- Citi refocuses Asia strategy to expand wealth management

- COVID-19 pandemic’s impact on Citi’s financial health

- Citi is not entirely closing its doors to the Asian market

Citi will cease its consumer banking operations in 13 markets, including Australia, Bahrain, China, India, Indonesia, South Korea, Malaysia, the Philippines, Poland, Russia, Taiwan, Thailand, and Vietnam.

Citi refocuses Asia strategy to expand wealth management

Jane Fraser, chief executive officer of Citi, announced that it will be exiting its consumer banking services in 13 countries that are mostly in Asia. It intends to focus on the more lucrative wealth management.

“While these are excellent franchises, we don’t have the scale we need to compete and we decided we simply aren’t the best owners of them over the long term. We believe our capital, our investment dollars, and other resources are better redeployed against higher-returning opportunities elsewhere,” explained Fraser.

Instead, Citi plans to focus its global consumer banking presence in Asia and Europe, Middle East and Africa, solely from four wealth centres in Singapore, Hong Kong, the United Arab Emirates (UAE) and London – places with great concentration of wealth opportunities, according to Fraser.

The shift will allow the redirection of Citi’s operating model. “We are directing investments and resources where we have competitive advantages and the scale necessary to drive higher returns over the long run,” said Mark Mason, chief financial officer, Citi. The bank also plans to hire 2,300 people (approximately 1,100 private bankers and relationship managers, and 1,200 technical and operational staff) in Hong Kong and Singapore. This is all part of Citi’s plan to grow their assets under management for clients in Asia to $450 billion by 2025.

“We believe our capital, investment dollars and other resources are better deployed against higher returning opportunities in wealth management and our institutional businesses in Asia,” Fraser added.

COVID-19 pandemic’s impact on Citi’s financial health

The COVID-19 pandemic has caused pervasive economic hardships for businesses and individuals which resulted in a decline in individual spending, fewer loans, and higher provisions for credit losses – all of which have hurt earnings.

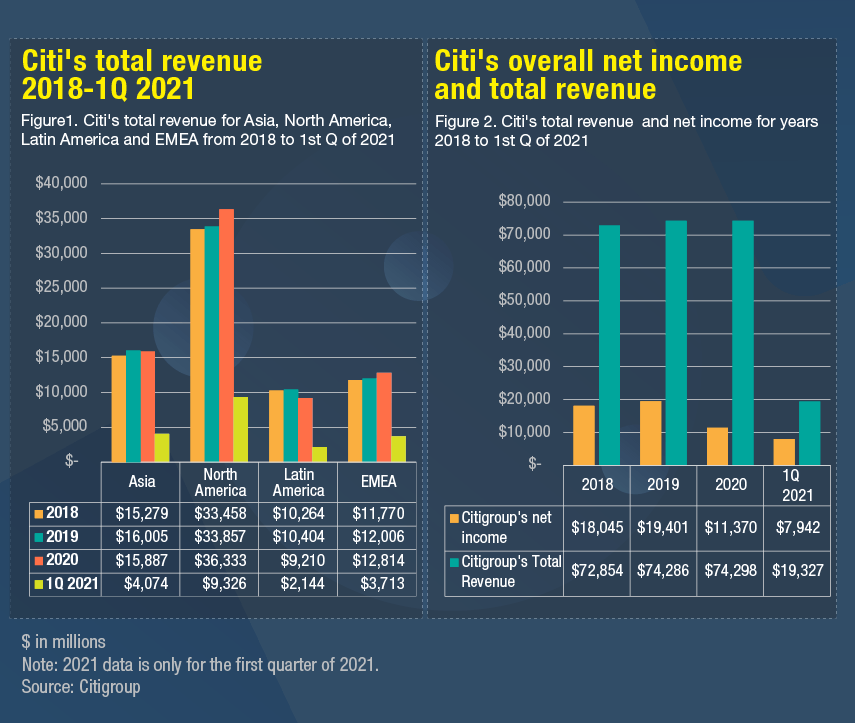

Historically, these markets are profitable. However, the impact of current expected credit losses weighed on full-year results due to the COVID-19 pandemic with cost of credit nearly doubling in these markets year-over-year. Accordingly, all the markets it is exiting made a combined loss of $40 million in the consumer banking business in 2020. Citi’s global consumer banking revenues were also down considerably. Citi’s revenue decreased 10% in 2019, primarily reflecting lower revenues in the global consumer banking (GCB) while its corporate/other net income declined 7% , driven by lower revenue.

Citi also posted a net income of $7.9 billion in the first quarter of 2021, more than tripling its profit in the first quarter of 2020. However, this is after Citi freed up $3.85 billion in loss reserves that it had built up for the expected loan losses from the continued impact of the global health crisis.

Citi is not entirely closing its doors to the Asian market

Consumer banking in Asia contributed a smaller proportion to Citi’s total revenue in the past years. In 2020, the 13 markets generated considerably low net income for the bank.

Citi’s consumer banking business in the 13 markets accounted for $4.2 billion of the bank’s $74.3 billion revenue in 2020.

Citi will not entirely close its doors to the Asian market and is only refocusing its strategy in the region. It will maintain consumer banking operations in Singapore, Hong Kong, London, and the UAE.

It will hire workers in Hong Kong and Singapore. Part of the plan is to open a 30,000 square feet wealth management hub in Singapore.

Rivals of Citi, however, are pushing ahead with ambitious growth and expansion.

HSBC has indicated its plans to grow its wealth business across Asia, mainly focusing on China and expand across South Asia.

Standard Chartered plans to increase head count in mainland China and has unveiled growth targets for its Greater Bay Area business including addition of approximately 1,000 new jobs. The expansion also includes $40 million investments in Guangzhou.

Goldman Sachs and JP Morgan have also announced that they are expanding operations and workers headcount in China.

Compared with other US banks, Citi has the most far-flung international retail network reach by far. It is one of the largest foreign banks in number of markets. Economy of scale and its struggle to keep up with competition are primary reasons for Citi’s decision. Banking became a low margin business. Banks’ global operations suffered, inevitably forcing them to proceed with cost-cutting measures.

All Comments