In October 2021, the Central Bank of Nigeria (CBN) became the first monetary authority in Africa to launch a digital currency – the eNaira –with hopes of expanding financial inclusion and boosting remittances.

The digital representation of Nigeria’s physical currency—the Naira— can be transferred through blockchain technology, the same as in cryptocurrency, but its value will be preserved. According to the International Monetary Fund (IMF), which provided technical assistance and policy advice during the rollout of eNaira, 90% of Nigeria’s population can be expected to adopt the digital currency.

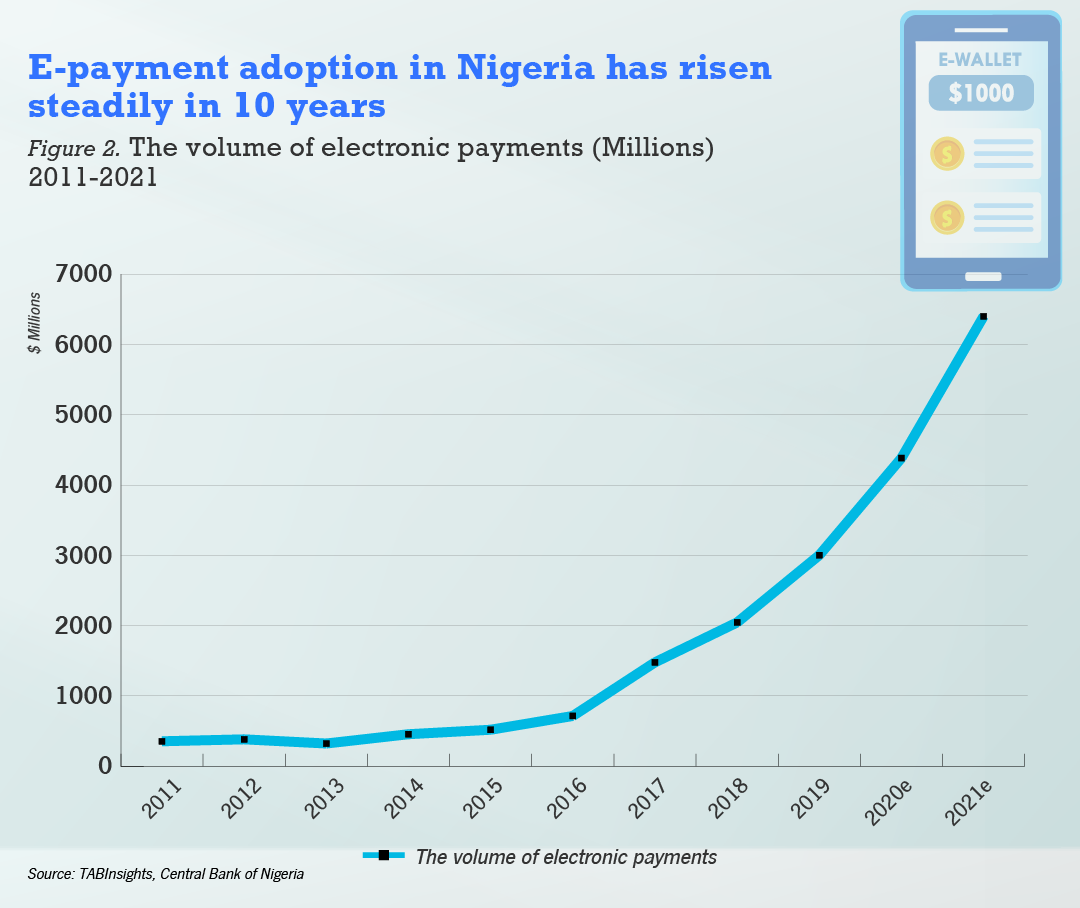

With the introduction of the new digital money, CBN is also optimistic of increasing access to banking and powering more digital transactions in the economy.

