- A renewed push to end-to-end supply chain financing has come from the “Industry 4.0” revolution

- Despite the slowdown in RMB internationalisation as a major theme in trade finance for 2017, it remains “systemically” important for banks in the region especially among Australian banks

- Increased volatility in the global financial markets has implications for Asia by virtue of its ever expanding integration

The financial services landscape in the past year has reflected some degree of consolidation as cross-border activities, including traditional trade transactions, slowed. Asia, where substantial trade finance flows have largely been driven by China’s massive commodity demand, has witnessed a deceleration as the latter undergoes fundamental economic and financial restructuring. With the ongoing rebalancing, Chinese growth has moderated, translating into reduced demand for trade finance and cross border products. While traditional channels of trade finance like documentary letter of credit have shrunk, the slowdown is being offset by increasing demand for end-to-end integrated supply chain financing. Open account trade and supply chain financing are providing flexibility for corporates to access financing according to their needs, with banks gaining more insights into their risk management through greater visibility of end use. End-to-end financing solutions incorporate the best characteristics of both domestic and foreign markets into one integrated product, the need of most corporations optimising their working capital requirements.

A renewed push to end-to-end supply chain financing has also come from the “Industry 4.0” revolution. Expansion through electronic solutions, largely through collaboration with and investment in financial technology has emerged as another key dominant theme in 2017. Blockchain technology, a key component of the application of innovative supply chain finance, has the potential to facilitate real-time and transparent transaction processing among banks and suppliers.

Despite the slowdown, China still matters

Even though renminbi (RMB) internationalisation has slipped down the list as a major theme in trade finance for 2017, it remains “systemically” important for banks in the region, especially among Australian banks (Figure 1). As regional supply chains are more likely to be integrated with China followed by robust expansion of outbound flows fuelled by the silk route initiative, banks are gearing to capitalise on increased transaction capabilities. China’s drive to a more market based system, deregulation and to more extent commodity linkages with rest of the region are driving demand for supply chain financing solutions, predominantly in RMB.

