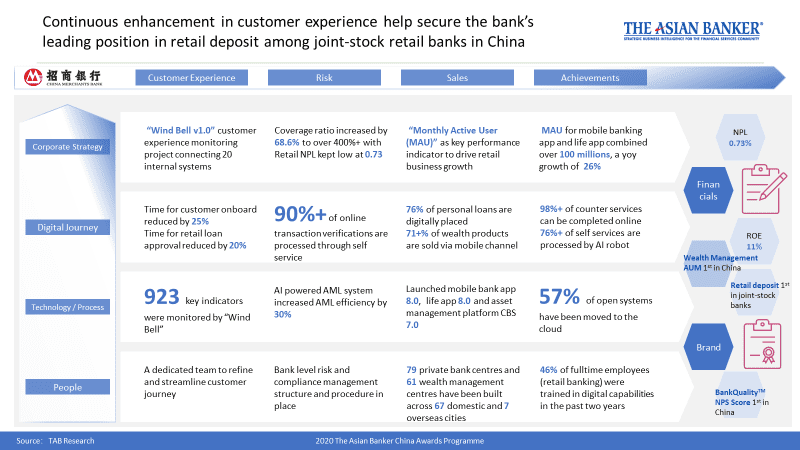

- Continuous enhancement in customer experience helped secure the bank’s retail customer base with highest market share in retail deposit among joint-stock retail banks

- The bank accounts for a leading 10% market share of China’s private wealth market, 43% higher than the second placed ICBC

- The bank provided financial support to corporates and donated to charitable organisation during the COVID-19 pandemic

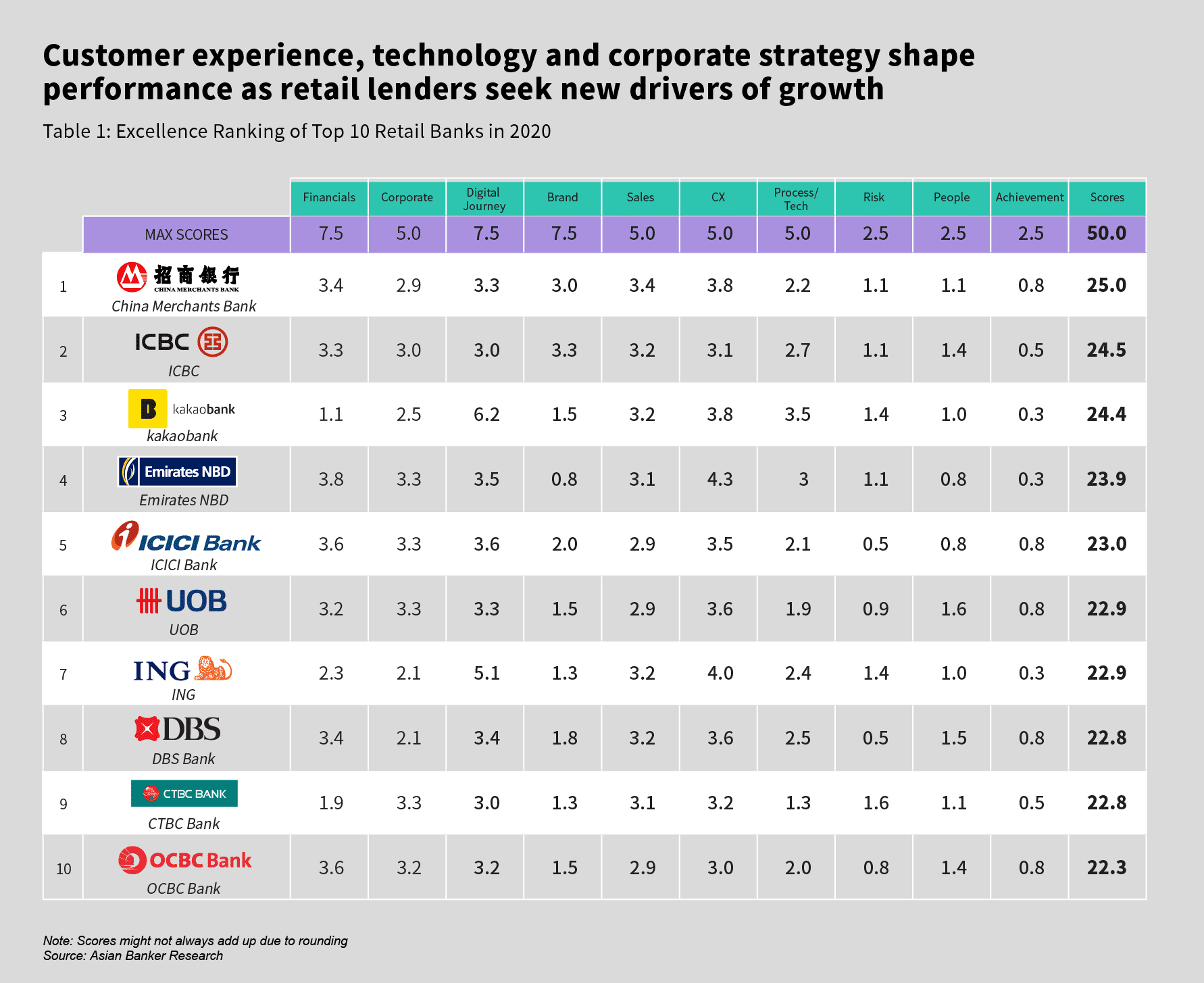

China Merchants Bank (CMB) was awarded Best Retail Bank and Best Wealth Management Bank in Asia Pacific and China at The Asian Banker International Excellence in Retail Financial Services Awards programme 2020. The bank also won Best Ecosystem Project under the products and service awards.