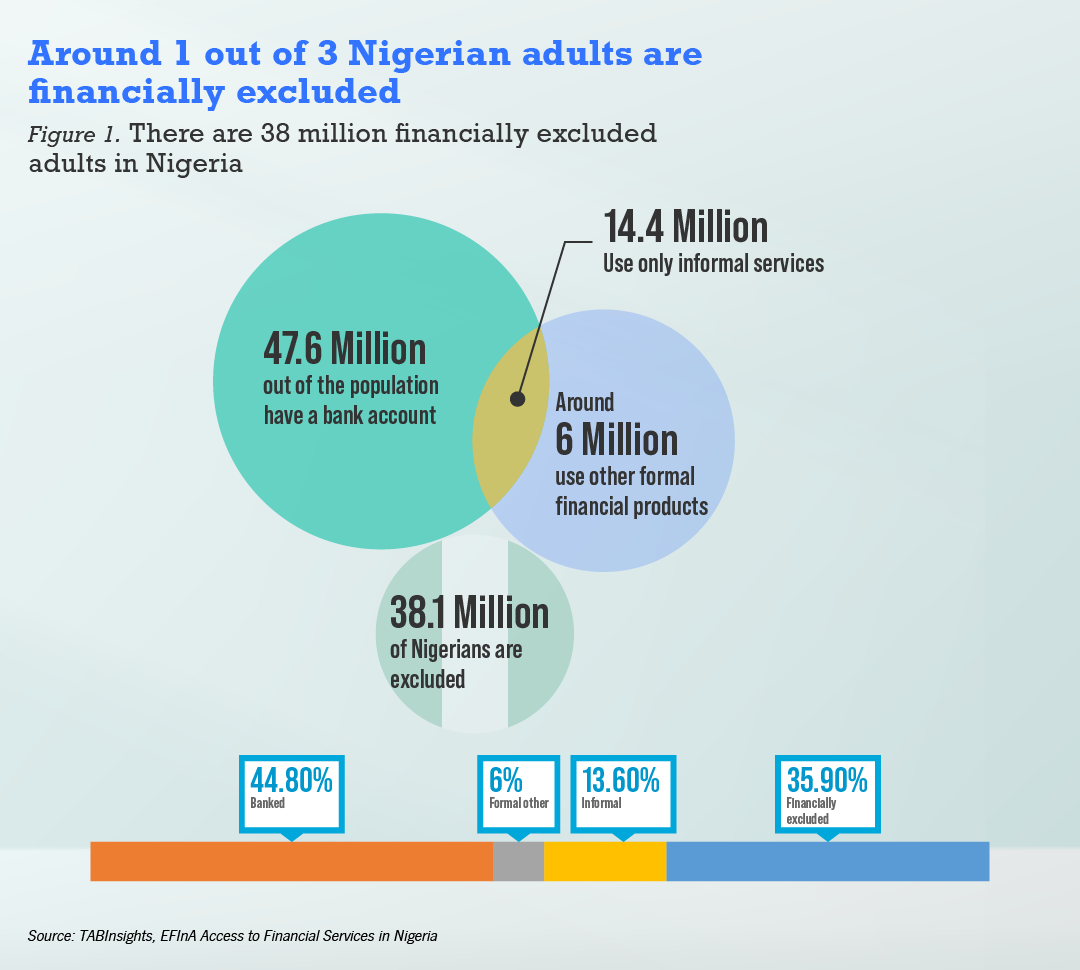

More than a third of Nigeria’s adult population has no access to banking services. Cash remains the dominant means of transaction in the highly informal economy. With eNaira, Nigerians will be able to register for a digital wallet using only their national identification number (NIN) and bank verification number (BVN).

This digital wallet is connected to a user’s bank account. Those without accounts can also use the eNaira wallet but would be limited to NGN 50,000 ($120) worth of transactions daily. Users with bank accounts, on the other hand, can transfer up to NGN 500,000($1,200). These transactions can be carried out worldwide at no cost.

It will then be easier and cheaper to transfer funds to Nigeria by obtaining eNaira from international money transfer operators and moving funds through digital wallets. Since 2018, Nigeria has been a key destination of remittances in sub-Saharan Africa. Nigerians living abroad transferred around $25 billion during this year, accounting for about 6.1% of Nigeria’s gross domestic product GDP). During the COVID-19 pandemic, remittance flows fell by 27.7%. However, it rose again in 2021 to reach $14.2 billion, a year-to-year growth of up to 10 %, driven by the introduction of new digital technologies that enabled almost instantaneous receipt of funds by bank transfers or cash pick-up.

