- The US dollar’s dominance as the world’s reserve currency is under threat

- Global financial intermediation will continue despite worsening US-China relations

- The internationalisation of RMB and financing the Greater Bay Area (GBA) are vital to remain a global financial centre

United States (US) President Donald Trump floating the possibility of imposing sanctions on Hong Kong may have dire consequences for the US, warned Joseph Yam, the former chief executive of the Hong Kong Monetary Authority (HKMA).

Yam spoke and gave a media interview at an online forum organised by the Our Hong Kong Foundation, a think tank established in 2014 by former chief executive Tung Chee Hwa.

Yam believes any penalties may hurt Hong Kong but would likely impact America more if it were to use the US dollar as a weapon.

“If you weaponise, you restrict the use of the currency, restrict investors from investing in the US, or restricting American investors from investing in China, forbid Chinese firms from conducting fundraising in Hong Kong,” Yam said.

The US being the largest economy in the world and the dominance of the US dollar in the international monetary system means it has a powerful arsenal at its disposal.

Restricting the trading of the dollar is an option the US can do to Hong Kong, a move Yam refers to as ‘nuclear option,’ considering the grave damage it could unleash on the city’s financial standing.

While this alternative may lead to another global financial crisis, Yam also explained why it is highly unlikely to happen.

US dollar under threat

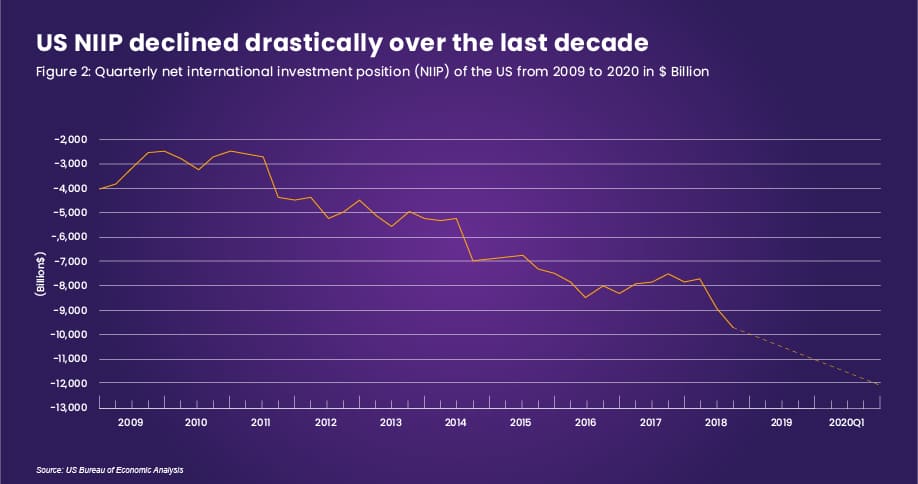

Yam believes such a move would put pressure on the dollar and the US' ability to repay its liabilities and potentially result in a default on its debts.