This year’s assessment of the Best Retail Bank in Asia Pacific was disrupted and delayed by the COVID-19 pandemic. To ensure the rigor and comprehensiveness of the evaluation, the assessment was expanded to consider banks’ response to the pandemic. In addition, it also incorporated customer derived net promoter score-based ratings from the BankQuality consumer survey on retail banks, including how they helped customers during the COVID-19.

CMB beat leading consumer banks from the region such as South Korea’s Kakaobank, India’s ICICI Bank, Singapore’s UOB and Taiwan’s CTBC Bank to emerge as the best retail bank in Asia Pacific. Based on the evaluation scorecard, the bank scored high in areas such as customer experience, sales, brand and risk management while steadily consolidating its position with the use of advanced technology in artificial intelligence and data and analytics.

With the strong ecosystem it has built via its CMB App that now exceeds 100 million users, CMB’s ability to connect and stay relevant to customers via daily lifestyle scenario tools, while partnering with leading platforms, is testament of its evolving role to enable the lives of its customers.

Customer experience and brand: Continuous enhancement in customer experience helped secure the bank’s retail customer base with highest market share in retail deposit among joint-stock retail banks

The bank continuously enhanced digital customer experience and secured leading position in terms of digital customer base and monthly active users (MAU) of its mobile apps. By the end of 2019, the total number of retail customer grew by 14.82% to 144 million, with the largest retail deposit of RMB 1.67 trillion ($240 billion) among joint-stock retail banks in China.

By implementing “Wind Bell”, a customer experience monitoring platform that connects 20 internal systems and tracks 923 key indicators, the bank reduced the turnaround time for customer onboarding and retail loan approval by 25% and 20% respectively. To support retail business to grow, 57% of open systems have been migrated to cloud.

Financials and sales: The bank accounts for a leading 10% market share of China’s private wealth market, 43% higher than the second placed ICBC

As of end 2019, CMB’s asset under management (AUM) totalled RMB2.23 trillion ($318 billion), accounting for an estimated 10% market share of China’s wealth management market, retaining the leading position, 43% higher than that of ICBC. The bank earned RMB19.45 billion ($2.78 billion) in fee income for its wealth management business, maintaining growth of RMB1.15 billion ($160 million), while its competitor Industrial and Commercial Bank of China (ICBC) registered a decline of 0.9%. The profitability of the bank’s wealth management business measured by return on equity (ROE) was 11% with cost to income ratio (CIR) of 24%, compared with 30% to 40% for Hong Kong and Taiwanese banks. So far, it has a network of 79 private bank centres and 61 wealth management centres across 67 domestic cities in China and seven cities overseas.

Digital journey: It capitalises on open ecosystems to maintain its leading position in active digital customer base

Through open banking and APIs, the bank integrates non-financial services such as dining and e-ticketing, and provides financial functions to 629 external business partners, and built an open ecosystem for its mobile and life apps. By the end of 2019, MAU of the bank’s mobile and life apps exceeded 100 million, with a year on year growth of 25.58%, maintaining its leading position in digital active customer base in China, and over 71% of the bank’s wealth products were sold via mobile channel.

However, to put the scale of digital transactions in China in context, Alipay chalked up RMB118 trillion ($16.85 trillion) in digital payments in 2019 while Wechat Pay has an estimated MAU of 800 million and annual transaction volume of RMB90 trillion ($12.85 trillion), which is equivalent to that of Industrial and Commercial Bank of China (ICBC), China Construction Bank and CMB combined.

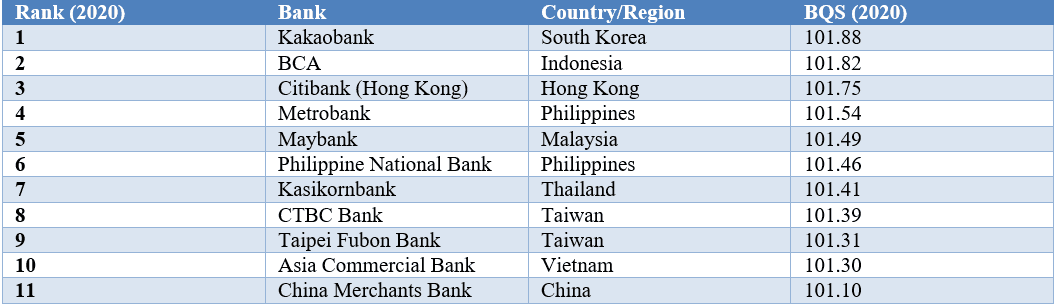

Customer experience: The bank ranked first in China in the net promoter score (NPS)-based BankQuality survey

In the annual BankQuality survey run by the Asian Banker, CMB received a BankQuality score (BQS) of 101.1 and was ranked first in China and eleventh in Asia Pacific behind other retail banks in the region such as Kakaobank from South Korea and Citibank (Hong Kong).

