In recent years, the dialogue on sustainable and responsible leadership in the financial services sector has gathered pace. There is a realisation that leaders no longer have the luxury to simply react to the climate change crisis, as they do other crises. They have to lead proactively and pre-emptively. In doing so, they will recognise and embrace their new roles and responsibilities towards society and not just the stakeholders of the financial institutions they lead.

The United Nations Environment Programme (UNEP) has since 1992 created the Finance Initiative (UNEP FI) framework to work with banks, insurers and investors, catalyse action across the financial system to deliver more sustainable global economies. Today, it works with over 400 member institutions representing over $100 trillion in assets to provide guidance to integrate sustainability into financial market practice.

Despite the impressive figures, the banking industry as a whole has been slow in partnering the UNEP FI to set, implement and achieve its sustainability goals. Notwithstanding its inception 30 years ago, most initiatives were introduced only in the last decade since the conclusion of the UN Paris Agreement in 2015. One example is the Principles for Responsible Banking, established in 2019 and has about 300 signatories representing over 45% of global banking assets today. In comparison, its precursors, the Principles for Responsible Investment, introduced over a decade earlier in 2006, is applied by over half of the world’s institutional investors with over $83 trillion of investment assets, and the Principles for Sustainable Insurance in 2012 is applied by a quarter of insurers worldwide.

More recent initiatives are targeted at fighting climate change and aimed at accelerating action to align public and private financing towards net-zero carbon emission by 2050 and limit the average global temperature rise to 1.5°C above pre-industrial levels by 2100. These comprise the three net-zero alliance initiatives with asset owners, banks and insurers introduced from 2019 to 2021. The Net Zero Banking Alliance (NZBA) in particular was launched in 2021 with over 100 banks representing $65 trillion in asset, about half of the global banking industry, and set goals of reaching net-zero or carbon neutrality by 2050. The UNEP FI has also since 2017 been working to implement the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD). However, to date only 48 banks, and investors, mainly the global and large players, are involved in the programme, the majority of the industry have chosen to stay on the sidelines.

Evidently, the industry’s response to the climate change crisis is neither proactive nor pre-emptive. The vast majority of the estimated 25,000 licensed banks remain outside. Detractors would argue that even among signatories of these initiatives, commitment to sustainability and net-zero may be more perfunctory. Note the difference between the signatories to the NZBA and those who are actually implementing the TFCD recommendations.

According to the Intergovernmental Panel on Climate Change (IPCC), global temperatures will rise above 3°C by 2050 unless urgent corrective policies are implemented. It warned that at the current rate of emission reduction there is more than 50% likelihood that global warming will reach or exceed the 1.5°C target by 2050.

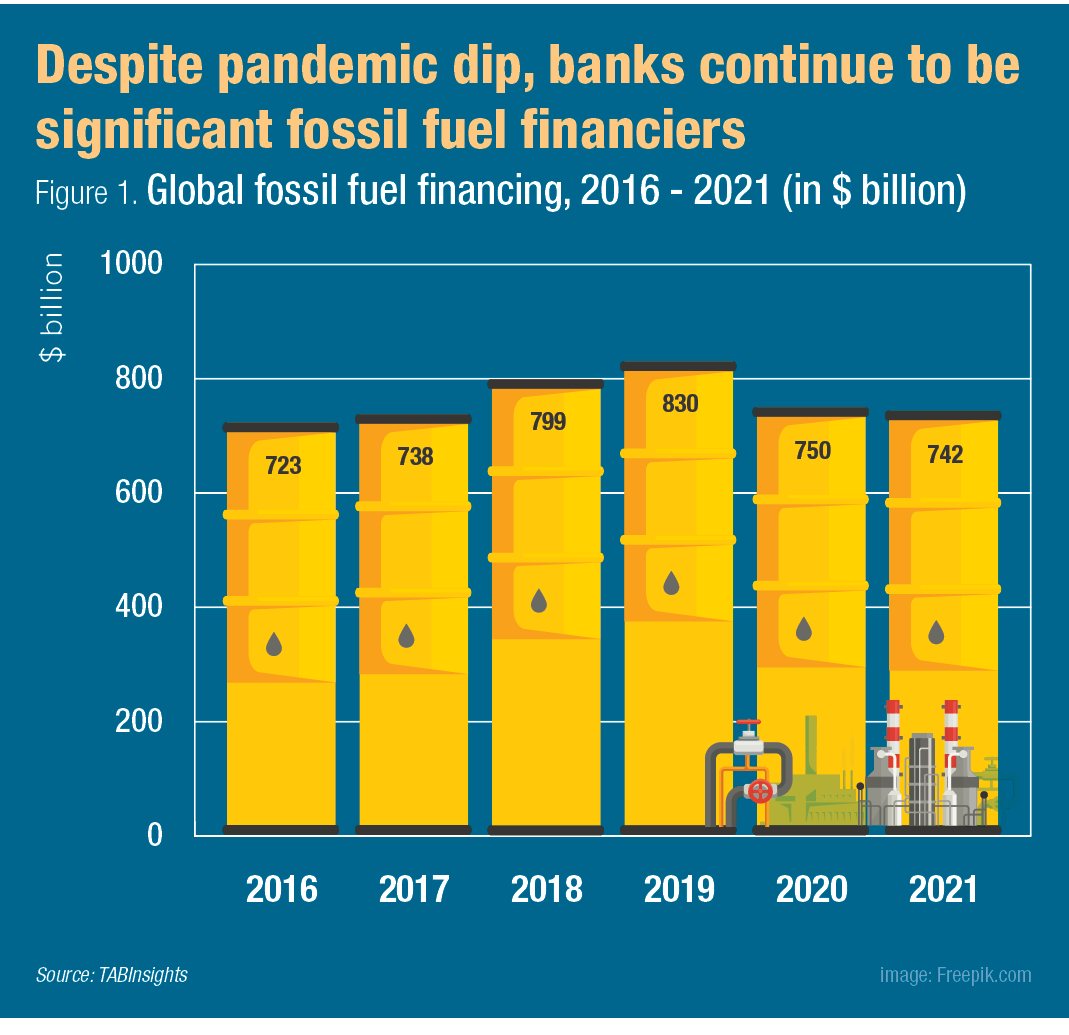

Meanwhile, in the real world, according to environmental organisation Rainforest Action Network, fossil fuel financing from the world’s 60 largest banks reached $4.6 trillion in 2021, with $742 billion in the past year. The numbers have been trending down since 2020 with the outbreak of the COVID-19 pandemic and may continue its trajectory due to supply disruptions from the Ukraine-Russia war and expected inflation-induced slowdown. Nevertheless, banks continue to play an important role to reduce and transition financing support from this and other high-emission industries. More leaders can start by committing their institutions today to setting and achieving these goals.

All Comments