On 18 January 2022, China’s ministry of finance and three other authorities issued an update to its new energy/electric vehicle (EV) subsidy policy that includes a 30% reduction in the total subsidy for new energy vehicles, with a cessation of the subsidy programme from 2023. Based on the latest subsidy policy, a new EV will get an average of $1,500 in subsidy. In 2022, around 5 million new EVs are expected to be sold in China. The cut of subsidy from 2023 will leave a financing gap of at least an estimated $8 billion for buyers, as well as producers and the wider EV ecosystem that face pressure on new EV sales and potentially reduced income.

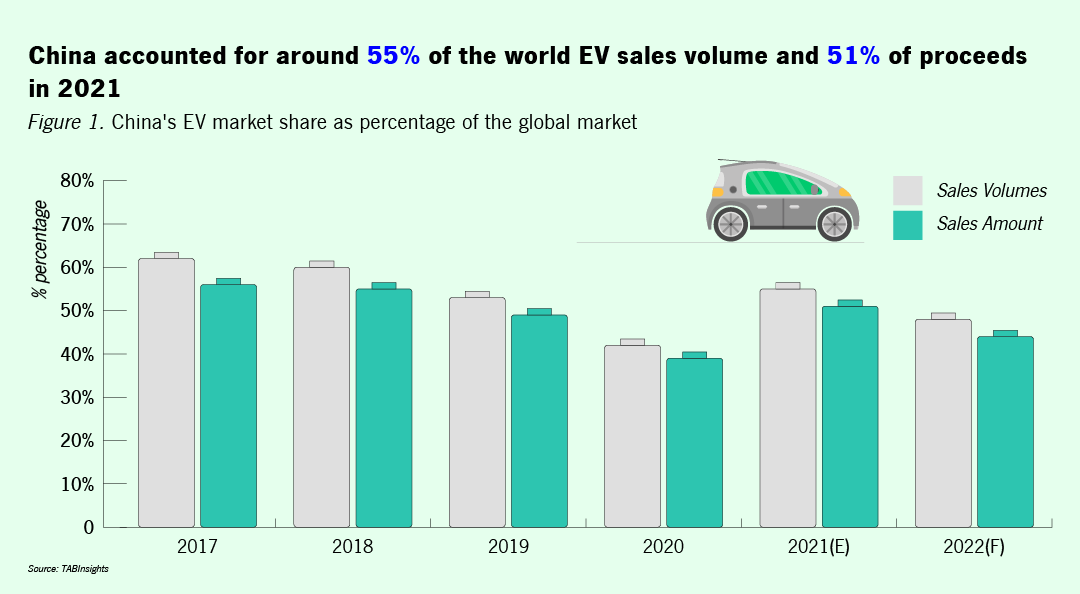

China, the European Union (EU), and United States (US) are the world’s three major EV markets. China holds a dominant share, accounting for around 55% of the world EV sales volume and 51% of proceeds in 2021. This is achieved after years of policy support, heavy investments in related supply and value chains, and despite fierce market competition from traditional automakers and new-EV producers.