CMB ranked 11th in Asia Pacific

Table 3: Top ranked banks in BankQuality survey 2020

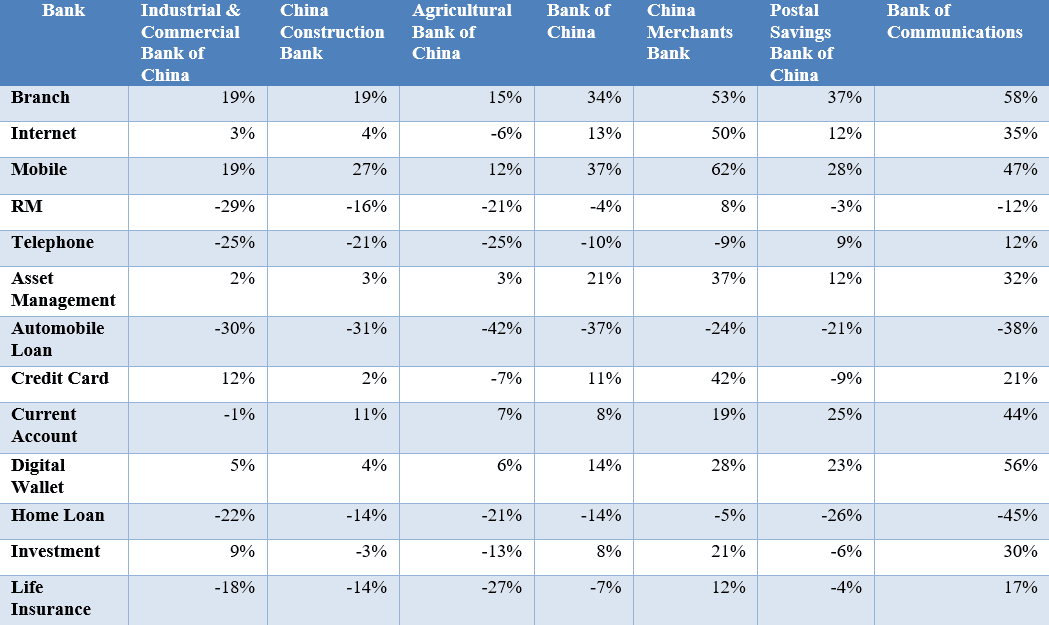

Compared with its domestic peers, the bank had the highest score in its internet and mobile banking channel, while having the second highest score in branch. In terms of business lines, CMB was ranked first in its asset management and credit card business.

CMB ranked top in China for overall NPS, digital channels, asset management and credit card

Table 4: Breakdown of BankQuality score by banks in China

Financials and risk Management: CMB expanded its retail loan book with highest credit card transaction volume in China

The bank registered retail business revenue of RMB144.7 billion ($20.7 billion) in 2019, accounting for 53.66% of total revenue. Retail cost to income (CIR) decreased by 1.73% to 33.74%, higher than ICBC’s 26% while lower than Ping An Bank’s 35%. The bank was able to maintain resilience with retail non-performing loan ratio (NPL) at industry low of 0.73%, 0.12 percentage point higher than ICBC. In comparison, NPL of China’s 24 listed municipal and rural commercial banks surged more than 20.3% year-on-year in 2019 to reach RMB 99 billion ($14 billion).

It increased its credit card and consumer finance loan balance. The bank had the highest credit card transaction volume in China of RMB4.34 trillion ($620 billion). Consumer finance loan balance increased by 17.12% to RMB2.33 trillion ($330 billion) by end of 2019, about five times that of ICBC and RMB330 billion ($44.04 billion) more than Ping An Bank.

The bank provided financial support to corporates and donated to charitable organisation during the COVID-19 pandemic

During the COVID-19 pandemic, the bank issued $423.6 million (RMB3 billion) through the China Inter-bank Bond Market (CIBM) to finance corporations and institutions working on treatment against the virus. It also donated $28.2 million (RMB 200 million) to philanthropic foundations in Wuhan immediately after the city was locked down.

It deployed its online banking and credit risk management systems to process loan applications to facilitate remote and contactless transaction during the pandemic. The bank also helped municipalities secure medical equipment supplies from overseas.by expediting cross-border payments to complete the transactions

For the full list and details of Excellence Awards winners 2020 click here

For details of the Excellence Awards programme 2020 click here

For details of the BankQuality Consumer Survey and Rankings click here

All Comments