- Embrace digitisation and integrate systems, channels and data analytics for better service capability

- Focus on finance and risk integration for a mature risk management model

- Implement stronger HR management and workforce empowerment tools

The Asian Banker, in partnership with Oracle, released a special report, “Imagining ‘The Future Bank’ India”, which benchmarks current developments in Indian banks against leading global banks, and identifies key gaps in their financial services industry. The research brings together strategic and opera¬tional models that are imperative to bridge these gaps and lead the way to “The Future Bank”.

Embrace digitisation and integrate systems, channels and data analytics for better service capability

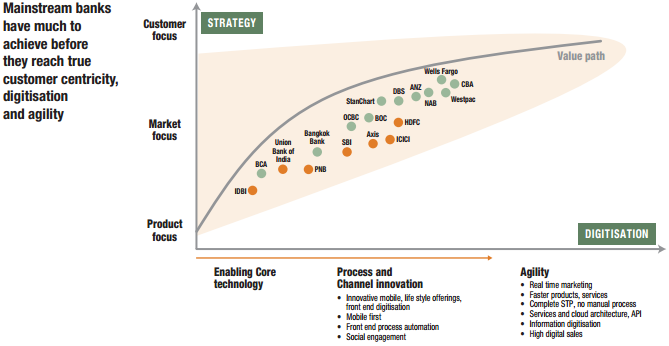

Banks in India are facing multiple challenges - emerging competition from new entrants and fintechs, reduced profitability, rising non-performing assets (NPA) and changing customer expectations. At the forefront is digital transformation. The banks need to have a customer centric focus which requires them to align their channels, products and analytics.In order to compete with the best in the world, the report reveals that Indian banks must implement holistic platform based, enterprise-wide digital transformation, cross-channel integration and seamless processes to achieve “omni-channel” service capability (Figure 1). They should also move in the direction of integrating technology towards agile systems and processes, empowered by data analytics, with better risk management tools and sound distribution network strategies.

Figure 1.

Source: Asian Banker Research.

Focus on finance and risk integration for a mature risk management model

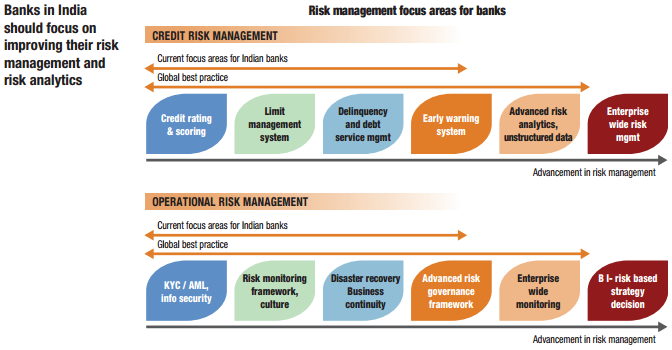

The asset quality of banks in India has been under pressure with many experiencing one of the highest NPAs in the region. There is an urgent need to strengthen their risk management capabilities. With upcoming Basel III and Indian accounting standards, there are compelling reasons for banks to integrate risk and finance and establish a mature risk management model that is empowered by risk analytics capability. The best banks are those that reinforce their risk analytics, develop early warning systems and embrace stronger enterprise-wide risk management (Figure 2).

Figure 2.

Source: Asian Banker Research.

Implement stronger HR management and workforce empowerment tools

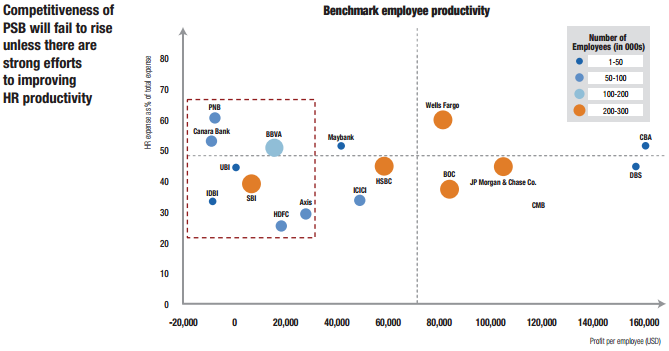

Public sector banks in India grapple with a lack of skilled middle and senior manage¬ment while productivity is low compared to international standards (Figure 3). The report established that banks need to instil robust measures in hiring and retaining talent to address this deficiency. In addition, human resource (HR) practices like empowering the workforce, addressing their development needs and better assessment of performance, will not only boost productivity but also gain competitive advantage for the banks.

Figure 3.

Source: Asian Banker Research.

Key strategies for future growth

Banks in India need to relook at their strategic and business models towards greater customer-centric propositions, differentiated service experience and optimised efficiency. They should also build holistic digitisation and create a proactive and customer-focused environment. In addition, banks must utilise big data information for real-time analytics to offer real time contextual marketing and risk management.

With emerging new competition, banks need to learn to think and act like a fintech and develop a nimble and agile technological capability. Cooperate, partner and coexist with fintechs, enable open systems and API based models to implement fintech innovations within the bank.

Need for improving asset quality and profitability is forcing banks in India to review their operating and business models. The interactions need to be more relationship focused enabled with analytics insight. Emerging technologies like clouds and new services architectures can facilitate lower computing costs.

Banks need to enable automation, real-time straight through processing, and improve customer experience for higher acquisition and better retention. Banks should integrate existing infrastructure and different operational silos towards an enterprise-wide digital transformation approach for greater synergy between processes and systems(Figure 4).

Figure 4.

Source: Asian Banker Research.

The report is based on extensive surveys and in-depth discussions with senior decision makers from leading Indian banks. The findings are derived from their expert views on key factors that will successfully shape the “bank of the future” in the changing landscape.

To know more of the specific findings and analysis, please visit http://www.theasianbanker.com/download-whitepaper where you can download a copy of the full report.

All Comments