- Cross-border trade strongly supports settlement in RMB

- ASEAN and RCEP continue to foster use

- Increase in RMB denominated bond and stock market signals confidence in Chinese economy

The past year saw a strong momentum in the international adoption of Renminbi (RMB) as its share as a reserve currency continued to increase. Claims in RMB rose to a five-year high of $336.1 billion (RMB 2.2 trillion) in the fourth quarter of 2021, accounting for 2.8% of the composition of world reserve currencies, the highest since RMB’s inclusion in special drawing rights (SDR) in 2016. In the latest review of the SDR, the International Monetary Fund (IMF) increased RMB’s weight to 12.3% from 10.9%.

Offshore RMB deposits continued to grow in 2021. Hong Kong still has the largest offshore RMB deposit, according to data from the Hong Kong Monetary Authority (HKMA). At the end of 2021, the scale of offshore RMB deposits in Hong Kong reached RMB 927 billion ($145.39 billion), an increase of 28.4% from the end of 2020. The UK market had the highest growth rate of offshore RMB deposits in 2021 with RMB 84 billion ($12.9 billion), a 35.5% increase, followed by Singapore with RMB 175 billion ($26.9 billion), growing 30.6%.

Data from Swift shows that while the RMB has remained at the fifth spot among major international payment currencies since March 2020, its share in global payments was 2.2% as of March 2022, 0.35 percentage points higher than it was two years ago. From December 2021 to January 2022, the proportion of RMB in global payments was at one point up to 3.2%, surpassing the Japanese Yen, reaching fourth place in the world.

In 2022, China Construction Bank (CCB) in partnership with The Asian Banker launched an annual survey to assess international usage of the RMB. The survey reached out to 2,546 executives from organisations based both in and outside China, and financial institutions (FIs) around the globe. Although trade frictions still exist and the impact of Covid-19 lingers, respondents are optimistic about international adoption of RMB.

Cross-border trade strongly supports settlement in RMB

In the past five years, despite Sino-US trade frictions and the pandemic, cross-border use of RMB has shown rapid growth, backed by the strong performance in trade between China and the rest of the world. According to the General Administration of Customs, the total trade volume of import and export in China in 2021 amounted to $6 trillion (RMB 39.1 trillion), a year-on-year (YoY) growth of 21.4%. Data from the People’s Bank of China (PBoC) showed that the scale of cross-border trade settled in RMB has increased from RMB 4.36 trillion ($667.2 billion) in 2017 to RMB 7.94 trillion ($1.25 trillion) in 2021, and its proportion of total import and export trade grew from 13.4% in 2017 to 21% in 2021.