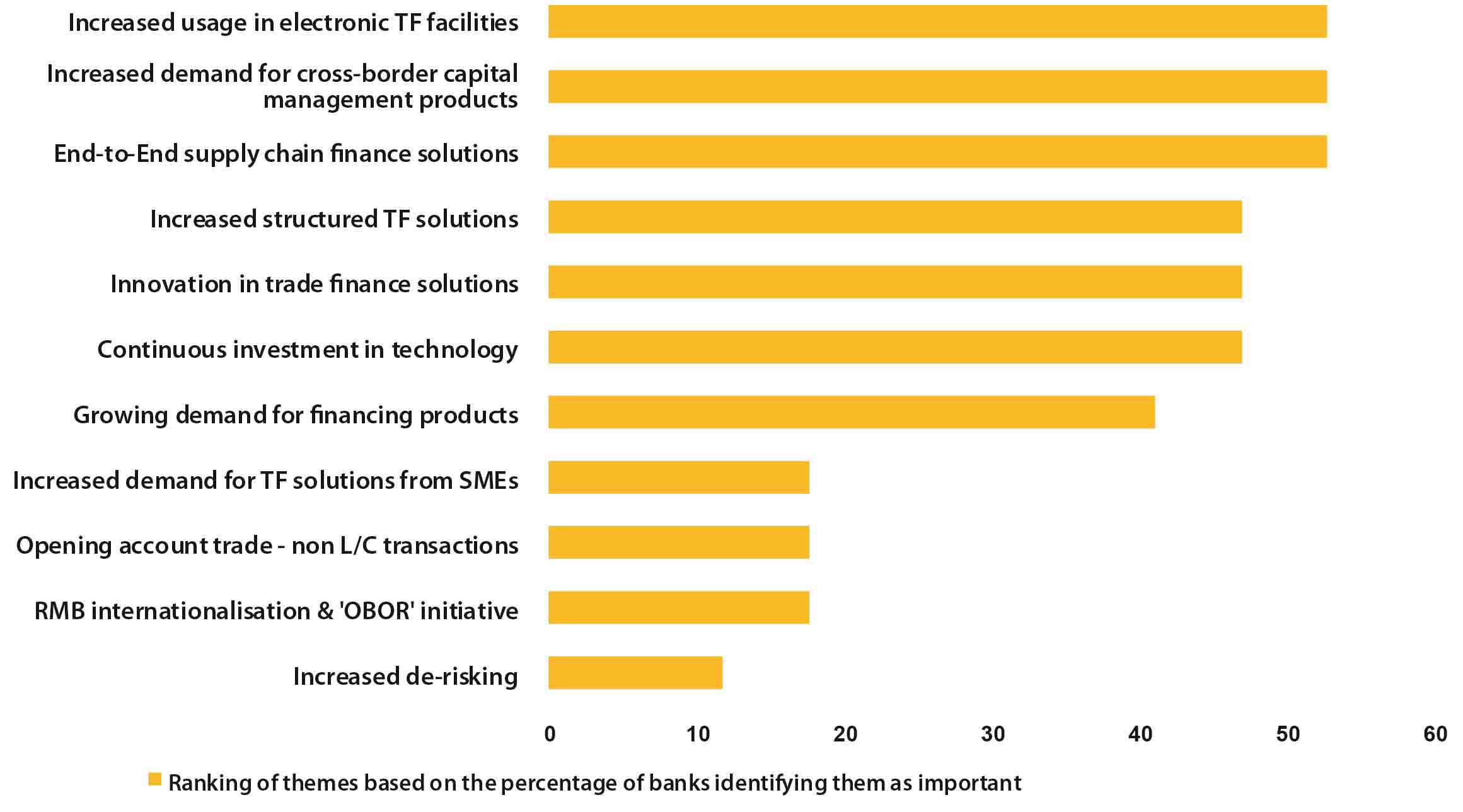

Increased usage in electronic TF facilities and demand for cross-border capital management products are two of the key themes in trade finance for 2017

Figure 1. Key themes in trade finance for 2017

Source: Asian Banker Research

Australia’s high commodity exposure to Chinese market makes an interesting case. Both major banks in Australia, Commonwealth Bank of Australia and Westpac have placed high stakes on RMB denominated business. CBA has deployed a dedicated RMB and China solutions team which delivers on end to end solutions. The team assists their clients in expanding investment and trade relationships across both geographies, and understand the cross-border transactions from regulatory perspective. To minimise risks, CBA has taken initiatives on 24-hour pricing across a spectrum of foreign exchange (FX) and interest rate products, including hedging and risk management instruments exposed to RMB.

Banking on growing payments in RMB, Westpac apart from extending support to its clients through a spatial network of its branches in Shanghai, Beijing, Singapore and a hub in Sydney, has also strategised on deepening relationships with Chinese counterparts. This creates opportunity in negotiating for better prices, reducing exchange and financing costs for clients.

Focus on innovative cross-border supply chain financing solutions

Global financing needs are ever complex and require application of innovative solutions to optimise transaction turnaround and thus costs. Asian banks are embracing integrated digital platforms to conduct cross border transactions, and are slowly transitioning to ‘real time’ network, with the objective of delivering service excellence.

With rapidly rising middle class and business aspirations, banks in the Chinese mainland are adopting sophisticated supply chain financing platforms, and forging strong relation with customers. For instance, China Construction Bank initiated an advanced study in supply chain finance, linking upstream and downstream businesses. It is developing payables financing to maximise working capital and minimise counterparty risk. Bank of China, Hong Kong (BOCHK) is deeply investing in electronic solutions such as corporate mobile banking, and applying fintech application in conjunction with blockchain technology to supply chain finance.

Their Indian counterparts are also following suit. Driven by government’s agenda to render paper economy obsolete, there is a heavy boost to online payment systems going ahead. Kotak Mahindra Bank is primarily focusing on micro, small and medium sized enterprises (MSMEs) and start-ups through low value- high volume financing strategy. YES Bank is devising innovative trade financing instruments using sophisticated cloud based technologies that connect e-commerce firms and the banking payment facility seamlessly.

With greater foreign direct investment (FDI) opportunities, Indonesia’s Bank Mandiri looks to cater to open account transactions of both local and cross border businesses with its new supply chain management system. Metrobank in the Philippines is deploying automation technology to structure tailor made solutions in meeting corporate requirements. In doing so, it has recognised the need to align supply chain finance instruments with each client’s physical supply chain.

Bangkok Bank, one of the largest investors in information technology in Thailand has collaborated with leading IT vendors to develop systems aligned with best international practices, yet tailor made for its local Thai market customers.

Shrugging off risks

Increased volatility in the global financial markets has implications for Asia by virtue of its ever expanding integration. As nerve centres for trade financing, banks are especially vulnerable to financial risks, requiring substantial vigilance. They are building standardised and accurate risk models that aid them in evaluating potential financial crimes. Visible practices in trade finance business point to seizures of client accounts that seem high risk propositions. Banks have raised their regulatory, supervisory and transparency disclosure requirements. They are also strengthening compliance to KYC and AML policies to alleviate risks. Such practice is now commonly referred to as “de-risking”.

With its greatest impact on foreign financial institutions (FFIs), global level regulations like Foreign Account Tax Compliance Act (FATCA) promoting cross border tax compliance and automatic exchange of information, are being increasingly pursued by banks. Moreover, interesting developments include introduction of innovative tools and automation technology that distribute associated risks. Banks in AsiaPacific have taken seriously to de-risking agenda.

Australian Westpac anticipates appreciating regulatory and funding costs with subsequent ‘‘normalisation’’ of US interest rates. With focus on liquidity management, Westpac is armed well with as strong capital position and BASEL III compliance. India’s Kotak Mahindra Bank has devised a more conducive regulatory framework, building substantial risk appetite to finance small and medium sized enterprises (SMEs) and entrepreneurial ventures based on collaterals and counterparty guarantee.

All Comments