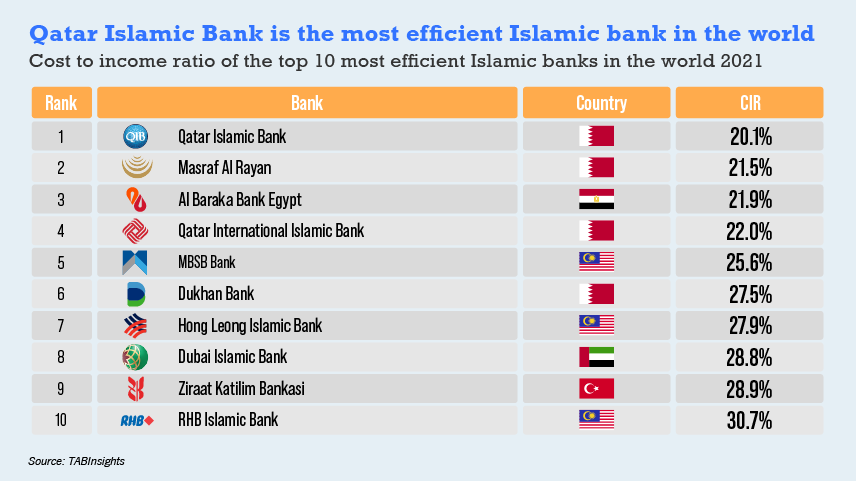

Qatar Islamic Bank is the most efficient Islamic bank among the top 50 largest of such financial institutions in the world, followed by Qatar-based Masraf Al Rayan and Al Baraka Bank Egypt. Qatar Islamic Bank has achieved steady improvement in operational efficiency in the past few years, driven by its continuous investment in digital transformation, along with strict cost management measures. Its cost to income ratio (CIR) dropped gradually from 26.6% in 2017 to 20.1% in 2020, which was significantly lower than the weighted average CIR of the world’s 50 largest Islamic banks, at 38.4%.

The top 10 most efficient Islamic Banks comprise four Islamic banks from Qatar, three from Malaysia and one each from Egypt, Turkey, and the United Arab Emirates (UAE). Masraf Al Rayan saw its operating income and operating expense increase by 11.6% and 5.4%, respectively, and thus its CIR improved to 21.5% from 22.8% in the year earlier. With a CIR of 32.5% in 2020, Saudi Arabia-based Al Rajhi Bank, the largest Islamic bank in the world, is the 11th most efficient Islamic bank.

At 22.2%, the Islamic banks from Qatar had the lowest CIR on average. This is followed by Islamic banks from Egypt, Saudi Arabia and the UAE, which recorded the weighted average CIR of 35%, 37.4% and 37.7%, respectively. On the contrary, the average CIR of Islamic banks in Bahrain and Bangladesh stood at a much higher level of 56.3% and 57.6%, respectively.

Malaysia-based MBSB Bank and Hong Leong Islamic Bank are the two most efficient Islamic banks in Asia, with a CIR lower than 30% in 2020. Maybank Islamic, the largest Islamic bank in Asia, reported a CIR of 38.7% in 2020, which was only slightly better than the average CIR of the 12 Islamic banks from Malaysia, at 39%. However, its CIR improved to 31% in 2021, as its operating income was up by 23.6% while its operating expense dropped by 1.2%

All Comments