- Taishin bank developed a card specifically targeted at online shoppers and millennials, to acquire new customers

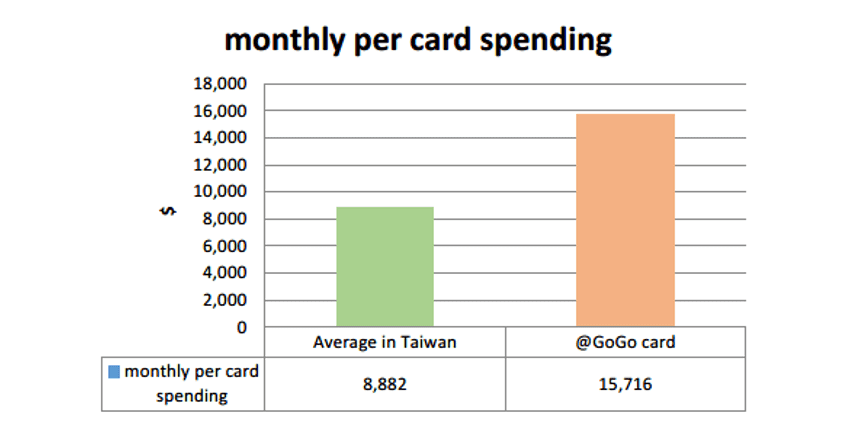

- Innovative features such as an LED light on the card and a user-focused design have helped to drive usage to double the average monthly volume in Taiwan

The innovative LED light in Taishin flashes when cardholders make contactless payments, making the card more compelling to consumers and driving spending per month to nearly double the average per card in Taiwan.

Developing a novel card in a crowded market

As it started to develop a new credit card in 2016, Taishin Bank took a deep look at what had driven credit card acquisition in Taiwan and found that four features stood out. Products that look fancy, have high rewards, offer simple rewards redemption and deliver online services have had better success, it found. Taishin designed its @GoGo card, which launched in 2016 and flourished in 2017, to meet these consumer needs.

Taishin said that eight features of the @GoGo card differentiate it from the competition:

- LED lights placed into the card light up for contactless payments

- A user-oriented design

- A user-friendly card face that makes it easy to read card information, making online shopping easier

- 3% cash back, capped at a maximum rebate of TWD500 per month, in addition to a rebate of 0.5% on every transaction

- A mechanism that saves the cash rebate straight into a digital saving account

- Smart notifications that ensure the cardholder controls all transactions

- Taishin’s Richart digital bank stands behind the @GoGo card and provides one-stop online financial services

- A virtual card version of the card

Taishin also has a policy that makes returns of online purchases easy, which encourages customers to use the card for ecommerce spending.

The factor that differentiates @GoGo the most is the LED light embedded in the card. E-shoppers and younger customers like to be different, the bank found, so staff looked at how to increase the joy of offline payments. When cardholders tap their card, it flashes. Cardholders see the payments as exciting, Taishin said, and that difference in the card encourages different payment behaviour. “They will tell the cashier to do contactless.”

Having found that online shoppers are concerned about the security of transactions, Taishin also decided to send an alert for every transaction so that cardholders could find out immediately if a transaction they did not authorise is made using their card. While most cardholders receive a message in their app, the bank can also send text messages.Beyond the card itself, Taishin has enhanced onboarding features to make the card more attractive. Taishin promotes the @GoGo card as environment-friendly, because digitalising the entire application has resulted in energy savings and a reduction in carbon emissions.

That digitisation also enables cardholders to receive at least a virtual card within 24 hours from the time they apply, which encourages them to make mobile payments sooner.

While the card has boosted revenue and customer numbers at Taishin, the bank wanted it to do more. The bank thus designed the product as a door to Taishin’s digital financial services. It targeted online shoppers, whom it believes are more likely to accept digital products and services, by offering higher rewards and by making it easier to read the information on the card so that they could use it to shop online more easily. The @GoGo card thus acts as a hook to bring customers in to Richart new digital finance services, such as app investments with ticket size as low as TWD10 and simple money transfers using email or a mobile phone number.

@GoGo delivers results

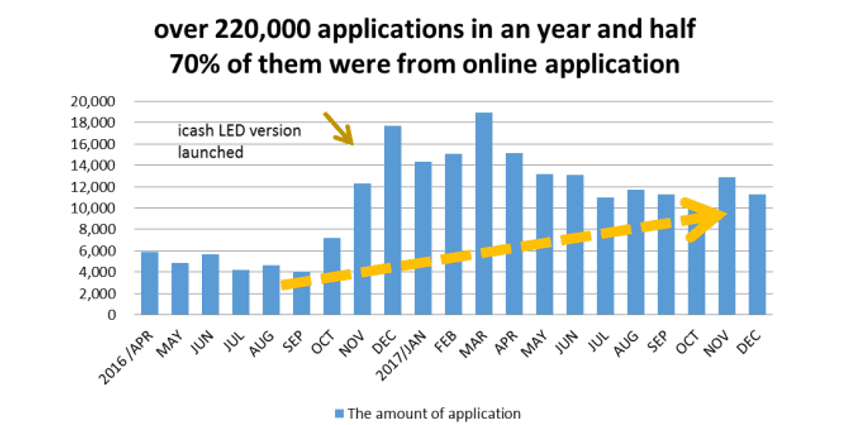

As shown in Figure 1 below, which is a relatively large number for Taiwan. The numbers were boosted by the launch of the LED card in November 2016, which led the number of applications per month to triple.

