- The fraud involves more than 400 thousand depositors and RMB 40 billion ($5.99 billion) worth of deposits.

- Lyu Yi used third-party internet financial platforms and made illegal transfers employing fictitious loans.

- Compensation policies have come out and Henan Financial System will go through major changes.

The fraud involves more than 400 thousand depositors and RMB 40 billion ($5.99 billion) worth of deposits

In mid-April, three rural banks in Henan Province - Yuzhou Xinminsheng Village Bank, Shangcai Huimin County Bank, Zhecheng Huanghuai Community Bank and one rural bank in Anhui Province (Guzhen Xinhuaihe Rural Bank) successively announced that deposits at these banks could not be withdrawn due to certain "system upgrades". Suspicion of financial fraud crimes grew as the depositors who wished to visit the banks were manually “grounded” by health code manoeuvring. Police went into an investigation which later shows that Lyu Yi’s criminal gang has gained actual control over rural banks such as Yuzhou Xinminsheng Village Bank through affiliated shareholding, cross-shareholding, capital increase and share expansion, executives’ manipulation, etc., and has used the third-party internet financial platforms as well as the self-operating platforms developed by a subsidiary company founded by Lyu Yi and a group of fund brokers. They have solicited deposits and promoted financial products through such channels and illegally transferred away the money under the name of fictitious loans. Specially Lyu set up Chenyu Information Technology to delete and modify data and conceal it from regulation. Such acts are suspected of various serious financial crimes.

Up to now, the fraud with Henan rural banks alone involves over 400 thousand depositors all over the country and the amount involved has reached RMB 40 billion ($5.99 billion).

Henan Financial System will go through major changes

In mid-July, it is announced that the deposits under RMB 50000 ($) in these rural banks will be firstly compensated to the depositors, covered by the assets confiscated from Xincaifu. As the investigation goes on, the compensation quota also goes up. On Aug 4th, CBIRC Henan Branch and Henan Local Financial Regulatory Bureau upgraded the compensation plan—victims with a deposit balance of lower than RMB 250 thousand ($) will be compensated. At this stage, most of the depositors’ losses have been gradually taken care of. What’s more important to the victims is that even though their money was not formally categorized under “deposit” but transferred away through a fictitious banking system, the compensation plan still covers their “off-account” losses, preventing the tensions from escalating. The Henan Rural Bank Crisis is indeed rare and unimaginable. But the real danger here is that Lyu Yi and his Xincaifu had been running a such fraudulent business in Henan for the past 11 years without being noticed. And the Henan Bank Crisis is much like the Baoshang Bank Incident where the largest shareholder deliberately falsified loans to transfer away the deposits. Regulation should have done something, but where have they been?

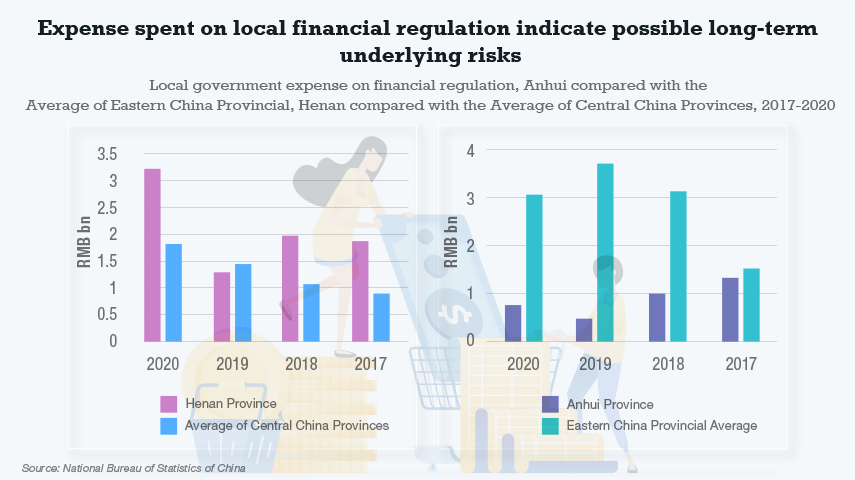

Expenses spent on financial regulation by local governments could probe into what’s gone wrong. When put into contrast with a steadily growing expense of Central China provinces, the volatility in Henan’s expense gives out the hint of an unstable and fragile financial system when exposed to fraud. Also, the regulators have failed to detect Lyu Yi’s fake banking system whereas in design every transaction should be made transparent. While Anhui is compared with its peers in Eastern China, it turns out that Anhui spent a lot less than other provinces, meaning that their local financial institutions are more likely to be less regulated, and hence less safeguarded from frauds. Both Henan and Anhui, the two epicentres in the rural bank crisis, have shown irregularities beforehand.

Usually, something like this would have automatically alerted all related parties through the banking regulatory system implemented by PBoC and CBIRC. Yet somehow Lyu Yi got away with such deeds for 11 years. As the investigation goes on, 8 major officials from Henan financial system were taken into custody by the Communist Party of China Central Commission for Discipline Inspection and the National Supervisory Commission. Among them, the most important three are XIA Jun (Secretary of the Party Committee and Director of Kaifeng Branch of CBIRC), GUO Qin (Director and First-Class Researcher of the Second Non-Bank Division of Henan Regulatory Bureau of CBIRC), ZHAO Dewang (Director of Financial Stability Division of Zhengzhou Central Sub-Branch of PBoC). Press releases indicate that these three officials are suspected of serious violations of discipline and law but no further linkage with the rural bank crisis is stated. Yet three of these officials have worked in rural or small-medium-sized banks, and the timing also triggers certain speculation about their association with the financial crime committed by Lyu Yi and Xincaifu. It appears now it is not only a fraud committed by the rural banks’ management, but could also involve severe dereliction or even accomplice in the local regulatory system.

All Comments