- Cash is unlikely to disappear anytime soon

- The monetary rescue of cash

- Digital currencies will be widely discussed

For the last fifty years, various publications have predicted the end of cash around the world. One of the first articles was written by Jack Lefler in 1968. He envisioned the emergence of a cashless society in which people would use a single identification card for all transactions. In February 2007, The Economist cover title was “The End of the Cash Era.” The corresponding article projected that cash would be a dinosaur doomed to extinction.

Obviously, all these predictions were wrong. Are today’s predictions about the demise of cash more accurate? No. We believe that cash will not likely disappear soon! In fact, the amount of cash in circulation has been surging and, more recently, the COVID-19 pandemic has caused the demand for cash to skyrocket.

Cash is unlikely to disappear anytime soon

According to data released by the Reserve Bank of India (RBI), currency in circulation grew by INR 5 trillion ($67.2 billion) between 1 January 2019 and 1 January 2020, likely due to the uncertainty brought about by the pandemic.

During the three months prior to May 2020, banknotes in circulation in the eurozone increased to EUR 75 billion ($90.2 billion). This was an all-time high that exceeded the increase of banknotes during the three months following the collapse of Lehman Brothers in late 2008.

This record increase in the eurozone can be explained in part by massive government fiscal efforts to support the economy and citizens which resulted in higher rates of saving.

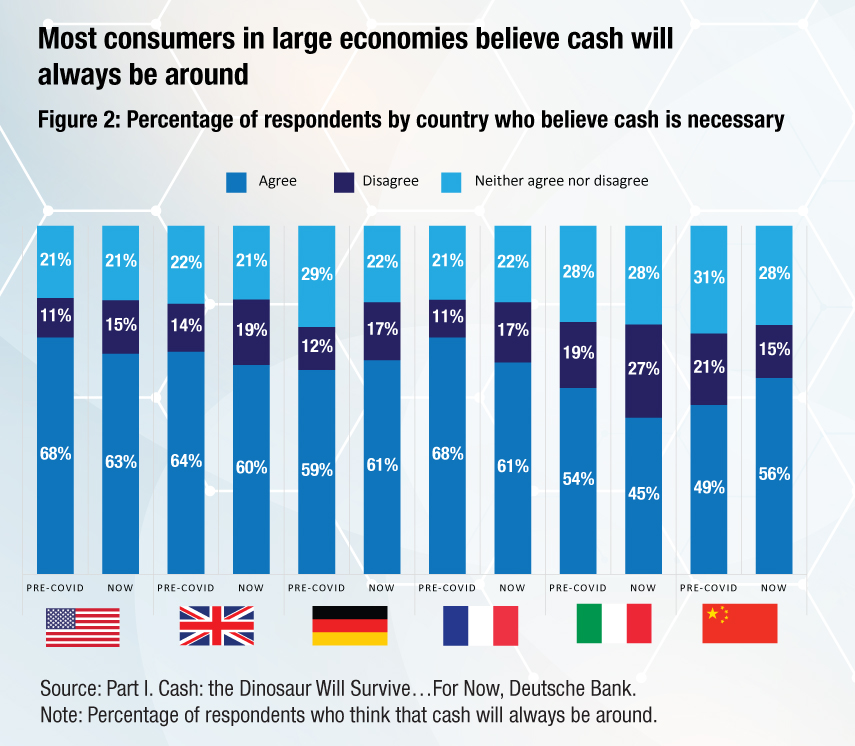

Among consumers, cash remains king. According to our proprietary survey of 3,600 individuals across the UK, US, mainland China, Germany, France, and Italy, a great majority of consumers agree that cash will always be around. Fifty-six percent of respondents in mainland China now believe that cash will always be around, versus 49% before the pandemic. We believe that this can be mainly attributed to the fact that people regard cash as a “store of value” or “safe haven” especially in times of crises.

