Financial services are undergoing a technological revolution, fuelled by advancements in artificial intelligence (AI). Generative AI, a subset of AI, is gaining significant traction in the financial sector due to its ability to generate realistic and valuable insights, predictions, and recommendations. By using large amounts of data and powerful algorithms, generative AI is transforming decision-making processes and enhancing efficiency in areas such as risk assessment, fraud detection, trading strategies, customer service, and personalised recommendations.

As financial institutions strive to gain a competitive edge in a data-driven world, generative AI has emerged as a key solution. It empowers these institutions to leverage the vast amount of data available to make informed decisions, mitigate risks, and improve customer experiences. By understanding the latest developments in generative AI within the financial services sector and identifying the most promising companies in this field, businesses can stay ahead of the curve and harness the full potential of this transformative technology.

1. Generative AI and its applications across industries

Advances in AI have revolutionised the way industries operate, and generative AI is one of its most promising breakthroughs. While traditional AI models automate predefined tasks, generative AI can create something new from the knowledge it has gained using deep learning algorithms and analysis of patterns in existing data. These models can be trained to generate a wide range of outputs, such as images, music, videos, text, and even whole websites. One of the most significant advantages of generative AI is its ability to emulate human creativity, allowing the technology to produce original content.

Generative AI technology delivers outcomes using generative adversarial networks (GAN), that consist of two neural networks that learn from each other. The first network is a generator that creates new content, while the other is a discriminator that decides whether the output is real or fake. The generator uses the discriminator’s feedback to improve and produce improved outputs. This feedback loop continues until the generator produces content that is indistinguishable from real-world outcomes.

Generative AI has diverse applications across different industries:

- In fashion, designers can use generative AI to create new clothing designs based on previous styles and customer preferences;

- The automotive industry can leverage generative AI to improve car design by generating thousands of possibilities and quickly testing their performance under different conditions;

- In the healthcare industry, generative AI is being used to provide personalised care by using machine learning (ML) algorithms to identify trends in patient data;

- In the retail industry, generative AI is being used to help businesses better understand customer behaviour and preferences.

Growing use of generative AI in financial services

The advancements in AI and the use of generative AI in particular are transforming the financial services sector by enabling financial institutions to increase their efficiency, lower costs, lower risk, and assist financial services companies in delivering improved services, boosting customer lifetime value, and gaining market share. Ninety-one percent of financial services companies are driving critical business outcomes with investments in AI. Fintechs are the second-most frequent users of deep learning after capital market firms. In 2022 alone, JPMorgan Chase planned to spend $12 billion on technology, including AI, and over 75% of financial services companies will use ML, deep learning, and high-performance computing.

Importance in enhancing efficiency and decision-making

By utilising large amounts of data and powerful algorithms, generative AI is transforming decision-making processes and enhancing efficiency in areas such as task automation, risk assessment, fraud detection, customer service, new product recommendations and trading strategies.

Generative AI is being used to generate new data based on existing data to improve the efficiency of financial services. For example, it is being used to automate tedious and repetitive tasks such as data entry that are prone to human error, reducing errors and improving accuracy at a lower cost.

By using generative AI, financial institutions are improving risk management processes by identifying potential risks earlier than before, for instance, the technology is being used to analyse market trends in real-time, and predict future market trends with a high level of accuracy, allowing institutions to develop better risk management strategies.

Generative AI is being used to develop algorithms that automatically detect fraudulent transactions, eliminating the need for time-consuming manual reviews. The enhanced understanding of fraud patterns allows these models to identify suspicious activities more accurately and effectively, leading to faster detection and prevention of fraud.

Generative AI has the potential to completely transform customer service in financial services by using AI-powered chatbots to assist customers with basic queries, leaving human agents to deal with more complex requests.

By using generative AI, financial institutions can identify areas of the market that are underserved and develop new products that cater to these markets. This leads to increased competition and innovation in the industry, ultimately resulting in better products and services for consumers.

Generative AI is being used for options trading to simulate volatility and other market conditions to be able to generate improved pricing accuracy, driving more accurate trading strategies through a targeted risk assessment.

