- National Commercial Bank is strongest bank by balance sheet in the Middle East as regional peers delivered weaker overall performance

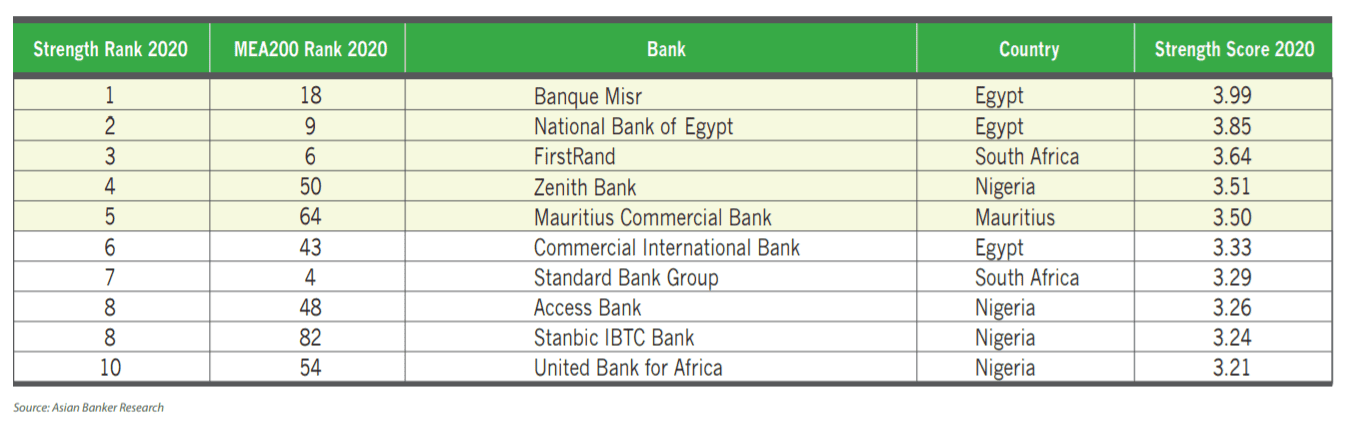

- Banque Misr is the strongest bank bank by balance sheet in Africa while its counterparts in the continent registered mixed results

- Qatar National Bank and Standard Bank are the largest bank in the Middle East and Africa respectively as players recorded lower profits

