are also offering guidance to build a strong company. VC firms too finance ideas and early-stage companies

that enables them to nurture the company from a nascent stage. Besides, PE firms often have a long investment horizon, the holding periods until exits can last from five to seven years. PE firms therefore have a unique advantage to do well by making impactful investment.

In the age of low-yield bonds, investors view alternative assets as a return enhancer in a portfolio of traditional assets. Among $857.9 billion global alternative investment funds raised in 2020, $502.9 billion was invested in PE funds.

According to McKinsey, PE has still outperformed public market equivalents – with net global returns of over 14%. The secret ingredient of high PE returns lies in the value creation. It involves operational improvements and realizing synergies. When utilized wisely, PE can inject its industry expertise, operational know-how, and a culture of sustainability, to the portfolio companies.

Bryce Klempner, partner at McKinsey said “The pandemic has accelerated change within the private markets. Now there is a greater sense of urgency forcreating more equitable and inclusive places to work, and in doing so, attracting better talent. ESG was a major theme before the pandemic, but ESG themes have now reached an inflection point, becoming increasingly top-of-mind for funds, LPs, talent, consumers, and regulators.”

Market has a high hope for PE, since it represents the largest portion of alternative investments, offers the highest returns, and now has nearly $ 2 trillion dry powder under the belt. Now, more than ever, PE can play a commensurate role in shaping the post-pandemic investment landscape by wholeheartedly embracing ESG and do well by doing good.

All Comments