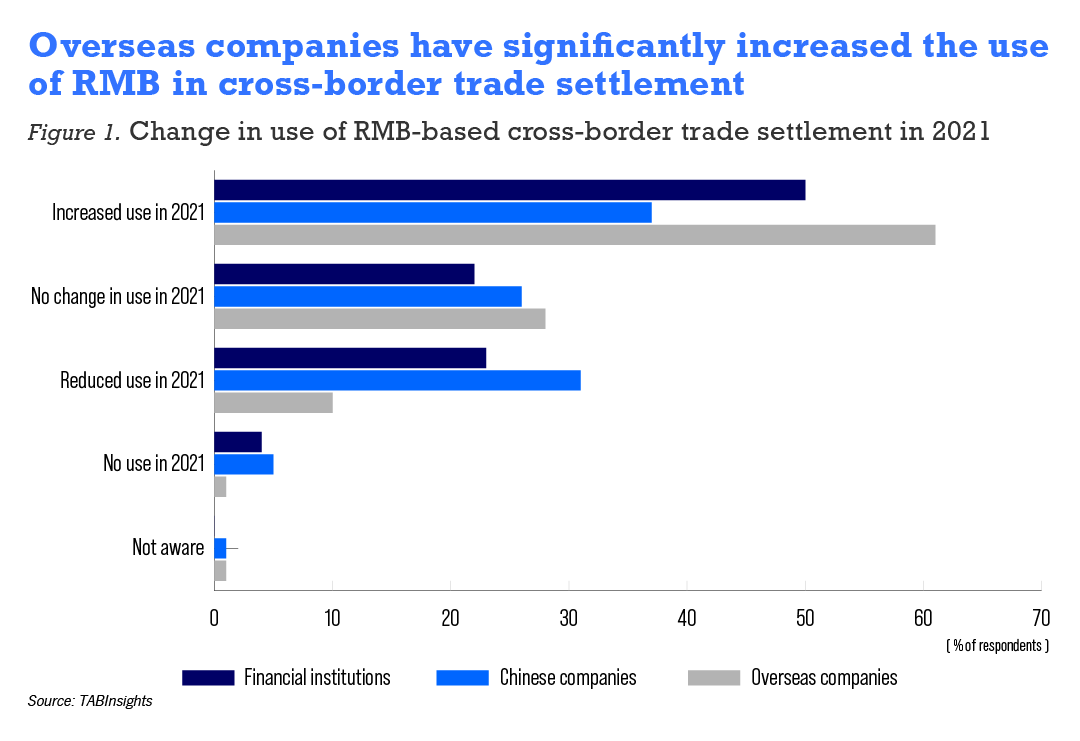

Continuing last year’s trend, the percentage of Chinese and overseas companies and FIs using RMB for cross-border trade settlement has increased further. About 88% of the overseas companies, 63% of Chinese companies and 73% of FIs said that they either maintained or increased the use of RMB in trade settlement in 2021, up from 74%, 62% and 78% last year, respectively. The number of overseas companies that increased the use of RMB for cross-border trade settlement increased significantly from 50% in 2020 to 61% in 2021.q

With the development of cross-border business, RMB products have also become more diversified. These address business needs in areas such as liquidity management, investment and financing. In the past two years, demand for offshore RMB cash management, wealth management and other products has increased significantly.

ASEAN and RCEP foster RMB

China and the Association of Southeast Asian Nations (ASEAN) have long maintained a close economic and trade relationship. This year’s report specifically investigates the use of RMB for institutions in ASEAN, member countries of the Regional Comprehensive Economic Partnership (RCEP) and organisations with business relationships within the region.

China has been ASEAN's largest trading partner for 13 consecutive years, and ASEAN became China's largest trading partner for the second consecutive year in 2022. The signing of a trade pact between RCEP member countries will undoubtedly further promote cross-border trade. Latest data showed that in the first quarter of 2022, China's imports and exports to the other 14 RCEP member countries amounted to RMB 2.86 trillion ($440 billion), a YoY increase of 6.9%, accounting for 30.4% of China's total foreign trade.

According to this year’s survey, compared to other countries, more ASEAN and RCEP-related institutions are interested in RMB cross-border trade settlement, offshore RMB financing products and in participating in China’s capital market. They are relatively consistent with the overall survey results in cross-border direct investment, channel selection to enter the capital market, and so on. However, the survey results show that there are differences between their choice of RMB products and the key reasons for using RMB.

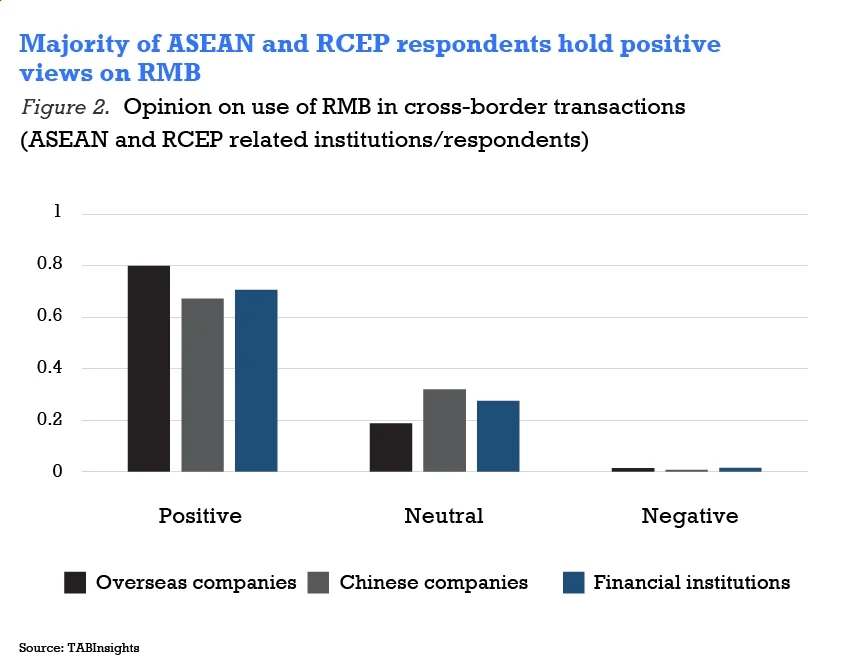

The respondents have a very positive attitude towards RMB in cross-border transactions with ASEAN and RCEP member countries. Of those who are optimistic, 67% are Chinese companies, 80% overseas companies and 71% are FIs. Those with neutral views in these categories made up 32%, 19% and 28%, respectively. Only 1% of respondents hold a negative view.

