- ESCA enables interest rate swaps trading, providing a supplemental derivative tool for “Bond Connect”

- Being bond-backed, an easier path towards internationalisation

- With central moneymarkets as the next promising major international central securities depository, Hongg Kong can remain at the top among RMB offshore centres

On 4 July, the fifth anniversary of “Bond Connect”, the People’s Bank of China (PBOC) and the Hong Kong Monetary Authority (HKMA) made a joint announcement on the enhanced currency swap agreement (ECSA) which will kick off in six months.

ECSA: A supplemental derivative tool for “Bond Connect”

ECSA targets smoothing out the managing process of risk-sensitive renminbi (RMB) assets (i.e, dim sum bonds) for investors overseas. A northbound channel will be first opened to allow investors overseas to access interbank derivative markets in mainland China via a joint-built financial infrastructure. The key infrastructure here is called central moneymarkets unit (CMU), where member banks can trade through a simplified trading procedure. Central securities depository institutions in mainland China connect with CMU to make the settlement process more efficient. A southbound channel is to be studied and enabled in the future for mainland Chinese investors to participate in Hong Kong’s derivative markets.

It is a major upgrade from the original agreement, not only in size but also in terms. The size of the agreement expands to RMB 800 billion / HKD 940 billion ($120 billion) from RMB 500 billion / HKD 590 billion ($75 billion) and ECSA becomes a long-standing agreement, with no need for further renewals. As a supporting policy, HKMA will double the fund amount during the day and overnight, from RMB 10 billion ($1.50 billion) to RMB 20 billion ($3.00 billion) respectively, which means the working capital available on the market will increase by RMB 20 billion ($3.00 billion).

The primary product of ECSA is interest rate swaps. Swaps function as both parties could reduce their financing costs by exchanging cash flows with fixed or floating interest rates. ECSA enables investors overseas to manage the interest rate risks of RMB bonds, which is “a breakthrough for a supplement derivative for the ‘Bond Connect’”, says Darryl Chan, executive director of HKMA.

Being bond-backed, an easier path towards internationalised

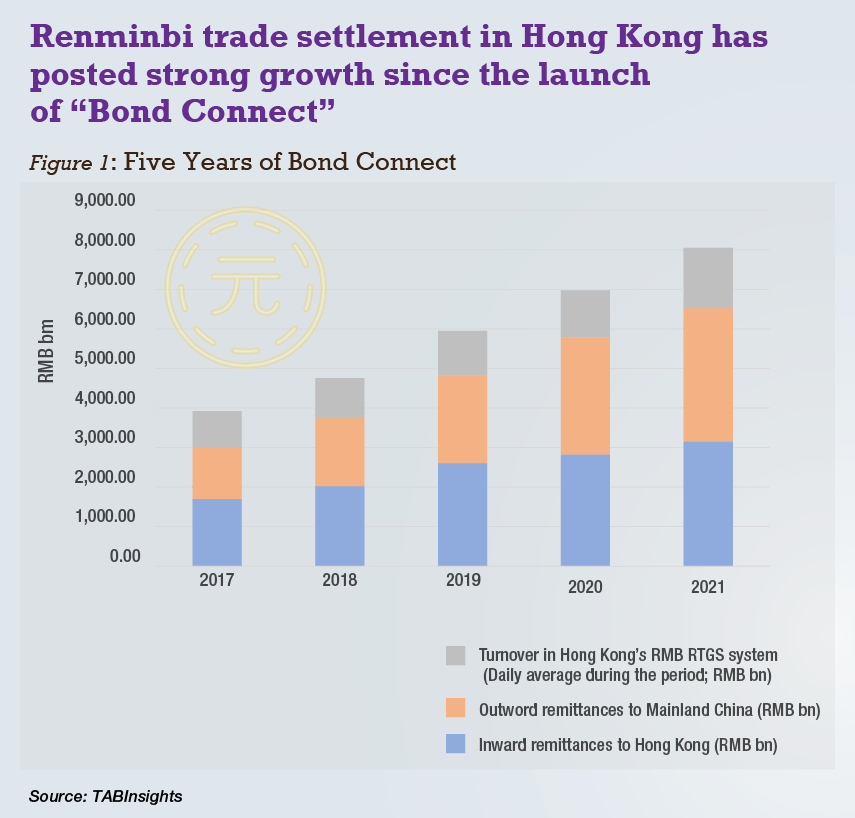

Though RMB is getting internationalised rapidly in recent years, the internationalisation level of RMB, compared to the immense trade size that the Chinese economy posts in the world, remain relatively lagging. This is due to its rather underdeveloped bond market and has been resolved largely thanks to “Bond Connect” initiated five years ago.

Before “Bond Connect”, investors overseas can access the mainland Chinese bond market through RMB Qualified Foreign Institutional Investor (RQFII) and Qualified Foreign Institutional Investor (QFII). Yet due to the channel cost, RQFII and QFII have not been popular with investors. With CMU removing most of the transaction costs and ECSA handling the interest risks, investors overseas will find mainland Chinese bonds more accessible and more attractive when allocating their assets.

A more robust and vibrant bond market can make RMB more internationalised. The underlying issue is that once more RMB bonds are issued and accepted in the global market, both its pricing and reserve functions get boosted from all the confidence and expectations. With a better pricing function, RMB gets to set more prices under international trade scenarios. With a better reserve function, RMB becomes more adopted both in central bank reverses as well as in private sector allocation. With a healthy, steady economy, RMB backed with bonds can get on an easier path towards internationalisation, which is the key incentive for PBOC to engage in ECSA.

Is CMU the next international central securities depository?

“Bond Connect” has accumulated over 3,500 institutional investors and the northbound “Bond Connect” alone has a total transaction of RMB 675 billion ($ billion), constituting over 60% of the participation of investors overseas in the mainland Chinese interbank bond market. ECSA will make “Bond Connect” more mature as a risk-management tool will be in place.

Hong Kong has yet more to contribute to the internationalisation of RMB. For instance, CMU has facilitated over RMB 800 billion ($120 billion) of mainland Chinese bonds to be held by investors overseas up to April 2022 and is expected to upgrade into a major international central securities depository as Eddie Yue, chief executive of HKMA mentioned at the ceremony.

According to TABInsights, 32% of enterprises overseas and 39% of financial institutions stated that Hong Kong is their first choice when it comes to offshore RMB trading centres. And both interviewee segments posted strong growth from 2020-2021, indicating more enterprises overseas and financial institutions are willing to trade in Hong Kong. With rising competition from emerging RMB offshore centres like Singapore and London, a well-functioning arrangement like ECSA and “Bond Connect”, and a powerful system like CMU, could be exactly what Hong Kong needs to stay at the top.

All Comments