- Digital payment transactions tripled from 2020 to 2022

- ‘Unified singleness’ of digital currency in layers with CBDC, tokenised deposits, and non-bank stablecoins

- Privacy issues lower public interest in digital currencies

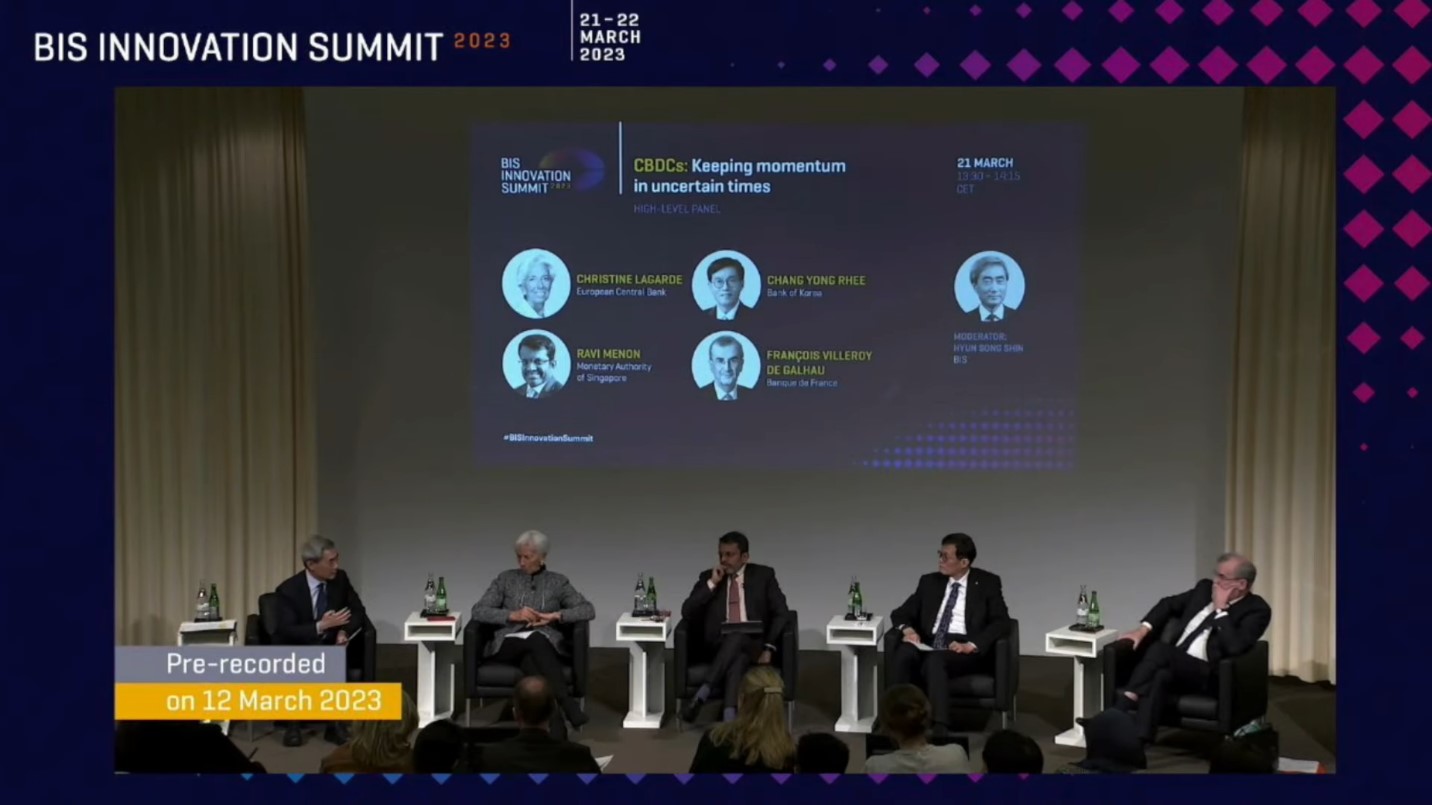

The COVID-19 pandemic and geopolitical tensions have hastened the transformation of the financial industry, particularly in the integration of digital payments. The European Central Bank (ECB) has been exploring the concept of ‘Digital Europe’ since October 2021 and is expected to pilot implementation in October 2023.