Figure 1: Card issuance per month

Taishin Bank said @GoGo is the fastest-growing card in Taiwan, with 200,000 issued over the course of 18 months. Data from FSC showed that CTCB alone issued 81,000 cards January 2018 and Cathay United issued 73,000.

Source: Taishin Bank

More importantly, the average monthly spending on @GoGo cards of more than TWD15,000 ($511) is almost double the average card spending in Taiwan, as indicated in Figure 2 below.

Figure 2: Spending per card per month

Data from Taishin Bank shows that spending on the @GoGo card is nearly double the market average.

Source: Taishin Bank

Easy online applications have also resulted in about 70% of applications coming in online rather than through the direct sales channels that the bank used in the past. About 70% of these new customers are new to the bank

The customers are also younger, with a significant portion in the 25-30-year age range. Research showed that the younger generation enjoys their life and what they spend, Taishin said. If they don’t have money to spend, they don’t spend. If they have money, they spend it. The rewards program makes the card particularly attractive for these younger cardholders.

Moreover, @Gogo has an image that it works especially well for ecommerce as well as mobile spending using Apple Pay or Line Pay, so customers have linked their mobile payments and online shopping portals to @GoGo. While card spending nearly averages the ceiling for the higher rebate, revolving is similar to other cards.

The credit card market in Taiwan is highly competitive

While Taishin sees the @GoGo card as very attractive, the bank also operates in a highly competitive market where the average cardholder has four cards in their wallet. Credit cards have proliferated, with data from the FSC showing spending on the 41.7 million credit cards issued in the country as of the end of 2017 by the 35 card issuers was TWD248 billion ($8 billion) per month. CTCB alone issued 81,000 cards in January 2018 and Cathay United issued 73,000, compared to the 200,000 cards @GoGo cards issued over the course of 18 months

Even those numbers pale in comparison with EasyCard, which is used for public transport and retail and which says the 60 million cards it has in circulation are used at more than 55,000 payment points throughout Taiwan.

Market observers also see co-brand cards especially as having strengthened their offerings in recent years, delivering a greater range of options that provide value in cardholders’ daily lives. The Formosa co-brand card, for instance, offers strong incentives for usage for petrol purchases and has also successfully increased out-of-store consumption.

Card Innovation around the World

Financial institutions around the world continue to launch a multitude of new credit cards. While consumers say that cards with higher rewards are among the most attractive, technology-based and high-end cards are proving popular as well and artificial intelligence is beginning to deliver customised benefits that can enhance relationships.

Sprint, US

Softbank subsidiary Sprint partnered with Dynamics to launch a battery-powered Wallet Card that functions as a debit, credit, prepaid, multi-currency or loyalty card. It has almost 200 parts, including a mobile phone chip and antenna, a battery and recharging chip, a programmable magnetic strip, and an EMV and contactless chip. It expects its partner banks, including Emirates NBD, Sumitomo, CIBC, and IndusInd, to roll it out in 2018.

American Express Platinum, US

High-end cards have proliferated, with offerings from Chase, American Express and others providing a slew of benefits. The American Express Platinum card, for instance, offers $200 worth of Uber rides and a $200 airline fee credit annually, 5x points on flights and hotels, gold membership at Hilton and Starwood, no foreign exchange mark-up and more. The 60,000 miles that come with sign-up can come in handy too.

Amazon Prime, US

Uber and Amazon along with other retailers have launched their own cards. The Amazon Prime Rewards Visa Signature card, for example, give 5% back on Amazon purchases, 2% on restaurants and petrol, and 1% on everything else. There is also a $70 sign-up bonus.

Rosan Diamond Card

Rosan Diamond offers a selection of gem-encrusted custom credit cards when consumers apply through a handful of partner banks. The cards, which come in a multitude of designs, cost $15,000 or more apiece. Companion cards are also issued, for actual payments.

Standing out in the crowd

While it’s difficult to stand out in a crowded card market, Taishin’s unique LED card and its array of benefits targeted at digital consumers have enabled it to shine. Its analysis of customer needs and development of a differentiated product have enabled it to deliver what customers want and stand out.

That said, Taishin still has a relatively small volume in the highly competitive Taiwan market.

And while the LED light is innovative, cards with high benefits such as American Express Platinum and Amazon Prime as well as technology driven cards such as the Sprint wallet card may offer even more benefits.

While an LED light clearly shines bright, cardholders may need even more to entice them to switch.

All Comments