2. Understanding use-cases in financial services

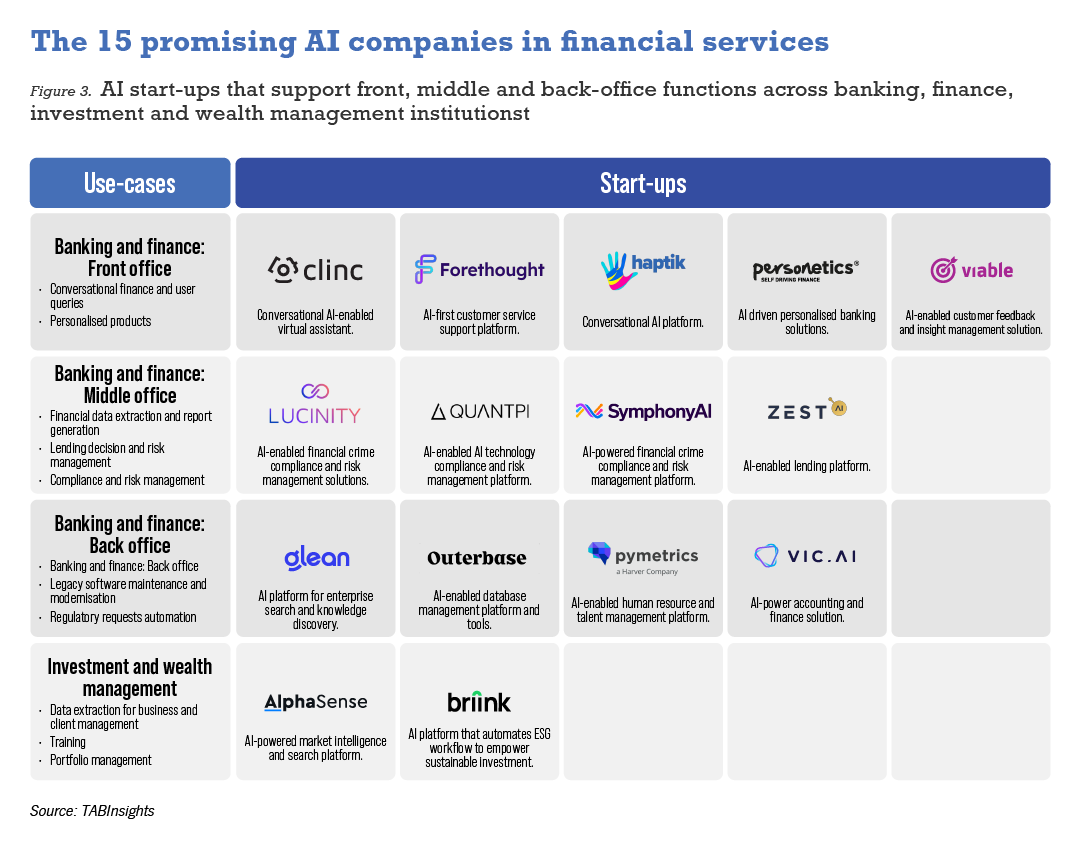

The key use cases for generative AI in financial services include both horizontal and vertical applications across financial services sectors.

Banking and finance: Front office

Conversational finance and user queries: With the use of generative AI for conversational finance, clients may get individualised assistance and financial guidance, in addition to receiving alerts and notifications for activities such as payments and transactions. Generative AI models being programmed to recognise and mimic human language patterns, are well-suited for this task, allowing for more natural and contextually appropriate replies, thereby significantly improving the quality and accuracy of the interactions, and giving users more nuanced responses that indeed, feel human-like.

Generative AI can deliver accurate and thorough solutions to monetary inquiries submitted by users because of its comprehension of human language patterns and its ability to produce cohesive, contextually appropriate responses. Regulatory compliance, accounting methodology and stock market research, are examples of such areas.

Personalised products: Banks will be able to analyse massive amounts of client data and provide better, more tailored product suggestions with the help of generative AI. In today’s hyper-personalised world, when clients want individualised financial solutions, this is an indispensable tool.

Banking and finance: Middle office

Lending decision and risk management: Generative AI will help banks and other financial institutions more accurately assess their customers’ financial health, set reasonable credit limits, and charge interest on loans commensurate with the inherent risks. Lenders will be able to boost their client base and attract new borrowers because of the decreased processing times and increased accuracy made possible by generative AI. Customer satisfaction can be maintained, and loan options can be communicated clearly if this is implemented.

