- India, the world’s biggest real-time and digital payments market registered over 25 billion transactions in 2020

- Insurance penetration remains low at 4%

- Opportunities seen in wealthtech and robo-advisory

Financial services are the economic products and services provided by financial institutions that cater to fund raising, deployment, management, personal finance management, and specialised services which are regulated by plethora of legislation and regulators. Fintech has brought various innovative offerings across payments and transfers, financing and banking, and capital markets and personal financial management.

The phenomena of India’s fintech industry growth are evident and estimated to inch up to $150 to $160 billion by 2025 from current value of $50 to $60 billion, according to the report “India Fintech: A $100 billion opportunity” published by Boston Consulting Group (BCG) and FICCAI.

Popularly advertised as “faceless, paperless, cashless” digital payment is one of the flagship programmes of the government of India to make it a digital economy. Before the introduction of latest tools like unified payments interfaces (UPIs) and digi-wallets, India had several methods for faster payments such as debit and credit cards, national electronic funds transfer (NEFT), real-time gross settlement (RTGS), and immediate payment service (IMPS).

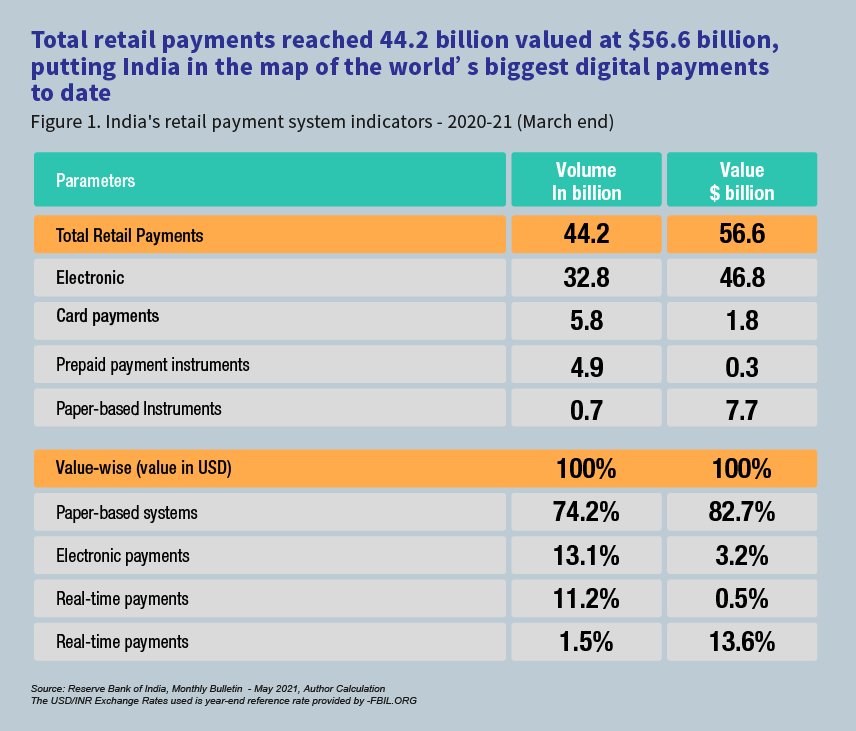

Total retail payments reached 44.2 billion valued at $56.6 billion, putting India in the map of world’s biggest digital payments to date

India holds the world’s biggest real-time, digital payments record

In India, the share of electronic payments is already significant in both volume and value terms as evidenced by the latest statistics of India’s retail payment system indicators (Figure 1). India has in fact now became the world’s biggest real-time and digital payments market with 25.5 billion real-time payment transactions in 2020, thus accounting for more than one-third of the worldwide figure of 70.3 billion based on the latest report by ACI, “Worldwide - Prime Time for Real Time” in March 2021.

The remarkable growth in digital payments will not only help improve the quality and reach of basic banking services but will also push digital lending, alternative credit and personal finance management, benefiting both merchants and customers. The India Stack platform initiative along with recent developments in electronic know your customer (eKYC), video-based customer identification process (V-CIP), digital signatures, digi-locker along with other innovative initiatives will surely put India as the benchmark in digital payments with over 90% adaptation rate in the coming years.

Insurance penetration remains low

India’s insurance penetration is still below 4% (premium as % of GDP). With current pandemic, the awareness and need for insurance has risen and will be visible in this sector. The current decision of the government to increase foreign direct investment (FDI) limit in Indian insurance sector to 74% will further boost the overall insurance industry and the insurtech segment.