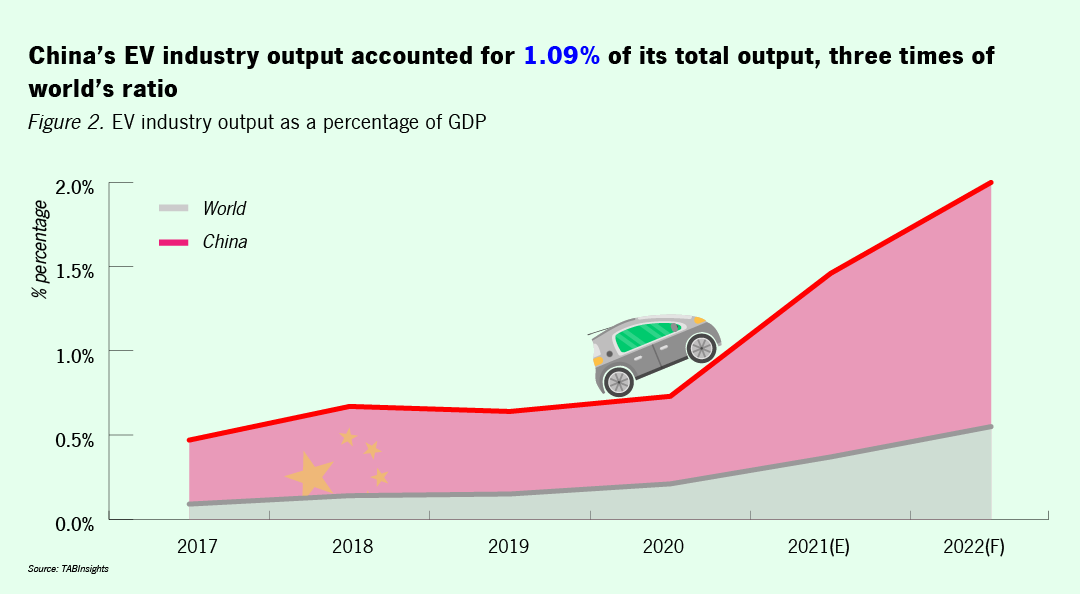

In 2021, China’s EV industry output accounted for 1.09% of its total output, three times of the world’s ratio, and the ratio is expected to increase in 2022 to 1.45%, growing at a three-year compound annual growth rate of 52%, higher than the world’s 46%.

Amid the subsidy cut, market analysts expect the growth of China’s new EV sales in 2023 to flatten out. To mitigate the impact, financial institutions (FIs) will be expected to step up to bridge the gap, particularly through local government support. Tesla for example, collaborated with the Shanghai municipal government in 2019, and received RMB 9 billion ($1.43 billion) in syndicated financing from several Chinese FIs and a separate RMB 4 billion ($635 million) loan from ICBC. It took Tesla just nine months to start operating its giant factory from the ground up. The Shanghai plant is now its international export hub contributing about a quarter of its global shipment and Tesla is now the third largest EV producer in China after BYD and SAIC Motor.

New investments in battery production and charging infrastructures will further reduce long term operating costs, critical to sustain growth and profitability. All these present opportunity for venture capital and the private sector to step in.

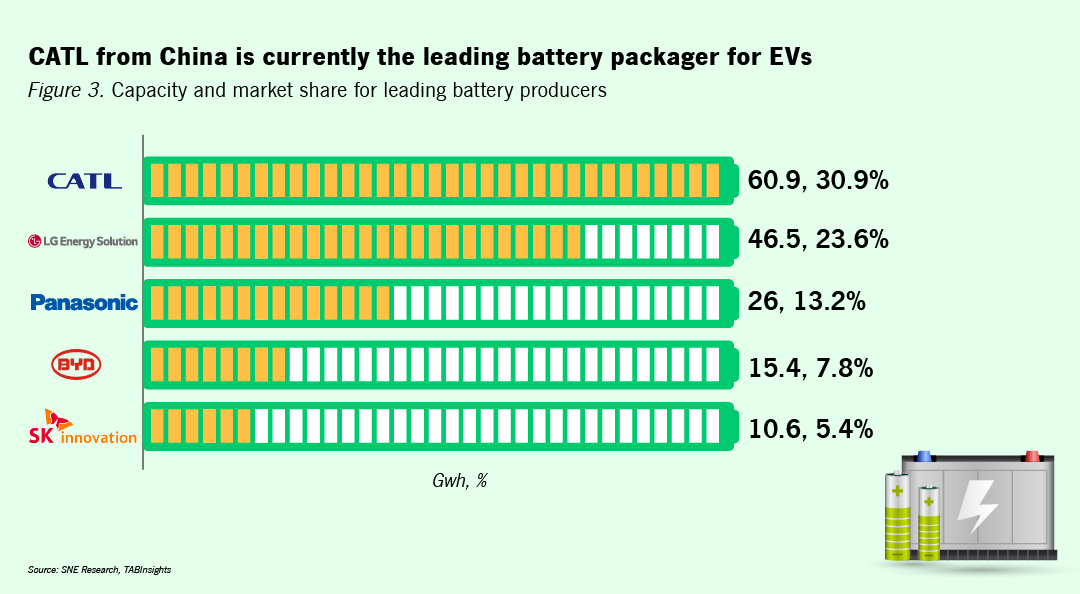

Generally, battery packs represent 40% of the cost of EV production, which directly affect the end sale price. In turn, the density and size of a battery pack affect the cruise miles of an EV, which is also the basis for the Chinese government's subsidy policy for passenger EVs. Electric vehicles with higher cruise miles will get higher subsidy. All these factors contribute to the competitive edge for battery producers in the country. China’s Contemporary Amperex Technology Ltd (CATL) is currently the leading battery packager for EVs, accounting for a 30.9% market share globally with total capacity of 60.9 gigawatt hours (GWh) as of September 2021, ahead of its major competitor, South Korea’s LG Energy. Another Chinese producer BYD accounts for around 8% of market share with 15.4 GWh. CATL is expected to expand its battery capacity to 340 Gwh by 2023 and 600 GWh by 2025.