Digital-payment transactions tripled while cash use declined

Christine Lagarde, president of the ECB, stated the three main reasons for this exploration as being integrity, resilience, and integration. Europe’s cash in general was seen to be dwindling since 2019. The central bank recorded cash usage declining from 72% in 2019 to 59% in 2022 while digital payments have tripled over the same period from 6% to 17%, with a transaction value of over $1 trillion.

Lagarde said: “Everything is going digital, and people are clearly expressing a preference for it. There is no reason why we as central bank should not be exploring.”

She described digital cash as ‘Cash Plus’ as it has the same purpose as physical cash, and is intended to be safe, sovereign and accessible to everyone, anytime and anywhere with minimum to no cost. She explained that integrity refers to the system’s capacity to offer both—digital and physical cash, anchored to the monetary policy and sovereign measures, in case the use of cash declines in the near future due to digital advancement of society.

Lagarde cautioned the public to be careful in using third-party payment applications and emphasised the potential risks of relying solely on a single method of payment.

Digital currency in layers of CBDC, tokenised deposits, non-bank stablecoins

Ravi Menon, managing director of Monetary Authority of Singapore commented that the traditional monetary system will continue to be the mainstay even though it lacks the features of a digital monetary system.

Digital currencies offer the benefits of physical cash and digital payments, allowing for instant and convenient transactions. Digital currencies are expected to create a two-tier monetary system where traditional forms of money will coexist with digital currencies. This new monetary system is expected to be built on a foundation of central bank money and commercial bank money.

The second major form of money is predicated on tokenised deposits. It will come from regular bank deposits expressed in digital form and transacted on a blockchain or distributed ledger, with embedded ownership and rights.

The digital monetary system is intended to have layers consisting of central bank digital currencies (CBDC), and tokenised deposits acting as its core foundation. Menon pointed out that the addition of non-bank stablecoins as the third layer in the digital monetary system, alongside CBDC and tokenised deposits, will add diversity, as long as they are fully secured and backed.

Menon highlighted the importance of ‘unified singleness’ in cash, where every dollar is equal to every other dollar. Non-bank stablecoins lack this characteristic, which presents a challenge that needs to be addressed. He also stressed the need for open participation and interoperability on payment rails, including integration with distribution ledgers, and the consideration of security in design due to the high-risk nature of the global stage.

Chang Yong Ree, governor of Bank of Korea noted that tokenisation of assets is already underway in Korea, with Korean music and beef being tokenised. These assets, unlike traditional collateral, can be transferred within minutes to serve as collateral.

They also provide individual investment opportunities, enabling owners to embed their rights and profit from the future sale of the asset. For instance, owners have embedded their rights into cattle that were subsequently bred and then sold, with the person whose rights were embedded in the asset benefiting from the sale.

Chang also mentioned that asset tokenisation has the potential to increase demand for tokens by creating an infrastructure that supports token projects, enables cross-border functionality, and provides automatic liquidity.

Privacy issues lowers public interest with digital currencies

Francois Villeroy de Galhau, governor of Banque de France and chair of BIS Board of Directors, commented that while CBDC generate significant interest from politicians, governments and the establishment, it has limited appeal to the public.

The European system has been actively pursuing innovative solutions such as the automated market-maker (AMM) to facilitate the automatic exchange of crypto-assets on blockchains using liquidity pools. Through AMM, the central bank aims to test the cross-border exchange of a hypothetical digital Swiss franc, Euro and Singapore dollar CBDC.

CBDC serves as a bridge for tokenised securities and will be distributed through commercial banks to ensure financial stability. De Galhau encouraged widespread participation in the adoption of CBDC. However, the European system is cautious about the expanding boundaries for non-bank providers as this will require regulating both banks and non-banks.

Privacy concerns are the main issues for the public regarding a digital Euro. Lagarde emphasised that the central bank has no interest in an individual’s personal data. Banks act as intermediaries and are responsible for what is legally required in terms of money laundering, terrorism, and new-customer onboarding mandates.

Lagarde also noted that financial technology companies show more interest in digital currencies than central banks.

While CBDC may not offer the same level of privacy as physical cash, efforts are being made to explore options that provide a comparable level of anonymity.

All Comments