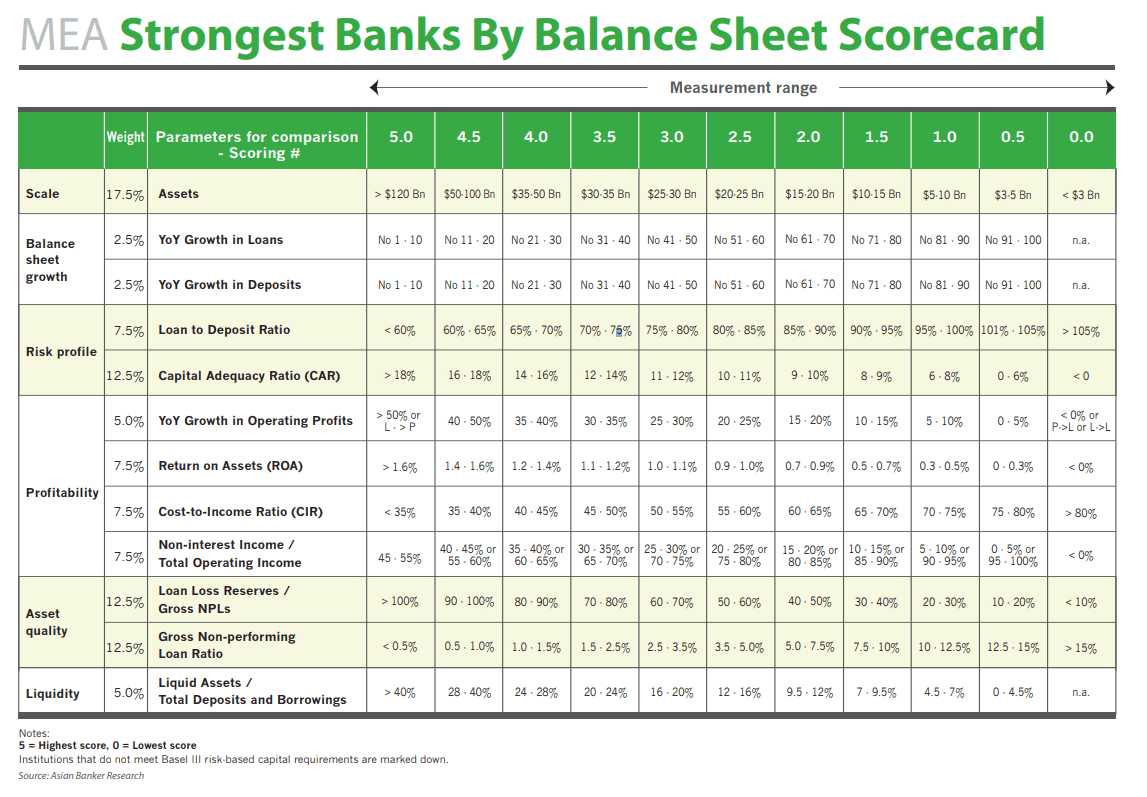

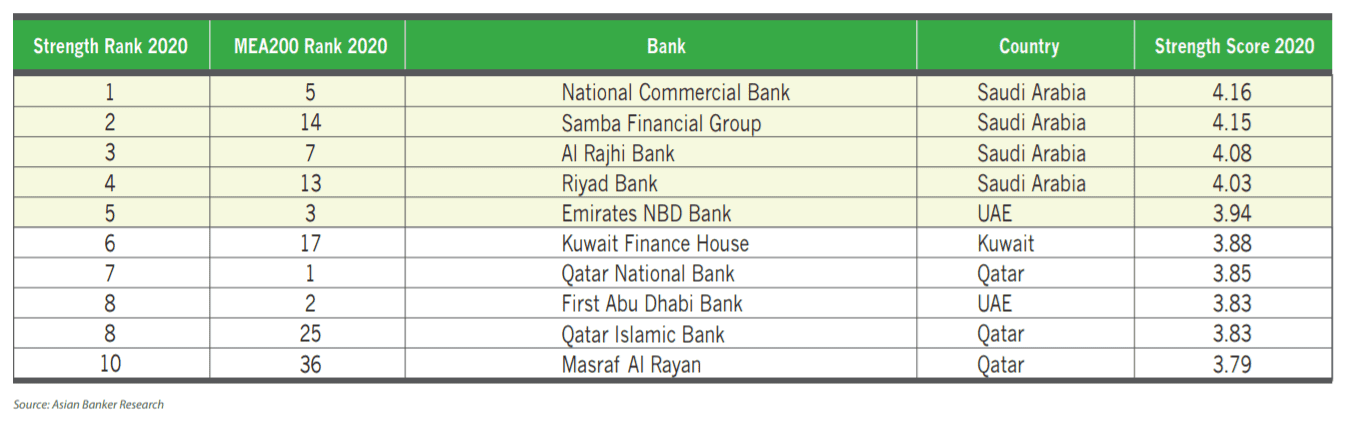

National Commercial Bank, the largest Saudi Arabian bank, tops the annual ranking of strongest banks in the Middle East, while Egypt-based Banque Misr is the strongest bank in Africa. This is based on a detailed and transparent scorecard that ranks banks on six areas of balance sheet financial performance; namely the ability to scale, balance sheet growth, risk profile, profitability, asset quality and liquidity. National Commercial Bank and Samba Financial Group have also entered into a merger to create the third largest bank in the region. The merger is expected to be completed in the second quarter of 2021.

Saudi Arabian and Qatari banks achieved the highest weighted average strength score, at 3.83 and 3.64 out of five, respectively. The average strength score recorded by banks in the Middle East fell from 3.62 in the previous year’s evaluation to 3.48 in 2020, a reflection of weaker overall financial performance. Apart from the impact of the pandemic, low oil prices also posed serious challenges to the banking system. Banks in the region registered an average return on assets (ROA) of 0.92% in 1H FY2020, much lower than 1.69% in 1H FY2019. Asset quality deteriorated and average capital adequacy ratio (CAR) also declined during the year.

This year, financial information in the first half of financial year 2020 (1H FY2020) was collated and incorporated into the assessment of how banks performed during the COVID-19 pandemic. This year’s evaluation covers banks from 15 countries, namely Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia and United Arab Emirates (UAE) in the Middle East and Egypt, Ghana, Kenya, Mauritius, Morocco, Nigeria and South Africa in Africa, and ranks them according to asset size and overall strength.

