- Governments, payment providers and health experts encourage the use of cashless payments in the time of COVID-19

- Social distancing has brought more consumers online

- E-commerce platforms in China have offered financial support as well as last-mile logistics solutions to aid merchants

As COVID-19 remains a global threat, its human impact becomes even more significant. The highly contagious nature of the virus has spurred public concern that the disease may be transmitted through banknotes. With this idea in mind, consumers seem increasingly ready to embrace digital wallets and contactless payments not just out of convenience, but also because of safety.

Cashless payments are encouraged during the pandemic

With cash passing from one hand to another, many people fear that the use of coins and banknotes may be a way to worsen the outbreak. A microbiology study published on The New England Journal of Medicine has found that the virus that causes COVID-19 can survive for three hours in the air, 24 hours on cardboard and even longer on other hard surfaces. The fact that the virus survives best on non-porous materials, such as plastic or stainless steel, means that ATMs, credit card terminals or PIN pads could transmit the virus too.

The World Health Organisation (WHO) itself has recognised this threat. In a report by WHO and Global Health Cluster, it was advised that “where this is possible, contact-less electronic or mobile payments should be the preferred option to reduce the risk of transmission.”

Some countries are taking this a step further. South Korea, for example, is quarantining all cash received by its central bank, the Bank of Korea, for two weeks before disinfecting and putting it back in circulation. China has undertaken similar efforts. The Central Bank of Kenya also issued new directives in March encouraging the use of mobile money transactions instead of cash to reduce the spread of the virus.

Payments provider Mastercard has encouraged going cashless too. Across the United Kingdom, it has upped contactless payment limits from $37.67 (GBP 30) to $ 56.5 (GBP 45) in an effort to help customers cut down on cash usage. This increase in limits took effect on 1 April.

Social distancing brings more consumers online

Consumer behaviour has changed on a massive scale, with those under lockdown unable to perform their usual routines and many shops ordered to close for safety reasons.

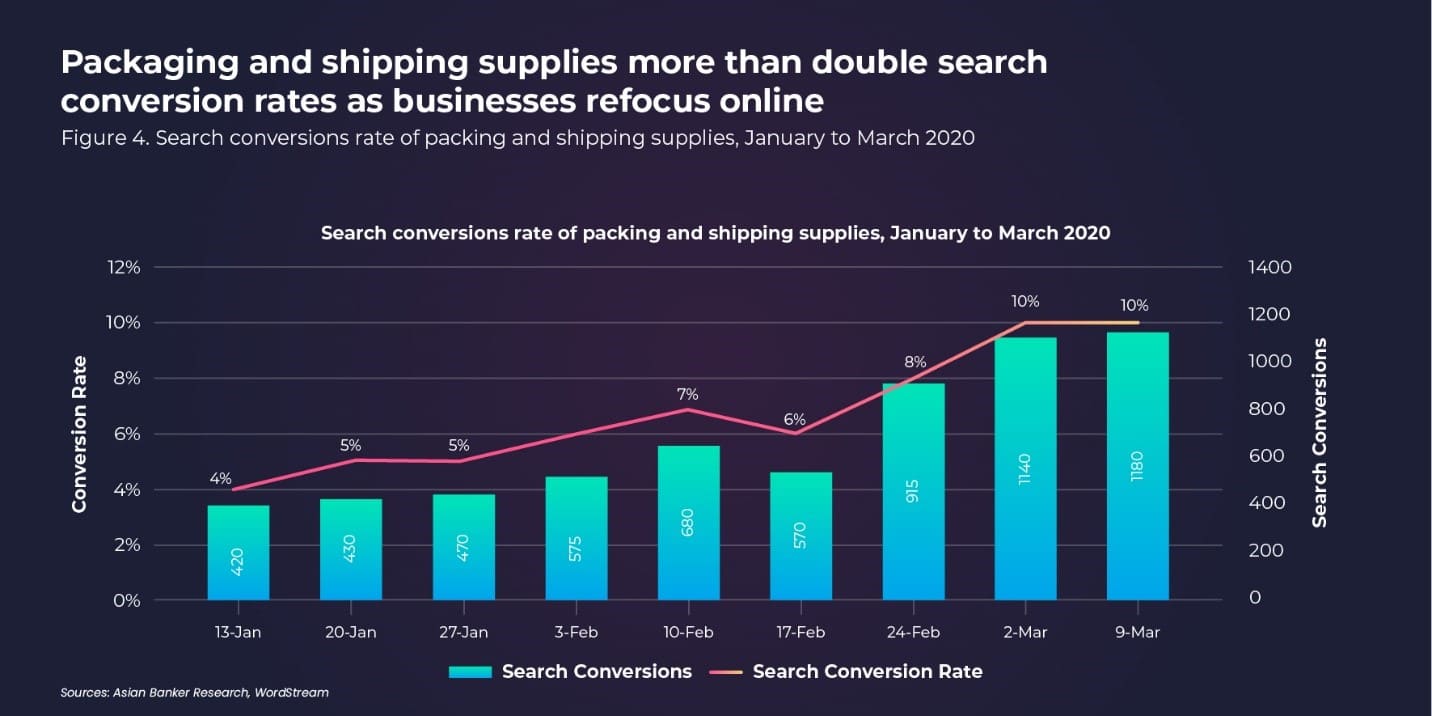

E-commerce activity is booming in the United States, particularly with health products and groceries. Digital shoppers are also willing to convert on products that they need even with longer delivery windows in order to avoiding going to stores where inventory may be limited anyway. Amazon, in particular, has been experiencing immense demand for household essentials such as groceries, toilet paper, hand sanitisers and more. Customers are willing to wait weeks to receive these items.

