- Attrition of credit cards will rise and new issuance of credit cards will drop

- Specific-use prepaid cards linked to a mobile-app (e.g. travel money card that helps consumers save on currency exchange, etc) growing in popularity (note: prepaid cards and debit cards do not attract the service tax levy)

- Rise of the e-wallet alternative payments (e.g. Boost, GrabPay, WeChatpay)

Lesson from the 2010 card service tax

The Government had imposed annual card service, effective January 2010,of $ 12 (50 MYR) for each principal credit card and $6.01 (25 MYR) for each supplementary card, in an effort to encourage prudent spending.

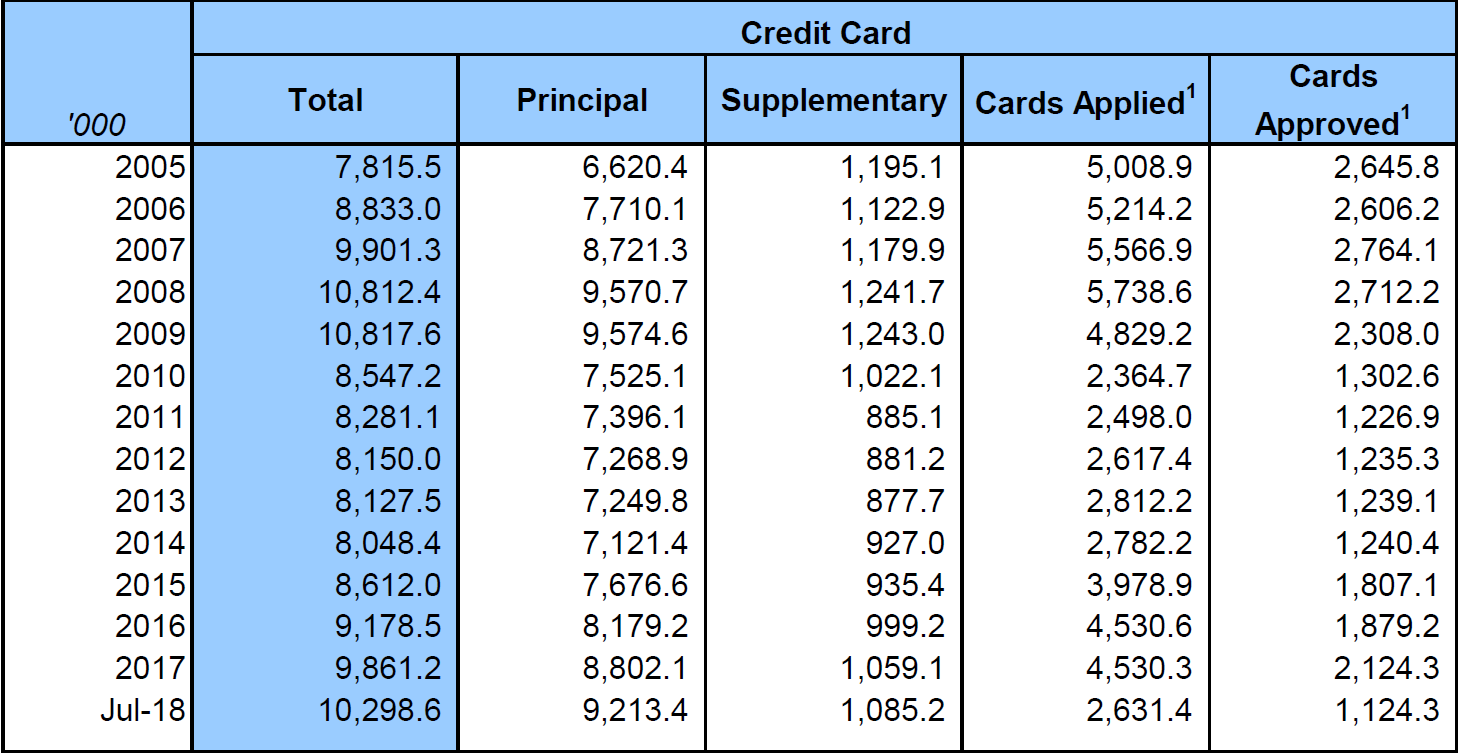

The 2010 card service tax regime had witnessed a severe drop in the country’s new credit card issuance and cards-in-force (CIF). These numbers rose again after the abolishment of the card tax levy in 2015.

New cards issuance

From more than 2 million cards per annum, the volume of new cards issuance had dropped to circa 1.2 million new cards issued per annum between 2009 and 2011.

The 2010 new cards issuance volume had dropped by a whopping 44% vs.2009. When the service tax was abolished in 2015, the new cards issuance volume returned to the 2 million cards by 2017. The 2015 new cards issuance volume had increased by a whopping 46% vs. 2014 (1.81 million cards issued in 2015 vs 1.24 million cards in 2014).

Cards in force (CIF)

In the case of the CIF, it had breached the 10 million mark in 2008 and 2009, before dropping to circa 8 million cards in 2010. The CIF has now returned back to 10 million cards level in July 2018.

Credit card limit

Despite the significant drop in CIF between 2009 and 2010; from 10.8 million cards to 8.5 million cards (a drop of 21%), it was observed that the average credit limit per principal card had increased. What this alludes to is customers were cutting off their “excessive’ cards, rather than totally closing their credit card accounts with the issuers.

Factors that will cause lower cards-in-force post-2018 card service tax regime:

Issuers’ focus on market share:

Tactics such as more cards per cardholder (despite same combined credit limit), credit limit increase offers, incentivising frontline sales to acquire additional cards for the same cardholder are some of the factors which had helped to increase the industry’s CIF back to the 10 million mark inJuly-2018.

Between 2014 and 2017, the total card limit had grown by 15%, and the total cards in force had grown by 24%. In 2014, the average credit limit per principal card was at circa $4,088.50(17,000 MYR). However, by 2018, the average credit limit per principal card had dropped to circa $3,848 (16,000 MYR). This is on the back of an increase in principal cards, from 7.1 million cards to 9.2 million cards. Both these data confirms the argument that issuers were pushing for ‘more cards per cardholder’.

Consumers’ cost-consciousness:

Credit card customers would have started looking at all the cards in their wallet and deciding which plastic to cut. Every plastic (including supplementary card) cut will mean a saving of $6.01 (25 MYR).

It is estimated that each unique customer has an average of 3principal cards. And assuming each principal card has one supplementary card, this will be an average of 6 cards ‘per family of two adults’. Cutting up 4 cards will translate into a savings of $24.05 (100 MYR) per annum.

Cardholders hoping that their issuer will waive the tax may be disappointed. Similar to 2010, it is envisaged that the issuers will make the cardholders pay the card service tax or use their rewards points to offset the tax.

Consumers looking for ways to save – alternative payments ahead:

Malaysians households are still looking for ways to save on their expenses. Alternative payments such as Boost, GrabPay, etc are making it rewarding for customers to pay for their daily expenses using their e-wallets, with rich cash-back propositions. Credit card issuers are not able to match such cash-back propositions.

In summary:

The implementation of the 2018 credit card service tax effective September, the aggressiveness of the issuers post-2015 card service tax removalin new cards issuance (especially multiple cards to the same customer), consumers’ search for cost-savings and the rise of alternative payments (including rising popularity of prepaid cards with Visa/MasterCard global acceptance) will be key factors that will drive down the country’s credit cards-in-force over the next 12 to 24 months.

Vince Au Yoong is chief payment officer at Merchantrade Asia (Malaysia). The views expressed herein are strictly of the author.

All Comments