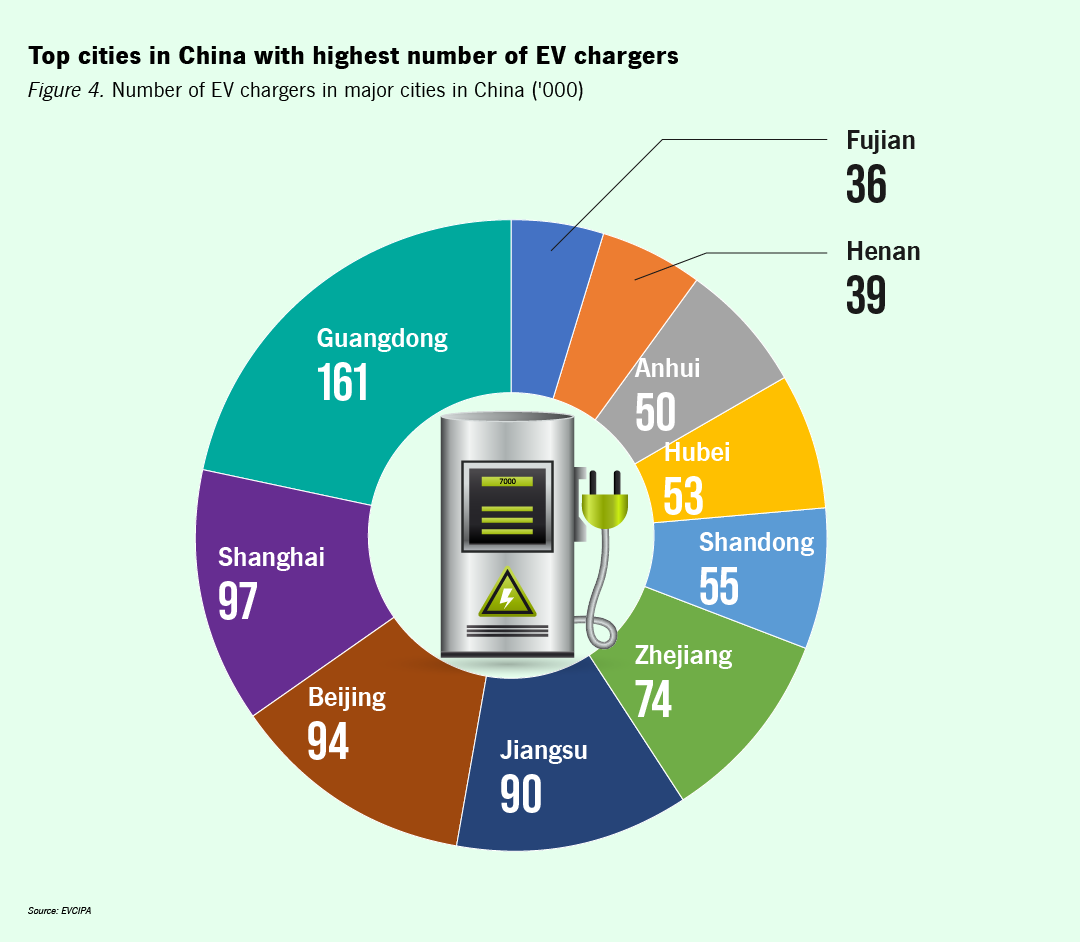

Another key element to facilitate the transition to EV is the charging infrastructures. Guangdong province is far ahead in the total number of EV chargers and the number of EVs per charger ratio, followed by Shanghai and Beijing.

Amid the current global climate challenge to achieve the goals of Paris Agreement (2015) of below 2 and 1.5 degree Celsius temperate increase, over 120 countries have committed to carbon neutrality or net-zero emission by 2050. As one of the major sources of greenhouse gas, the automotive sector is at the core of this transition – the electrification of transportation. Bloomberg estimates that to achieve these objectives, zero-emission vehicles or EVs need to represent almost 60% of global new passenger vehicle sales by 2030.