Financial data extraction and report generation: From massive volumes of financial documentation like annual reports, balance sheets, income and cash-flow statements, and other financial statements, earnings calls, and other sources, generative AI can be used to extract and structure information in a user-friendly way to generate customised financial reports and build complex insights, enhancing consistency and accuracy for better customer service, allowing for more efficient analysis and decision-making. This automation streamlines the reporting process, increases consistency, accuracy, and timely delivery of reports, and reduces manual effort. Generative AI models may be used to build sophisticated representations that are tuned to particular demands from business and financial experts.

Financial forecasting: Generative AI models may forecast future trends, asset prices, and economic indicators by learning from past financial data and identifying complex patterns and linkages in the data. They may simulate market circumstances, macroeconomic factors, and other variables to develop many scenarios, each of which might shed light on the dangers and possibilities present in a given situation.

Banking and finance: Back office

Automated accounting: Generative AI can aid in the automation of functions such as auditing and accounts payable, including invoice capture and processing.

Legacy software maintenance and modernisation: A generative AI model fluent in older computing languages like COBOL can replace hard-to-find developers and speed up both essential development and maintenance, as well as convert code to newer languages, including documentation of data structures and methods, allowing applications to be modernised and reducing technology and operational costs.

Regulatory requests automation: Banks could use generative AI to respond to simple and less critical queries from regulators that are essentially reports and aggregations.

Financial application stack integration: Generative AI can deliver better vertical integration of financial applications to support cost control and responsible financial reporting, as well as financial language training via bots. These technological advancements increase the effectiveness of monetary institutions.

Investment and wealth management

Data extraction for client management: Data access, extraction, and use inefficiencies have a major impact on wealth and investment management. With the help of generative AI, wealth and investment managers are now able to provide their clients with more accurate information and identify trends in the data they collect.

Training: As wealth and investment management services become more complex due to the addition of new assets and frameworks, generative AI becomes a crucial tool to enrich and transform on-demand corporate training programs for wealth and investment management professionals to deliver compelling responses to clients in a language they can comprehend as well as support on-job employee queries.

Portfolio management: Portfolio optimisation is another use case for generative AI in the financial sector. By examining historical financial data and creating a number of investment scenarios that take into account factors like investment horizons, expected returns, and risk tolerance, generative AI models can determine the best practices for asset, wealth and investment management. Generative AI can simulate the effects of various market and economic scenarios and events on portfolio performance, enabling better portfolio management choices and helping to adjust investment strategies to optimise risk-adjusted returns.

3. Promising companies in generative AI for financial services

The field of generative artificial intelligence (AI) in finance is nascent and dynamic. Given the high levels of interest around AI, financial services companies, fintechs and others are keen to adopt AI technologies into their products and services.

Any list of promising companies in the industry must therefore distinguish ‘announcements’ and ‘intentions’ from veritably deployed products and services that are being validated by the market. This list was compiled based on research into the team and investors of each company, as well as their partners and awards, current products and services, as opposed to those announced for the future, and publicly-available customer testimonials and case studies. In and of itself, revenue-to-date was not a criterion for exclusion

4. Latest technical developments for financial services

Variational Autoencoders (VAE)

Some generative AI models used in the financial industry employ an artificial neural network architecture called variational autoencoders (VAE). In the world of finance, VAE are useful in a number of contexts.

Applications of VAE in risk and fraud management:

- Anomaly detection VAE can identify abnormal patterns in financial transactions or market behaviour in near real-time.

- Risk modelling VAE can be used to model and assess risks in financial systems, building on anomaly detection.

- Fraud detection VAE can help detect fraudulent activities in financial transactions, again building on the two previous properties.

Generative Adversarial Networks (GAN)

GAN are used in finance for tasks like synthetic data generation, and improving risk modelling. There are two parts to a GAN, the generator and the discriminator, making it a generative AI model. The capacity of GAN to produce synthetic data and enhance numerous financial activities, such as market simulation and risk modelling, has led to a surge in their popularity and use in the financial industry.

Applications of GAN in finance:

- Synthetic data generation Financial data may be generated synthetically using GAN, helping to overcome issues like as scarce or skewed data sources. Modelling risk, algorithmic trading, and portfolio optimisation are all enhanced by these numbers.