The monetary rescue of cash

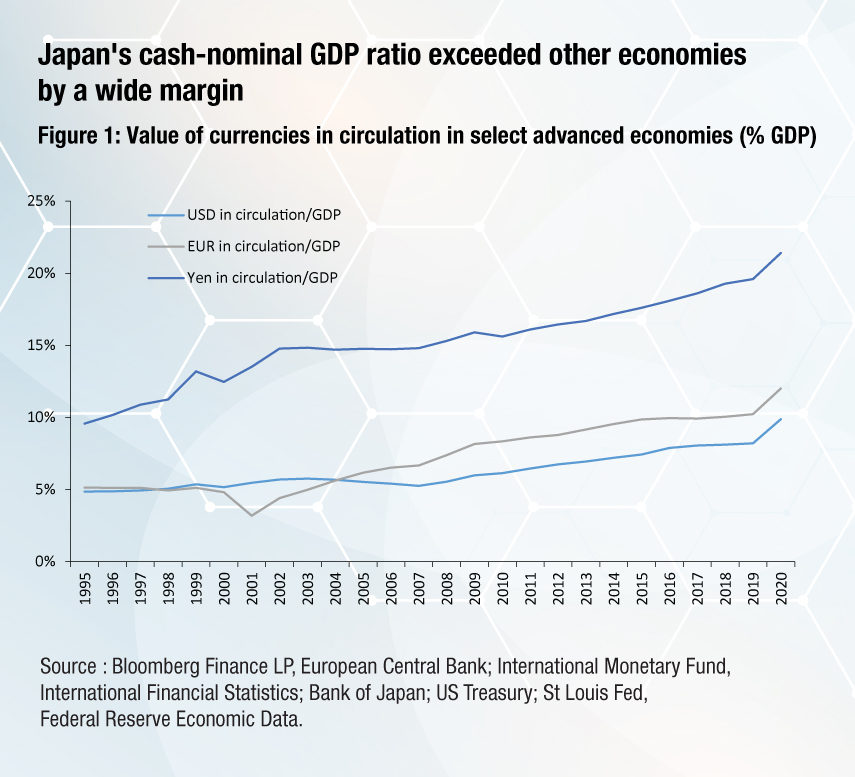

Our analysis of cash in circulation and interest rates within advanced economies reveal a strong negative association between the level of central bank interest rates and cash in circulation. Proving a causal relationship between cash in circulation and interest rates would require more work. However, we can say that low central bank interest rates certainly play a role in increasing the amount of cash in circulation. The opposite is also true - higher interest rates would likely help bring about the end of cash as a store of value.

The Federal Reserve, the ECB, the Bank of England (BoE), and the Bank of Japan (BoJ) have all lowered interest rates to near or below zero. And this trend may continue for a while. Most central banks in advanced countries have a mandate that is centred on the 2% inflation target.

Low interest rates are a major challenge for advanced economies to lead the transition to central bank digital currencies (CBDCs). In our view, low interest rates are a barrier that hinders populations in advanced economies from adopting CBDCs. However, this barrier is less of a concern in most emerging economies, especially China, because they have higher interest rates.

Digital currencies will be widely discussed

As we described in an earlier research piece “When digital currencies become mainstream,” with bank accounts paying low interest rates, a CBDC has a high potential to disintermediate the banking system. People might choose to hold their money directly at the central bank. If that occurs at scale, it would disrupt legacy bank franchises and impact financial stability. Credit card volumes, interchange fees, payment transaction fees, and deposit interest margins could be seriously affected. This would shake the current two-tier system and create additional responsibilities for central banks such as know your customer (KYC) issues and disputes, monitoring transaction levels, preventing money laundering and terrorism financing (AMLCFT), and tax compliance.

Some degree of disintermediation is an inevitable consequence of a successful CBDC. Thus, commercial banks need to consider how to react to a prospective loss of deposit funding. Two possible solutions would be to pay a higher interest rate on deposits as a way of limiting further outflows to a CBDC. Banks could also replace lost deposit funding with alternatives, such as longer term deposits or wholesale funding. Overall, both options would raise the cost of funding. Assuming banks seek to maintain profit margins, they could increase the cost of the credit they provide to the economy which would result in a lower volume of lending by banks (all else being equal).

The digital currency model currently favoured by most central banks seems to be two-tier issuance. As with a traditional currency, transactions would be decentralised and supply would be centralised.

While the dream of a cashless society is still on the horizon, it will take some time. People will need a new alternative to “cash under the mattress” that is separate from their mainstream means of payment, because after all, we are all human. So it is fair to say that the cash dinosaur is not dead yet.

Marion Laboure is a senior economist at Deutsche Bank where she covers payment, digital currencies, and financial technology; she also lectures in finance and economics at Harvard University and Harvard Kennedy School of Government.

All Comments