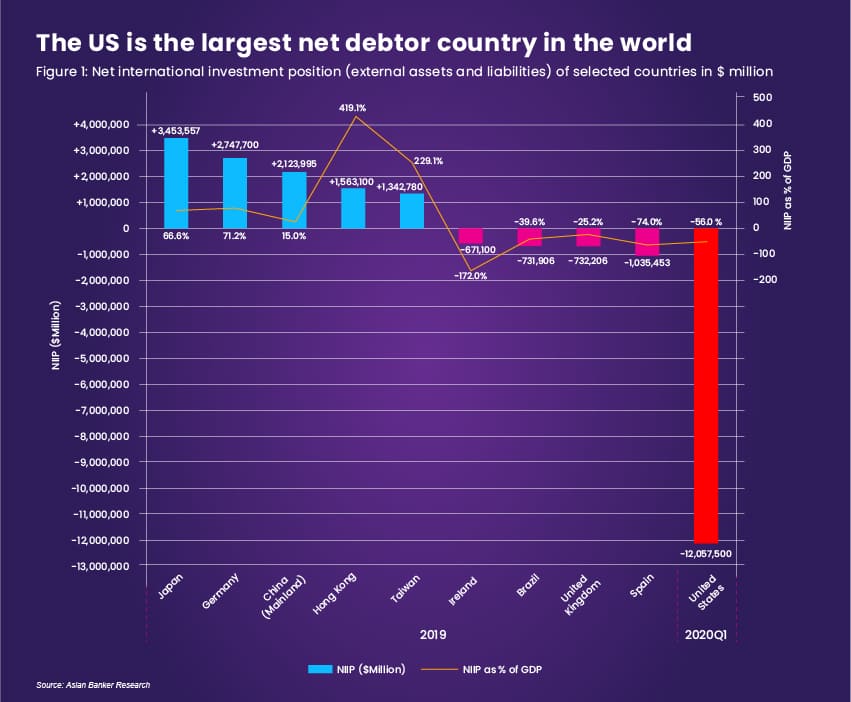

To drive his point, Yam presented a chart on the net international investment position (NIIP), overseas assets and liabilities, of a number of countries.

The NIIP is an important barometer of a nation’s financial condition and creditworthiness. A nation with a positive NIIP is a creditor nation, while a nation with a negative NIIP is a debtor nation. “The US is way at the bottom as a debtor country. It has borrowed money on a net basis amounting to $12 trillion. By far the US is the largest debtor in the world,” Yam pointed out.

He also showed a list of unstable monetary policies that the US has implemented over the years and referred to it as ‘cardinal sins’ in running an economy.

Yam then echoed American economist Stephen Roche who said, “The era of the US dollar’s exorbitant privilege as the world’s primary reserve currency is coming to end.”

Any action to undermine the Linked Exchange Rate System (LERS) of Hong Kong will backfire according to Yam. “That’s a two-edged sword, and I hope clever politicians like Trump will opt out of that alternative,” he added.

Global financial intermediation to continue

Yam expressed concern over US policy to end any preferential economic treatment for Hong Kong. Trump signed into law the Hong Kong Autonomy Act early this month and announced the end to special privileges in response to a new security law imposed by China in the semi-autonomous city.

Under the act, Yam pointed out that some people or companies could be targeted and banned for trading and doing business in the US.

While this could definitely undermine specific individuals and businesses, he said it should not make a dent in the city’s capital markets in general. Yam believes Hong Kong’s financial system is strong enough to withstand the impact of a partisan trade and investment prohibition. “There has been capital inflows into Hong Kong amounting to HKD120 billion ($15.48 billion). That actually is very clear. Our financial system and monetary system remain very robust,” Yam said.

In May, China’s legislature passed a controversial proposal that enforced a sweeping national security law in Hong Kong, a move many critics, including the US, believe could curtail political freedom, civil rights, and undermine autonomy. Yam thinks otherwise and stressed the law is necessary to restore order following months of political unrest any more than it being key to maintain Hong Kong’s viability as an international financial centre. “The demand for financial intermediation will continue to grow because China is the second largest economy in the world. If its financial needs in terms of investment and fundraising will grow, the rest of the world will have to deal with China,” Yam added.

RMB internationalisation and financing the Greater Bay Area

To foster the city’s unique advantages, Yam highly recommends accelerating the internationalisation of the renminbi (RMB) and further development of the Guangdong-Hong Kong-Macao Greater Bay Area (GBA). Promoting the wider use of the RMB in the capital markets has its advantages according to Yam - this will provide international investors and fundraisers an additional channel for managing currency risk and reduce the amount of capital flows thereby enhancing currency stability. Improving the GBA meantime will lead to greater capital mobility, currency convertibility, and connectivity of financial infrastructures, according to Yam. Another plus point for Hong Kong is its special relations with China’s huge economy that may well serve as the territory’s silver lining to maintain its position as an international financial centre. "Hong Kong is still the preferred place because after all we are still the biggest and most efficient offshore RMB market and centre for fundraising of Chinese (mainland) enterprises," Yam concluded.

All Comments