- Market simulation and scenario analysis By simulating market conditions and analysing potential outcomes, GAN can help us better comprehend market dynamics, make accurate price predictions, and assess the relative importance of various market influences.

GAN have become an effective technique for detecting credit card fraud, and provide superior performance and resilience in comparison to other approaches.

The usage and regulation of client data presents unique challenges for accounting departments due to the sensitive nature of the data. In order to comply with privacy requirements like the European Union’s General Data Protection Regulation and California Consumer Privacy Act, financial institutions can use GAN to create synthetic data. Financial institutions then use these synthetic datasets for a number of reasons, including training ML models and performing stress testing, without worrying about disclosing private client information.

Autoregressive models

The field of finance often makes use of autoregressive models, a kind of time-series models, for the purposes of analysis and forecasting. In order to get the closest possible estimate of an autoregressive model, it is common practice to use past data.

Applications of autoregressive models in finance:

- Financial forecasting Financial indicators such as stock prices, interest rates, and currency exchange rates can be predicted.

- Risk management and portfolio optimisation Autoregressive models help model the volatility and correlations of asset returns.

The model coefficients in autoregressive models can be interpreted to shed light on the prior connections between variables, which is a distinct advantage of these types of models.

Transformer models

A transformer is a specific type of neural network architecture that has gained popularity for its ability to process sequential data, like text, more efficiently. In the context of finance, transformer models have been applied to tasks such as sentiment analysis, document classification, and financial text generation.

Applications of transformer models in finance:

- Sentiment analysis Financial news, social media messages, and other textual data may all be analysed for their underlying sentiment by using transformer models. By recognising the relationships between words and their contexts, they help investors get valuable insights into market mood.

- Document classification Large volumes of financial data may be sorted and filtered into different categories using transformer models, including financial reports, research papers, and other textual materials.

- Financial text generation Transformer models may create synthetic financial reports, market commentary, and other pertinent content. They learn to write language based on patterns and structures found in financial data, allowing for automated report development and content creation.

The use of transformers is particularly well-suited for sentiment analysis, an approach within natural language processing (NLP), which categorises texts, images or videos according to their emotional tone as negative, positive, or neutral. Financial companies may develop plans to improve their services or goods by acquiring insights into their consumers’ emotions and views. Sentiment analysis may help financial institutions monitor their brand reputation and customer satisfaction via social media postings, news articles, contact centre interactions, and other sources.

5. Outlook and challenges

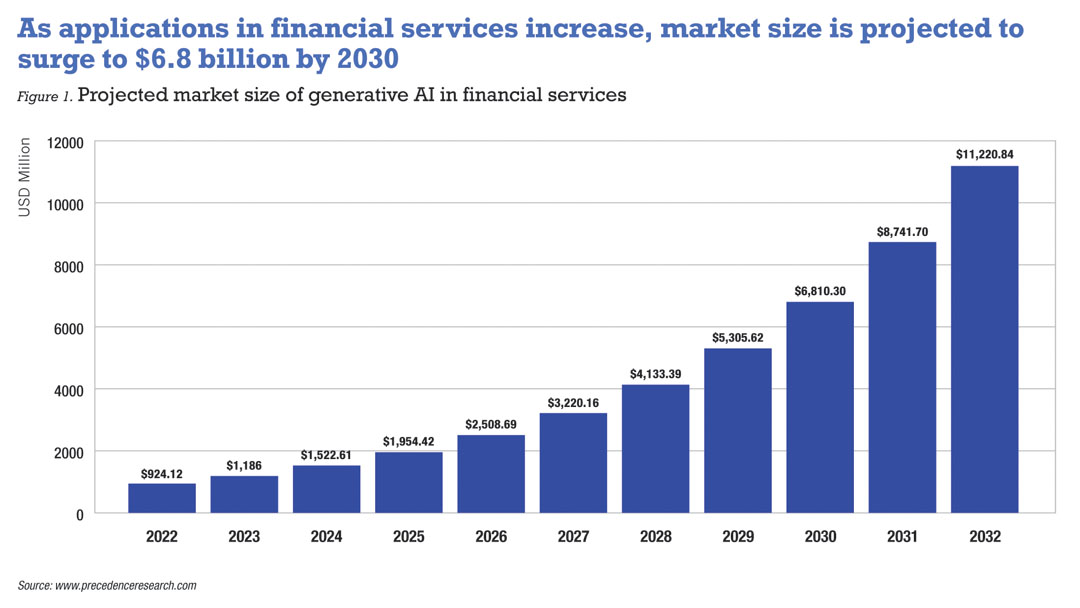

The worldwide generative AI in financial services market was worth $924.12 million in 2022 and is expected to be worth $11,220.84 million by 2032, growing at a compound annual growth rate of 28.36% between 2023 and 2032. According to an NVIDIA poll released in February 2023, the top AI use cases in financial services include big language models, NLP (26%), portfolio optimisation (23%), and fraud detection (22%).