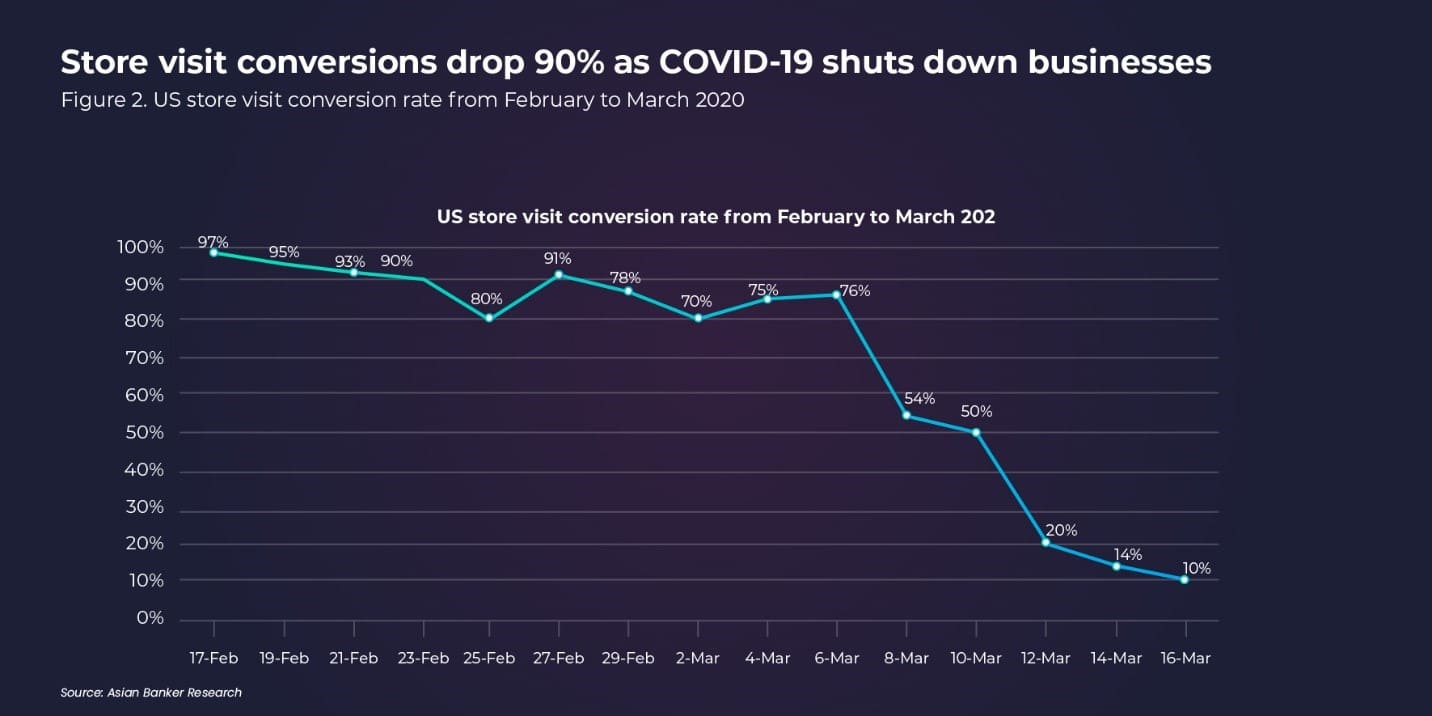

During the first weeks of the outbreak in the US, both in-store and online sales steadily increased until the beginning of March. Since then, in-store sales have been steadily declining. In-store sales were down 46% last week, compared to January. At the same time, online sales have grown by 58%.

E-commerce platforms offer retailers financial support, last-mile logistics

To help weather the crisis, some major e-commerce platforms in China have provided financial support to merchants, alongside different online marketing tools for merchants to reach more consumers. They have also provided special logistics solutions during the outbreak to help deliver orders more efficiently.

For instance, Tmall waived service fees for the first half of 2020 and offered free services to eligible merchants registered in Hubei, the epicentre of the coronavirus outbreak. JD Digits reduced interest rates for loans and allowed merchants to delay repayment. JD also provided low-interest or interest-free loans to merchants.

E-commerce operators have also ramped up efforts to offer contactless delivery and deployed autonomous vehicles or drones to deliver orders in a bid to reduce human contact and prevent the spread of COVID-19. By providing financial, technology, marketing and logistics support to merchants on their platforms, e-commerce operators may be able to keep their merchants afloat while fostering growth even amid the pandemic.

The pursuit of offline-to-online (O2O) strategies has long been a key priority for both retailers and e-commerce players. The COVID-19 outbreak has further reinforced the need for companies to undergo digital transformation, which has now become crucial for survival in the digital economy. To ensure seamless integration of online and offline businesses, brands and retailers will further deploy state-of-the-art technologies, while strengthening supply chain management and customer relationship management. On the other hand, e-commerce giants will harness their digital capabilities to increase their offline presence and further expand their business ecosystems.

All Comments