As payments made through eNaira are more traceable, it can also usher in policies that encourage formalisation of the economy. Most of Nigeria’s economic activities, around 60% GDP, are informal, neither taxed nor regulated by the government.

The new digital currency could also make it easier for the government to extend welfare assistance to the underserved population in the country.

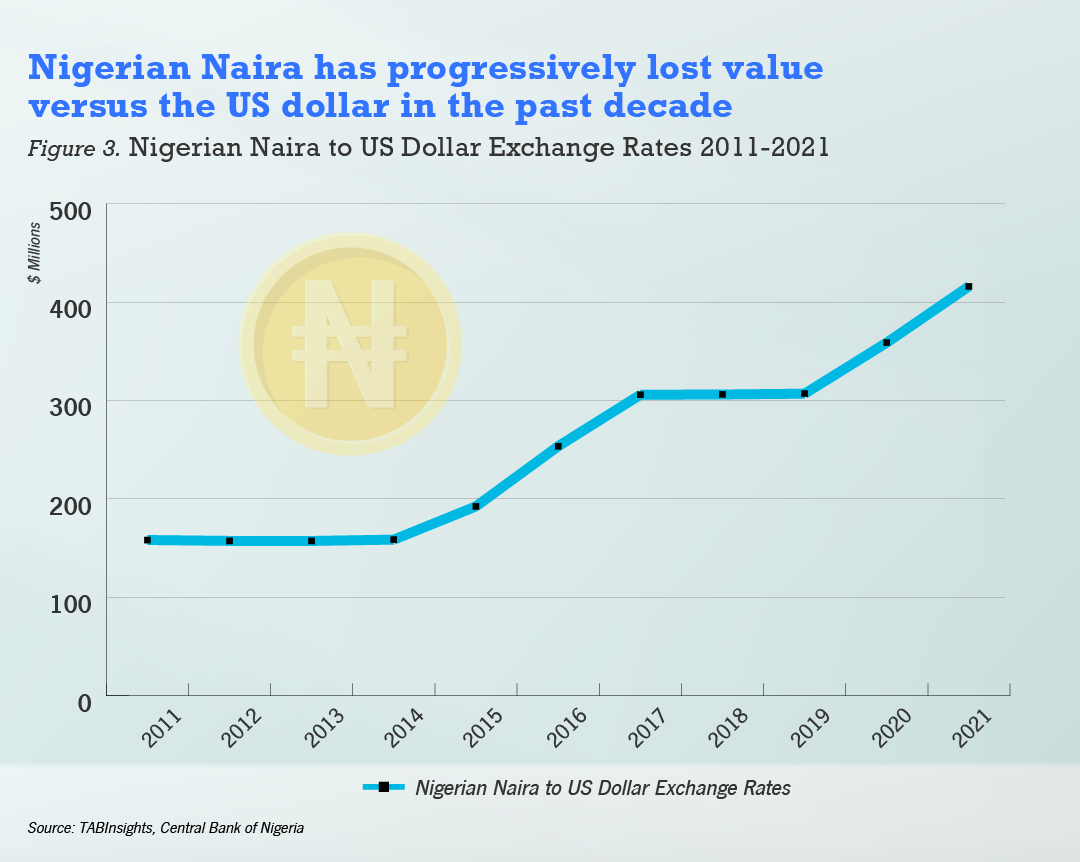

Another key goal of the CBN in launching eNaira is to bring down inflation. The introduction of digital money will ease the inflow of foreign currency into the country and control the rise in prices. In 2021, inflation in Nigeria rose to 16%, reflected by the impact of the depreciation of the Naira. The local currency has been depreciating since 2012, with the current exchange rate at around 416 naira to the US dollar, as demand for dollars has outpaced supply.

But is Nigeria ready for eNaira?

The level of digital literacy among Nigerians remains low, making it challenging for most to maximise the use of eNaira to improve their lifestyle. The government will therefore need to implement an extensive digital literacy programme in the country to increase awareness on the use of eNaira.

The new digital currency also faces risks related to cyber-attacks and user protection. Therefore, the CBN has the responsibility to mitigate risks while managing the digital currency.

In order to enhance financial literacy, the CBN implemented training programmes for farmers to help them manage their personal finance. In addition, it designed the eNaira system with a fraud management system to ensure the security of transactions and protect customer data.

All Comments