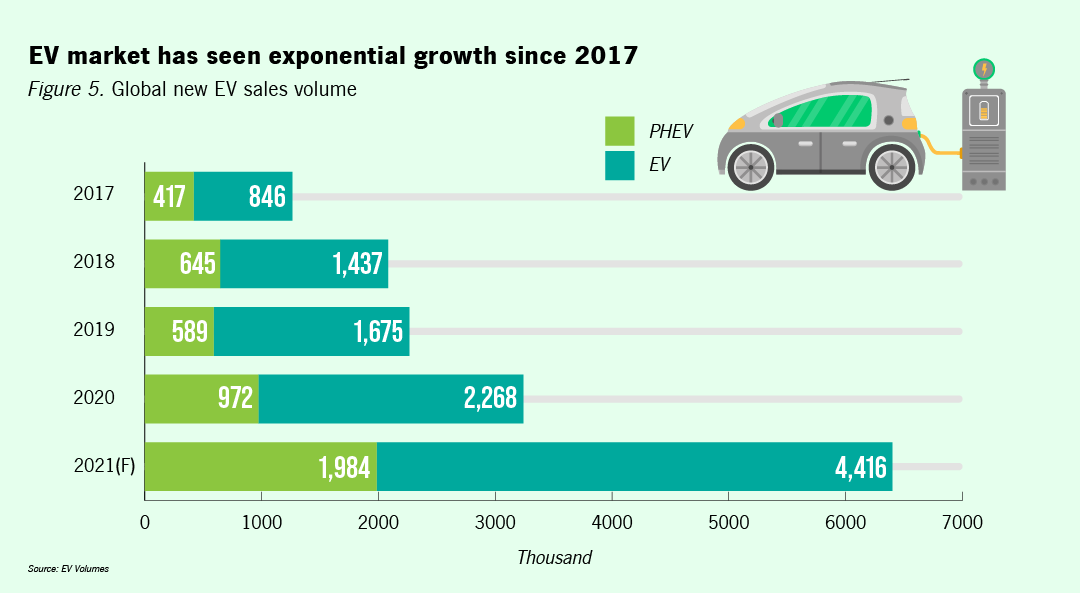

Even though the penetration of EVs globally is still low, the market has seen exponential growth since 2017. Based on data from EV Volumes, an estimated 6.4 million EVs and plug-in hybrid electric vehicles (PHEVs) were sold globally in 2021.

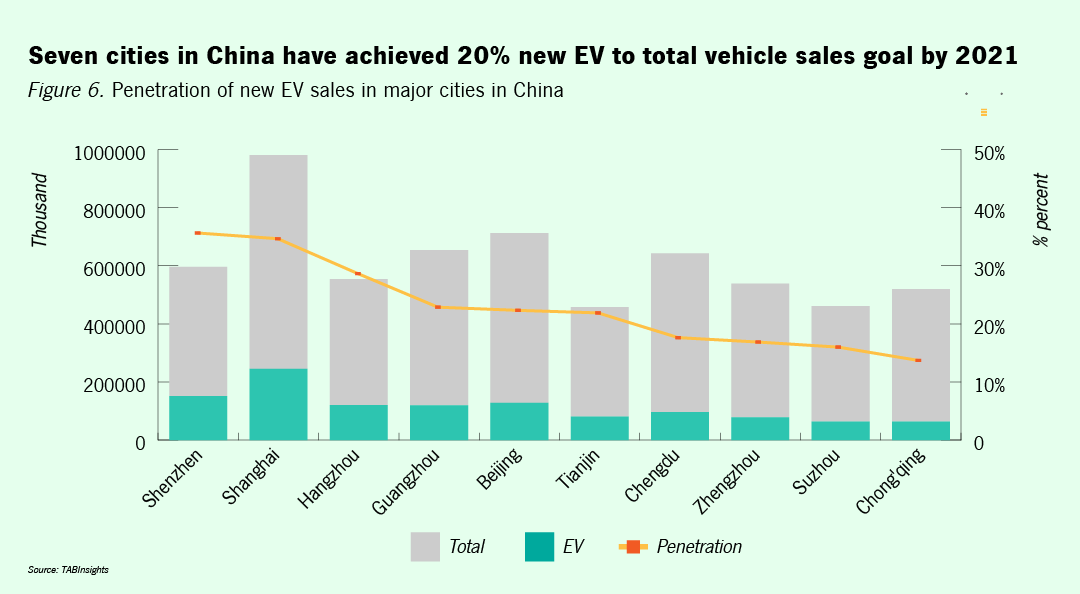

In December 2020, China issued its 2021 to 2035 development plan for new energy vehicles, in which it targets to achieve 20% of new EV to total vehicle sales by 2025. So far, seven cities have achieved the goal, with Shenzhen and Shanghai hitting 30% of new EV to total vehicle sales.

Overall, the penetration of EVs to total passenger vehicle population in China is around 16%. It is still low in relation to the transition to no-emission transportation and the net-zero goal. The new subsidy cut may bring further challenges to the transition but it will benefit the industry in the long run by forcing makers to become more efficient and cost effective.

All Comments