With over 100 startups in insurtech, its landscape in India includes digital insurance aggregators and distributors providing various policies under one platform, neo insurance carriers, and sachet insurers. New startups providing infrastructure application programming interfaces (APIs), also known as enablers, are constantly providing solutions to both traditional players and new incumbents in the sector. Traditional insurance policy providers are becoming the full carriers by providing their own APIs and digital platforms thus digitising the disintermediation of insurance products.

The ancillary services are also being provided from these insurtech startups in the areas of risk management and underwriting as well as in digital claim settlement. The internet of things (IoT) and wearable providers are helping indirectly the growth of insurance. The extensive use of blockchain with its distributed ledger technology is helping immensely in accelerating payments, issuing policies, maintaining records with adequate securities and seamless claim processing.

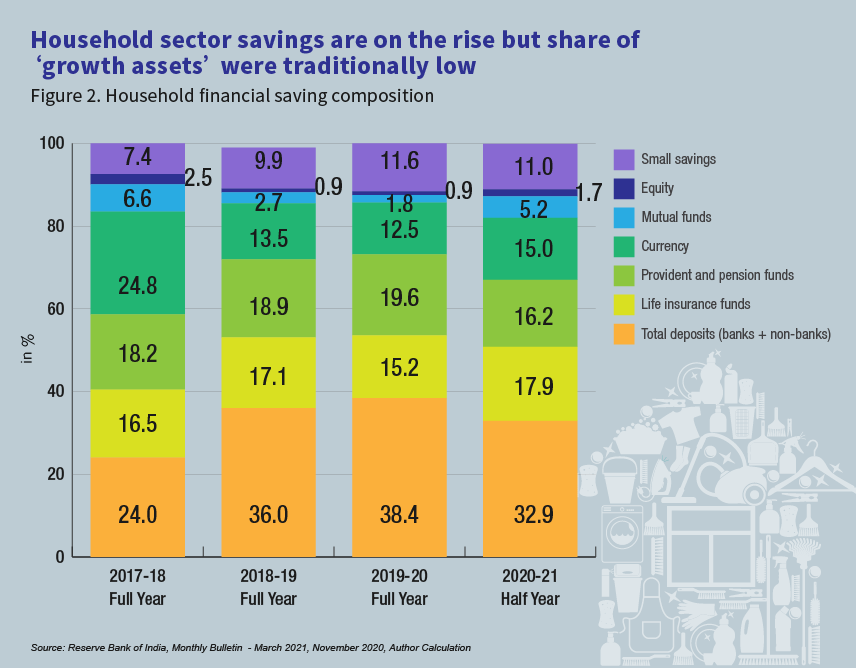

Household sector savings are on the rise but share of ‘growth assets’ were traditionally low

Opportunities seen in wealthtech and robo-advisory

India has more than 450 startups bifurcated into personal financial management, investment platforms, robo-advisors and ancillaries service providers. The initial players in wealthtech in India were dominated by investment platforms where the individuals are able to invest across asset class mainly for equities and mutual funds at a discounted rate under a single platform. It was then flavoured with goal-based investment advisory. If one adds the benefits of machine learning and artificial intelligence, we get robo-advisors, the highest competitive market in Indian wealthtech which is aiming to cover the whole value chain of personal financial planning and wealth management. The offering ranges from plain vanilla - automated universal solutions to personalised goal-based planning across life cycle through investment advisory. It also provides options of investing in various asset classes from equities to mutual funds and from bonds to gold to name a few. Owing to its minimum investment ticket-size and lower costs, it attracts millennials on one hand. Due to its sophisticated services, it attracts the high net-worth individuals at the extreme while it is also beneficial to India’s large middle class population who are looking for their life cycle planning.

The other segments in wealthtech are collaborations model where existing digital payment players like digital wallets are offering mutual fund products through their APIs. On a similar path, using UPIs, the people are now able to subscribe to equity initial public offering and purchase mutual funds.

However, the biggest challenge that lies in the expansion of wealthtech is the apparent lack of ‘trust’ factor. Traditionally, Indians put the ‘trust’ factor foremost when it comes to money management especially in financial planning. And hence, the hybrid model can do wonders which combines the experience and skills of financial advisors with the reach, convenience and agility provided by robo-advisors.

In a nutshell, India is on its way to lead the globe in the fintech space which is certainly possible with the harmonised efforts of service providers, enablers, regulators, government and most importantly through fintech adoption by end users.

Krupesh Thakkar is a chartered financial analyst, assistant professor, and head of department of fintech and financial markets at ITM Business School, Navi Mumbai, India.

All Comments