Clearly, there is a high demand for generative AI in financial services with these being the leading areas for future development. It is also clear that more and more, financial services institutions will have their own custom-developed and maintained generative AI technology and application suites, fully integrated to create a CFO AI stack. The comprehensiveness and power of this integration will determine the efficiency, efficacy and profitability of the financial institution.

The limitations, hazards, and recommended approach of deploying generative AI must be understood. Since AI currently lacks the sophistication to properly capture the nuances of financial services and market scenarios, generative AI models cannot totally replace human financial advisors. A client may still see value in a company’s shares even when trading algorithms predict the price will fall.

Second, the use of biased findings from training data sets may degrade performance. Therefore, constant monitoring, coaching, and feedback are required to hasten digital journeys, boost staff effectiveness, and earn customer confidence. Similarly hallucinations, where the generative AI creates wholly convincing fake information and sources, and well as MAD syndrome, or model autophagy disorder, affects generative AI models and engines. Finally, businesses will need to closely firewall sensitive corporate and consumer information at all times to prevent leakages of proprietary information.

Generative AI presents numerous ethical issues, including manipulation and the ability to deceive users, copyright abuses, data privacy violations, proprietary and sensitive data leaks, intellectual property rights violations, amplification of existing bias and incorporation of new biases during training, lack of accountability and transparency, ethical risks such as safety, robustness, fairness, transparency, and environmental impact and lack of explainability and interpretability.

This has led to global efforts to regulate generative AI with governments worldwide grappling with how to control AI to ensure its benefits to the society without infringing on rights or safety. This includes the EU, UK, China and the US, countries that are taking steps to ensure governance of generative AI systems globally.

The EU plans to regulate AI as part of its digital strategy. In April 2021, the European Commission proposed the first EU regulatory framework for AI, which once approved, will be the world’s first binding rules for AI. The goal is to ensure that AI systems used in the EU are safe, transparent, traceable, non-discriminatory, and environmentally friendly, and that AI systems are overseen by humans, not machines, to responsibly prevent harmful outcomes.

The framework essentially categorises AI systems according to the risk they pose to users and establish obligations for providers and users depending on the category the AI system falls into. Once the act is approved, generative AI systems operating in the EU will have to comply with transparency requirements:

- Disclosing that the content was generated by AI

- Designing the model to prevent it from generating illegal content

- Publishing summaries of copyrighted data used for training

Heavy investments needed to realise full potential

With its ability to provide realistic and relevant insights, projections, and recommendations, generative AI is revolutionising the financial sector’s decision-making processes. Financial institutions are using generative AI to enhance customer service, reduce risk, and improve decision-making. Task automation, risk evaluation, fraud detection, customer service, product innovation, and trading techniques are just a few of the domains where generative AI is being used to improve efficiency and decision-making.

The inclusion of biased results from training data sets may reduce performance, limiting the ability of generative AI models to fully replace human financial advisers. Accelerating digital journeys, increasing staff efficiency, and gaining consumers’ trust call for constant monitoring, coaching and feedback. Governments throughout the world are taking action to assure regulation of generative AI systems in the face of significant ethical and legal difficulties posed.

Clearly, while there is a high demand for generative AI in financial services, financial companies need to invest heavily in research and development in the generative AI space and aim to create their own custom-developed fully integrated AI stack. In this way, businesses may have access to the full potential of their data and knowledge. The effectiveness, efficiency, and profitability of today’s financial institutions are directly tied to the depth and breadth of this integration.

Mastercard’s fellow of data and AI Jo Ann Stonier captured the mood succinctly, describing it as ‘everything, everywhere, all at once’. Generative AI has brought about a once-in-a-generation shift in the financial services industry.

All Comments