The continued increase of foreign holdings in RMB denominated bond and stock market signals confidence in Chinese economy

From 2021, China has continued to demonstrate its commitment to deepen market integration with global capital markets that will further drive the demand and use of RMB, as well as related asset classes. The China Securities Regulatory Commission has indicated intentions to expand the scope of both the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect Schemes, while improving the existing Shanghai-London Stock Connect programme framework.

Given the existing interlinkages between international financial markets, China is looking to source further foreign investment in various RMB-denominated Chinese asset classes by widening the channels available to foreign institutional investors. Likewise, an enhancement to China’s domestic bond market reflects investor appetite for greater exposure to Chinese RMB–denominated assets.

The share of overseas investors in China’s bond and stock market further expanded. Data from the PBoC showed that at the end of March 2022, overseas institutions held RMB 4 trillion ($615.4 billion) or 2.9% of the outstanding amount of bonds under custody in China’s bond market. This is an increase from RMB 3.5 trillion ($520 billion) at the end of March 2021. Overseas institutions and individuals held RMB 3.19 trillion ($490 billion) of Chinese stocks, an increase of nearly 90% from RMB 1.68 trillion ($258 billion) at the end of March 2019.

This year’s survey results showed that FIs continue to expand their investments in both RMB-denominated bonds and equities, with over 52% of institutional respondents looking to increase the RMB-based bond holding in their portfolio to over 20% in 2022 and 2023. More than 49% of them will enhance their equity exposure to over 20% in the next two years, signaling greater confidence in the Chinese economy and its resilience.

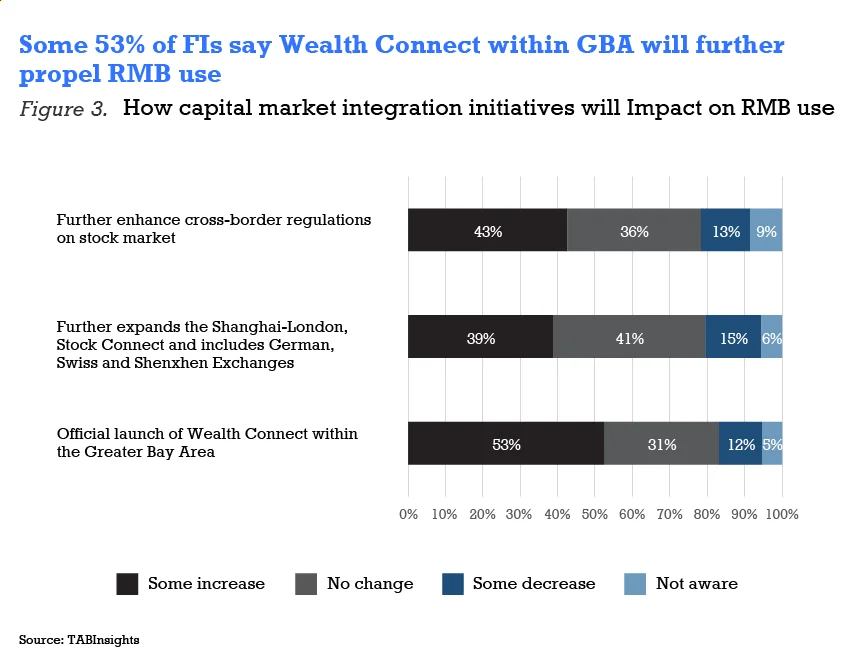

Certainly, having the requisite market infrastructure in place is essential to cater to increased investor appetite for quality RMB-denominated assets. The raft of policy initiatives that have helped liberalise China’s financial markets now include cooperation between the US and China on audit supervision and upgrading the various Stock Connect and Wealth Connect programmes in the Greater Bay Area (GBA). The GBA is made up of nine municipalities including Guangzhou and Shenzen, and the two Special Administrative Regions of Hong Kong and Macau. Most significant and resonating is the response amongst FIs, with 53% saying they will increase the usage of RMB as a result of the initiatives.

Certainly, having the requisite market infrastructure in place is essential to cater to this increased investor demand for quality RMB-denominated assets. The draft of policy initiatives that have helped liberalise China’s financial markets now include cooperation between the US-China on audit supervision, upgrading the various stock-connect and wealth connect programmes in Greater Bay Area (GBA). It is perhaps the latter that has emerged as most significant and resonating most with 53% of FIs responded, it will increase the usage of RMB owing to this programme.

All Comments