- Kasikornbank strengthens profitability

- A digital ecosystem that encompasses customers’ daily life

- The bank continuously develops its mobile app for user satisfaction

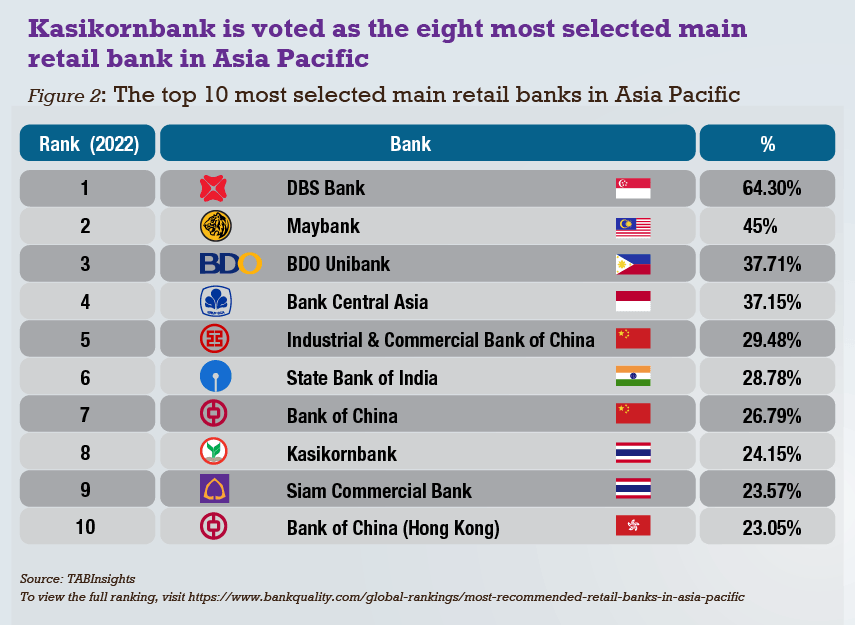

Kasikornbank has the highest penetration rate among banks in Thailand and ranked eighth in Asia Pacific, with 24.15% of the consumers selecting it as their main bank. The bank continued to focus on the consistent execution of its strategies and invested in digitalisation to scale up its business and meet the needs of its consumers, increasing its customer base to 18.1 million, with a 10.2% year-on-year (YoY) growth.

To view the full ranking, visit https://www.bankquality.com/global-rankings/most-recommended-retail-banks-in-asia-pacific

Kasikornbank strengthens profitability

Kasikornbank was established on 8 June 1945 and was listed on the Stock Exchange of Thailand (SET) in 1976. As of March 2022, the bank’s assets reached $124.3 billion with a market share of 16.4%, its loans reached $73.8 billion with a market share of 16.5% while the bank’s deposits recorded $79.1 billion with a market share of 16.9%.

Kasikornbank grew its operating income by 5% YoY from $4.43 billion in 2020 to $4.67 billion in 2021 and net profit growth of 29.05% from $843 million in 2020 to $1.08 billion in 2021. Higher earnings before profit and tax (EBPT) and lower expected credit losses contributed to strengthening of the bank’s profitability. The total deposits grew by 10.8% YoY from $67.03 billion in 2020 to $74.29 billion in 2021.

The second placer Siam Commercial Bank sets its long-term digital banking strategy by focusing on retail segment that entails controlling cost and generating revenue. This was done by targeting high-quality customers with high-return products through the use of data analytics for customer segmentation and product customisation as well as for business model innovation. This results to generate new revenue streams, expand and build quality customer base while deepening engagement with diverse customer segments including teen debit-card users, e-commerce and online merchants, and subscription service consumers.

For the growing small e-commerce and online business customer segment, Siam Commercial Bank increased lending channels by embedding “Manee Merchants” in the bank’s ecosystem. The bank also offers end-to-end business solutions through “Manee Social Commerce” that consolidates multiple platforms for both front and back-end store management into one single system. The bank also improved its core capabilities and infrastructure through technology and business model innovation to reduce cost to serve and assign more banking agents and electronic know your customer (e-KYC) in order to support cross-border payments.

A digital ecosystem that encompasses every aspect of customers’ daily life

Kasikornbank’s enhanced and advanced digital ecosystem is designed to create, integrate, and provide services that cover every aspect of customers’ daily life. This ecosystem aims to tap into the new norms of digital services such as e-commerce and payment, social media, wealth advisory, education, public health, clean-energy transportation, and even tourism to be proactive in the recovering travel industry. Kasikornbank’s ecosystem is not only built to increase transaction volume, but also to offer the best value-added services to users and to exchange valuable information with strategic partners to better understand customers.

Kasikornbank continuously develops its mobile app for user satisfaction

Kasikornbank’s mobile application, the K PLUS has been continuously developed and closely monitored to ensure seamless digital onboarding and self-service experiences. Its service performance dashboard has been used for proactively monitoring and triggering any potential issues emerging in all channels. With the use of knowledge management, machine learning, and data analytics, the bank’s call centres and chat channels have been greatly enhanced in both capacity and capability in order to handle the higher enquiry volumes and cover a wider range of services.

LINE BK, Thailand’s first social banking platform allows customers to transfer money, open savings accounts, apply for loans, and make payments easily and conveniently from the LINE app that was launched in October 2020. The platform users grow by 115% from 2 million users in February 2021 to 4.3 million users in March 2022. The bank’s saving accounts reached 5.6 million, debit cards reached 2.4 million, credit line accounts reached 600,000, and special rate accounts reached 133,000.

Siam Commercial Bank uses a multi-platform approach to provide digital lending services by offering access on both its own mobile banking platform “SCB EASY” and the platforms of subsidiary companies. At the end of 2021, the number of digital users rose by 42.8%, 20 million from 14 million users at the end of 2020. In October 2020, Siam Commercial Bank created the Robinhood food delivery application and eliminated the gross profit fee imposed by other platforms. The Robinhood has also created over 10,000 food delivery jobs during a time of high unemployment. The app’s cashless feature benefits delivery drivers and restaurant customers alike; delivery drivers can get instant payments while customers can pay directly to restaurants with various payment options. By the end of 2021, Robinhood’s users rose to 2.4 million.

About the BankQuality Consumer Survey and Rankings 2022 Survey Methodology

The BankQuality™ Consumer Survey and Rankings interviewed 11,000 bank customers in 11 markets across the Asia Pacific region on their engagement, experience and satisfaction with their main retail banks.

- The online survey was conducted from 1 February 2022 to 30 March 2022

- The survey covered a total sample size of 11,000, comprising 1,000 respondents per market in China, Hong Kong, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand, and Vietnam

- The respondents are between the ages of 18 and 65 years and hold at least one bank product

The BankQuality™ Score (BQS) is derived from the normalised net promoter score (NPS) of “main bank” institutions to a uniform scale of 0 to 1. A standardised z-score is then calculated from the normalised score, with mean set to 100, so that comparison can be made across markets. The final ranking excludes banks that achieved less than 30 “main bank” responses.

All Comments