The MEA200 scorecard allows banks to reflect on the factors that underpin the strength of their balance sheets

Figure 1: Criteria of the MEA200 scorecard

Weaker overall performance from Middle Eastern banks

Qatari banks enjoyed the highest average ROA of 1.4% and the lowest average cost to income ratio of 25.1%, while banks in Lebanon and Bahrain recorded the lowest score in profitability. Overall, profitability was weaker in this year’s evaluation, and banks in UAE saw average ROA fall the most, from 1.9% to 0.9%. The average ROA of banks in Bahrain also dropped considerably from 1.3% to 0.4%, and average cost to income ratio was up from 50.5% in 1H FY2019 to 62.2% in 1H FY2020, the highest increase in the region.

Saudi Arabian banks maintained the strongest asset quality, followed by banks in Kuwait and Qatar. However, average gross non-performing loan (NPL) ratio deteriorated overall. Banks in Oman, Qatar and UAE witnessed both a rise in gross NPL ratio and a drop in loan loss reserves to gross NPL ratio. In addition, Saudi Arabian banks enjoyed the highest level of capitalisation, with CAR averaging 18.9%. Middle Eastern banks have remained well-capitalised, although average CAR was down marginally from 18.4% to 17.8%.

The Lebanese banking sector suffered huge losses in the year due to a severe and deepening economic and financial crisis since 2019. Lebanese banks are required to increase capitalisation by 20% by the end of February 2021 and face possible government takeover should they fail to meet threshold.

National Commercial Bank tops the annual ranking of strongest banks in the Middle East

Figure 2: Top 10 Strongest Banks By Balance Sheet in the Middle East

Mixed performances from African banks

The top 10 strongest banks in Africa comprise four Nigerian banks, three Egyptian banks, two South African banks and one bank from Mauritius. With average strength score of 3.46 and 3.23, out of five, respectively, banks in Egypt and South African continued to outperform.

Banks in Africa enjoyed strong liquidity, with an average of liquid assets to total deposits and borrowings ratio of around 40%. Liquidity improved further in this year’s evaluation. The average loan to deposit ratio dropped to 70% at the end of 1H FY2020 from 74% in the prior year. Overall profitability weakened, average ROA fell from 1.7% in 1H FY2019 to 1.15% in 1F FY2020 and cost to income ratio rose from 51.9% to 52.3%.

Banking sectors in the region continued to deliver mixed financial performances. Egyptian banks maintained the strongest asset quality and their average cost to income ratio remained the lowest. Ghanaian banks enjoyed the highest average ROA at 3.2% and also maintained robust capital levels, but the high level of NPLs is the main challenge they face. South African banks recorded the largest drop in average ROA from 1.75% to 0.7%. Kenyan banks achieved lower strength score than their regional peers. In addition to weak asset quality, they are also among the smallest banks in the region.

In the past few years, banks across the region have increased mergers and acquisitions activities. In the near term, as bank performance is expected to weaken further due to deterioration in asset quality and profitability, those that struggle to weather the increased stress will become likely takeover targets.

Egypt-based Banque Misr is the strongest bank in Africa

Figure 3: Top 10 Strongest Banks By Balance Sheet in Africa

MEA banks recorded lower profit growth

Qatar National Bank retained its position as the largest bank by assets in the Middle East and Africa, followed by First Abu Dhabi Bank and Emirates NBD Bank. Emirates NBD Bank surpassed Standard Bank Group to become the third largest bank, due to stronger asset growth.

This is according to The Middle East and Africa 200 (MEA200) 2020 ranking, an evaluation of the 200 largest commercial banks and financial holding companies (banks) in the Middle East and the Africa.

Emirates NBD surpassed Standard Bank as the third largest bank driven by stronger asset growth

Figure 4: Top 20 Largest Banks in the Middle East and Africa

The 200 banks listed have combined total assets of $3.9 trillion, net loans of $2.2 trillion and customer deposits of $2.6 trillion. However, aggregate net profit generated by these banks was down from $29.1 billion in 1H FY2019 to $18.7 billion in 1H FY2020. Kenya and Ghana have the largest number of banks on the list, while UAE and Saudi Arabia hold the largest combined bank assets. The aggregate total assets of banks in UAE, Saudi Arabia, South Africa and Qatar account for 64% of total assets. Ghana and Mauritius combined have less than 1% share of total bank assets.

The top 20 largest banks by assets in the region comprise six Saudi Arabian banks, four South African banks, four UAE banks, two Egyptian banks, two Kuwaiti banks and one each from Morocco and Qatar. Saudi British Bank and Alawwal Bank merged their businesses in 2019 to become one of the top 20 largest banks. The aggregate total assets of the top 20 largest banks account for 57% of total assets of the 200 banks.

Click here to view the MEA200 Strongest Banks ranking

Click here to view the MEA200 Largest Banks ranking

All Comments